About Raydium Defi Coin

Raydium Defi Coin is an automated market maker (AMM) and liquidity provider built on the Solana blockchain for the Serum decentralized exchange (DEX). Unlike any other AMMs, Raydium provides on-chain liquidity to a central limit orderbook meaning that funds deposited into Raydium are converted into limit orders which sit on Serum’s orderbooks. This gives Raydium LPs access to all of Serum’s order flow as well as their existing liquidity.

Raydium Defi Facts

| Lightning Network | Facts |

|---|---|

| Defi Coin Name | Raydium |

| Circulating Supply | 519,457 |

| Explore | Click Here To View Explore |

| Source | Click Here To View Source |

| Chat Option | Click Here To Visit Chat |

| Document | Click Here To View Document |

| Official Website | Click Here To View Website |

Raydium provides Ecosystem-Wide Liquidity for users and projects

Order Book AMM

Raydium Defi Coin AMM interacts with Serum’s central limit order book, meaning that pools have access to all order flow and liquidity on Serum, and vice versa.

Best Price Swaps

Raydium determines whether swapping within a liquidity pool or through the Serum order book will provide the best price for the user, and executes accordingly.

High-Liquidity Launches

Accele Raytor offers projects a straightforward 3 step process to raise funds, launch an IDO, and bootstrap liquidity on Raydium and Serum.

How many RAY tokens are in circulation?

Raydium Defi Coin launched its main net on February 21st, 2021 with 555,000,000 tokens created at genesis. 34% of all tokens will be released as liquidity mining incentives over a 3-year period. 30% of tokens are earmarked for partnerships and the expansion of the Raydium ecosystem. This includes giving grants to projects building projects around Raydium or helping our communities in general. These tokens are generally locked for 1 year and unlock linearly for the next 2 years.

Who are the founders of Raydium Protocol?

AlphaRay leads overall strategy, operations, product direction and business development for Raydium. With a background in algorithmic trading in commodities, Alpha transitioned to market making and liquidity providing for cryptocurrency in 2017 and hasn’t looked back. After diving into DeFi in the summer of 2020, Alpha saw a market need for an order book AMM to aggregate liquidity, and with the release of Serum, pulled together a team of experienced trading developers to tackle the problem head on.

XRay is Raydium’s Chief of Technology and Dev Team leader. X has 8 years of experience as a trading and low latency systems architect for both traditional and crypto markets. X designs all of Raydium’s systems and infrastructure as needed. GammaRay heads up marketing and communications while also playing a key role in strategy and product direction. Gamma spent a large part of his career at a leading data analytics and market research firm, working on both client engagements and corporate marketing. Prior to Raydium, Gamma’s focus within cryptocurrency has been technical analysis and discretionary trading.

Why is Raydium different?

Other AMM DEXs and DeFi protocols are only able to access liquidity within their own pools and have no access to a central order book. Additionally, with the majority of platforms running on Ethereum, transactions are slow and gas fees are high.

Raydium offers a few key advantages:

- Faster and cheaper: They leverage the efficiency of the Solana blockchain to achieve transactions magnitudes faster than Ethereum and gas fees which are a fraction of the cost.

- A central order book for ecosystem-wide liquidity: Raydium provides on-chain liquidity to the central limit order book of the Serum DEX, meaning that Raydium allows access to the order flow and liquidity of the entire Serum ecosystem.

- Trading interface: For traders who want to be able to view TradingView charts, set limit orders and have more control over their trading.

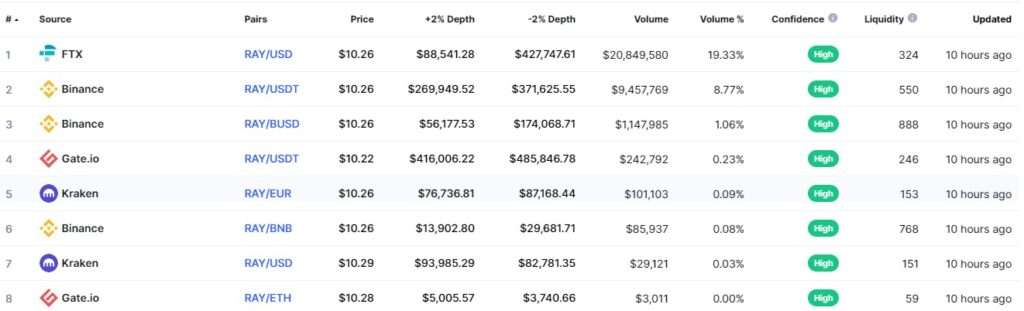

Where can I buy RAY?

RAY is available on a growing number of exchanges with cryptocurrency and stablecoin pairs currently available. The most liquid exchanges include Raydium.io itself, FTX.com and gate.io