About KLAYswap Protocol Defi Coin

KLAYswap Protocol Defi Coin is a complete on-chain instant swap protocol that operates with an on-chain liquidity pool, where liquidity is guaranteed by automated market-making (AMM) mechanisms. It is an on-chain swap service that allows anyone that has any KLAY or KCT-type token cryptocurrency to become a liquidity provider and earn income from transaction fee commissions. In KLAYswap, Ethereum-based tokens (ETH, ORC, DAI, WBTC) can be transferred to the Klaytn ecosystem via Orbit Bridge, a transparent IBC bridge, built on Orbit Chain, to offer yield farming with asset pairings previously unconnected in the decentralized world

The KSP token is the governance token of the KLAYswap platform. Holders have the responsibility and authority to determine governance agendas in compliance with the protocol related rules and regulations to lead the development of the service. As such, KSP holders directly participate in deciding things like fees, mining distribution, and contracts. Another main utility of KSP is for creating new liquidity pools. A specific amount of KSP must be paid as a pool contract creation fee when a new KCT token pair pool is created on KLAYswap.

KLAYswap Protocol Defi Coin Facts

| Compound | Facts |

|---|---|

| Defi Coin Name | KLAYswap |

| Short Name | KSP |

| Platform | Decentralized Finance |

| Ethereum Contract | 0x8762db106b2c2a0bccb3a80d1ed41273552616e8 |

| Chat Option | Chat |

| Whitepaper | Click Here To View |

| Official Website | Click Here To Visit |

Price

KLAYswap Protocol price today is $2.23 USD with a 24-hour trading volume of $450,080 USD. KLAYswap Protocol is up 3.74% in the last 24 hours. The current CoinMarketCap ranking is #542, with a market cap of $13,040,852 USD. It has a circulating supply of 5,835,257 KSP coins and a max. supply of 126,141,000 KSP coins.

The KSP token

KLAYswap Protocol Defi Coin has a structure in which tokens can be acquired through liquidity mining. KSP is distributed only through liquidity mining in each Genesis block and is distributed as compensation to KLAYswap liquidity providers in proportion of their provided liquidity to the pool total.

KLAYswap Protocol

No Central Operating Party

KLAYswap operates autonomously through various governance participants, such as traders and liquidity providers, rather than a specific central party.

Non-Custodial Trades

Directly communicating with the smart contracts by connecting a wallet without creating an account or depositing assets to a specific address.

Complete Control over Assets

Executive power and responsibility for the asset are soley the user’s, without the need for any intervention or trust in the transaction process.

Why KLAYswap

Transparency and Security

KLAYswap Protocol Defi Coin transactions are transparent and secure without counter-party risk as it is a trustless on-chain asset exchange.

Diverse Asset Pairs

Assets can be used efficiently because Ethereum-based assets such as ETH, WBTC, DAI as well as Klaytn-based assets can be swapped.

Bountiful Liquidity

The automated market making (AMM) mechanism and liquidity pool-based trading created from a variety of providers allow you to quickly and easily participate in various financial opportunities on Klaytn DeFi.

Liquidity by KLAYswap participants

Anyone can freely contribute to growing the KLAYswap ecosystem by participating in adding to the liquidity pools, liquidity providers can receive fair rewards by contributing through the liquidity mining program.

KLAYswap Advantages

Reliability

KLAYswap is having a security audit conducted by Certik, a globally renowned security audit agency. The KLAYswap protocol is comprised of and operates through a variety of smart contracts. A single, small vulnerability within a smart contract can lead to devastating accidents related to service availability and security. KLAYswap puts the safety of its users’ transactions first, and is in the process of getting a security certification with Certik to assure safe protection against any possible security incidents in the near future.

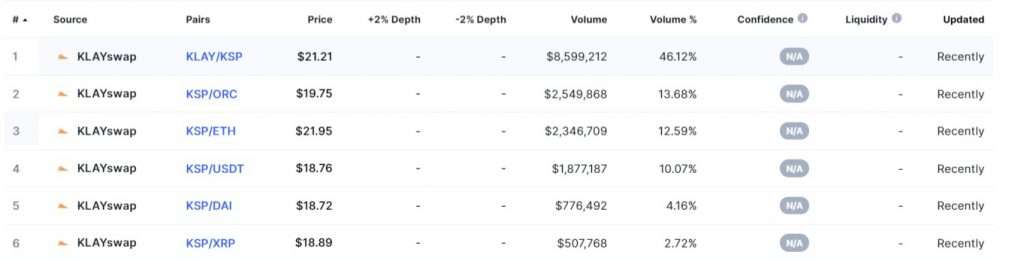

KLAYswap Protocol Markets

Sustainability

KLAYswap Protocol Defi Coin is not a copycat of Uniswap, neither is it a simple fork. We’ve developed KLAYswap from the ground to make it go much further than just offering liquidity mining as Uniswap does. The structure itself assures substantial and significant trading volume centered on sKLAY and KLAY. In particular, since sKLAY is an asset bonded to a staked KLAY, there will be an interesting market where the demand for a ‘discount’ to avoid the 7-day unstaking period and the demand to purchase KLAY at a lower price than the market price will meet. Especially if one contributes to this sKLAY-KLAY pool, the possibilities are.