About Reserve Rights Defi Coin

We’re building a stablecoin that can’t be shut down, and a network of decentralized fiat on/off ramps. Reserve Rights Defi Coin believe that everyone’s money should be secure. Billions of people around the world don’t have a safe place to store their money. Banks in some countries can’t be trusted, and some governments inflate their own currency to pay off debts, hurting citizens in the process.

With a few exceptions (money laundering, terrorist financing), Reserve Rights believe anyone in the world should be able to transact with anyone else. This requires low-friction, cross-border transactions, which are surprisingly hard to do in many cases today. That’s the reason for creating a stable, decentralized currency that can’t be abused by a government, because it is globally distributed outside of anyone’s control, and thus nearly impossible to shut down.

Reserve Rights Defi Coin Facts

| Compound | Facts |

|---|---|

| Defi Coin Name | Reserve Rights |

| Short Name | RSR |

| Platform | Decentralized Finance |

| Ethereum Contract | 0x8762db106b2c2a0bccb3a80d1ed41273552616e8 |

| Chat Option | Click Here To Visit Chat |

| Location | Headquartered in Oakland, CA |

| Official Website | Click Here To Visit |

Vision

Cryptocurrency started as a technical discussion on a mailing list, grew into a small movement, attracted hordes of speculators, and then splintered into a zillion useless imitations of itself. We believe it’s destined to consolidate and eventually give way to a battle for power on the global stage. We foresee uncomfortable disruption, a real threat of catastrophe, and a real promise of increased prosperity. Let us try to explain why.

- Money is broken in some parts of the world – corrupt governments have a hard time maintaining stable value in their currencies.

- Cryptocurrency is attempting to solve this problem, with many projects working on centralized coins that are pegged to the US dollar.

- The future dominant cryptocurrency will be a decentralized, dollar-independent stablecoin, and it will change the economic situation in many countries around the world.

Background

The initial production version of the Reserve Protocol will operate in a substantially centralized way, and over time each protocol component will be migrated on-chain and released from control by the founding team, eventually becoming fully decentralized. There are three planned phases of the Reserve network:

- The centralized phase — where Reserve is backed by a small number of collateral tokens, each of which is a tokenized US dollar.

- The decentralized phase — where Reserve is backed by a changing basket of assets in a decentralized way, but still stabilized in price with respect to the US dollar.

- The independent phase — where Reserve is no longer pegged to the US dollar, with the intent of stabilizing its real purchasing power regardless of fluctuations in the value of the dollar.

The Tokens

The Reserve Protocol interacts with three kinds of tokens:

- The Reserve token (RSV) — a stable cryptocurrency that can be held and spent the way we use US dollars and other stable fiat money.

- The Reserve Rights token (RSR) — a cryptocurrency used to facilitate the stability of the Reserve token.

- Collateral tokens — other assets that are held by the Reserve smart contract in order to back the value of the Reserve token, similar to when the US government used to back the US dollar with gold. The protocol is designed to hold collateral tokens worth at least 100% of the value of all Reserve tokens. Many of the collateral tokens will be tokenized real-world assets such as tokenized bonds, property, and commodities. The portfolio will start off relatively simple and diversify over time as more asset classes are tokenized.

How the Reserve Token is Stabilized

If demand goes down for the Reserve token, prices are expected to fall on secondary markets. What happens then?

Suppose the redemption price of Reserve is $1.00. If the price of Reserve on the open market is $0.98, arbitrageurs will be incentivized to buy it up and redeem it with the Reserve smart contract for $1.00 worth of collateral tokens. They’ll continue buying on open markets until there is no more money to be made, which is when the market price matches the redemption price of $1.00.

Reserve Rights Defi Coin same mechanism works in reverse when demand goes up. If the price of Reserve on the open market is $1.02, arbitrageurs will be incentivized to purchase newly minted Reserve tokens for $1.00 worth of either collateral or Reserve Rights tokens (the latter only if there is an excess pool of Reserve tokens available), and immediately sell them on the open market. They’ll continue selling on open markets until there is no more money to be made, which is when the market price matches the purchase price of $1.00.

How the Reserve Protocol is Capitalized

The Reserve Protocol holds the collateral tokens that back the Reserve token. When new Reserves are sold on the market, the assets used by market participants to purchase the new Reserves are held as collateral. This process keeps the Reserve collateralized at a 1:1 ratio even as supply increases.

At times, the Reserve Protocol may target a collateralization ratio greater than 1:1. When this is the case, scaling the supply of Reserve tokens requires additional capital in order to maintain the target collateralization ratio. To accomplish this the Reserve Protocol mints and sells Reserve Rights tokens in exchange for additional collateral tokens.

How Is the Reserve Rights Network Secured?

Reserve Rights Defi Coin Rights is currently an ERC-20 token based on the Ethereum blockchain. As a result, it is secured against attacks by a robust proof-of-work (POW) consensus mechanism backed by a network of thousands of Ethereum miners.

Reserve Rights is scheduled to migrate to its mainnet in 2020. As of October 2020, Reserve has not yet announced which consensus mechanism the new blockchain will use to secure the network.

Where Can You Buy Reserve Rights (RSR)?

Reserve Rights (RSR) is a popular token that currently maintains excellent liquidity. It is available to purchase and trade on several of the most well-established cryptocurrency exchange platforms, including Binance, Huobi Global and OKEx, and can be traded against various popular cryptocurrencies, including Bitcoin (BTC), Tether (USDT) and Ethereum (ETH), as well as the U.S. dollar (USD) on multiple platforms. To get started, consider buying Bitcoin with your credit or debit card. You can then exchange this for Reserve Rights tokens on various exchanges.

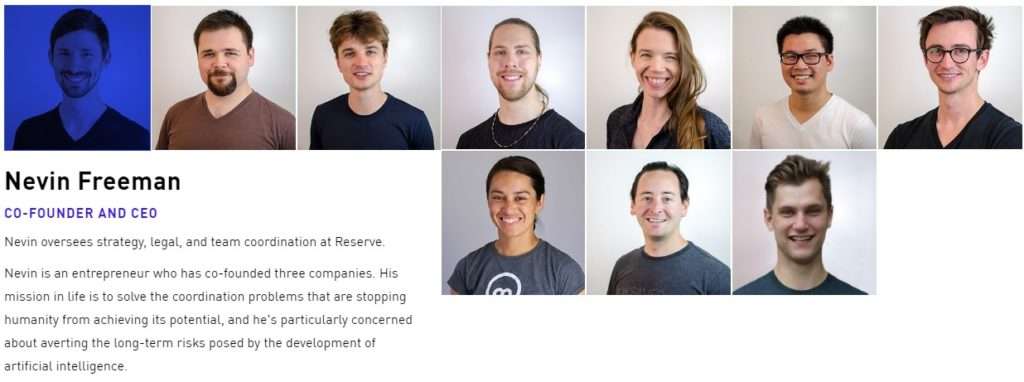

Meet the Team

We see a whole lot of utility in stable crypto.

Protect Your Money

Reserve enables people and businesses in countries with high inflation to protect their money by moving it out of broken currencies into a stable digital currency.

Send Money Across Borders

Reserve makes it cost-effective to send money across borders. This enables people to send money home to their families, and businesses to pay international suppliers in a stable currency.

Easily Accept Payments

Reserve allows businesses to accept payments in a stable digital currency, enabling them to easily pay their international suppliers, while also keeping their money out of inflation-prone local currency.

Two tokens power the Reserve protocol:

Reserve (RSV)

The stable cryptocurrency that is economically and legally robust at any scale. Decentralized, 100% asset backed, and funded by top Silicon Valley investors.

Reserve Rights (RSR)

The fluctuating protocol token that plays a role in stabilizing RSV and confers the cryptographic right to purchase excess Reserve tokens as the network grows.