About Frax Finance – Frax Ether Coin

Frax Finance – Frax Ether Coin many stablecoin protocols have entirely embraced one spectrum of design (entirely collateralized) or the other extreme (entirely algorithmic with no backing). Collateralized stablecoins either have custodial risk or require on-chain overcollateralization. These designs provide a stablecoin with a fairly tight peg with higher confidence than purely algorithmic designs. Purely algorithmic designs such as Basis, Empty Set Dollar, and Seigniorage Shares provide a highly trustless and scalable model that captures the early Bitcoin vision of decentralized money but with useful stability.

The issue with algorithmic designs is that they are difficult to bootstrap, slow to grow (as of Q4 2020 none have significant traction), and exhibit extreme periods of volatility which erodes confidence in their usefulness as actual stablecoins. They are mainly seen as a game/experiment than a serious alternative to collateralized stablecoins.

Frax Finance – Frax Ether Coin Point Table

| Coin Basic | Information |

|---|---|

| Coin Name | Frax Finance – Frax Ether Coin |

| Short Name | FRXETH |

| Circulating Supply | 52,171.18 FRXETH |

| Max Supply | N/A |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

Price Stability

FRAX can be minted and redeemed from the system for $1 of value, allowing arbitragers to balance the demand and supply of FRAX in the open market. At all times in order to mint new FRAX a user must place $1 worth of value into the system. If the market price is above the price target of $1, then there is an arbitrage opportunity to mint tokens by placing $1 of value into the system per FRAX and sell the minted FRAX for above $1 in the open market. The difference is simply the proportion of FXS and collateral comprising the $1 of value.

When FRAX is in the 100% collateral phase, all of the value that is used to mint FRAX is collateral. As the protocol moves into the fractional state, some of the value that enters into the system during minting becomes FXS (which is then burned). For example, in a 96% collateral ratio, every FRAX minted requires $.96 of collateral and burning $.04 of FXS. In a 95% collateral ratio, every FRAX minted requires $.95 of collateral and burning $.05 of FXS, and so on.

Collateral Ratio

The protocol adjusts the collateral ratio during times of FRAX expansion and retraction. During times of expansion, the protocol decollateralizes (lowers the ratio) the system so that less collateral and more FXS must be deposited to mint FRAX. This lowers the amount of collateral backing all FRAX. During times of retraction, the protocol recollateralizes (increases the ratio). This increases the ratio of collateral in the system as a proportion of FRAX supply, increasing market confidence in FRAX as its backing increases.

Frax Shares (FXS)

The Frax Share token (FXS) is the non-stable, utility token in the protocol. It is meant to be volatile and hold rights to governance and all utility of the system. It is important to note that we take a highly governance-minimized approach to designing trustless money in the same ethos as Bitcoin. We eschew DAO-like active management such as MakerDAO. The less parameters for a community to be able to actively manage, the less there is to disagree on.

Parameters that are up for governance through FXS include adding/adjusting collateral pools, adjusting various fees (like minting or redeeming), and refreshing the rate of the collateral ratio. No other actions such as active management of collateral or addition of human-modifiable parameters are possible other than a handwork that would require voluntarily moving to a new implementation entirely.

Why Choose Frax Finance – Frax Ether Coin?

Fractional

Frax is the first and only stablecoin with parts of its supply backed by collateral and parts of the supply algorithmically stabilized. The stablecoin (FRAX) is named after this hybrid fractional-reserve system.

Fraxswap, a native AMM

Fraxswap is the first AMM with time weighted average market maker orders used by the Frax Protocol for rebalancing collateral, mints/redemptions, expanding/contracting FRAX supply, and deploying protocol owned liquidity on chain.

Fraxlend, permission less lending markets

Fraxlend is the lending facility for the FRAX & FPI stablecoins allowing debt origination, customized non-custodial loans, and onboarding collateral assets to the Frax Finance economy.

Crypto Native CPI Stablecoin

Frax’s end vision is to build the most important decentralized stablecoins in the world. The Frax Price Index (FPI) stablecoin is the first stablecoin pegged to a basket of consumer goods creating its own unit of account separate from any nation state denominated money.

Four Tokens

FRAX is the stablecoin targeting a tight band around $1/coin. Frax Share (FXS) is the governance token of the entire Frax ecosystem of smart contracts which accrues fees, seigniorage revenue, and excess collateral value. FPI is the inflation resistant, CPI pegged stablecoin. FPIS is the governance token of the Frax Price Index and splits its value capture with FXS holders.

Gauge Rewards System

The community can propose new gauge rewards for strategies that integrate FRAX stablecoins. FXS emissions are fixed, halve each year, and entirely flow to different gauges based on the votes of veFXS stakers.

Where Can You Buy Frax Finance – Frax Ether Coin?

Tokens Can Be Purchased On Most Exchanges. One Choice To Trade Is On Curve Finance, As It Has The Highest FRXETH/ETH. e Trading Volume, $8,947 As Of February 2021. Next is OKEx, With A Trading Volume Of $6,180,82. Other option To Trade Include FRXETH/ETH And Huobi Global. Of Course, It Is Important To Note That Investing In Cryptocurrency Comes With A Risk, Just Like Any Other Investment Opportunity.

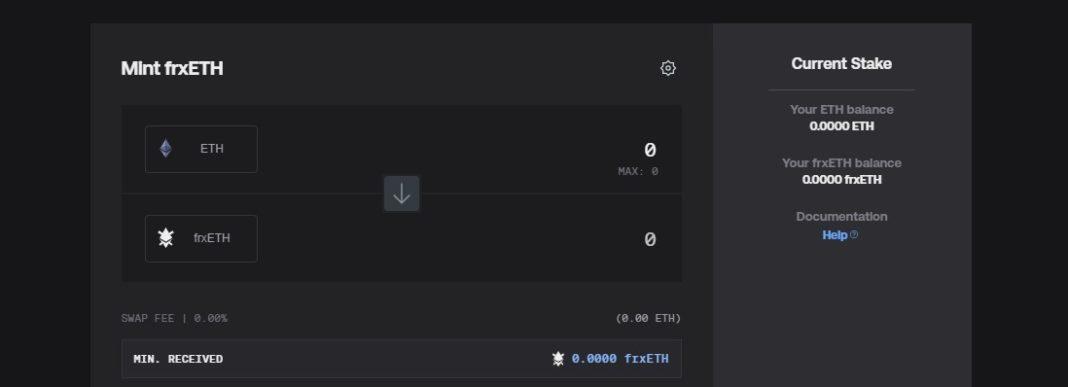

Market Screenshot

Frax Finance – Frax Ether Coin Supported Wallet

Several Browser And Mobile App Based Wallets Support Frax Finance – Frax Ether Coin. Here Is Example Of Wallet Which Frax Finance – Frax Ether Coin – Trust Wallet For Hardware Ledger Nano.

FAQ Of Frax Finance – Frax Ether Coin

here I Can Find Frax Finance – Frax Ether Coin Whitepaper?

You Can Find Frax Finance – Frax Ether Coin Whitepaper By Clicking Here.

Where I Can Buy/Sell Balancer Token?

You Can Buy or Sell Balancer Token On Some Popular Exchange For Example – Curve Finance.

What is Circulating Supply Of Balancer Token?

Circulating Supply Of Balancer Token Is 52,171.18 FRXETH.