What Is Dot Dot Finance?(DDD)

Dot Dot Finance is a protocol to optimize yield, voting power, and liquidity provisioning on Ellipsis. Ellipsis is a decentralized exchange (AMM) where tokens may be swapped using liquidity provided by other users. Those users earn EPX emissions. Those who lock EPX receive vlEPX and earn a higher share of EPX rewards. vlEPX or vote locked EPX aims to reward long term users of a protocol. Those who hold vlEPX earn trading rewards from the protocol as well as voting power to direct EPX emissions.

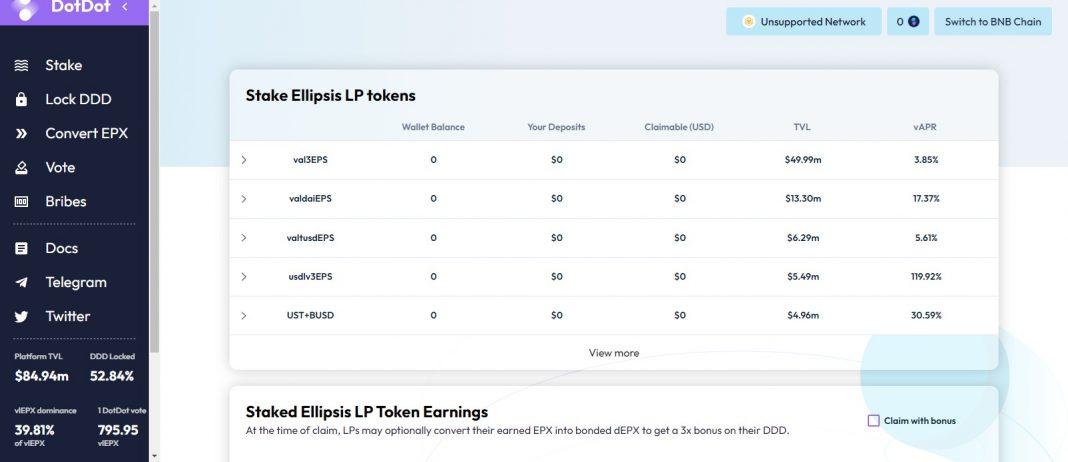

Important Points Table Of Dot Dot Finance

| Basic | Points |

|---|---|

| Coin Name | Dot Dot Finance |

| Short Name | DDD |

| Circulating Supply | 23,390,497.39 DDD |

| Explorer | Click Here To View |

| Documentation | View Document |

| Website | Click Here To Visit |

How to Buy the Continental & Trade On Exchange?

dEPX Token

A representation of every locked vlEPX token in the protocol. 1 dEPX is minted for every 1 vlEPX that Dot Dot Finance has.

DDD Token

The Dot Dot Finance Coin protocol token, which once locked controls voting power and earns protocol bribes and rewards. DDD is emitted in two ways, one-off to bootstrap the protocol, and continuously as EPX is farmed by Liquidity Providers.

There is no capped supply of DDD, instead the token emission largely follows that of EPX, with tokens only minted if the protocol is used and therefore found to be of value to its users.

Fees

Liquidity providers who use Dot Dot Finance earn a greater share of boosted EPX emissions. This is made possible thanks to those who have locked EPX on dot dot. In return, they earn a share of the rewards they have helped boost. Dot Dot charges 15% performance fee on all the boosted EPX earned by Liquidity Providers. This is distributed to Dot Dot users the following way.

DEPX Token

A tokenized representation of Dot Dot Finance vlEPX position, earning rewards and trading fees.

Converting EPX into dEPX

The supply of dEPX is always 1:1 with the amount of EPX locked by the protocol. Users convert EPX, locking them into the protocol forever, and receive the equivalent amount of dEPX in return.

Staking times

- 1.Once staked, 8 days must pass before you can unstake.

- 2.After these 8 days, you can unstake at any time, and you will continue to earn rewards until you initiate the unstaking process.

- 3.Once initiated, unstaking streams dEPX out linearly and lasts for 15 days. During this period, the tokens do not earn rewards.

Staking rewards

- 10% of all EPX earned by all dot dot Liquidity Providers.

- DDD tokens, minted to the same ratio as the total EPX earned as protocol fees from dot dot Liquidity Providers (i.e. 15% at a 20:1 ratio).

- All Ellipsis trading fees earned by Dot Dot.

DDD Token

The Dot Dot Finance protocol token, controlling vlEPX voting power and accruing bribes and rewards. DDD earns rewards and controls voting power once locked in Dot Dot.

Locking times

Dot Dot Finance can be locked between 1-16 weeks:

- Voting and reward weight is relative to the lock duration, with the maximum 16 weeks being 16x greater than the minimum 1 week.

- Locking is a weekly step function – every Thursday at 00:00:00 UTC every user’s lock decreases by one step and remains on this step until next Thursday.

- Locks can be extended (up to the maximum of 16 weeks) at any time.

- A user can have multiple DDD locks of different duration.

- Once expired, unlocked DDD can be withdrawn by initiating an exit stream. Once initiated, the tokens stream linearly over a week during which they can be partially claimed. During this process, DDD rewards are not earned.

Locking rewards

- Voting power, controlling Dot Dot vlEPX to determine future EPX emissions.

- Bribes, from the pools which you voted for in the previous week.

- 2.5% of all EPX farmed by protocol (as dEPX).

- 2.5% of all EPX farmed by protocol (as dEPX), if voting on the dEPX/EPX pool.