In this article, I will discuss the best Forex DeFi hybrid exchanges, which combine the efficiency of centralized platforms with the transparency and security of decentralized finance.

These exchanges offer traders a unique environment to execute advanced forex-like strategies while maintaining full control over their assets. Let’s explore the top platforms that seamlessly blend both worlds.

Key Points & Best Forex DeFi Hybrid Exchange List

| Platform | Key Point |

|---|---|

| dYdX | A decentralized perpetuals exchange known for low fees and high leverage. |

| Uniswap | Leading Ethereum-based DEX offering seamless token swaps via liquidity pools. |

| Balancer | DeFi protocol enabling customizable liquidity pools and smart portfolio management. |

| ApeX Pro | Decentralized derivatives exchange with zero gas fees and cross-chain support. |

| Raydium | Solana-based DEX offering high-speed trading and yield farming. |

| Kraken | Centralized exchange known for strong security, fiat support, and compliance. |

| OKX | Global crypto exchange offering spot, futures, and DeFi integration. |

| PancakeSwap | Popular BNB Chain DEX with yield farming, lottery, and token launchpad features. |

| P2PB2B | Centralized exchange with a focus on altcoins and high liquidity. |

9 Best Forex DeFi Hybrid Exchange

1.dYdX

Among the myriad DeFi solutions, dYdX is the leading hybrid exchange integrating forex-style trading alongside decentralized finance. Its built on a layer-2 Ethereum solution, it offers perpetual contracts with high leverage, low fees, and instant trade execution.

Users enjoy enhanced security and transparency because, in contrast to centralized systems, they have full custody of their funds.

The powerful model that dYdX uses integrates DeFi with centralized order books, making it perfect for skilled traders. With sophisticated instruments and a simple design, dYdX furthers innovations in decentralized trading.

| Feature | Description |

|---|---|

| Perpetual Contracts | High-leverage contracts for advanced traders. |

| Layer-2 Solution | Built on StarkWare for faster and cheaper transactions. |

| No Gas Fees | Zero gas fees for trading, reducing costs for users. |

| Full Asset Control | Users retain custody of assets, maintaining decentralization. |

| Advanced Trading Tools | Includes limit orders, stop losses, and charting for pro traders. |

2.Uniswap

Uniswap stands as one of the most recognized DEXs (decentralized exchanges) for its immense utility in the DeFi contracting. The platform allows seamless forex-like token swaps without the involvement of intermediaries.

Uniswap utilizes the AMM (automated market maker) model that enables the trading of thousands of tokens with ease. Users enjoy unparalleled liquidity and complete control over their assets.

Although not a forex trading platform in the classic sense, its trading support for myriad tokens and non-restrictive access renders it a hybrid for decentralized currency trading.

Continuous upgrades and community-powered governance have strengthened Uniswap’s core position as a benchmarkin DeFi innovations.

| Feature | Description |

|---|---|

| Automated Market Maker (AMM) | Liquidity pools enable token swaps without order books. |

| Ethereum-Based | Operates on the Ethereum blockchain with low slippage. |

| Permissionless | Anyone can trade, list tokens, and provide liquidity. |

| Liquidity Pools | Deep liquidity for a wide range of token pairs. |

| Governance by UNI Token | Decentralized governance via community voting with UNI tokens. |

3.Balancer

Balancer is a leading merger among hybrid forex like exchanges because it innovatively alters decentralized trading and liquidity provisioning. It lets users design customized liquidity pools containing as many as eight assets in different proportions, which is perfect for multi-currency strategies.

This freedom offers dynamic forex portfolios complete with automatic rebalancing and efficient swaps. With Balancer smart pook technology, traders can now execute permissionless trading with little slippage and optimized fees.

Balancer combines portfolio management and DeFi liquidity, allowing traders to transparently and empowering them to diversify their decentralized asset strategies.

| Feature | Description |

|---|---|

| Multi-Asset Liquidity Pools | Supports up to eight tokens in a pool with customizable ratios. |

| Automated Portfolio Management | Users can create and manage portfolios within liquidity pools. |

| Flexible Fees | Fee structure is customizable, optimizing cost-efficiency. |

| Smart Pool Technology | Advanced pool management to reduce slippage and enhance liquidity. |

| Token Swapping | Facilitates seamless token swapping with low slippage. |

4.ApeX Pro

The ApeX Pro is a next generation decentralized derivatives exchange with Hybrid trading functionalities that are most suitable for Forex-like tactics. It is powered by StarkWare’s layer-2 scaling and offers trade execution within seconds, liquidity, and no gas fees.

Traders have access to perpetual contracts on key crypto assets with high leverage, simulating traditional forex operations in a fully decentralized setting. ApeX Pro also allows for cross-chain deposits along with self-custody making it both flexible and secure.

Its highly sophisticated interface coupled with strong risk management features enables ApeX Pro to balance the innovations in DeFi and the performance of forex markets.

| Feature | Description |

|---|---|

| Zero Gas Fees | No gas fees for trading on the platform. |

| Perpetual Contracts | Supports high-leverage crypto derivatives. |

| Layer-2 Technology | Built on StarkWare for fast execution and scalability. |

| Cross-Chain Support | Allows assets from multiple blockchains to be traded. |

| Advanced Risk Management | Tools for managing trades and minimizing risk in volatile markets. |

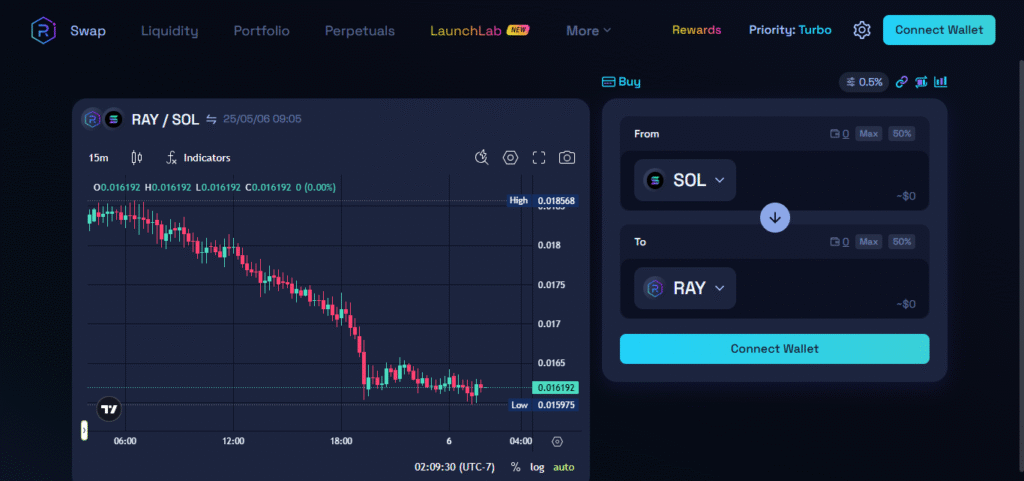

5.Raydium

Raydium is a hybrid decentralized exchange on Solana offering both facilities of an automated market maker and traditional order book. This allows execution through Serum using trades from both liquidity pools and order books.

This combination allows users to experience speed and accuracy akin to the CeFi trading platforms, while DeFi counterparts provide unparalleled openness.

With ultra-fast transactions, deep liquidity, and low fees, Raydium is ideal for multi-asset trading which is desirable for forex traders looking for a decentralized platform without compromising on performance.

| Feature | Description |

|---|---|

| Solana-Based | Built on Solana for fast and low-cost trading. |

| Automated Market Maker (AMM) | Liquidity pools for token swaps, ensuring deep liquidity. |

| Serum Integration | Combines an order book for traditional trading with DeFi pools. |

| Low Fees | Offers ultra-low transaction fees, thanks to Solana’s scalability. |

| Yield Farming | Provides opportunities to earn rewards through liquidity pools. |

6.Kraken

Kraken ranks amongst the elite centralized exchanges with remarkable distinguishing characteristics of a hybrid platform for forex-style cryptocurrency trading.

It accommodates diverse fiat-crypto pairs, boasts substantial liquidity, margin trading, and future contracts—all well-regulated.

While not DeFi-centric, Kraken alleviates the burden by offering secure API access, staking, and decentralized wallet integrations. It employs industry leading security measures while also maintaining low and clear fees.

Price withstanding institutional quality tools makes Kraken a trusted platform for pro multi-asset traders and fosters the use of crypto trading amongst traditional forex traders.

| Feature | Description |

|---|---|

| Fiat Support | Allows for deposit and withdrawal of fiat currencies. |

| Spot & Margin Trading | Offers both spot and margin trading for various assets. |

| Futures Trading | Provides advanced derivatives trading for institutional investors. |

| High Security | Strong regulatory compliance and robust account security. |

| Staking | Allows users to stake crypto and earn rewards. |

7.OKX

OKX is a crypto trading platform that accommodates a range of trading strategies. Its versatile OKX trading interface hybridizes the traits of both centralized exchanges and DeFi, creating an environment suited for forex-style trading.

OKX features various markets such as spot, margin, and derivatives, boasting high liquidity and an extensive range of trading pairs that includes both dominant cryptocurrencies and stablecoin-backed fiat.

In addition, OKX features a self-regulated DeFi ecosystem built around yield farming and DApps, which can be accessed through its Web3 wallet.

This allows traders to switch from traditional exchange services to decentralized finance solutions, making OKX an advanced platform for sophisticated forex-style crypto trading.

| Feature | Description |

|---|---|

| Wide Range of Pairs | Offers a broad selection of fiat and crypto trading pairs. |

| Spot, Margin, and Futures | Supports a variety of trading options including derivatives. |

| DeFi Hub | Access decentralized finance features, like staking and yield farming. |

| Web3 Wallet | Offers seamless connection to decentralized applications. |

| API Trading | Enables automated and institutional trading via API. |

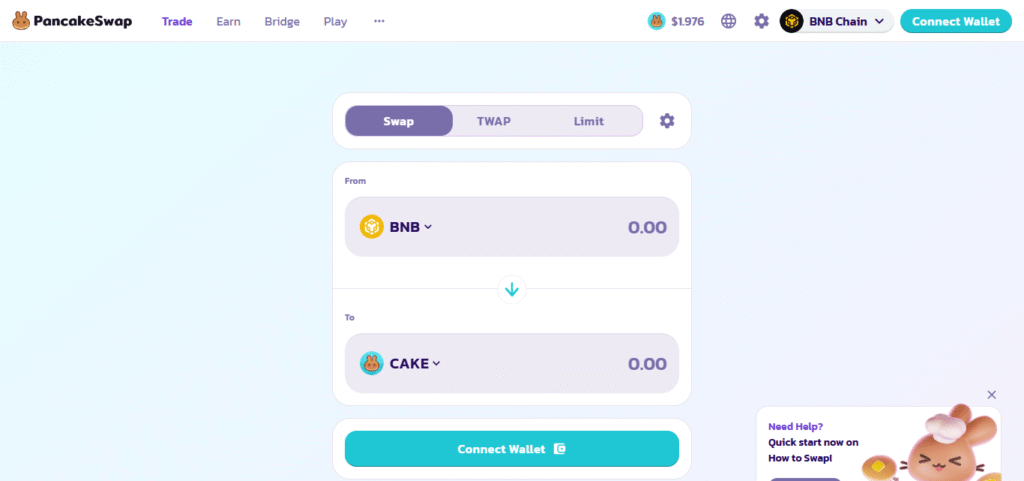

8.PancakeSwap

PancakeSwap is the most popular dai swap service in BNB Chain and its region as it supports quick and affordable token trading.

Due to its AMM model, swaps are done in real-time for its thousands of listed tokens as there are numerous liquidity pools which cater to various strategies.

It also interfaces advanced features of DeFi like staking, yield farming, prediction markets and others with simple UI and smooth execution.

These traits make PancakeSwap cross chain and facilitate DAO governance, increasing the accessibility and efficiency of a platform aiming to bring forex operations into decentralization.

| Feature | Description |

|---|---|

| BNB Chain-Based | Built on BNB Chain for fast, low-cost transactions. |

| Automated Market Maker (AMM) | Provides liquidity pools for token swapping. |

| Yield Farming & Staking | Offers users the ability to farm and stake tokens for rewards. |

| Lottery & NFT Marketplace | Adds fun elements like lottery and NFT trading. |

| Governance by CAKE Token | Community-driven governance through staking CAKE tokens. |

10.P2PB2B

P2PB2B is a centralized exchange that offers a unique combination of forex-style centralized trading with decentralized aspects, allowing crypto enthusiasts to experience the best of both worlds.

It has an extensive list of trading pairs which includes both major fiat currencies and altcoins which is perfect for a multitude of complex trading strategies. Competitive fees, high liquidity as well as numerous trading options make P2PB2B suitable for both professional and novice traders.

Although not entirely DeFi-native, the integration of decentralized systems and wallets can be done effortlessly, providing users the ability to combine the central control of their assets with decentralized freedom.

| Feature | Description |

|---|---|

| High Liquidity | Provides deep liquidity for a wide range of crypto pairs. |

| Advanced Trading Options | Supports spot, margin, and futures trading. |

| API Integration | Allows for automated trading via API. |

| Low Fees | Competitive trading fees for a wide range of assets. |

| Wide Altcoin Support | Offers numerous altcoins, especially emerging tokens. |

Conclusion

In summation, the leading hybrid Forex DeFi exchanges integrate the precision of centralsed systems alongside the flexibility of decentralized systems. dYdX, Uniswap, and ApeX Pro are some of the platforms that offer low fees, high level of security, and sophisticated trading solutions.

These traders are optimally placed to execute DeFi forex strategies within a dynamic ecosystem. Each offer distinct advantages specifically designed to meet diverse trading requirements.