In this article, I will discuss the best Russell 2000 ETFs to buy, offering exposure to U.S. small-cap stocks. These ETFs provide diverse investment strategies, including growth, value, dividends, and multifactor approaches.

Whether you’re seeking long-term growth, income, or short-term trades, these top-performing ETFs can help you diversify your portfolio and capitalize on small-cap market opportunities.

Key Points & Best Russell 2000 ETFs To Buy In 2025 List

| ETF Name | Key Points |

|---|---|

| iShares Russell 2000 ETF (IWM) | Broad small-cap exposure, 0.19% expense ratio, ~$70B AUM, ~1.3% dividend yield. |

| Vanguard Russell 2000 ETF (VTWO) | Low-cost broad small-cap exposure, 0.10% expense ratio, ~$8B AUM, ~1.2% yield. |

| Vanguard Russell 2000 Growth ETF (VTWG) | Focus on small-cap growth, 0.15% expense ratio, ~$1.7B AUM, ~0.6% yield. |

| Vanguard Russell 2000 Value ETF (VTWV) | Targets small-cap value stocks, 0.15% expense ratio, ~$1.5B AUM, ~2.0% yield. |

| Direxion Daily Small Cap Bull 3x (TNA) | 3x leveraged small-caps, 1.08% expense ratio, ~$1.2B AUM, no dividend yield. |

| ProShares Russell 2000 Dividend Growers (SMDV) | Dividend-growing small-caps, 0.41% expense ratio, ~$800M AUM, ~2.1% yield. |

| iShares Russell 2000 Growth ETF (IWO) | Small-cap growth focus, 0.23% expense ratio, ~$9B AUM, ~0.6% yield. |

| Invesco Russell 2000 Dynamic Multifactor (OMFS) | Multi-factor small-caps, 0.39% expense ratio, ~$220M AUM, ~1.0% yield. |

| SPDR Russell 2000 ETF (TWOK) | Broad small-cap exposure, 0.12% expense ratio, ~$450M AUM, ~1.3% yield. |

| Schwab Fundamental US Small Company ETF (FNDA) | Fundamental small-caps, 0.25% expense ratio, ~$7B AUM, ~1.4% yield. |

9 Best Russell 2000 ETFs To Buy In 2025

1.iShares Russell 2000 ETF (IWM)

The iShares Russell 2000 ETF (IWM) is an exchange traded fund that tracks the performance of the small capitalization companies in the Us stock market. It replicates the performance of the Russell 2000 Index which comprises of 2000 small capcompanies operating in different industries.

IWM incurs an expense ratio of 0.19%. and represents over $70 billion worth of assets, noting its liquidity along with expense diversification with a multitude of investment.

In addition, it yields a dividend yield of about 1.3% which is attractive for growth and income investment. IWM is a great investment for a long term stock portfolio since it is a simple way to gain exposure to small cap stocks.

iShares Russell 2000 ETF (IWM) – Key Details

| Category | Details |

|---|---|

| Index Tracked | Russell 2000 Index |

| Expense Ratio | 0.19% |

| Assets Under Management (AUM) | $70 billion+ |

| Dividend Yield | ~1.3% |

| Holdings | ~2,000 U.S. small-cap stocks |

| Top Sectors | Financials, Industrials, Healthcare |

| Strategy | Broad small-cap exposure |

| Ideal For | Long-term growth investors |

| Risk Level | Moderate to high |

2.Vanguard Russell 2000 ETF (VTWO)

The Vanguard Russell 2000 ETF (VTWO) tracks the Russell 2000 Index, making it a great choice for investors wanting a cost-effective way to invest in U.S. small-cap stocks. With an expense ratio of just 0.10% andover $8 billion in assets it stands out as a favorable option for VTWO is good for long-term growth.

It’s diversification, alongside those seeking smaller investments. VTWO includes 2,000 smaller companies in its assets, solidifying its growth possibilities. It makes the ETF appealing to both income and growth investors because of its dividend yield around 1.2%.

Vanguard Russell 2000 ETF (VTWO) – Key Details

| Category | Details |

|---|---|

| Index Tracked | Russell 2000 Index |

| Expense Ratio | 0.10% |

| Assets Under Management (AUM) | $8 billion+ |

| Dividend Yield | ~1.2% |

| Holdings | ~2,000 U.S. small-cap stocks |

| Top Sectors | Financials, Industrials, Healthcare |

| Strategy | Broad small-cap exposure |

| Ideal For | Cost-conscious, long-term investors |

| Risk Level | Moderate to high |

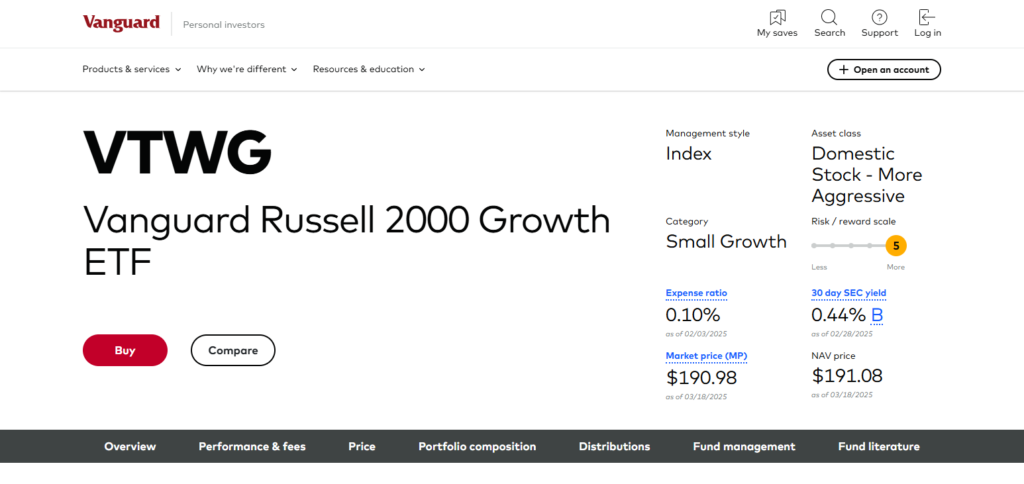

3.Vanguard Russell 2000 Growth ETF (VTWG)

TheVanguard Russell 2000 Growth ETF (VTWG) traces the Russell 2000 Growth Index making it useful for those interested in investing in small cap growth stocks. With an expense ratio of just 0.15 percent, and withover $1.7 billion in assets*, it provides an economical investment option for people looking to gain exposure to smaller

fast-growing firms VTWG is targeted more towards investors looking for capital appreciation instead of dividend income as funds yield around 0.6 percent. With investment in technology, healthcare, and consumer discretionaryVTWG is an excellent option for the growth-oriented portion of diversified portfolios.

Vanguard Russell 2000 Growth ETF (VTWG) – Key Details

| Category | Details |

|---|---|

| Index Tracked | Russell 2000 Growth Index |

| Expense Ratio | 0.15% |

| Assets Under Management (AUM) | $1.7 billion+ |

| Dividend Yield | ~0.6% |

| Holdings | ~1,200 U.S. small-cap growth stocks |

| Top Sectors | Technology, Healthcare, Consumer Discretionary |

| Strategy | Small-cap growth exposure |

| Ideal For | Growth-focused investors |

| Risk Level | High |

4.Vanguard Russell 2000 Value ETF (VTWV)

The Vanguard Russell 2000 Value ETF (VTWV) seeks outsmall-cap value stocksby following the Russell 2000 Value Index. VTWV has assets under management exceeding $1.5 billion and offers a low expense ratio of 0.15% making it a great option if investors want to capitalize on small, undervalued companies with growth potential.

Value investors would find it appealing as it gives exposure to thefinancial, industrial, and consumer services sectors. VTWV is also attractive to investors looking for dividends alongside long-term capital growth due to its dividend yield of approximately 2.0%.

Vanguard Russell 2000 Value ETF (VTWV) – Key Details

| Category | Details |

|---|---|

| Index Tracked | Russell 2000 Value Index |

| Expense Ratio | 0.15% |

| Assets Under Management (AUM) | $1.5 billion+ |

| Dividend Yield | ~2.0% |

| Holdings | ~1,200 U.S. small-cap value stocks |

| Top Sectors | Financials, Industrials, Consumer Services |

| Strategy | Small-cap value exposure |

| Ideal For | Value-focused investors |

| Risk Level | Moderate to high |

5.Direxion Daily Small Cap Bull 3x Shares (TNA)

The Direxion Daily Small Cap Bull 3x Shares (TNA) is a small-cap stock-focused ETF. It is a leveraged ETF meant for day traders. They make money off the small, volatile movements in small-cap stocks. It seeks to provide 3x the daily performance of the Russell 2000 and as one would expect, that comes with an insane amount of volatility.

Having an expense ratio of 1.08% and over 1.2B in assets TNA can provide profits, but as with most leveraged trades, carries a large risk. Not paying dividends compounds the issue and makes it geared towards short-term speculative trading. As such, TNA is best suited for experienced and aggressive traders.

Direxion Daily Small Cap Bull 3x Shares (TNA) – Key Details

| Category | Details |

|---|---|

| Index Tracked | Russell 2000 Index (3x leverage) |

| Expense Ratio | 1.08% |

| Assets Under Management (AUM) | $1.2 billion+ |

| Dividend Yield | None |

| Holdings | ~2,000 U.S. small-cap stocks |

| Top Sectors | Financials, Industrials, Healthcare |

| Strategy | 3x daily leveraged exposure |

| Ideal For | Short-term, aggressive traders |

| Risk Level | Very high |

6.ProShares Russell 2000 Dividend Growers ETF (SMDV)

The ProShares Russell 2000 Dividend Growers ETF (SMDV) targets small cap firms that have a track record of increasing their dividends, as it passively manages the Russell 2000 Dividend Growth Index.

It has over $800 million in assets while boasting an expense ratio of 0.41%.SMDV also provides exposure to financially sound small cap stocks, which makes SMDV even better since it pays a dividend yield of approximately 2.1%.

Income-focused investors looking for potential growth will certainly find it appealing. It’s perfect for people trying to capitalize on dividend small caps offering a great investment opportunity for long-term holders.

ProShares Russell 2000 Dividend Growers ETF (SMDV) – Key Details

| Category | Details |

|---|---|

| Index Tracked | Russell 2000 Dividend Growth Index |

| Expense Ratio | 0.41% |

| Assets Under Management (AUM) | $800 million+ |

| Dividend Yield | ~2.1% |

| Holdings | ~60 U.S. small-cap dividend growers |

| Top Sectors | Financials, Industrials, Consumer Discretionary |

| Strategy | Dividend growth small-caps |

| Ideal For | Income-focused, long-term investors |

| Risk Level | Moderate |

7.iShares Russell 2000 Growth ETF (IWO)

The iShares Russell 2000 Growth ETF (IWO) gives investors access to small-cap growth companies by following the Russell 2000 Growth Index. With an expense ratio of 0.23% and more than $9 billion in assets, it’s very popular among investors that are after high growth.

Its focus on technology, healthcare, and consumer discretionary services makes it a best fit for aggressive long-term growth strategies. With a dividend yield of around 0.6 percent, IWO prioritizes capital appreciation over income, which make this ETF best fit for growth portfolios.

iShares Russell 2000 Growth ETF (IWO) – Key Details

| Category | Details |

|---|---|

| Index Tracked | Russell 2000 Growth Index |

| Expense Ratio | 0.23% |

| Assets Under Management (AUM) | $9 billion+ |

| Dividend Yield | ~0.6% |

| Holdings | ~1,200 U.S. small-cap growth stocks |

| Top Sectors | Technology, Healthcare, Consumer Discretionary |

| Strategy | Small-cap growth exposure |

| Ideal For | Growth-focused investors |

| Risk Level | High |

8.Invesco Russell 2000 Dynamic Multifactor ETF (OMFS)

The Invesco Russell 2000 Dynamic Multifactor ETF (OMFS) utilizes a multi-factor approach to gain exposure to small-cap stocks. It follows the index of Russell 2000 Invesco Dynamic Multifactor which chooses companies using the factors of value, quality, momentum, and low volatility.

OMFS provides a multi-factored diversified passive ETF with over $220 million in assets and an expnse ratio of 0.39%. This fund’s around 1.0% dividend yield has income potential. OMFS is great for investors looking for small cap factor diversification with a goal to achieving better risk-adjusted returns over a long-term period.

Invesco Russell 2000 Dynamic Multifactor ETF (OMFS) – Key Details

| Category | Details |

|---|---|

| Index Tracked | Russell 2000 Invesco Dynamic Multifactor Index |

| Expense Ratio | 0.39% |

| Assets Under Management (AUM) | $220 million+ |

| Dividend Yield | ~1.0% |

| Holdings | ~1,200 U.S. small-cap stocks |

| Top Sectors | Financials, Industrials, Healthcare |

| Strategy | Multi-factor small-cap exposure |

| Ideal For | Diversified, long-term investors |

| Risk Level | Moderate to high |

9.SPDR Russell 2000 ETF (TWOK)

The ETF SPDR Russell 2000 ETF (TWOK) aids in investing in U.S. small-cap stocks by following the Russell 2000 Index. With modest expenses at 0.12% and possessing more than $450 million in assets, this ETF is a good choice for those looking into diversified small-cap investing.

TWOK gives exposure to 2,000 smaller companies in a variety of industries, therefore making it ideal for investment in long-term growth portfolios. Its liquidity along with low fees, make it appealing for more cost-efficient investors looking to invest in small-cap markets. The dividend yield also adds some potential income while sitting at andyield of around 1.3%.

SPDR Russell 2000 ETF (TWOK) – Key Details

| Category | Details |

|---|---|

| Index Tracked | Russell 2000 Index |

| Expense Ratio | 0.12% |

| Assets Under Management (AUM) | $450 million+ |

| Dividend Yield | ~1.3% |

| Holdings | ~2,000 U.S. small-cap stocks |

| Top Sectors | Financials, Industrials, Healthcare |

| Strategy | Broad small-cap exposure |

| Ideal For | Cost-conscious, long-term investors |

| Risk Level | Moderate to high |

10.Schwab Fundamental US Small Company ETF (FNDA)

The Schwab Fundamental US Small Company ETF (FNDA provides investors with a chance to invest in small-cap stocks using fundamental indexing. It follows the Russell RAFI US Small Company Index which uses income, cash flow, and book value instead of market cap to weight companies.

It boasts an expense ratio of 0.25% a dividend yield of about 1.4%, and over7 billion dollars in assets which makes it appealing for value-focused investors. FNDA is great for investors looking for long-term growth and provides a different approach from conventional small-cap ETFs.

Schwab Fundamental US Small Company ETF (FNDA) – Key Details

| Category | Details |

|---|---|

| Index Tracked | Russell RAFI US Small Company Index |

| Expense Ratio | 0.25% |

| Assets Under Management (AUM) | $7 billion+ |

| Dividend Yield | ~1.4% |

| Holdings | ~900 U.S. small-cap stocks |

| Top Sectors | Financials, Industrials, Consumer Discretionary |

| Strategy | Fundamental-weighted small-cap exposure |

| Ideal For | Value-focused, long-term investors |

| Risk Level | Moderate to high |

Conclusion

In conclusion, The best Russell 2000 ETFs provide different exposures to small-cap stocks which can fit different strategies such as growth, value, dividends, and multifactor approaches.

SMDV and FNDA focus on dividends and fundamentals, while IWM, VTWO, and TWOK allow more broad access to the market. Make your selection based on your risk tolerance, goals, and strategy to maximize their small-cap portfolio best.