In this article, I explain the top forex brokers that allow users to collateralize with cryptocurrencies.

As cryptocurrency continues to evolve, a number of forex brokers permit traders to collateralize margin trading with digital currencies such as Bitcoin and Ethereum.

This development brings more convenience as traders can now maximize their trading opportunities in both traditional forex and cryptocurrency markets.

key Points & Best Forex Broker with Crypto-Collateral Support List

| Broker | Key Points |

|---|---|

| Fusion Markets | Low spreads, commission-based pricing, great customer support, solid trading tools, focused on forex and CFDs. |

| Pepperstone | Regulated in multiple regions, low spreads, fast execution, wide range of trading platforms including MT4 and MT5. |

| FP Markets | Strong regulatory status, competitive spreads, offers a range of account types, excellent customer service. |

| Global Prime | ECN pricing, tight spreads, high-quality execution, focuses on forex and commodities. |

| BlackBull Markets | Low spreads, ECN accounts, regulated, offers a variety of account types, great for scalping and day trading. |

| Tickmill | Low spreads, strong regulatory framework, fast execution, excellent for forex traders with a focus on low costs. |

| Eightcap | Competitive spreads, low fees, offers MT4, MT5 platforms, good customer service, strong regulatory status. |

| OctaFX | Low spreads, offers MT4, MT5, and mobile trading apps, strong promotions for new traders, global reach. |

| Plus500 | Regulated in multiple countries, wide range of instruments, easy-to-use platform, no commission fees. |

| HFM | Offers a variety of accounts, solid leverage options, strong customer support, primarily focused on forex and CFDs. |

10 Best Forex Broker with Crypto-Collateral Support

1.Fusion Markets

Fusion Markets is a low-cost forex broker that accepts crypto collateral. As with other brokerage services, both retail and institutional clients can use crypto to back margin accounts. Cryptocollateral is particularly useful for margin Forex trading to increase earnings.

With Fusion Markets, users get responsive customer service alongside a dependable trading infrastructure, making the platform ideal for crypto and forex traders.

Due to the broker’s wide coverage of trading assets, it gives users participating in both markets considerable flexibility and fosters diversification of investment portfolios with Forex and crypto assets.

| Feature | Description |

|---|---|

| Spreads and Pricing | Low spreads and commission-based pricing ideal for cost-conscious traders. |

| Crypto-Collateral Support | Allows clients to use cryptocurrencies like Bitcoin for margin trading. |

| Trading Platforms | Offers robust platforms such as MetaTrader 4 and 5, with advanced charting tools. |

| Customer Support | Strong customer support with fast response times and a knowledgeable team. |

| Asset Range | Focus on forex and CFDs, offering various pairs and instruments. |

2.Pepperstone

The online broker Pepperstone is known for their robust regulation and is notable for having an extensive selection of platforms that include MetaTrader 4 and 5, cTrader, and even TradingView. Although primarily focused on forex and CFD trading, it also welcomes clients who wish to utilize crypto collateral for margin trades.

This option allows traders to make use of their digital assets, increasing their trading potential relative to lower initial capital outlay.

With low spreads, quick execution, and strong regulation in deal markets, Pepperstone provides a crypto-friendly environment to trade across multiple financial markets such as Forex and cryptocurrencies.

| Feature | Description |

|---|---|

| Regulation | Regulated in multiple jurisdictions including Australia, the UK, and Germany. |

| Spreads and Execution | Low spreads, fast execution, and minimal slippage during high volatility. |

| Platforms | Offers MetaTrader 4, MetaTrader 5, and cTrader with customizable features. |

| Crypto-Collateral Support | Supports using cryptocurrency as collateral for margin trading. |

| Instruments Offered | Wide range of forex, indices, commodities, and cryptocurrencies. |

3.FP Markets

FP Markets is an international broker with a general reputation and good regulation that is well-known for its competitive spreads and diverse account offerings. It accommodates customers willing to trade with crypto-collateral such as Bitcoin and Ethereum, which can be used as collateral for margin trading.

This provides additional flexibility for traders participating in the forex and crypto markets. With advanced trading platforms such as MetaTrader 4, MetaTrader 5, and Iress, FP Markets makes available the essential tools for making trades. The broker’s customer support and speed of executing trades also stood out as important when trading with crypto collateral.

| Feature | Description |

|---|---|

| Spreads | Competitive spreads, especially on major currency pairs. |

| Crypto-Collateral Support | Allows traders to use crypto assets like Bitcoin for margin trading. |

| Trading Platforms | MetaTrader 4, MetaTrader 5, and Iress platforms, suitable for different trading styles. |

| Customer Service | High-quality support with 24/5 availability. |

| Asset Range | Strong focus on forex and commodities with a variety of pairs and instruments. |

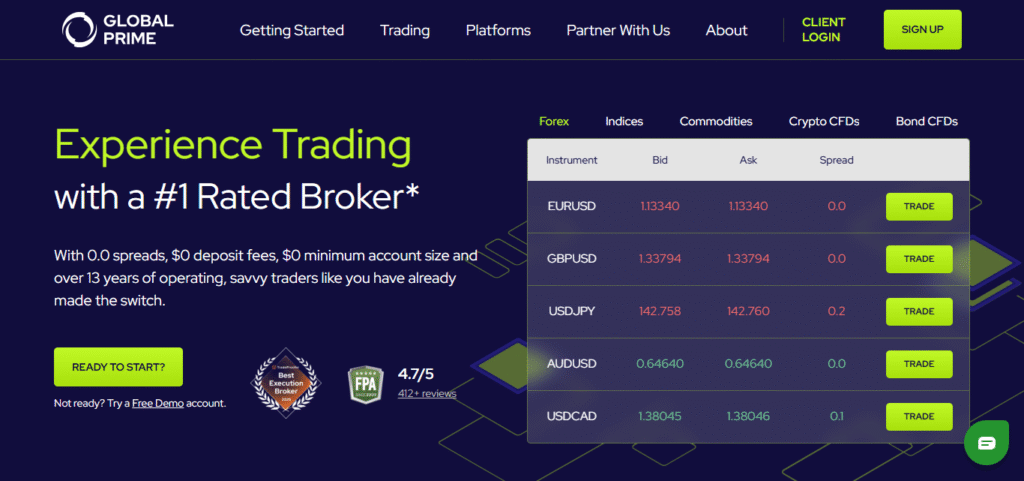

4.Global Prime

Global Prime has a friendly condition for those wishing to trade with crypto-collateral. It is especially strong in servicing traders whereby the ECN pricing and tight spreads offered by the broker allow margin trading with digital assets like Bitcoin. This allows traders to access higher leverage without the need of converting their crypto into fiat money.

This is particularly advantageous for participants in both the forex and crypto spheres. Notably, Global Prime provides stellar execution and transparency, while offering quality customer service and a dependable trading platform. This facilitates traders in efficiently using crypto assets as collateral for a variety of trades.

| Feature | Description |

|---|---|

| Pricing and Spreads | ECN pricing with tight spreads, ideal for professional traders. |

| Crypto-Collateral Support | Allows the use of crypto assets as collateral for margin trading. |

| Execution Speed | Fast and reliable order execution with minimal slippage. |

| Customer Support | Responsive support team available to assist with technical issues and inquiries. |

| Asset Range | Specializes in forex and commodities trading with a strong focus on execution. |

5.BlackBull Markets

BlackBull Markets is an ECN forex broker for professional traders offering some of the best trading conditions. The broker supports crypto-collateral for margin trading, which means clients can remain invested in cryptocurrencies while simultaneously trading in the forex markets.

BlackBull Markets, which has ultra-low spreads and high-quality execution, serves a diverse range of traders with various account types.

Whether one is interested in crypto or forex, the use of digital assets as collateral provides additional flexibility and the possibility of obtaining better positions without the need to liquidate holdings. BlackBull Markets remains a top choice for advanced traders.

| Feature | Description |

|---|---|

| Spreads and Account Types | Low spreads with multiple account types tailored to different trading needs. |

| Crypto-Collateral Support | Offers the ability to use cryptocurrencies as collateral for margin trades. |

| Regulation | Well-regulated in major markets, ensuring safety for funds. |

| Platform Availability | Offers MetaTrader 4/5 with advanced tools for analysis and execution. |

| Trading Focus | Great for scalping and day trading, with fast execution times. |

6.Tickmill

Tickmill is distinguished as a forex broker because of its low spreads and strong regulatory reputation. The broker allows crypto collateral which enables clients to use cryptocurrencies such as Bitcoin for margin trading.

This feature is helpful for traders who wish to utilize their crypto assets without needing to liquidate them into fiat currency.

Tickmill offers fast execution, effective trading tools, and access to numerous markets such as forex, commodities, and indices. The ability to use crypto as collateral lends additional advantage to traders because Tickmill’s focus on low-cost trading helps bolster their profits even further.

| Feature | Description |

|---|---|

| Spreads and Costs | Extremely low spreads with competitive pricing on forex and CFDs. |

| Crypto-Collateral Support | Allows using cryptocurrencies such as Bitcoin and Ethereum for margin trading. |

| Regulatory Status | Strong regulatory status with licenses in multiple jurisdictions. |

| Execution Speed | Fast and reliable execution, especially important for high-frequency traders. |

| Trading Platforms | Offers MetaTrader 4 and MetaTrader 5 with full customization options. |

7.Eightcap

Eightcap stands out for having competitive spreads and low trading costs, making it popular among traders in the forex and crypto domains. The broker allows clients to use crypto collateral for margin trading which is beneficial for those looking to diversify their portfolios without losing leveraging power.

With Eightcap, traders can use both MetaTrader 4 and MetaTrader 5 which provides them with advanced tools and features.

On top of that, the broker provides solid customer service and has a reliable reputation, allowing clients to trade comfortably and efficiently when using cryptocurrencies as collateral for their forex trades.

| Feature | Description |

|---|---|

| Competitive Spreads | Competitive spreads, particularly on major pairs and commodities. |

| Crypto-Collateral Support | Supports using cryptocurrencies as collateral for margin trading. |

| Platforms Available | Offers MetaTrader 4 and MetaTrader 5 with full feature support. |

| Customer Service | Strong customer service available through multiple channels. |

| Regulation | Well-regulated with a strong presence in Australia and offshore markets. |

8.OctaFX

OctaFX is well-regulated and offers a variety of trading platforms including the popular MetaTrader 4 and 5, ensuring smooth trading. With OctaFX, clients can use their crypto holdings as collateral to enable higher margins without having to cash out.

This is advantageous for traders who wish to preserve their crypto investments while actively trading in the forex markets.

OctaFX is widely accepted among traders due to their low spreads and reliable execution, along with exemplary customer service. Novice and seasoned traders alike find value in the platform’s flexible offerings, such as crypto-collateral, that diversify their trading strategies.

| Feature | Description |

|---|---|

| Spreads | Low spreads with minimal commission fees on most account types. |

| Crypto-Collateral Support | Offers the ability to use cryptocurrencies as collateral for margin trades. |

| Trading Platforms | Provides MetaTrader 4, MetaTrader 5, and a mobile app for flexible trading. |

| Promotions | Regular promotional offers to enhance the trading experience. |

| Customer Support | Excellent customer service with multi-lingual support. |

9.Plus500

Plus500 is a leading broker offering a wide range of instruments for trading, including cryptocurrencies. As a CFD broker, Plus500 stands out by allowing traders to use their crypto as collateral for margin trading.

This strategy supports traders seeking to optimize their cryptocurrency holdings without converting to fiat. The automated trading features on Plus500 make the platform appealing with it’s low spreads and commission-free trading for forex and crypto markets.

Having trusted regulatory licenses means traders can use their digital’s assets as collateral and trade with peace of mind.

| Feature | Description |

|---|---|

| Spreads and Commissions | No commissions on trades, with tight spreads on CFDs. |

| Crypto-Collateral Support | Supports using crypto assets for margin trading. |

| Platform | User-friendly proprietary platform with no downloads required. |

| Range of Instruments | Wide range of CFDs, including forex, stocks, indices, and cryptocurrencies. |

| Regulatory Status | Strong regulatory presence across multiple regions. |

10.HFM

HFM, or HotForex as it was referred to in the past, is a well-regulated broker that provides account options with an exceptional level of leverage.

In addition to account types, HFM also provides crypto-collateral support, enabling clients to use Bitcoin and Ethereum as collateral for margin trading.

This offers traders the opportunity to retain their digital currencies while still being able to trade Forex. Alongside trading accounts, HFM is known for providing decent customer service and advanced trading tools such as MetaTrader 4 and 5.

Being able to trade crypto and forex simultaneously makes HFM a good choice for traders because of the low spreads and quality trading conditions.

| Feature | Description |

|---|---|

| Account Types | Multiple account types catering to different trading strategies. |

| Crypto-Collateral Support | Allows using cryptocurrency for margin trading, providing more flexibility. |

| Leverage Options | High leverage options suitable for both conservative and aggressive traders. |

| Platforms Available | MetaTrader 4 and MetaTrader 5 with full functionality for advanced traders. |

| Customer Support | Excellent customer support available 24/5 to assist with any issues. |

Conclusion

To wrap things up, while choosing the best forex broker with crypto collateral, it is Fusion Markets, Pepperstone, and FP Markets that stand out due to their competitive spreads and excellent customer support.

They allow traders to use Bitcoin as collateral which adds flexibility as well as leverage in trading both forex and crypto. Such features make these brokers ideal for traders who value digital assets.