In This Article I Will Talk About How To Become a Crypto Whale, including the essential tactics and procedures needed to get there.

Capital needs, accumulation strategies, whale trading approaches, and necessary tools will all be covered.

This guide will assist you in navigating the route to becoming a whale, regardless of your goals—influencing the market or securing substantial riches.

What Is Crypto Whale?

Cryptocurrency whales are people or organizations that possess such a large amount of cryptocurrency that they can alter the market value of particular currencies. Whales have a large share of currencies like Bitcoin (BTC) and Ethereum (ETH).

Usually, other traders in the market are impacted by the price changes that result because of their larger buy or sell orders.

Early adopters, exchange agents, investment funds, affluent people, and many more make up the group of crypto whales. In cryptocurrency trading, whale watching is quite popular because their activities often indicate trends or fluctuations in the market.

How To Become a Crypto Whale

Start With Substantial Capital:

- To become a whale, you have to own millions of dollars in crypto assets.

- Invest in top currencies like BTC, ETH, or stablecoins.

Accumulate Incrementally:

- DCA, or dollar cost averaging, ensures you don’t buy in when the price rallies.

- Trade on OTC desks to lessen the impact on the market.

Use Whale Strategies:

- Use big-limit orders and order book sell-offs.

- Track whale wallets with Whale Alert tools.

Control Risks:

- Invest in cold storage and diversified assets.

- Monitor regulations and market changes. These tips can help you become a whale in no time.

Understanding Whale Strategies

Accumulation Strategies

- Gradual Buying: They use dollar-cost averaging (DCA) to avoid sudden shifts in prices while buy certain assets over time.

- Bulk Purchases: They sometimes buy in large blocks, usually via OTC (over-the-counter) desks, to prevent slippage.

Price Manipulation Techniques

- Spoofing: Creating false supply or demand by placing fake large orders.

- Wash Trading: Trading a product back and forth by buying and selling it to create some volume on the product.

Exploiting Liquidity

Whales are able to profit from volatility during low liquidity and price movement stimulation.

Tools and Platforms for Whales

OTC (Over-the-Counter) desks: These are used for high volume transactions that don’t affect market prices. Well-known platforms include Genesis Trading, Binance OTC, and Kraken OTC.

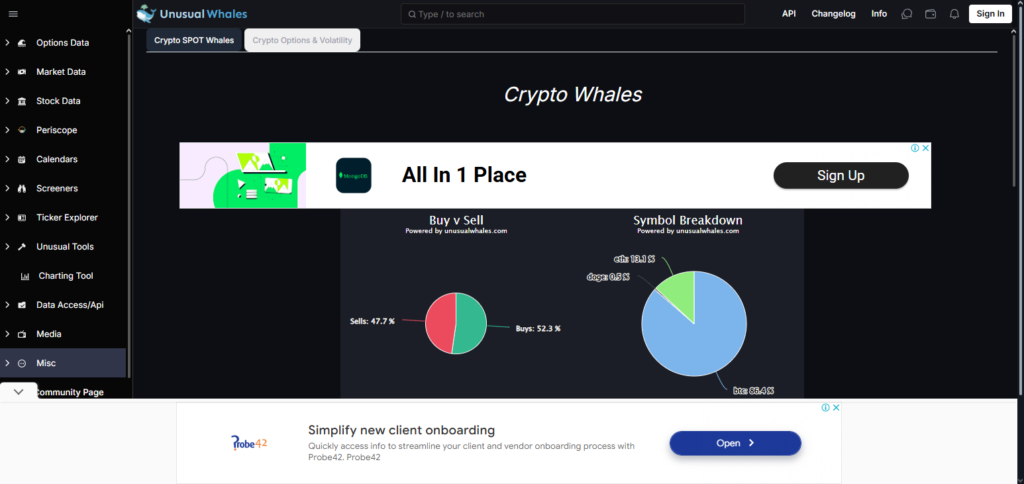

Whale Tracking Tools: – Keep an eye on big wallet movements to spot market cues.

Whale Alert, Lookonchain, and Etherscan Whale Tracker are the tools.

Privacy and Security Platforms: – To hide trades, use DEXs or privacy-focused exchanges.

Platforms: Haven Protocol and SecretSwap.

Advanced Trading Platforms: – Whales employ high-level platforms with substantial liquidity and minimal expenses. Examples include Coinbase Prime, Kraken Pro, and Binance VIP.

Conclusion

To sum up It takes a significant amount of money, careful accumulation, and astute risk management to become a crypto whale. Effective management of huge trades is facilitated by the use of OTC markets, whale-tracking technologies, and privacy platforms.

Disciplined investing, market knowledge, and patience are essential. Focus on long-term growth, reduce exposure risks, and keep up with laws and industry changes if you want to thrive.