Best Cryptocurrency Tax Software are When navigating the complexity of digital asset taxation, individuals and organisations must select the finest bitcoin tax software. CoinTracker is one of the leading competitors in this space. CoinTracker is well-known for its extensive feature set and user-friendly design, which make it easier to track, manage, and report cryptocurrency transactions. Its compatibility with well-known wallets and exchanges allows for seamless transaction syncing, which minimises the need for human data entry.

- Why Choose Best Cryptocurrency Tax Software?

- Here Is List of The Best Home Theatre Systems

- 30 Best Cryptocurrency Tax Software In 2024

- 1.CoinTracker (Best Cryptocurrency Tax Software)

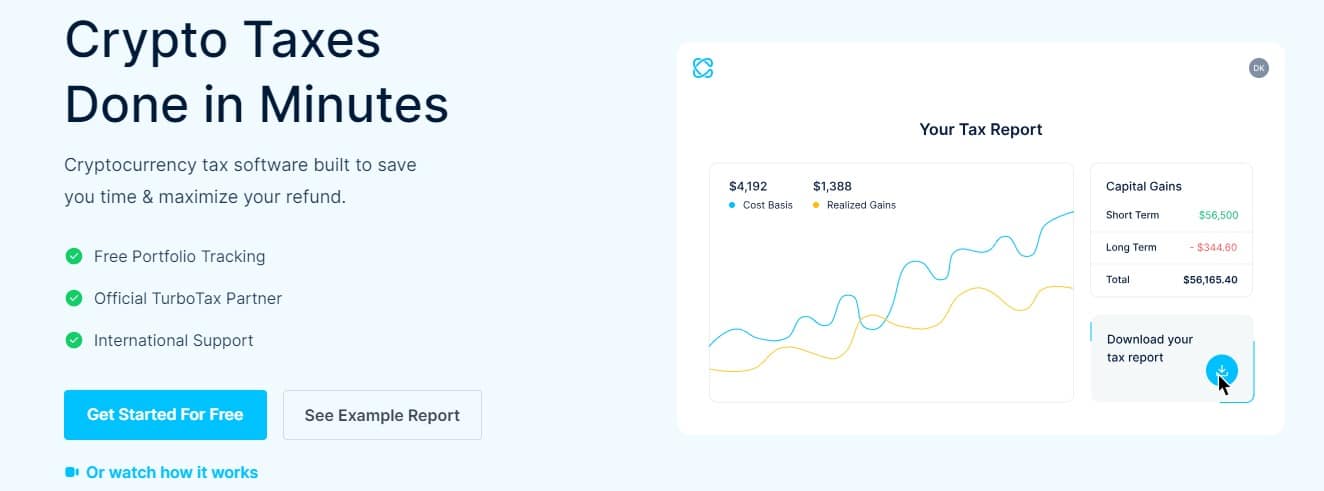

- 2.CoinLedger

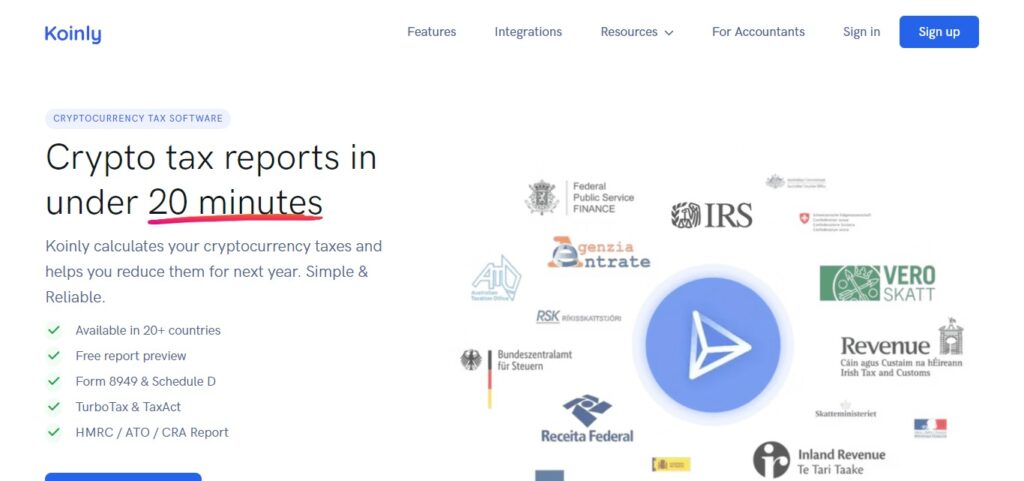

- 3.Koinly

- 4.TokenTax

- 5.BitcoinTaxes (Best Cryptocurrency Tax Software)

- 6.Accointing

- 7.TaxBit

- 8.Coinpanda

- 9.Awaken

- 10.BearTax (Best Cryptocurrency Tax Software)

- 11.Blockpit

- 12.TurboTax Crypto

- 13.Cryptio

- 14.ZenLedger

- 15.Cointelli (Best Cryptocurrency Tax Software)

- 16.CryptoTaxCalculator

- 17.Fyn

- 18.Chain.report

- 19.CryptoPrep

- 20.CryptoTaxTools (Best Cryptocurrency Tax Software)

- 21.BlockSentry

- 22.AEM Journaler

- 23.COYN

- 24.Binocs

- 25.Kryptosekken (Best Cryptocurrency Tax Software)

- 26.LukkaTax

- 27.NODE40

- 28.Bitwave

- 29.Cryptotrader.tax

- 30.TaxToken (Best Cryptocurrency Tax Software)

- How Does Cryptocurrency Tax Software Work?

- What Is role of Best Cryptocurrency Tax Software?

- Pros And Cons Best Cryptocurrency Tax Software

- Conclusion Best Cryptocurrency Tax Software

- FAQ Best Cryptocurrency Tax Software

- Why do I need cryptocurrency tax software?

- Can cryptocurrency tax software handle different types of transactions?

- Is cryptocurrency tax software compatible with international tax regulations?

- How secure is my data with cryptocurrency tax software?

- Can I use cryptocurrency tax software for multiple tax years?

- Are there free options for cryptocurrency tax software?

To accommodate a range of user preferences, CoinTracker also offers many tax calculating techniques, such as FIFO, LIFO, and particular identification. In order to help users minimise their tax obligations, the software also offers real-time portfolio tracking and tax loss harvesting capabilities. For individuals looking for dependable and effective bitcoin tax solutions, CoinTracker stands out as a great option because to its strong security features and regular upgrades to account for legislative changes.

Why Choose Best Cryptocurrency Tax Software?

For those who deal in cryptocurrencies, both people and companies, selecting the finest bitcoin tax software might be crucial. Choosing reputable cryptocurrency tax software is advantageous for the following reasons:

Precision and Adherence: Tax laws pertaining to cryptocurrencies can be complicated and differ between states. Employing specialised software lowers the possibility of mistakes and possible legal problems by ensuring correct computations and compliance with tax regulations.

Time Conserving: It can be time-consuming and error-prone to manually track and calculate cryptocurrency transactions. This procedure is automated by cryptocurrency tax software, saving time and effort.

Monitoring Transactions: Wallets and exchanges are frequently connected to by cryptocurrency tax software, which automatically imports transaction data. This makes it easier to keep track of every bitcoin transaction, including buys, sells, and trades.

Instantaneous Data Updates: The market values and prices of cryptocurrencies fluctuate. Real-time bitcoin price updates are provided by high-quality tax software, guaranteeing precise valuation for tax filing.

Analysis of a Portfolio: In order to help customers comprehend their total bitcoin holdings, capital gains, and losses, several tax software solutions include portfolio analysis capabilities. Planning and strategy for investments may benefit from this.

Support for Multiple Exchanges: On several exchanges, users swap cryptocurrency frequently. Multiple exchanges are supported by the best tax software, which also aggregates data from several sources for thorough reporting.

Here Is List of The Best Home Theatre Systems

- CoinTracker

- CoinLedger

- Koinly

- TokenTax

- BitcoinTaxes

- Accointing

- TaxBit

- Coinpanda

- Awaken

- BearTax

- Blockpit

- TurboTax Crypto

- Cryptio

- ZenLedger

- Cointelli

- CryptoTaxCalculator

- Fyn

- Chain.report

- CryptoPrep

- CryptoTaxTools

- BlockSentry

- AEM Journaler

- COYN

- Binocs

- Kryptosekken

- LukkaTax

- NODE40

- Bitwave

- cryptotrader.tax

- TaxToken

30 Best Cryptocurrency Tax Software In 2024

1.CoinTracker (Best Cryptocurrency Tax Software)

One of the greatest bitcoin tax software options on the market right now is CoinTracker. For individuals, traders, and companies operating in the cryptocurrency area, this all-inclusive platform is a useful tool as it streamlines the intricate process of computing and filing bitcoin taxes. With its broad support for cryptocurrencies and smooth integrations with well-known exchanges and wallets, CoinTracker enables users to easily track their portfolio and transactions in real-time. Its capacity to automatically synchronise and aggregate transaction data from several sources, lowering the possibility of errors and minimising manual data entry, is one of its main advantages.

Additionally, the site offers robust tax optimisation tools that assist users in devising legal framework-compliant solutions to reduce their tax obligations. CoinTracker also produces thorough tax reports that are comply with IRS regulations, streamlining and expediting the filing procedure. CoinTracker is an essential tool for anyone navigating the difficulties of bitcoin taxation because of its user-friendly layout, strong functionality, and dedication to compliance.

2.CoinLedger

You’re praising CoinLedger, a bitcoin tax programme, as the greatest in its sector; nonetheless, there are a number of things to take into account. Features like automatic transaction tracking, smooth interaction with well-known wallets and exchanges, support for a variety of cryptocurrencies, tax optimisation techniques, and the creation of precise and IRS-compliant tax reports are common strengths of top cryptocurrency tax software. Crucial elements also include a user-friendly interface, strong security measures, and adherence to tax laws.

Platforms that make it easier for users to calculate and report cryptocurrency taxes are frequently appreciated. It is advisable to investigate user reviews, testimonials, and any available third-party assessments to evaluate CoinLedger’s efficacy and dependability in order to confirm its position as the greatest bitcoin tax software.

3.Koinly

One of the greatest cryptocurrency tax software options available is Koinly, which offers a thorough and intuitive platform to help people and companies deal with the challenges of taxing cryptocurrencies. Koinly has a user-friendly design and robust tools that make tracking, calculating, and reporting cryptocurrency transactions easier. Because the software supports a large number of cryptocurrencies and exchanges, users can import their transaction data from several sources with ease. Koinly’s strong algorithm computes capital gains, losses, and tax obligations with precision, accounting for FIFO, LIFO, and particular identification techniques.

Furthermore, Koinly facilitates tax reporting across many jurisdictions, rendering it adaptable for global users. Additionally, the platform produces thorough tax reports that are simple to share with accountants, financial advisors, and tax authorities. All things considered, Koinly is a dependable and effective option for people and companies looking to simplify their cryptocurrency tax compliance procedures.

4.TokenTax

As one of the best cryptocurrency tax software solutions on the market, TokenTax provides both individuals and businesses with a thorough and easy-to-use solution for managing the intricacies of crypto taxation. TokenTax’s user-friendly design and sophisticated features make it easier to manage, calculate, and report on bitcoin transactions. Users may easily import their transaction data using this software, which interacts with several exchanges and supports a long variety of cryptocurrencies. Using a powerful algorithm, TokenTax computes capital gains, losses, and tax liabilities with accuracy while allowing for different techniques such as FIFO and specific identification

TokenTax stands out for its capability to manage intricate situations like margin trading, airdrops, and forks, guaranteeing a complete and correct tax reporting procedure. Moreover, TokenTax offers thorough tax reporting appropriate for a range of jurisdictions, making it a flexible option for consumers worldwide. TokenTax is a dependable and advanced solution for cryptocurrency tax compliance, suitable for both individual investors and companies with a wide range of cryptocurrency holdings.

5.BitcoinTaxes (Best Cryptocurrency Tax Software)

One of the greatest bitcoin tax software programmes out there is BitcoinTaxes, which provides an extensive and easy-to-use platform for handling tax liabilities associated with digital assets. The platform makes it easier to manage transactions and determine capital gains or losses by supporting a wide range of cryptocurrencies and integrating smoothly with well-known exchanges and wallets. The capacity of BitcoinTaxes to manage intricate tax scenarios, including token swaps, staking, and cryptocurrency mining, is one of its most notable characteristics. The portal facilitates users’ compliance with tax requirements by offering comprehensive tax reports, such as IRS Form 8949.

Furthermore, BitcoinTaxes allows users to keep a thorough and accurate record of their cryptocurrency transactions over time by supporting various tax years. BitcoinTaxes has established itself as a dependable option for people and companies looking for a dependable solution for cryptocurrency tax reporting and compliance because to its user-friendly interface and extensive feature set.

6.Accointing

Reputable bitcoin tax software provider Accointing is well-known for its feature-rich features and easy-to-use UI. One notable feature of this platform is its seamless integration with many cryptocurrency wallets and exchanges, which makes it simple for users to import and organise transaction data. Accointing provides customers with a thorough perspective of their financial actions related to cryptocurrencies by using sophisticated algorithms to precisely assess capital gains, losses, and tax responsibilities. Its ability to support numerous fiat currencies, which makes it accessible to users worldwide, is one of its standout characteristics.

In order to assist users in keeping track of their cryptocurrency holdings and the associated tax ramifications, Accointing also provides real-time portfolio tracking. Accointing guarantees that customers may confidently manage the complexities of bitcoin taxes while being compliant with pertinent rules because to its commitment to security and compliance.

7.TaxBit

A state-of-the-art bitcoin tax software called TaxBit makes the difficult task of tracking and filing taxes related to digital assets much easier. As cryptocurrencies gain popularity, TaxBit stands out as a comprehensive solution that provides consumers with an easy-to-use and effective platform. This programme automates the computation of gains, losses, and tax obligations while streamlining the tracking of cryptocurrency transactions across several wallets and exchanges. One of TaxBit’s standout characteristics is its smooth integration with well-known cryptocurrency exchanges, which guarantees precise and instantaneous synchronisation of data.

It makes it simpler for users to comply with tax laws by supporting a large variety of digital assets and offering comprehensive tax reports. TaxBit also provides users with personalised insights to optimise tax status and keeps them updated on changes in tax regulations. TaxBit is essential in helping people and companies understand the intricate world of cryptocurrency taxation with accuracy and confidence, especially in light of the challenges faced by governments across the world in trying to regulate the rapidly growing crypto industry.

8.Coinpanda

Leading bitcoin tax software company Coinpanda was created to streamline the frequently difficult and time-consuming process of tracking down and filing taxes on digital assets. Given the volatility of the cryptocurrency market, Coinpanda is a particularly effective option for both people and companies. The software ensures smooth data synchronisation by supporting automatic integration with many bitcoin wallets and exchanges. Coinpanda makes transaction tracking easier by precisely computing gains, losses, and tax requirements. Users can easily prepare tax reports that are thorough and compliant with tax requirements.

To accommodate customers’ varied portfolios, the platform offers a wide range of coins and tokens. In addition, Coinpanda provides useful services that help customers calculate taxes accurately, like historical data and real-time market prices. For individuals managing the intricacies of bitcoin taxation, Coinpanda proves to be a dependable resource because to its user-friendly design and frequent updates that accommodate evolving tax regulations.

9.Awaken

The revolutionary cryptocurrency tax software Awaken transforms how people and companies handle their tax obligations. With its cutting-edge functionality and intuitive design, Awaken makes it easier to track, calculate, and report bitcoin transactions for tax purposes—a challenging task made simpler. For users with a variety of cryptocurrency portfolios, the platform offers extensive coverage by supporting a large number of cryptocurrencies and exchanges. Its unique feature is its automatic importation of transaction data from many exchanges, which eliminates the laborious manual data entry process.

Awaken allows consumers to keep informed about their tax requirements all year round by offering real-time tax liability estimations. Users can rely on Awaken to handle sensitive financial information securely because it has strong security safeguards in place. Awaken provides a comprehensive solution to handle the complexity of cryptocurrency taxation, making the process precise, stress-free, and efficient for both novice and experienced traders.

10.BearTax (Best Cryptocurrency Tax Software)

BearTax is an all-inclusive bitcoin tax programme that aims to streamline the frequently intricate procedure of computing and disclosing taxes on virtual assets. BearTax seeks to simplify tax compliance for customers as the cryptocurrency economy expands and becomes more significant. The platform makes it simpler for users to import their transaction data by integrating with well-known exchanges and supporting a large variety of cryptocurrencies. For people and companies navigating the complex world of bitcoin taxation, BearTax offers a user-friendly experience with features like automated tax computations, real-time portfolio management, and the capacity to create IRS-compatible tax forms.

Because the platform is built to handle a variety of scenarios—including trading, mining, staking, and more—users may record their crypto-related activities with accuracy. BearTax is a part of the expanding tool ecosystem that supports compliance and transparency in the bitcoin industry.

11.Blockpit

Blockpit is an all-inclusive bitcoin tax software that makes it easier to manage tax responsibilities in the complicated world of digital assets in an accurate and effective manner. The objective of this platform is to streamline the frequently complex procedure of monitoring, computing, and disclosing bitcoin transactions for taxation. With Blockpit’s extensive support for many cryptocurrencies and exchanges, users can easily combine their multiple accounts and aggregate transaction data. Its straightforward tools make it easy to analyse trading activity, capital gains, and losses thanks to its user-friendly layout.

Blockpit offers real-time tax liability computations and automatic transaction categorisation, among other capabilities, to make tax compliance easier for both individual and institutional customers. Blockpit keeps users updated about the constantly changing tax laws pertaining to cryptocurrencies, enabling them to make wise financial decisions while maintaining compliance with tax authorities. All things considered, Blockpit is an invaluable companion for anybody negotiating the complexity of cryptocurrency taxation, providing a dependable and effective way for individuals to handle their tax obligations in this ever-changing and dynamic environment.

12.TurboTax Crypto

One of the best tax preparation software programmes, TurboTax, has included tools to handle the intricacies of bitcoin taxation after realising the increasing significance of cryptocurrency transactions in the current digital economy. With the rise in popularity of virtual currencies like Ethereum and Bitcoin, taxpayers frequently find it difficult to understand the complex tax ramifications of their cryptocurrency activity. With its easy-to-use interface, TurboTax Crypto enables users to import their bitcoin transactions with ease, guaranteeing accurate and thorough reporting.

The software offers instructions on how to report several sorts of transactions, including mining, staking, and airdrops, in addition to supporting the computation of capital gains and losses from cryptocurrency investments. Because of its dedication to staying current with changing financial environments, TurboTax is a useful tool for investors and cryptocurrency aficionados who want to ensure that their tax obligations are clear and compliant. TurboTax Crypto enables users to comfortably manage the complexity of digital asset taxation while maintaining compliance with the constantly changing tax legislation by streamlining the crypto tax filing process.

13.Cryptio

A state-of-the-art cryptocurrency tax software called Cryptio was created to make the difficult task of computing and filing taxes on digital assets simpler. Many people and businesses now find it difficult to manage their tax requirements due to the growing diversity and popularity of cryptocurrencies. By providing a user-friendly platform that easily interacts with different cryptocurrency exchanges and wallets, Cryptio seeks to expedite this process. By automating the recording and classification of transactions, the software maintains precise and current records of cryptocurrency holdings.

To help customers meet their tax requirements, Cryptio also offers thorough tax reports that include capital gains and losses. Its complex algorithms deliver accurate and trustworthy tax computations by taking into account variables like transaction history and market swings. Users can confidently traverse the complex world of cryptocurrency taxes by utilising Cryptio, which also saves time and lowers the possibility of error while guaranteeing regulatory compliance.

14.ZenLedger

Leading cryptocurrency tax software ZenLedger transforms how people and companies manage their tax obligations in the quickly changing world of digital assets. ZenLedger’s user-friendly interface makes it easy to integrate with a variety of cryptocurrency wallets and exchanges, making it simple for users to import and organise transaction data. The platform is a flexible option for a variety of portfolios because it supports a large number of cryptocurrencies and tokens. Generating thorough tax reports with income, capital gains and losses, and other pertinent tax-related data is one of ZenLedger’s best capabilities.

In order to guarantee precise computations, the programme uses complex algorithms that take previous data and market changes into account. By using ZenLedger, users may lower the chance of error, stay in compliance with tax laws, and ease the difficult work of bitcoin tax reporting. This cutting-edge technology gives people and companies the ability to confidently and effectively negotiate the complexities of bitcoin taxation.

15.Cointelli (Best Cryptocurrency Tax Software)

Cointelli presents itself as an all-inclusive Crypto Tax Software that has been painstakingly designed to meet the requirements of small and large businesses alike. Cointelli is a fully functional online application solution that simplifies the complex process of managing cryptocurrency taxes. It provides end-to-end services. Exchange Integration is a crucial aspect of the platform, which easily interfaces with many exchanges while emphasising user-friendly functionality. Automated data import features facilitate the tracking and importation of transaction data, which increases efficiency even more.

With features like Income Overview, Export Transactions, and a central hub for Crypto Tax management, Cointelli guarantees a comprehensive approach to tax filing. Cointelli hopes to provide customers with a unified and effective experience in navigating the intricacies of cryptocurrency taxation by combining these components into a single platform.

16.CryptoTaxCalculator

Among the best cryptocurrency tax software programmes is CryptoTaxCalculator, which provides customers with an all-inclusive and effective way to handle their tax requirements. Manual tax computation can be a difficult undertaking due to the intricate structure of cryptocurrency transactions. CryptoTaxCalculator saves customers a great deal of time and lowers the possibility of error by automating the computation of capital gains, losses, and tax liabilities. With its broad support for cryptocurrencies and smooth integrations with well-known exchanges, wallets, and platforms, the platform expedites the import of data. It is accessible to both inexperienced and seasoned cryptocurrency investors due to its user-friendly layout and intuitive design.

Moreover, CryptoTaxCalculator ensures that customers comply with tax authorities by staying up to date with the constantly changing tax legislation. Users can file correct and timely tax returns with more ease thanks to the software’s generation of comprehensive tax reports and forms. All things considered, CryptoTaxCalculator is the best option available to people and companies looking for a dependable and effective way to deal with the intricacies of cryptocurrency taxation.

17.Fyn

Fyn is a leading cryptocurrency tax software that provides customers with an innovative and intuitive platform to streamline the complex process of managing bitcoin taxes. The power of Fyn rests in its ability to easily interface with a wide range of cryptocurrency wallets and exchanges, enabling users to input transaction data for precise tax computations. A wide variety of cryptocurrencies are supported by the platform, guaranteeing thorough coverage for customers with varied portfolios. Because of Fyn’s user-friendly design, tax reporting is simple to understand and manage for both novice and experienced cryptocurrency aficionados.

Its real-time tax computations, which give customers immediate information about their possible tax obligations as they complete transactions, are one of its most notable features. Fyn also ensures compliance with changing tax regulations by keeping consumers updated on the most recent regulatory changes. For people and companies trying to understand the intricacies of bitcoin taxation, Fyn stands out as a dependable and effective option because to its extensive reporting features and emphasis on accuracy.

18.Chain.report

Among the top bitcoin tax software programmes is Chain.report, which provides customers with an advanced and all-inclusive way to handle their tax duties connected to cryptocurrencies. The programme is excellent at tracking and computing capital gains, losses, and total tax liabilities related to bitcoin transactions in a smooth and effective manner. With its broad range of cryptocurrency compatibility and seamless integration with popular exchanges, wallets, and trading platforms, Chain.report makes it easier to import transaction data automatically. Both inexperienced and seasoned bitcoin investors can utilise it thanks to its user-friendly interface and intuitive design.

Chain.report ensures compliance with constantly evolving tax rules by streamlining the difficult process of tax calculations and informing users of recent regulatory developments. For people and companies looking for a complete solution for bitcoin tax administration, Chain.report stands out as a dependable and user-centric option because to its extensive reporting tools and thorough transaction histories.

19.CryptoPrep

Being the best bitcoin tax software, CryptoPrep offers users an incredibly effective and intuitive platform to handle their tax obligations. Because cryptocurrency transactions are complex, CryptoPrep makes tax calculations easier by automating the calculation of capital gains, losses, and tax liabilities. Users may import transaction data with ease because to this software’s smooth integration with well-known exchanges and wallets, which supports a wide variety of cryptocurrencies.

The user-friendly design of CryptoPrep makes the complicated world of tax filing more approachable for both novice and seasoned cryptocurrency investors. The technology ensures that customers keep compliant with changing tax rules by staying up to date with the newest regulatory changes. Users may file accurate and timely tax returns with CryptoPrep’s thorough transaction summaries and extensive reporting tools. All things considered, CryptoPrep is an intelligent and dependable option for people and companies looking for a simplified way to deal with the difficulties of bitcoin taxation.

20.CryptoTaxTools (Best Cryptocurrency Tax Software)

In the field of bitcoin tax software, CryptoTaxTools is a standout option since it provides a thorough and easy-to-use platform designed to help people and businesses navigate the complexity of cryptocurrency taxation. This programme excels at making the difficult process of figuring out taxes on bitcoin transactions simple and seamless for consumers. Its user-friendly interface makes it simple for users to import transactions from different wallets and exchanges, which expedites the process of creating precise and comprehensive tax returns. Strong tracking and reporting features that let users create informative reports that adhere to tax laws are one of CryptoTaxTools’ standout features.

The software makes sure users can appropriately account for their entire portfolio by supporting a large variety of cryptocurrencies and regularly updating its database to accommodate new tokens. Furthermore, CryptoTaxTools continues to be dedicated to privacy and security, using cutting-edge encryption methods to protect private financial data. For people and companies looking for dependable cryptocurrency tax software, CryptoTaxTools stands out for its intuitive design, robust functionality, and dedication to compliance.

21.BlockSentry

In the field of cryptocurrency tax software, BlockSentry stands out as a unique solution since it provides a sophisticated and effective platform that makes organising and reporting cryptocurrency transactions easier. With its state-of-the-art capabilities, this software stands out from the competition, offering customers an extensive toolkit to monitor, assess, and document their cryptocurrency activity. BlockSentry facilitates smooth interaction with many wallets and exchanges, making it simple for users to import and reconcile transactions for precise tax computations.

Because of its user-friendly interface, the platform is accessible to both novice and seasoned bitcoin investors. BlockSentry’s impressive reporting features let users create thorough tax reports that comply with legal requirements. Furthermore, the software updates its database frequently to incorporate new coins and guarantee precise portfolio management in line with the constantly changing cryptocurrency market. BlockSentry stands out as a top option for people and companies looking for dependable and effective bitcoin tax software because of its emphasis on security, compliance, and user ease.

22.AEM Journaler

AEM Journaler makes a name for itself as a leader in the field of bitcoin tax software by offering consumers a strong and advanced platform designed for effective administration of cryptocurrency transactions and tax reporting. The focus on precision and automation in AEM Journaler is what makes it unique. Transaction import and classification are automated by the programme, which interfaces with several exchanges and wallets with ease. This guarantees accurate and error-free tax computations in addition to saving consumers a significant amount of time. Users of all skill levels, from novices to seasoned cryptocurrency aficionados, may utilise AEM Journaler thanks to its user-friendly design.

Users can easily generate detailed and compliant tax reports with the platform’s extensive reporting options. AEM Journaler maintains a competitive edge in the ever-changing cryptocurrency market by regularly adding new tokens to its database and guaranteeing precise portfolio tracking. With an emphasis on automation, precision, and user-friendliness, AEM Journaler stands out as a superior option for people and companies looking for dependable and effective bitcoin tax software.

23.COYN

One of the greatest cryptocurrency tax software options available is COYN, which provides a thorough and intuitive platform to help people understand the intricacies of taxing cryptocurrencies. The unique feature of COYN is its ability to easily interact with different cryptocurrency wallets and exchanges, integrating transaction data precisely and accurately automatically. To ensure compliance with constantly changing tax legislation, the programme uses sophisticated algorithms to determine capital gains, losses, and tax liabilities.

Both inexperienced and seasoned users may easily generate tax reports thanks to COYN’s user-friendly design. It also offers up-to-date information on tax ramifications in real time, assisting users in making wise investment decisions in cryptocurrencies. For those looking for a hassle-free way to handle their bitcoin tax requirements, COYN is a dependable and effective solution because it has strong security safeguards in place to safeguard sensitive financial information.

24.Binocs

Binocs is widely recognised as one of the top bitcoin tax software programmes on the market right now. A challenging undertaking for many investors has become monitoring taxes related to digital assets, with the legal landscape changing and bitcoin transactions becoming more complex. By providing a thorough and intuitive platform that makes it easy for users to track, compute, and report their bitcoin gains and losses, Binocs streamlines this process. The programme makes sure that customers may combine all of their financial information into a single, central platform by supporting a large variety of cryptocurrencies and exchangers. Binocs uses sophisticated algorithms to compute tax obligations precisely, accounting for transaction history, income, and capital gains.

Its intuitive interface and detailed reporting features provide users with a clear overview of their tax obligations, facilitating compliance with tax regulations. Additionally, Binocs often integrates with popular accounting software, further streamlining the overall financial management process for cryptocurrency investors. With its robust features and commitment to user-friendly design, Binocs stands out as an indispensable tool for individuals navigating the intricate landscape of cryptocurrency taxation.

25.Kryptosekken (Best Cryptocurrency Tax Software)

As a top cryptocurrency tax software, Kryptosekken distinguishes itself by providing customers with an all-inclusive and intuitive approach to managing the intricacies of bitcoin taxation. This cutting-edge tool is excellent at automating the frequently complex process of figuring out and disclosing bitcoin earnings and losses, guaranteeing precision and adherence to tax laws. In order to streamline data import and reduce human input, Kryptosekken smoothly interfaces with well-known cryptocurrency exchanges, wallets, and financial institutions. It supports a large variety of cryptocurrencies.

With the help of its sophisticated tracking and reporting capabilities, users can create comprehensive transaction histories, capital gains reports, and tax forms, making tax season easier. Security is a top priority for Kryptosekken, which uses strong encryption techniques to protect confidential financial data. For people and companies navigating the complex world of cryptocurrency taxation, Kryptosekken proves to be an invaluable resource because to its user-friendly design and dedication to maintaining current with changing tax rules.

26.LukkaTax

At the vanguard of cryptocurrency tax software, LukkaTax offers consumers a dependable and highly effective way to handle their tax obligations related to cryptocurrencies. LukkaTax, well-known for its robust features and easy-to-use interface, makes it easier to calculate and report cryptocurrency earnings and losses. The platform makes it easier to import transaction data by supporting a wide range of cryptocurrencies and integrating with popular exchanges and wallets.

LukkaTax uses complex algorithms to guarantee accurate and precise tax computations, assisting users in producing detailed reports and summaries that are necessary for filing taxes. Its real-time tracking features also enable consumers to stay updated on their tax liability all year long. LukkaTax is dedicated to security and compliance, following the most recent legal guidelines to create a safe haven where users may confidently and easily traverse the complex world of bitcoin taxation.

27.NODE40

One of the top bitcoin tax software programmes is NODE40, which provides a robust platform that makes the difficult process of managing and filing taxes pertaining to digital assets easier. Because the cryptocurrency market is so dynamic, NODE40 does a great job of delivering precise and current computations for capital gains, losses, and other tax liabilities. The programme simplifies the data import procedure by supporting a large variety of cryptocurrencies and integrating with well-known exchanges, wallets, and financial platforms.

Both novice and expert users may easily navigate NODE40 thanks to its intuitive design and user-friendly interface, which guarantees a seamless tax reporting process. Furthermore, the platform stays up to date with changing tax laws, assisting users in adhering to the constantly shifting tax landscape associated with cryptocurrencies. All things considered, NODE40 sticks out as a dependable and effective option for people and companies looking to confidently negotiate the complexity of bitcoin tax reporting.

28.Bitwave

Managing and reporting cryptocurrency transactions for tax purposes can be made easier with Bitwave, a state-of-the-art tax software for cryptocurrencies. Developed to address the distinct difficulties brought about by the decentralised character of digital assets, Bitwave provides users with an intuitive interface that easily interacts with a range of cryptocurrency wallets and exchanges. To provide accurate and current reporting, the programme automatically tracks and categorises transactions using sophisticated algorithms. The capacity of Bitwave to provide thorough tax reports that include capital gains and losses, staking income, and other taxable events is one of its most notable features.

Furthermore, Bitwave is a flexible option for investors with a variety of portfolios because it supports a large number of cryptocurrencies. Bitwave gives consumers peace of mind by focusing on security and compliance, making sure they fulfil their tax requirements while navigating the always changing world of cryptocurrency rules. Bitwave is a useful tool for simplifying the frequently complex process of bitcoin tax filing, regardless of experience level with cryptocurrencies.

29.Cryptotrader.tax

Offering a comprehensive and user-friendly solution for cryptocurrency traders, Cryptotrader.tax stands out as the top option among cryptocurrency tax software. Cryptotrader.tax makes the difficult work of computing and reporting taxes on digital assets less complicated in light of the intricacies of bitcoin transactions and the changing regulatory environment. This programme makes it easier to import transaction data by supporting a large number of wallets and exchanges.

Its capacity to automatically compute capital gains and losses while accounting for elements like FIFO, LIFO, and particular identification techniques is one of its main advantages. Along with comprehensive tax reports, such as IRS Form 8949, Cryptotrader.tax facilitates users’ ability to file correct and legally compliant tax returns. For both new and seasoned cryptocurrency traders negotiating the complexity of tax responsibilities in the digital asset industry, the platform’s user-friendly interface and real-time tracking capabilities greatly improve the entire user experience. The finest cryptocurrency tax software available is Cryptotrader.tax, because to its strong features and dedication to staying current with legislative changes.

30.TaxToken (Best Cryptocurrency Tax Software)

A state-of-the-art cryptocurrency tax software called TaxToken was created to make the difficult task of maintaining and filing taxes on digital assets more straightforward and efficient. Since cryptocurrencies are becoming more and more popular, people and companies frequently find it difficult to understand the complex tax ramifications of holding these assets. In order to overcome this difficulty, TaxToken offers a simple-to-use platform that makes tracking, calculating, and reporting bitcoin transactions automated.

This programme easily interacts with well-known exchanges, wallets, and financial platforms while supporting a large variety of digital currencies. It uses sophisticated algorithms to compute tax obligations precisely, accounting for capital gains, losses, and different tax laws. Users can create thorough tax reports, reducing the possibility of mistakes and guaranteeing compliance with tax authorities. With the ever-changing world of digital assets, TaxToken seeks to provide investors and cryptocurrency enthusiasts with a powerful tool for successfully and efficiently managing their tax liabilities.

How Does Cryptocurrency Tax Software Work?

Through their smooth integration with different cryptocurrency exchanges and wallets, these software solutions significantly contribute to the simplification of the difficult process of bitcoin tax reporting. These technologies spare users from the laborious manual entry of each trade by automating the importation of transaction data, increasing process efficiency and reducing mistake rates. The programme performs exceptionally well at classifying transactions and applying pertinent tax laws to compute gains or losses precisely.

Consequently, customers can create thorough tax reports with ease, possibly including necessary forms like IRS Form 8949. This simplifies the tax filing procedure and guarantees adherence to the constantly changing laws governing bitcoin taxes. All things considered, these software programmes offer a helpful aid for anyone attempting to understand the tax implications of cryptocurrencies and give them a dependable and easy means to keep track of their financial commitments related to digital assets.

What Is role of Best Cryptocurrency Tax Software?

Here are some key roles of the best cryptocurrency tax software:

Automated Transaction Monitoring: Tax software for cryptocurrencies enables the automated monitoring of transactions between different exchanges and wallets. It assists customers in compiling information from many sources to provide them a thorough picture of their cryptocurrency activity.

Precise Tax Calculation: Taking into account variables like income, capital gains, losses, and other taxable events, the software precisely computes tax obligations. It ensures compliance with local tax laws by accounting for the unique tax legislation of the user’s area.

Fiat Currency Conversion: Converting cryptocurrencies into fiat currencies is a common step in cryptocurrency transactions. For appropriate tax reporting, the software frequently include capabilities to translate these transactions into currency values.

Integration with Exchanges and Wallets: Reputable cryptocurrency exchanges and wallet providers are easily integrated with leading cryptocurrency tax software. Users save time and lower their chance of making mistakes when entering data by hand thanks to this connection, which expedites the process.

Creation of Tax Reports: For the purpose of filing taxes, users have the ability to create comprehensive tax reports. These reports usually contain income, capital gains, losses, and other pertinent information required for tax compliance.

Portfolio Insights: A few software packages include with extra capabilities like performance analysis and portfolio tracking. By gaining a comprehensive understanding of their whole bitcoin holdings, users can make well-informed judgements regarding their investing strategy.

Pros And Cons Best Cryptocurrency Tax Software

Here are some pros and cons associated with the use of cryptocurrency tax software:

Pros:

Accuracy and Automation: By automating the computation of gains, losses, and tax obligations, cryptocurrency tax software lowers the possibility of human error. It can immediately pull transaction data from a variety of wallets and exchanges, facilitating accurate reporting.

Saving Time: It can take a while to manually track and calculate gains and losses in cryptocurrencies. This procedure is streamlined by tax software, which saves consumers a great deal of time.

Entire Reporting: Easily helps consumers understand their tax requirements by offering comprehensive reports that break down transactions, capital gains, and other pertinent information.

Combining Tax Forms with Integration: A lot of cryptocurrency tax software programmes can provide paperwork specific to the IRS or other tax authorities, making the filing procedure easier.

Cons:

Price: Certain tax software solutions may come with a fee for use, something that low-income people or companies may want to take into account.

Learning Curve: It could take some time for users to become comfortable with the software, particularly if they are unfamiliar with tax laws or bitcoin transactions.

Security Issues: There are security issues when entrusting a third-party software with sensitive financial data. Users are responsible for making sure the software has strong security features.

Conclusion Best Cryptocurrency Tax Software

In conclusion, for people and companies navigating the complicated world of digital asset taxation, choosing the finest bitcoin tax software is an essential first step. With the correct software, customers can save time and money by streamlining the process and guaranteeing accurate reporting.

When selecting cryptocurrency tax software, a number of elements should be taken into account, such as ease of use, automation capabilities, exchange integration, computation accuracy, and tax regulatory compliance. A complete solution covering a range of transactions, such as trading, mining, staking, and lending, should be offered by the programme.

Moreover, continuous support and upgrades are necessary to stay up to date with the ever changing bitcoin tax environment. For accurate and compliance reporting, it is essential that the software remains up to date with changes in tax laws and regulations.

The best cryptocurrency tax software will ultimately depend on personal preferences and demands. While some users may place more value on complex features and customisation possibilities, others may prioritise a user-friendly design. It’s a good idea to thoroughly weigh your options, taking your needs into account both now and down the road.

Those who invest in trustworthy bitcoin tax software can reduce the likelihood of audits and ease the frequently difficult work of filing taxes, all while enjoying piece of mind and compliance with tax laws. Selecting the appropriate tax software is a crucial first step towards financial accountability and compliance in the quickly changing world of cryptocurrencies.

FAQ Best Cryptocurrency Tax Software

Why do I need cryptocurrency tax software?

Cryptocurrency tax software helps you calculate and report your cryptocurrency transactions for tax purposes. It automates the process, saving time and reducing the risk of errors when preparing your tax returns.

Can cryptocurrency tax software handle different types of transactions?

Yes, reputable tax software can handle various types of transactions, including buying, selling, trading, mining, staking, airdrops, and more. Ensure the software supports the specific activities you’ve engaged in.

Is cryptocurrency tax software compatible with international tax regulations?

Many cryptocurrency tax software solutions are designed to comply with tax regulations in different countries. However, it’s essential to choose software that aligns with the tax laws relevant to your location.

How secure is my data with cryptocurrency tax software?

Reputable cryptocurrency tax software employs encryption and security protocols to protect your sensitive financial data. Ensure the software complies with industry standards and uses secure practices to safeguard your information.

Can I use cryptocurrency tax software for multiple tax years?

Yes, most software allows you to store and access data for multiple tax years. This feature is useful for maintaining a comprehensive record of your cryptocurrency transactions over time.

Are there free options for cryptocurrency tax software?

Some platforms offer basic versions for free, but for more advanced features and support, you may need to opt for paid versions. Evaluate your specific needs and the complexity of your crypto transactions to determine the best fit.