Best Cryptocurrency Lending Platforms for lending cryptocurrencies have come to light as cutting-edge financial options, giving consumers the chance to obtain loans with their digital assets or generate passive income. Celsius Network is a prominent platform that is distinguished by its open and community-focused methodology. Celsius provides customers with favourable terms for borrowing against their bitcoin holdings and offers competitive interest rates that frequently outperform those of traditional banking options. BlockFi is another well-known platform, renowned for its intuitive user interface and wide selection of supported cryptocurrencies.

BlockFi offers an extensive range of financial services, including interest-bearing accounts, loans backed by cryptocurrency, and a credit card that accrues Bitcoin rewards. Another interesting site is Nexo, which is available to a wider user base because to its instantaneous, crypto-backed loans that do not require credit checks. In the quickly developing field of bitcoin finance, these platforms use blockchain technology to guarantee safe and effective transactions, establishing a decentralised substitute for traditional banking services. Before engaging in bitcoin lending, users should proceed with caution and carefully investigate the terms, security protocols, and reputation of each platform.

Why Choose Best Cryptocurrency Lending Platforms?

Selecting the top cryptocurrency loan platforms can benefit lenders and borrowers in a number of ways. Here are a few explanations for why people could choose these platforms:

Lenders’ Interest Earnings: By lending their bitcoin holdings to other people, lenders can make interest on their investments. They are able to profit passively from their assets as a result.

Borrowers’ Access to Liquidity: Platforms for cryptocurrency lending give borrowers access to liquidity without requiring them to liquidate their assets. For individuals who choose to hang onto their cryptocurrency investments in anticipation of possible future returns, this can be especially helpful.

Broad Variety of Cryptocurrencies: Numerous lending services enable users to select the assets they wish to lend or borrow from a wide range of cryptocurrencies.

Competitive Interest Rates: Interest rates on cryptocurrency lending platforms can be competitive when compared to traditional financial institutions because many of them are decentralised. Lower rates might be available to borrowers, and lenders might see increased profits.

Worldwide Availability: Users from all around the world can frequently access cryptocurrency loan platforms. Due to this, borrowers and lenders can engage in the market from anywhere in the world, promoting a worldwide lending ecosystem.

Transparency and Security: The majority of cryptocurrencies are based on blockchain technology, which offers a safe and transparent method of conducting transactions. Fraud risk is decreased by ensuring that lending and borrowing actions are documented on the blockchain through the use of smart contracts and decentralised platforms.

Here Is List of The Best Cryptocurrency Lending Platforms

- Arch

- Nexo

- Aqru

- CoinRabbit

- Aave

- Nebeus

- YouHodler

- Compound

- Crypto.com

- Binance

- CoinLoan

- kucoin

- Cex.io

- Bitmart

- EthLend

- Kava

- Staked

- Lendf.Me

- TrueFi

- Alkemi Network

- CoinList

- Unchained Capital

- MakerDAO

- Constant

- Bitrue

- BlockFi

- Celsius Network

- Salt Lending

- Hodlnaut

- Liquid

30 Best Cryptocurrency Lending Platforms

1.Arch

One of the greatest cryptocurrency lending platforms is Arch Lending, which provides consumers wishing to leverage their digital assets with a safe and easy process. For both borrowers and lenders, Arch Lending offers a reliable environment with an easy-to-use interface and strong security features. The platform makes it simple for users to borrow or lend different cryptocurrencies by facilitating speedy and effective transactions. In order to ensure that lenders obtain excellent returns on their investments and borrowers enjoy affordable borrowing costs, Arch Lending sets itself apart by providing competitive interest rates.

Furthermore, Arch Lending uses sophisticated risk management procedures to reduce possible dangers and improve the process’ general safety. Arch Lending is at the vanguard of the cryptocurrency business’s ongoing evolution, always adjusting to market trends and governmental changes to provide consumers a dependable and innovative lending platform.

2.Nexo

Given its reputation for cutting-edge features and extensive services, Nexo has solidified its position as one of the leading bitcoin lending platforms. With an intuitive interface that streamlines the loan and borrowing procedures, Nexo serves both individual and institutional customers. A unique aspect of Nexo is its quick credit lines, which let customers access money without requiring a traditional credit check and are backed by their cryptocurrency holdings. To further improve accountability and safeguard assets, Nexo uses blockchain technology to offer a transparent and safe platform.

With a large selection of accepted cryptocurrencies, adaptable loan lengths, and affordable interest rates, Nexo guarantees its customers a flexible and pleasant lending experience. Furthermore, Nexo’s token, NEXO, provides extra advantages and incentives to encourage involvement in their loan ecosystem. Nexo, a pioneer in the bitcoin lending market, keeps maintained its standing as one of the greatest platforms by continuously adjusting to consumer demands and market changes.

3.Aqru

One of the greatest cryptocurrency lending platforms available is Aqru which gives customers a safe and effective way to lend and borrow money in the cryptocurrency market. The user-friendly layout of Aqru’s platform makes it suitable for both inexperienced and seasoned users. The platform’s sophisticated security measures, which make use of cutting-edge encryption technology and reliable authentication procedures, place a high priority on protecting users’ assets.

One of Aqru’s main advantages is the variety of cryptocurrencies it supports, giving customers a lot of alternatives when it comes to lending and borrowing. Because of its inclusivity, the platform is more flexible and can accommodate a wider range of user preferences. Aqru’s attractiveness is further enhanced by its clear and competitive interest rates, which draw in both lenders seeking profitable returns and borrowers searching for affordable financing options.

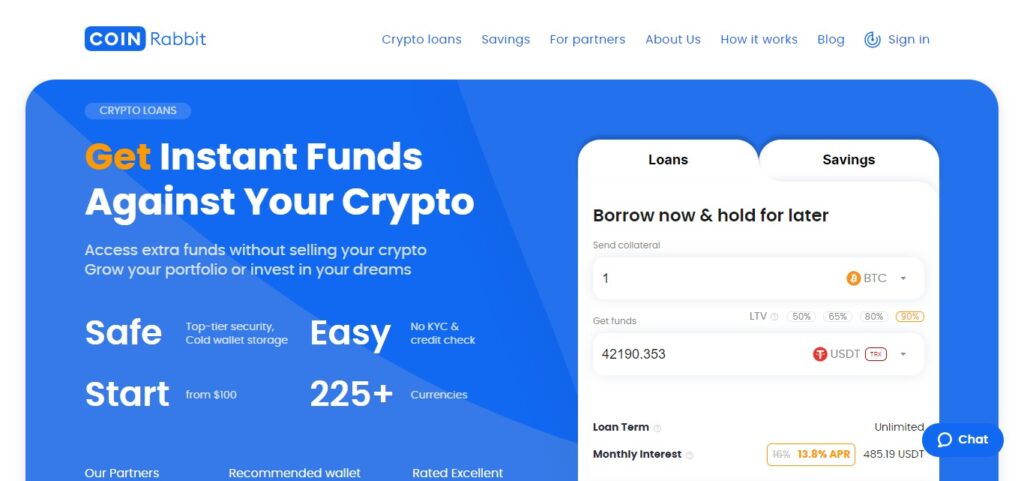

4.CoinRabbit

One of the greatest cryptocurrency lending platforms is CoinRabbit, which gives consumers a safe and effective way to earn money on their digital assets. For both novice and seasoned cryptocurrency aficionados, CoinRabbit stands out as a dependable platform thanks to its user-friendly design and transparent lending process. Users can lend well-known assets like Bitcoin, Ethereum, and other cryptocurrencies because to the platform’s support for a wide range of cryptocurrencies. CoinRabbit uses cutting edge security techniques to protect user cash, giving loan programme members piece of mind.

The website guarantees that users can optimise their returns on their deposited cryptocurrency by providing competitive interest rates. Among cryptocurrency lending platforms, CoinRabbit stands out for its dedication to security, transparency, and reasonable interest rates. This makes it a desirable choice for individuals looking to leverage their digital assets for passive income while lowering risks.

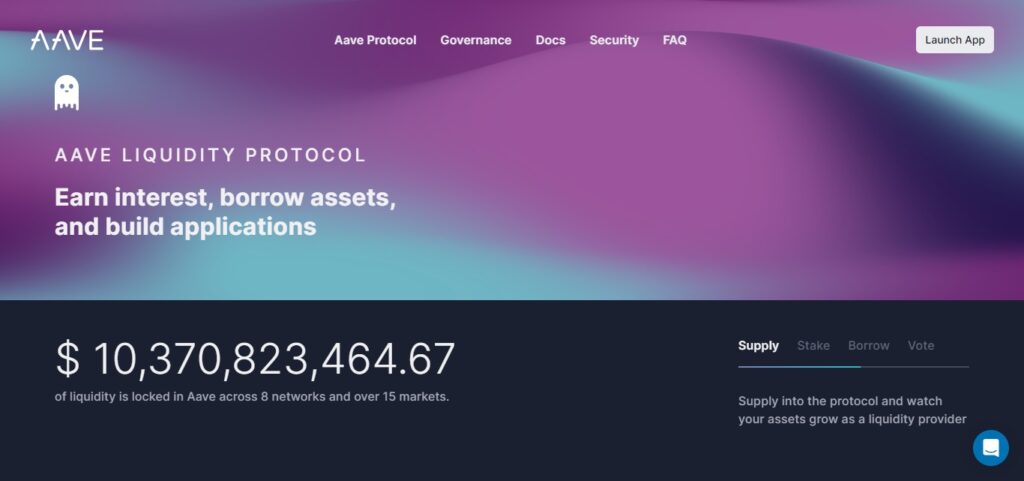

5.Aave

As a result of its creative decentralised finance (DeFi) solutions, Aave has become one of the leading cryptocurrency lending platforms. Aave is a cryptocurrency lending and borrowing platform that runs on the Ethereum network. Using smart contracts to facilitate user interaction with the platform instead of depending on conventional financial middlemen is one of Aave’s unique characteristics. An algorithmic interest rate structure is a feature of Aave’s innovative lending strategy, which dynamically modifies rates in response to market situations pertaining to supply and demand.

By borrowing against their holdings, users can obtain liquidity or earn interest on the assets they have deposited. Due to its decentralised structure and dedication to security and transparency, Aave has drawn a large user base of those looking for adaptable and effective loan options in the bitcoin market. Aave, a leader in the DeFi space, is still influencing the direction that decentralised lending platforms will take.

6.Nebeus

Nebeus is a notable participant in the cryptocurrency lending market, providing a wide range of services to meet the requirements of lenders as well as borrowers. Nebeus offers an easy-to-use interface that makes it easier for consumers to leverage their digital assets for lending or borrowing. By supporting numerous well-known cryptocurrencies, the site enables users to diversify their lending holdings. Nebeus sets itself apart by offering loans backed by money, which enables users to obtain liquidity without having to sell their bitcoin holdings.

Those looking to unlock the value they require while keeping exposure to the potential upside of their digital assets may find this option appealing. Nebeus also prioritises security, putting in place rigors safeguards to protect user payments and private data. Nebeus is one of the greatest cryptocurrency lending platforms, providing a dependable and easily accessible way for people to take advantage of the advantages of decentralised financing. It has established a strong reputation for itself through affordable interest rates and a dedication to user satisfaction.

7.YouHodler

Being one of the top platforms for lending cryptocurrencies, YouHodler is well-known for offering a wide range of financial services specifically designed for cryptocurrency aficionados. YouHodler’s user-friendly interface makes it simple for users to lend, borrow, and earn interest on a range of cryptocurrencies. The platform’s capacity to offer crypto-backed loans, which let customers release liquidity without having to sell their digital assets, is one noteworthy feature. YouHodler offers support for popular cryptocurrencies including Bitcoin, Ethereum, and stablecoins, making it suitable for a wide variety of users.

Users can possibly boost their returns by multiplying their cryptocurrency holdings with the platform’s revolutionary Multi HODL feature. YouHodler places a high priority on security, using cutting-edge techniques to safeguard private data and user payments. Its attractive interest rates and open fee structure make it a popular choice for anyone looking for dependable and effective bitcoin lending options. YouHodler’s impressive feature set and dedication to user satisfaction make it one of the top cryptocurrency lending platforms available.

8.Compound

Compound is a unique player in the cryptocurrency lending market, operating as an Ethereum-based decentralised finance (DeFi) system. Compound, one of the leading companies in the space, enables algorithmic borrowing and lending without the use of conventional middlemen. Through the Compound protocol, users can deposit different cryptocurrencies and receive interest. They can also borrow against the assets they have placed. Compound is unique in that it has an autonomous interest rate model that dynamically modifies rates according to the supply and demand of each supported asset in real time.

This strategy promotes a decentralised and effective lending ecosystem. Those looking for decentralised lending solutions have found Compound to be popular because of its accessibility, security, and openness. Compound has cemented its position as one of the top cryptocurrency lending platforms by fusing smart contract technology with a wide range of supported assets. This has allowed Compound to play a significant role in influencing the direction of decentralised finance.

9.Crypto.com

A well-known and diverse cryptocurrency platform, Crypto.com provides a full range of financial services, including loans for cryptocurrencies. Users can easily lend their digital assets and earn interest with Crypto.com, which is well-known for its user-friendly design and large selection of supported cryptocurrencies. With the help of the platform’s Earn feature, users may deposit different cryptocurrencies and receive interest rates that are competitive, giving cryptocurrency holders a source of passive income. Moreover, Crypto.com’s lending platform serves a wide range of users by supporting well-known cryptocurrencies like Ethereum, Bitcoin, and stablecoins.

The platform prioritises security by implementing strong security measures that guarantee the safety of user payments and personal data. Users searching for trustworthy bitcoin loan platforms have come to trust Crypto.com because of its dedication to openness and creative financial solutions. The company’s appeal as a complete and user-centric cryptocurrency platform is aided by the integration of loan services with its wider ecosystem, which also includes a wallet, cryptocurrency exchange, and payment services.

10.Binance

Offering a thorough and intuitive lending experience, Binance distinguishes itself as one of the top cryptocurrency lending platforms available. Binance offers users a safe and effective platform for lending as well as trading as one of the biggest and most respected cryptocurrency exchanges in the world. Through the platform’s lending feature, users may lend their digital assets to margin traders on Binance and receive interest on their investments. Users can choose the amount and length of their loans, and the lending process is simple.

A large selection of supported cryptocurrencies and reasonable interest rates make Binance a desirable choice for both new and seasoned investors looking to optimise returns on their holdings. Furthermore, consumers are more confident in Binance because of its dedication to security, liquidity, and transparency, which reinforces its standing as one of the top cryptocurrency lending platforms in the market.

11.CoinLoan

One of the most notable cryptocurrency lending platforms is CoinLoan, which provides a special combination of borrowing and lending services for the digital asset market. The unique method of CoinLoan, which enables users to use their cryptocurrency holdings as security for loans or to earn interest by lending out their assets, is what makes it stand out. This platform is available to a broad spectrum of people due to its seamless and user-friendly experience. With its support for numerous cryptocurrencies, CoinLoan gives customers the freedom to select from a wide selection of digital assets for lending and borrowing.

The site is well-liked by the cryptocurrency community in part because of its straightforward pricing structure and competitive interest rates. Additionally, CoinLoan places a strong emphasis on security, taking precautions to safeguard customer funds and private data. Overall, CoinLoan is one of the greatest cryptocurrency loan platforms available, meeting the many needs of the knowledgeable community because to its blend of adaptability, user-friendliness, and security.

12.kucoin

Among the top cryptocurrency lending platforms, KuCoin stands out as a major participant since it offers consumers a dependable and feature-rich environment for lending and trading. KuCoin is well-known for supporting a wide variety of cryptocurrencies and trading pairings. It also gives users the option to trade margin, which lets them lend or borrow digital assets. KuCoin’s lending method is user-friendly, letting consumers choose the conditions and quantity of loans they want.

KuCoin appeals to a wide range of users, from novice traders to seasoned investors, with its user-friendly design and excellent interest rates. The platform’s trustworthiness is further strengthened by its dedication to security, liquidity, and openness. KuCoin is a notable option for anyone wishing to investigate cryptocurrency lending with ease and confidence because of its vibrant ecosystem and ongoing efforts to improve user experience.

13.Cex.io

Among the greatest cryptocurrency lending platforms is Cex.io, which provides a stable and intuitive environment for novice and seasoned traders alike. The platform makes it simple for users to lend or borrow different digital assets by supporting a large variety of cryptocurrencies. Competitive interest rates are one of the main characteristics that distinguish Cex.io; they offer lenders appealing returns and fair terms for borrowers. To protect user funds and sensitive data, the site uses cutting edge security methods.

In addition, Cex.io provides an intuitive user experience that makes it easy for users to navigate and participate in loan operations. Cex.io is one of the greatest cryptocurrency loan platforms available thanks to its transparent and well-established reputation in the industry. The community has come to trust it. In the fast-paced world of bitcoin finance, Cex.io is a dependable option whether you’re wanting to make passive income through lending or simply need a safe place to borrow money.

14.Bitmart

One of the greatest platforms for lending bitcoin is BitMart, which provides a stable and easy-to-use environment for lending and borrowing digital assets. BitMart offers consumers a multitude of alternatives to diversify their lending portfolios, with a large selection of supported cryptocurrencies and tokens. Due to its user-friendly interface, both novice and seasoned traders can easily navigate through the financing procedure on this platform. BitMart uses cutting edge security procedures, such as cold storage and encryption methods, to guarantee the security of users’ money.

The portal also provides lenders with competitive interest rates and those looking for liquidity with appealing loan arrangements. The cryptocurrency community has come to trust BitMart because of its reputation for openness and dependability, which makes it a top option for anyone wishing to lend bitcoins with confidence.

15.EthLend

One of the leading cryptocurrency lending platforms in the decentralised finance (DeFi) market is EthLend, which has relaunched as Aave. Aave offers consumers a decentralised and transparent lending ecosystem via its Ethereum blockchain operation. Users can lend and borrow a range of cryptocurrencies via smart contracts, enabling peer-to-peer lending without the need for middlemen. Aave is distinguished by its novel characteristics, such as the utilisation of flash loans, which let borrowers obtain cash without requiring collateral—but only inside a single transaction block.

The site is renowned for its dedication to security and has put in place a number of safeguards to keep users’ money safe. Users can participate in the development and decision-making processes of the platform through Aave’s decentralised governance approach. In the cryptocurrency industry, Aave is a go-to platform for individuals looking for effective and trustworthy lending solutions because of its innovative approach to decentralised lending.

16.Kava

As a major player in the bitcoin lending market, Kava provides a decentralised finance (DeFi) platform based on the Cosmos blockchain. Kava is an expert in enabling consumers to borrow against and collateralize their digital assets, hence promoting a safe and effective lending procedure. Kava stands out for its distinctive multi-collateral lending mechanism, which enables users to manufacture USDX, a stablecoin backed by the US dollar, and stake a range of cryptocurrencies as collateral.

This contributes to stability in the loan environment in addition to giving users access to liquidity. Users are empowered to engage in decision-making through Kava’s governance approach, which guarantees a decentralised and community-driven platform. The platform is a dependable option for people looking for stable and decentralised bitcoin lending solutions because of its dedication to security, interoperability, and innovation.

17.Staked

Staked has grown in popularity as a means of generating passive income for cryptocurrency owners, and a number of sites have become industry leaders in this regard. Binance is a well-known option among the top cryptocurrency loan platforms for Staked . Binance gives users flexibility and lucrative rewards by offering a large selection of staking alternatives for different cryptocurrencies. Celsius Network is another notable platform, well-known for its competitive interest rates and easy-to-use interface.

To improve the whole staking experience, Celsius Network offers weekly rewards and support for a wide range of coins. Staked may also be interested in sites like Kraken, which provides a dependable and safe environment for users in addition to staking services. The crypto community has come to trust Kraken because of its dedication to openness and strong security protocols. Key players in the exciting world of bitcoin lending and staking, these platforms—along with others like Coinbase and Bitfinex—offer consumers a variety of staking options.

18.Lendf.Me

Lendf.Me was a prominent participant in the decentralised finance (DeFi) domain, operating as an Ethereum blockchain-based lending platform. Its main goal was to enable users to use a range of cryptocurrencies for lending, borrowing, and interest-earning activities. This was made possible by the use of smart contracts. Lendf.Me aimed to create a peer-to-peer lending ecosystem by utilising a decentralised and trustless infrastructure. This would enable users to efficiently leverage their cryptocurrency holdings without depending on conventional intermediaries.

By utilising smart contracts to ensure seamless and safe loan and borrowing transactions, the platform furthered its commitment to transparency and security. Lendf.Me further made a concerted effort to link with other protocols and decentralised applications (DApps) in the larger DeFi ecosystem, thereby augmenting the general interoperability and interconnectivity of decentralised financial platforms.

19.TrueFi

As one of the top cryptocurrency lending platforms, TrueFi is well known for providing a transparent and decentralised lending ecosystem based on the TrustToken technology. Its dedication to trust and openness, demonstrated by its cutting-edge on-chain credit rating system, is one of its main advantages. By evaluating borrowers’ creditworthiness using a community-driven approach and a special combination of smart contracts, TrueFi lowers the risks involved with lending in the bitcoin industry. Furthermore, TrueFi uses an open, permissionless infrastructure that enables users to lend and borrow different cryptocurrencies without the need for middlemen.

The platform’s user-friendly interface, quick loan approval procedures, and affordable interest rates have helped it become well-known. Furthermore, TrueFi has put strong security measures in place, giving consumers a safe environment for their borrowing and lending activities. TrueFi’s commitment to openness, decentralised governance, and user-centered design sets it apart from other platforms in the quickly expanding field of decentralised finance (DeFi) as the bitcoin lending market continues to change.

20.Alkemi Network

In the rapidly developing field of decentralised finance (DeFi), Alkemi Network distinguishes itself as one of the leading cryptocurrency lending platforms by providing an advanced and decentralised lending solution. Alkemi Network, which operates on the Ethereum blockchain, offers users a smooth interface for lending and borrowing different cryptocurrencies, promoting capital allocation that is both efficient and liquid. The platform’s usage of decentralised autonomous organisations (DAOs) for governance, which enables user participation in decision-making, is one of its noteworthy aspects. By using cutting-edge algorithms, Alkemi Network maximises loan lengths, collateralization ratios, and interest rates while improving the overall effectiveness of its lending protocols.

By employing smart contracts and decentralised oracles to reduce counterparty risks and maintain the integrity of the loan ecosystem, the platform further demonstrates its dedication to security. Alkemi Network is gaining recognition as a leading cryptocurrency lending platform thanks to its user-friendly interface, sophisticated financial tools, and decentralised governance model. By offering a safe and effective means of lending and borrowing in the cryptocurrency space, Alkemi Network also helps to advance DeFi.

21.CoinList

As one of the top platforms for lending bitcoin, CoinList provides a wide range of services to meet the needs of lenders and borrowers in the constantly changing cryptocurrency market. CoinList offers users a safe and open environment with an intuitive user experience and a dedication to regulatory compliance. Through the platform, lenders may participate in lending pools and earn interest on their holdings while borrowers can obtain loans by using their cryptocurrency assets as collateral.

By ensuring the smooth execution of transactions, CoinList’s smart contract technology lowers the risk associated with counterparties. Additionally, the site offers flexibility to consumers with a variety of portfolios by supporting a large number of cryptocurrencies. For individuals looking for dependable and effective bitcoin loan options, CoinList is a great option due to its stellar reputation for dependability and commitment to industry best practices.

22.Unchained Capital

As one of the leading cryptocurrency lending platforms, Unchained Capital has made a name for itself by combining the decentralised aspect of blockchain technology with conventional financial concepts. The site sets itself apart by offering loans secured by Bitcoin, which enables users to increase the value of their assets without having to sell them. By requiring multiple keys for transaction authorisation, Unchained Capital’s multi-signature wallet technology improves security and reduces the possibility of unauthorised access.

Transparency is also highly valued by the business, which gives customers real-time access to information on the collateralization of their loans. Unchained Capital enables people to make knowledgeable decisions about borrowing against their assets or lending money by emphasising client education and support. In the field of bitcoin lending, Unchained Capital is notable overall for its dedication to innovation, security, and user empowerment.

23.MakerDAO

MakerDAO has firmly established itself as one of the leading cryptocurrency lending platforms, revolutionizing the decentralized finance (DeFi) space. Operating on the Ethereum blockchain, MakerDAO enables users to generate DAI, a stablecoin pegged to the US Dollar, by locking up their Ethereum assets as collateral. This approach offers users the flexibility to access liquidity without the need to sell their cryptocurrencies. The decentralized and autonomous nature of MakerDAO’s smart contract system ensures transparency and minimizes counterparty risk.

The governance token, MKR, allows users to participate in the platform’s decision-making processes, making it a community-driven endeavor. With its robust and innovative design, MakerDAO provides a decentralized lending solution that aligns with the principles of the blockchain, offering users a secure and transparent way to interact with the rapidly evolving world of decentralized finance.

24.Constant

One of the greatest cryptocurrency lending platforms is Constant, which provides a distinctive and adaptable method of lending and borrowing in the digital asset market. Peer-to-peer, the network links lenders hoping to make money on their cryptocurrency holdings with borrowers seeking immediate access to funds. Constant offers users flexibility and choice by supporting multiple cryptocurrencies as collateral. Constant is unique in that it incorporates CONSTANT, a stablecoin that is based on the US dollar.

By reducing the volatility that is frequently connected to cryptocurrencies, this stablecoin provides consumers with a dependable unit of account. Constant’s real-time collateral tracking and flawless smart contract transaction execution demonstrate their dedication to transparency. Within the bitcoin lending space, Constant has made a name for itself as a reliable and effective platform with an easy-to-use UI and a customer-focused approach.

25.Bitrue

Among bitcoin lending platforms, Bitrue stands out as a significant player since it offers a complete and user-friendly environment that is beneficial to both lenders and borrowers. With a wide variety of supported cryptocurrencies, the platform makes crypto lending and borrowing easier and gives users more control over how they manage their digital assets. Competitive interest rates and quick transaction processes define Bitrue’s loan services. Lenders can participate in lending pools to earn interest on their idle assets, while users can easily use their cryptocurrency holdings as collateral to receive loans.

Because of Bitrue’s dedication to security and compliance, users feel more confident using it, and both new and seasoned participants in the cryptocurrency loan market can easily use its user-friendly interface. For those looking to participate in bitcoin lending, Bitrue offers a dependable and transparent platform with features like risk management procedures and automated loan liquidation methods.

26.BlockFi

Offering a full range of financial services for cryptocurrency aficionados, BlockFi stands out as one of the top platforms for lending cryptocurrencies. Crypto-backed loans are one of its main features; these let customers borrow fiat money by using their digital assets as security. In order to meet the various needs of its consumers, BlockFi offers customisable lending terms together with low interest rates. Numerous cryptocurrencies, including well-known ones like Bitcoin, Ethereum, and Litecoin, are supported by the site. BlockFi provides interest-bearing accounts in addition to lending services, allowing users to profit passively from their cryptocurrency holdings.

BlockFi offers interest rates that are frequently greater than those of traditional banks, making it a desirable choice for people who want to get the most out of their digital assets. BlockFi is an excellent option for anyone looking for financial opportunities inside the bitcoin ecosystem because of its user-friendly interface and dedication to security. It has established itself as a reliable platform in the cryptocurrency lending market.

27.Celsius Network

Celsius Network is a well-known participant in the bitcoin loan market, providing financial services in the digital asset market with a distinctive and user-focused methodology. With a goal of giving its users 80% of its money, the platform sets itself apart by putting the needs of the community first. By lending money to institutional borrowers, Celsius Network enables individuals to earn interest on their bitcoin holdings and build a mutually beneficial and long-lasting ecosystem. Positive interest rates are available to users, frequently outpacing those provided by conventional financial institutions.

Because Celsius offers a large number of cryptocurrencies, it is accessible to a wide range of fans for digital assets. The company’s standing as a reliable lending platform has also been aided by its dedication to security and transparency. Celsius Network is among the greatest cryptocurrency lending platforms for those looking to maximise their cryptocurrency holdings because of its commitment to providing fair and transparent financial services as well as its competitive interest rates.

28.Salt Lending

Salt Lending has established itself as a noteworthy participant in the cryptocurrency lending sector, offering innovative solutions for borrowers and investors alike. The platform enables users to leverage their digital assets as collateral to secure loans, providing a flexible and accessible avenue for obtaining liquidity without the need to sell their cryptocurrencies. Salt Lending caters to a diverse range of users and supports various cryptocurrencies, including popular ones like Bitcoin and Ethereum.

One of the notable features of Salt is its membership-based model, where users can become Salt members and gain access to additional benefits such as lower interest rates and higher loan-to-value ratios. The platform’s commitment to transparency and compliance adds an extra layer of trust for users. Salt Lending’s unique approach to collateralized lending and its user-friendly interface contribute to its standing as one of the noteworthy cryptocurrency lending platforms in the market.

29.Hodlnaut

In the world of cryptocurrency lending platforms, Hodlnaut has become a formidable force, providing consumers with a simple and open method of earning money on their digital assets. Through the site, users may lend out their cryptocurrency holdings to institutional borrowers and earn lucrative profits. Stablecoins like USDC and USDT, as well as well-known cryptocurrencies like Ethereum and Bitcoin, are supported by Hodlnaut. Hodlnaut’s lending programme is now simple enough for both inexperienced and seasoned customers to participate in thanks to its intuitive design.

Hodlnaut’s competitive interest rates are one of its best qualities; they frequently outperform those of regular banks. The platform prioritises security and uses best practices in the industry to protect customer monies. Overall, Hodlnaut is a notable option for anyone wishing to generate passive income through cryptocurrency lending because of its dedication to ease of use, security, and competitive returns.

30.Liquid

Offering lovers of digital assets a full range of financial services, Liquid has made a name for itself in the bitcoin loan market. Users can lend and borrow a number of cryptocurrencies on the site, including Ethereum, Bitcoin, and other cryptocurrencies. With reasonable interest rates, Liquid’s lending platform enables borrowers to access liquidity through the use of their cryptocurrency holdings as collateral. To make it accessible to both novice and expert users, the platform also has an easy-to-use interface and a simple loan procedure.

Liquid’s reputation as a reliable cryptocurrency lending platform is further strengthened by its dedication to security, compliance, and transparency. Liquid is an appealing option for bitcoin loan seekers because of its variety of supported assets, competitive interest rates, and emphasis on security and user experience.

How Do Cryptocurrency Lending Platforms Work?

Platforms for lending cryptocurrencies function as middlemen, enabling decentralised borrowing and lending of digital assets. In return for interest payments, users can lend their cryptocurrency holdings to other people, and borrowers can obtain funds by putting up collateral. An essential part of automating the loan process is the use of smart contracts, which are generally executed on blockchain platforms such as Ethereum. Smart contracts handle the terms and conditions, such as interest rates and collateral requirements, when a borrower makes a loan request.

The collateral is returned and the lender gets paid the principal amount plus interest when the borrower complies with the terms of the loan. Through the provision of an alternate funding source for people in need, this peer-to-peer lending strategy increases market liquidity and enables users to earn interest as a passive income. Users should proceed with caution, though, as lending entails risks by nature, such as the possibility of borrower default or fluctuations in the market that impact collateral values.

What Is Importance Best Cryptocurrency Lending Platforms?

For customers who want to engage in lending and borrowing activities, selecting the top bitcoin lending services is essential. The following elements might affect users’ overall experience, security, and possible returns, making platform selection crucial:

Asset Protection: The top lending platforms put their consumers’ money first, utilising strong security features like two-factor authentication, encryption, and cold storage for cryptocurrency assets.

Track Record: Reputable and well-established platforms within the cryptocurrency ecosystem tend to be more reliable. Testimonials and reviews from users might provide light on how trustworthy the platform is.

Diverse Assets: A reputable lending platform will allow customers to utilise a range of cryptocurrencies as collateral, giving them the freedom to choose which assets to use for lending or borrowing.

Simple User Interface: Easy to use interfaces and seamless user experiences make loan and borrowing procedures more effective. It’s also critical to provide accurate and transparent information about terms, conditions, and interest rates.

Active Markets: Users have greater opportunity to match their lending or borrowing demands on platforms with strong liquidity and market depth. This lessens the possibility of transaction delays or unfavourable rates.

What Is Features Best Cryptocurrency Lending Platforms?

Here are key features to look for in the best cryptocurrency lending platforms:

Rates of Interest: Competitive lending rates are an important component. While borrowers look for fair rates, lenders want to get a respectable return on their cryptocurrency holdings.

LTV (loan-to-value) ratio: A reasonable loan-to-value ratio guarantees that borrowers offer enough collateral for the loan. This aids in risk management for both sides.

Options for Collateral: Users can lend or borrow money using a variety of cryptocurrencies thanks to diverse collateral alternatives. Users have flexibility while using a platform that supports a variety of assets.

Conditions of Loan: Platforms that provide adjustable loan terms, like either a short-term or long-term option, serve a wider variety of users with various requirements.

Safety: To safeguard user cash, security features like cold storage, multi-signature wallets, and hacker insurance are essential.

Conclusion Best Cryptocurrency Lending Platforms

Finally, in the quickly changing world of digital banking, bitcoin lending services have shown themselves to be creative answers. These platforms provide people and organisations with the chance to use their cryptocurrency holdings for a variety of financial goals, such as obtaining liquidity or generating income without having to sell them.

The decentralised character of transactions, which is frequently made possible by smart contracts on blockchain networks, is one of the main benefits of bitcoin lending platforms. By doing this, the requirement for middlemen is reduced, which lowers expenses and boosts productivity. These platforms also give customers flexibility by giving them the option to select from a variety of loan and borrowing terms, interest rates, and collateral alternatives.

But before using any platform, players in the cryptocurrency lending area should be very careful and make sure they’ve done their homework. Users should give priority to platforms with strong security measures, open procedures, and a proven track record of dependability because security is still of the utmost importance. Another crucial element is regulatory compliance, since following the law can support a lending platform’s legitimacy and long-term profitability.

It’s possible that new platforms with better features and services will appear as the cryptocurrency loan market develops. For users to successfully traverse the ever-changing world of bitcoin lending and make informed judgements, they should stay up to date on market developments, regulatory changes, and technological breakthroughs. In the end, selecting a cryptocurrency lending platform should be in line with one’s personal risk tolerance, financial objectives, and need for a reliable and safe lending experience in the rapidly developing decentralised finance sector.

FAQ Best Cryptocurrency Lending Platforms

What is a cryptocurrency lending platform?

A cryptocurrency lending platform is a service that allows users to lend or borrow digital assets, primarily cryptocurrencies, in exchange for interest payments. These platforms connect lenders with borrowers and facilitate the lending process through smart contracts or other mechanisms.

Are cryptocurrency lending platforms safe?

Safety can vary among platforms. It’s essential to choose reputable platforms with transparent security measures, such as cold storage for funds, encryption, and two-factor authentication. Additionally, user reviews and the platform’s track record can provide insights into its reliability.

What cryptocurrencies can be lent or borrowed?

The availability of cryptocurrencies for lending or borrowing depends on the platform. Major cryptocurrencies like Bitcoin and Ethereum are commonly supported, but platforms may also support various altcoins. Check the platform’s offerings before participating.

How is interest calculated on cryptocurrency lending platforms?

Interest rates can vary and may be influenced by factors such as market demand, supply, and the chosen lending platform. Interest is typically calculated as an annual percentage rate (APR) and can be paid daily, weekly, or monthly.

Can lose money on a cryptocurrency lending platform?

Yes, there are risks involved. Lenders may face the risk of default from borrowers, and borrowers may lose their collateral if the value of the borrowed assets drops significantly.