About Ampleforth.org

Ampleforth.org is a cryptocurrency and financial building block. Much like Bitcoin, it is algorithmic and uncollateralized. However, unlike Bitcoin, AMPL can be used to denominate stable contracts. The Ampleforth protocol translates price volatility into supply volatility. This means the number of AMPL tokens in user wallets automatically increases or decreases based on price.

Ampleforth.org is airdropping their new governance token FORTH (67% of the total supply) to eligible airdrop participants. The snapshot was taken on March 30th, 2021. Users who’ve interacted with AMPL, Geyser participants, and users who held AMPL during negative rebase periods are eligible to claim free FORTH tokens. FORTH is already tradable on Binance.

| Platform | Total Supply | End Date | Website |

|---|---|---|---|

| ETH | 15,000,000 FORTH | 2022-04-16 | Click Here To Visit |

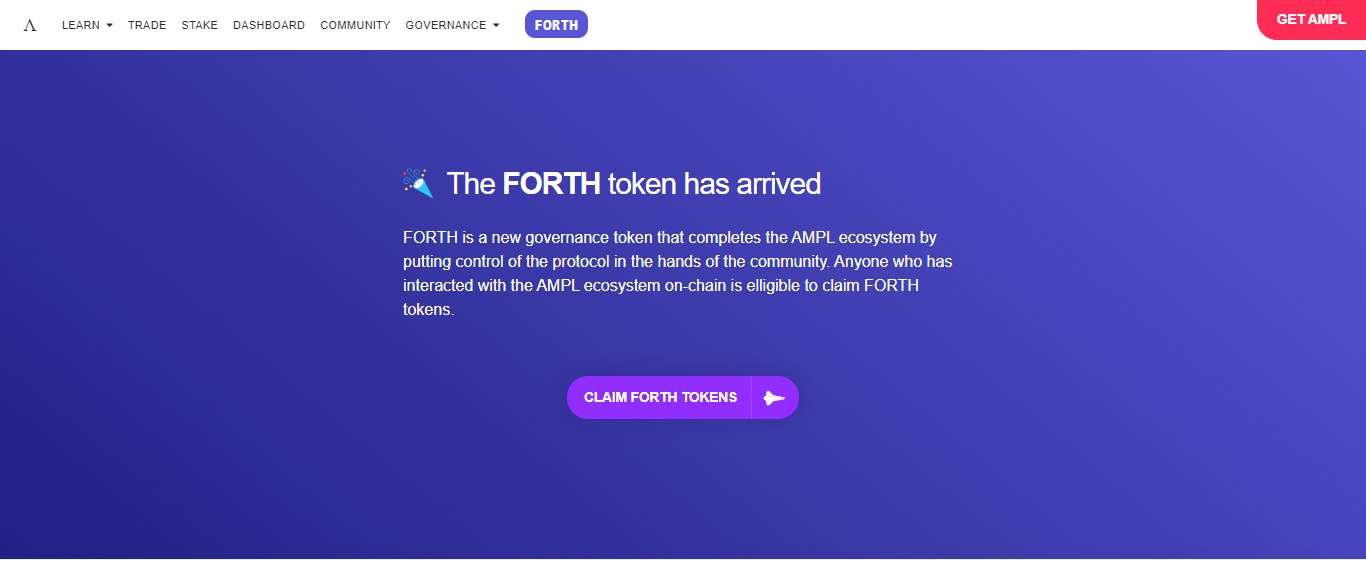

The FORTH token has arrived

FORTH is a new governance token that completes the AMPL ecosystem by putting control of the protocol in the hands of the community. Anyone who has interacted with the AMPL ecosystem on-chain is elligible to claim FORTH tokens.

AMPL is like Bitcoin except it can be used in contracts

Ampleforth.org is a cryptocurrency and financial building-block. Much like Bitcoin, it is algorithmic and uncollateralized. However unlike Bitcoin, AMPL can be used to denominate stable contracts.

How does the protocol work?

The Ampleforth protocol translates price-volatility into supply-volatility. This means the number of AMPL tokens in user wallets automatically increases or decreases based on price:

These supply adjustments are called “Rebases” and rebases occur once each day. When the AMPL network grows you’ll automatically have more tokens, when the AMPL network shrinks you’ll automatically have fewer tokens, but the price per AMPL will tend to cycle around $1. This novel rebasing mechanism is what allows AMPL to be used in contracts.

What do we mean by Stable Contracts?

Let’s go through a simple example. Imagine Evan and Micah enter into a bet: If the Lakers make it to the 2022 NBA conference finals, Micah will pay Evan 10 coins. Otherwise, Evan will pay Micah 10 coins.” They would not want to denominate this bet using Bitcoin, because Bitcoin’s price volatility makes for an unstable contract obligation.

AMPL vs Stablecoins Today

Often we’re asked: “If the number of tokens in my wallet can change, then isn’t AMPL still speculative and volatile? Why not use a stablecoin like Tether or DAI for contract denomination?”

Our Answer: “Because the goal of the decentralized finance movement, is to create an alternative financial ecosystem, beyond the reach of politics.”

Stablecoins today either rely on 1) traditional banks, or 2) lenders of last resort.

AMPL is an independent financial primitive that does not rely on centralized collateral or lenders of last resort. It’s like Bitcoin, except it can be used in contracts.

Fast and Slow

The Ampleforth.org protocol establishes a set of initial conditions and incentives for the network. There is no centralized oversight of price or supply in the Ampleforth protocol. Rather, it depends on a decentralized network of actors. While the protocol propagates price information into supply, it’s the actors that propagate supply information back into price.

Recall that the Ampleforth protocol programmatically sets equilibrium supply targets, which is important because the promise of elastic supply needs to be strictly enforced. However changing supply does not mean that actors will correspondingly adjust their bids, nor will they do so in unison. Instead, actors will respond to supply changes based on how quickly or slowly they think others will respond.

Conclusion

By analysis above, they conclude that the market dynamics of Amples cannot be determined by price alone, and require the consideration of supply in addition to price. As a result, the volatility fingerprint of Amples will be distinct from current-generation synthetic commodities. While any structural distinction in movement pattern can benefit asset managers seeking to reduce diver- sifiable risk (Lintner 1965), the question of how correlated or uncorrelated Amples will be with existing synthetic commodities, remains open.