In this article I will discuss the about How to Choose the Best Crypto Exchange for Beginners in Europe can identify their ideal crypto exchange. For beginners intending to trade crypto successfully, ease of use, safety, and selecting an ideal platform are of utmost importance.

- Understanding Crypto Exchanges

- How to Choose the Best Crypto Exchange for Beginners in Europe

- Check Regulation and Licensing

- Prioritize Security Measures.

- Look for Ease of Use

- Compare Fees and Charges

- Check Supported Cryptocurrencies

- Evaluate Payment Methods

- Assess Customer Support

- Examine Reputation and User Reviews

- Assess Available Features and Tools

- Start Small and Test the Exchange

- Best Crypto Exchanges in Europe for Beginners

- Tips for Safe and Smart Crypto Trading

- Start With Little Investments.

- Use a Regulated Exchange

- Set Up Strong Security Settings.

- Use Cold Wallets for Saving

- Avoid Trading with Emotion.

- Diversify Your Portfolio

- Stay Updated on Market Trends

- Avoid Scams and Fake Projects

- Set Stop-Loss and Take-Profit Levels

- Keep Learning Continuously

- Common Mistakes Beginners Should Avoid

- Ignoring Security Measures

- Falling for Scams and Fake Promises

- Trading Without Research

- Overtrading or Acting on Emotions

- Not Diversifying Investments

- Ignoring Fees and Costs

- Keeping All Funds on Exchanges

- Skipping Education and Continuous Learning

- Conclusion

- FAQs

As beginners embark on the crypto journey, identifying key features such as regulation, security, and different fees available will be fundamental in identifying the right platform.

Understanding Crypto Exchanges

A crypto exchange is where users buy, sell, trade, and store cryptocurrencies such as Bitcoin and Ethereum. Mostly, each exchange is a market where buyers and sellers meet to trade digital assets, whether it is other cryptocurrencies or traditional money such as euros and dollars. There are mainly two exchange types — centralized (CEX) and decentralized (DEX).

Examples of centralized exchanges include Binance or Coinbase, as such platforms are fully managed by a company which handles transaction facilitation, compliance of regulation, and provision of customer support. In contrast, decentralized exchanges allow peer-to-peer trading directly through blockchain smart contracts, hence, no intermediaries.

In the context of the cryptocurrencies market, exchanges ensure liquidity, transparency of prices, and security which includes 2-factor authentication (2FA), cold wallet storage, and user identity confirmation (KYC).

Most exchanges offer higher order tools such as staking, margin trading, and portfolio tracking. For beginners, it is critical to select a trustworthy exchange with a low fee, user-friendly interface, and strong regulatory oversight to ensure a safe and smooth trading experience.

How to Choose the Best Crypto Exchange for Beginners in Europe

Check Regulation and Licensing

Before creating an account with a crypto exchange, check to see if it is regulated by European authorities, like the FCA (UK), BaFin (Germany) or under the MiCA (Markets in Crypto-Assets Regulation). Regulation means the provider has to be open with you about the services, and it means user protection and safety of funds against potential scams or fraud.

Prioritize Security Measures.

A secure exchange will utilize two-factor authentication (2FA), cold wallet storage, encryption, and proof of reserves. All of these will secure an account and the digital funds against cyberattacks and unauthorized access. Always select services with a proven track record of safety.

Look for Ease of Use

A beginner will benefit from an exchange with a simple user interface and streamlined navigation. Coinbase and eToro are particularly user friendly in the sense that they enable buying and selling of crypto in just a few clicks. Availability of mobile apps and demo modes are added benefits for training.

Compare Fees and Charges

Every exchange has different trading fees, withdrawal fees, and deposit costs. Beginners should pick exchanges with transparent and low-cost fee structures. Avoid platforms with hidden charges that can affect your profits, especially for small trades.

Check Supported Cryptocurrencies

A good exchange should offer a wide range of popular and trusted cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and stablecoins. Beginners should start with well-known coins before exploring altcoins. Ensure the exchange regularly updates its coin listings.

Evaluate Payment Methods

For European users, check if the exchange supports SEPA bank transfers, credit/debit cards, PayPal, or local payment gateways. Choose one that offers convenient and fast payment methods with minimal transaction costs and supports your local currency (EUR).

Assess Customer Support

Responsive and professional customer service is vital for beginners. Look for exchanges that offer 24/7 live chat, email, or phone support, and multilingual assistance. This ensures quick help in case of technical or account issues.

Examine Reputation and User Reviews

When evaluating a platform’s reputation, always check its history and user feedback and check places like Trustpilot and Reddit. Make sure to steer clear of exchanges that have a lot of complaints about withdrawals and account lockouts. Selecting a reputable exchange will prevent a lot of trader headaches.

Assess Available Features and Tools

Certain exchanges go the extra mile to support their clients by offering additional features like copy trading, portfolio tracking, educational material, and staking. These features are particularly beneficial to novice traders as they facilitate quicker learning and efficient investment management. It is important to select a trading platform that aligns with your educational and trading ambitions.

Start Small and Test the Exchange

You don’t want to overfund your account to begin with. Make a small deposit and execute some test trades. You will get a feel for the platform, its speed, and how withdrawals work. You will be able to invest more once you’re sure of the your trading platform.

Best Crypto Exchanges in Europe for Beginners

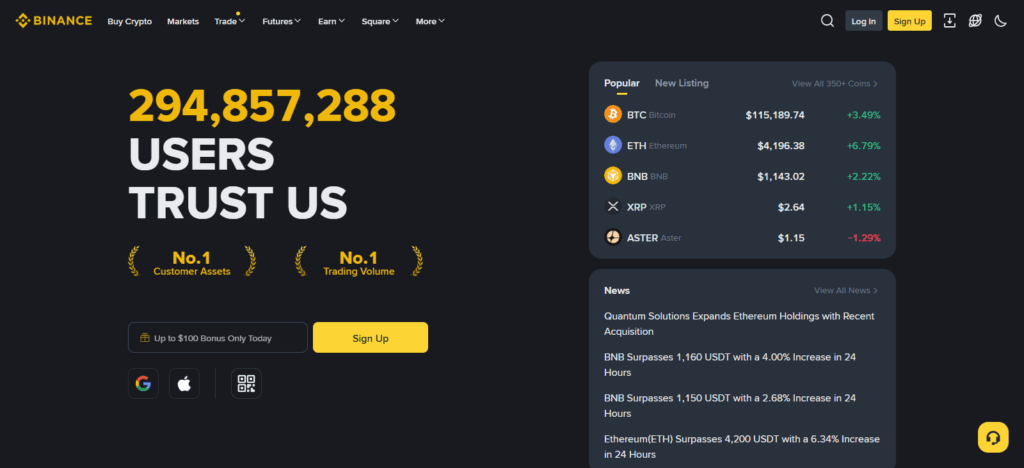

Binance

Launched in 2017, Binance has become one of the leading bitcoin exchanges in Europe, especially for beginners. The exchange embraces numerous European languages and permits diverse cryptocurrencies, from bitcoin and ethereum to numerous altcoins. Binance enhances its reputation in the industry for safety features and advanced and innovative security systems.

These include two-factor identification (2FA), cold wallet storage, and proof of reserves. As of 2022. Binance has 24/7 and multilingual customer support service. The customer service guarantees that the new customers can receive assistance whenever they require it.

As a beginner crypto trader, the excellent customer service, competitive fees, and regulatory compliance in Europe when trading on the platform makes Binance an excellent choice.

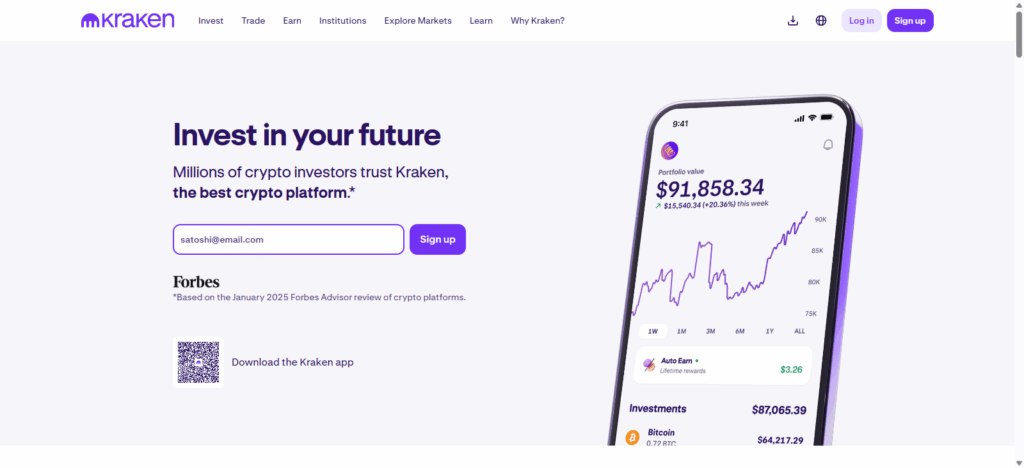

Kraken

Founded in 2011, Kraken is among the most highly regarded cryptocurrency exchanges in Europe due to its excellent reputation for transparency, regulatory compliance, and customer support.

The Kraken platform is translated into multiple European languages and supports the trading of several cryptocurrencies, including Bitcoin, Ethereum, and many altcoins. To enhance account security, Kraken employs 2FA, keeps coins in cold storage, and conducts regular security audits.

Moreover, they provide customer service, via live chat and email, in a way that is very responsive for novices and most new crypto users 24/7.

Kraken is a great option for novice users in the European cryptocurrency market due to its low trading fees, high level of security, and intuitive platform.

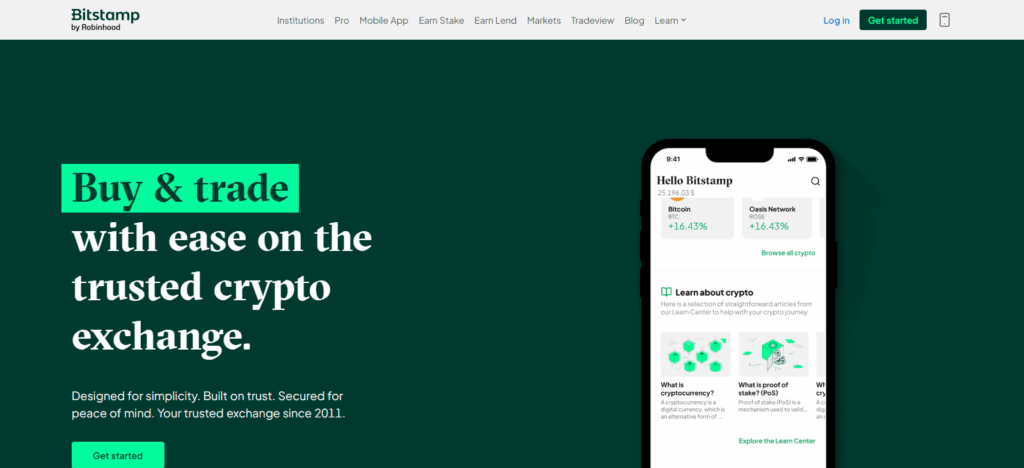

Bitstamp

Launched in 2011, Bitstamp is one of the oldest and most established crypto exchanges in Europe and is highly recommended for beginners. Bitstamp is located in Luxembourg, and its clientele can trade in 5 different European languages and in 5 popular crypto currencies including Bitcoin, Ethereum, and Ripples.

Clients’ funds are kept in cold storage with 2-factor authentication and encryptions, and ensured high level of security. Their customer service representatives are readily available 24/7, and their account operators can be reached via email and chat, in case a user needs attention right away.

Bitstamp easy and straightforward platform, low and easy to understand commissions, and licenses with the Luxembourg Financial Regulator (CSSF) render Bitstamp an ideal and trustworthy platform, especially to first time crypto buyers.

Tips for Safe and Smart Crypto Trading

Start With Little Investments.

Place small investments first Before placing huge bets. The crypto market is extremely unstable and by investing small amounts. You’ll get to figure out your trading tactics within the market without big losses

Use a Regulated Exchange

Traders must use regulated and licensed exchanges in Europe like Kraken, Bitstamp, and Binance. When exchanges are regulated, your money is protected, and the exchanges lower the likelihood of a scam.

Set Up Strong Security Settings.

Use two-factor authentication (2FA), strong passwords, and set anti-phishing codes. Never sell your password, and don’t use public Wi-Fi when trading!

Use Cold Wallets for Saving

Store your crypto in hardware wallets or cold wallets when you are not trading instead of online exchanges to avoid being hacked! Cold wallets store your crypto offline, so you don’t have to worry about hackers getting into being your assets.

Avoid Trading with Emotion.

For a successful trade, you have to create a trade and stick to it. Setting a plan saves you from losses brought about by fear and greed. Emotions cloud your judgment, and when you wish to deviate from the plan, it is a sure sign your plan is working.

Diversify Your Portfolio

Investing all your money in one cryptocurrency can lead to losses. You can mitigate risk and reward imbalance by diversifying across multiple coins. This strategy also safeguards your portfolio from sudden and steep downturns.

Stay Updated on Market Trends

Keep up with crypto news, regulations, and market analysis to understand market sentiment. Analyze and capture the global environment in which the markets operate to make sound and profitable trading decisions.

Avoid Scams and Fake Projects

Beware of suspicious links, fake giveaways, and get-rich-quick schemes. Always check the credibility of a project. Things that sound appealing and unrealistic are often just scams, so be smart and stay safe.

Set Stop-Loss and Take-Profit Levels

Control risks by using trading instruments like stop-loss and take-profit orders. During extreme market conditions, these commands mitigate risks and protect your funds from horrific losses.

Keep Learning Continuously

The crypto world changes every minute. Keep enhancing your skills by enrolling in courses, following tutorials, and visiting quality crypto news sites. Increased knowledge translates into higher quality trading decisions.

Common Mistakes Beginners Should Avoid

Ignoring Security Measures

Many beginners skip essential security steps like enabling two-factor authentication (2FA) or using secure wallets. Neglecting these measures can expose your funds to hacks or theft. Always prioritize account and wallet safety.

Falling for Scams and Fake Promises

Beware of fake exchanges, giveaway scams, and “guaranteed profit” schemes. Scammers often target new traders with unrealistic returns. Always research and verify before investing or sharing personal details.

Trading Without Research

Jumping into trades based on hype or social media trends often leads to losses. Study market trends, coin fundamentals, and project backgrounds before making any investment decision.

Overtrading or Acting on Emotions

Emotional decisions driven by fear or greed can cause significant losses. Avoid panic buying or selling. Develop a clear trading plan and stick to your strategy, regardless of short-term volatility.

Not Diversifying Investments

Putting all your money into one cryptocurrency increases risk. Diversify your portfolio across different coins and sectors to balance potential losses and returns.

Ignoring Fees and Costs

Beginners sometimes fail to account for trading, withdrawal, and network fees. These fees compound over time and can wind up costing you a lot. Always analyze and optimize cost-efficient trading strategies, and don’t forget to compare exchange fees.

Keeping All Funds on Exchanges

This practice is risky. If an exchange gets hacked or shuts down, you can lose access to your funds. For better safety, keep your cryptocurrency in hardware or cold wallets.

Skipping Education and Continuous Learning

Crypto Beginner s that do not prioritize constant education, won’t keep up on market updates and changes. Always Learn with trusted resources, educational courses, and expert guidance for your analysis.

Conclusion

As a beginner, selecting the top crypto exchange in Europe requires considering safety and practicality, compliance, and affordability.

Platforms that have the most comprehensive safety measures, are regulated, and support many payment methods for European customers should be the top priority.

User-friendly exchanges like Binance, Kraken, and Bitstamp are good options since those have easy-to-use systems, customer assistance in multiple languages, and trustworthy customer support.

Don’t forget the importance of doing your own research before each investment, activating every security measure, and making small deals first.

It is possible to enter the crypto market, and establish a solid and secure foundation with long-term profitability, as a beginner with the appropriate exchange and good planning.

FAQs

Are crypto exchanges legal in Europe?

Yes, crypto exchanges are legal in Europe, provided they comply with local and EU regulations such as the MiCA (Markets in Crypto-Assets Regulation) framework. Always choose platforms registered or licensed under reputable European authorities.

What should beginners look for in a crypto exchange?

Beginners should focus on security, regulation, ease of use, low fees, customer support, and supported cryptocurrencies. A simple interface and educational tools can also help new users learn faster and trade confidently.

Which payment methods can I use on European crypto exchanges?

Most European exchanges support SEPA bank transfers, debit/credit cards, PayPal, and local payment gateways. Check each platform’s deposit and withdrawal options for speed and cost before choosing.