I will discuss the Where to Check Daily Trading Volume for Micro-Cap Tokens. Monitoring daily volume is essential for calculating liquidity, assessing overall market dynamics, and detecting possible price swings.

- What is Micro-Cap Tokens?

- Why Daily Trading Volume Matters for Micro-Cap Tokens

- Top 5 Popular Platforms to Check Daily Trading Volume

- 1.CoinMarketCap

- CoinMarketCap Features

- 2.CoinGecko

- CoinGecko Features

- 3.DEXTools

- DEXTools Features

- 4.Nomics

- Nomics Features

- 5.Messari

- Messari Features

- Tips for Safely Monitoring Micro-Cap Tokens

- Risk & Considerations

- Elevated Price Volatility

- Restricted Liquidity

- Amplified Manipulation Opportunity

- Scarce Transparency

- Unsettled Regulatory Position

- Pros & Cons

- Conclusion

- FAQ

Reliance on trustworthy aggregators guarantees the precision of the reported figures, thereby enabling traders to base their strategies on sound evidence and to avert dangers tied to low-liquidity or notoriously volatile micro-cap assets across the cryptocurrency landscape.

What is Micro-Cap Tokens?

Micro-cap tokens are digital currencies characterized by modest market capitalizations, generally below $50 million. Generally, these tokens are incubating projects or modestly position markets in the broader blockchain landscape, rendering them extremely speculative and subject to pronounced price volatility.

Their limited liquidity often exacerbates sudden and severe price movements, thereby classifying them as instruments of pronounced risk as well as prospective, if uncertain, reward.

Although the prospect of outsized appreciation exists, the prerequisite of rigorous, continuous analysis—focusing in particular on executed volume, order-book dynamics, and macro market sentiment—remains essential to mitigating exposure to these turbulent investments.

Why Daily Trading Volume Matters for Micro-Cap Tokens

Liquidity Proxy: A sustained elevated daily volume allows execution of market orders with minimal slippage, preserving execution price integrity.

Volatility Dampener: Anonymously regular trading mitigates the exaggerated price oscillations often characteristic of low-market-cap securities.

Sentiment Gauge: Abrupt contractions or expansions in volume frequently reveal emerging investor conviction or distress.

Strategy Calibration: Observing volume gradients aids the identification of emerging narrative-driven tokens or consoles the assessment of overripe bargains.

Manipulation Radar: Deviant spikes, particularly those unsupported by corresponding price change, frequently precede orchestrated juicer rounds, empowering pewtient [[patient]] scrutiny.

Top 5 Popular Platforms to Check Daily Trading Volume

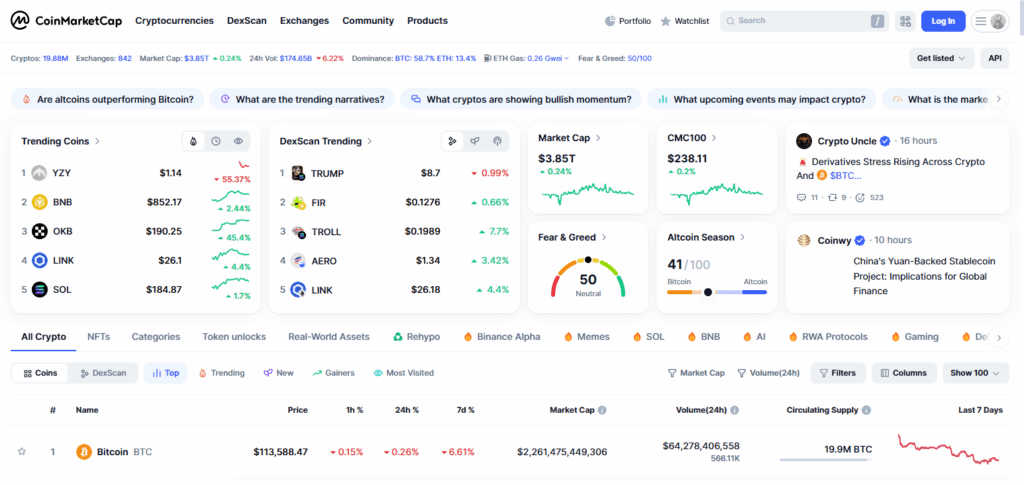

1.CoinMarketCap

CoinMarketCap remains a premier resource for monitoring daily trading volume across a comprehensive spectrum of cryptocurrencies, including micro-cap tokens. The platform aggregates real-time trading data, market capitalization figures, and liquidity measurements, thereby furnishing investors with a solid empirical basis for decision-making.

Its user-centric design, complemented by refined filtering capabilities, enables rapid assessment of volume trends across multiple exchanges. The distinguishing feature of CoinMarketCap is its consistently high reliability and data integrity, two attributes that contribute to its status as a preferred reference for evaluating micro-cap token dynamics and for detecting emergent market shifts.

CoinMarketCap Features

- Live Volume Feed: Updates volume across all selectable markets minute-by-minute, with activity by each listed exchange clearly displayed.

- Extensive Token Inventory: Among over twenty-five thousand assets, micro-caps list within hours of trading inception.

- Customizable Sorting: Volume, depth, and micro-cap inversion rankings can be applied in a single dropdown for immediate macro insights.

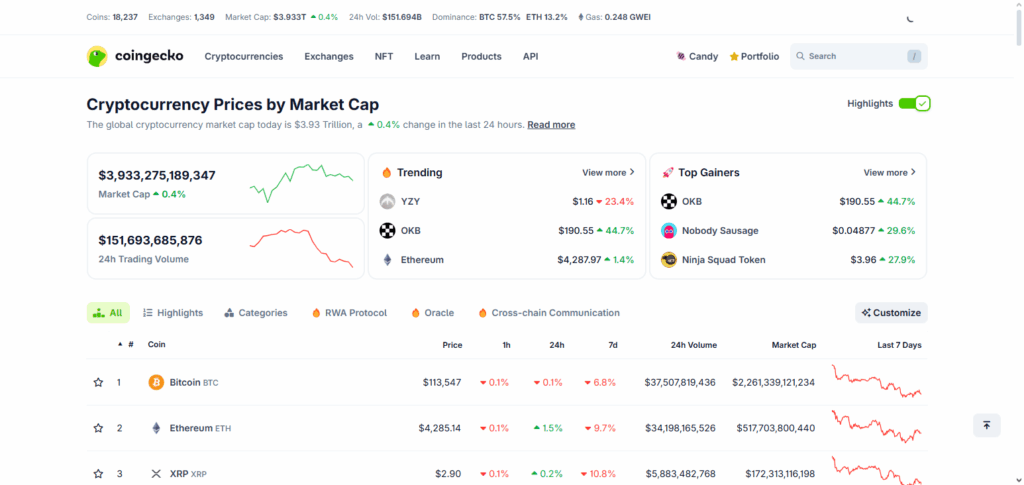

2.CoinGecko

CoinGecko has established itself as a premier resource for assessing daily trading volume in cryptocurrency markets, particularly for micro-cap tokens. By aggregating real-time data from a diverse spectrum of assets, it charts market depth, liquidity, and trading activity across both centralized and decentralized exchanges.

Its competitive advantage resides in the inclusion of ancillary metrics—such as on-chain developer activity, social media sentiment, and multi-period volume histories—thereby furnishing investors with a multi-faceted perspective that transcends price snapshots. For market participants requiring precise and contextualized intelligence on micro-cap ecosystems, the platform has become a non-optional analytical utility.

CoinGecko Features

- Layered Analytics: Integrates volume figures with liquidity ratios, code commits, and social metrics, all exported in tabular form in one request.

- Hybrid Exchange Footprint: Volume partitioned by centralized and decentralized markets, allowing cross-spot comparison with latency-free averages.

- Time-Series Graphs: Daily, weekly, and three-month merged volume plots with moving averages, downloadable as PNG or CSV.

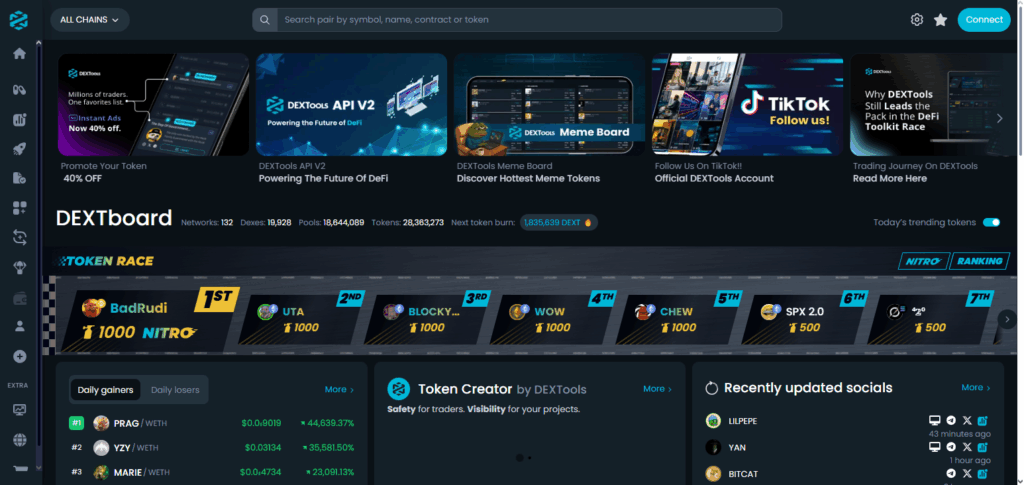

3.DEXTools

DEXTools serves as an authoritative platform for monitoring daily trading volume, primarily because it specializes in aggregated data from decentralized exchanges, the principal venue for most micro-cap tokens. Users benefit from real-time visualizations, live liquidity metrics, and comparative trading-pair analysis, permitting instantaneous scrutiny of token behavior.

The platform’s distinguishable feature is the capacity to observe new and nascent tokens prior to broader market coverage; this early visibility yields actionable indicators of emergent trading dynamics. Consequently, DEXTools is indispensable for investors who require precise and contemporaneous information on micro-cap volume patterns.

DEXTools Features

- One-Click DEX Universe: Filters exclusively from on-chain liquidity pools across the most active decentralized venues, prioritizing newly issued liquidity pairs.

- Instant Candle-Style Updates: Volume and TWAP displayed in candlestick format, with one-minute updates reducing lag to seconds around surges.

- Emerging Token Tracker: Pressure-trigger alerts for tokens under three million USD, enabling early monitoring of liquidity crescendos.

4.Nomics

Nomics has established itself as a leading resource for daily trading-volume verification through an unwavering commitment to data transparency and the provision of high-fidelity, sanitized cryptocurrency market information.

The platform aggregates trading metrics from a diverse array of exchanges, delivering precise volume forecasts and comprehensive historical visualizations, particularly for micro-cap tokens.

Its distinguishing advantage is the public documentation of all underlying data feeds, augmented by stringent filtration to exclude ephemeral or artificially inflated volume records, a feature that becomes vital for assets with limited liquidity.

Such dependable fidelity has rendered Nomics an authoritative reference for market participants seeking granular and trustworthy assessments of ongoing trading dynamics prior to executing any investment deliberation.

Nomics Features

- Transparent Volume Nodes: Aggregates each transaction based on verified on-chain hash and trading ticket verification across aggregated brokers.

- Depth & Micro-Cap Historical Series: Back to genesis or twelve months, volume history exported for any emerging asset in a single API call.

- Federated Exchange Audits: Frequent audits and listings of on-chain and off-chain venues empowering a holistic trading vista.

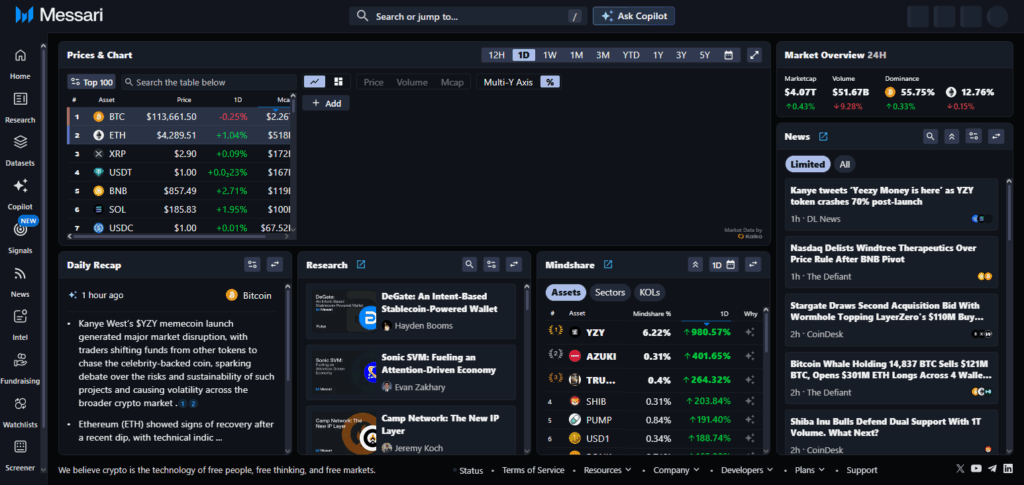

5.Messari

Messari serves as a premier resource for assessing daily trading volume by integrating real-time exchange data with advanced research and quantitative analysis specific to the cryptocurrency landscape.

The platform encompasses a broad spectrum of digital assets—extending to micro-cap tokens—delivering not only precise volume figures and liquidity depths but also enriched historical datasets.

Its distinctive advantage resides in a suite of institutional-quality analytics and rigorously vetted research publications that elucidate price formation and investor sentiment beyond surface statistics.

This comprehensive context equips market participants, particularly those monitoring nascent tokens, with a dependable source of evidence-based intelligence that supports nuanced decision-making and ongoing performance surveillance.

Messari Features

- Curated Research Integration: Enfolds trading volume figures within curated, qualitative market studies, substantially broadening context.

- Historical and Live Data Feeds: Supplies comprehensive time-series and current market data to facilitate trend extrapolation and investment validation.

- Sourced Analysis: Delivers structured evaluations of micro-cap assets, capital depth, and prevailing market psychology to enhance situational awareness.

Tips for Safely Monitoring Micro-Cap Tokens

Employ Established Dashboards: Monitor daily trading volume and distributed ledger signals via reputable interfaces such as CoinMarketCap, CoinGecko, DEXTools, and Nomics.

Cross-Verification: Consult multiple monitoring endpoints to diminish dependence on potentially distorted or artificially enhanced figures.

Pre-configure Notifications: Establish threshold alerts for price and volume to capture abrupt shifts and mitigate latency in response.

Trend Examination: Deliberate volume, pricing, and liquidity trajectories over defined intervals before formalising allocation frameworks.

Remain Skeptic of Hype Cycles: Exercise prudence towards tokens displaying abrupt volume surges correlated with coordinated promotion on social platforms or chatrooms.

Risk & Considerations

Elevated Price Volatility

Securities at the lower end of market capitalization are prone to abrupt fluctuations, presenting outsized upside and downside outcomes.

Restricted Liquidity

Thin trading volumes hinder efficient execution of buy or sell orders, often forcing transactions at adverse price levels.

Amplified Manipulation Opportunity

The small market float renders these tokens especially vulnerable to artificial price elevation schemes, including coordinated buy spikes followed by abrupt sell-offs.

Scarce Transparency

Widespread analytical or operational disclosures are often lacking, resulting in a heightened information deficit and a corresponding increase in assessment risk.

Unsettled Regulatory Position

Novel issuance arrangements might confront retrospective or prospective enforcement actions, subjecting holders to legal remediation or forced market exit.

Pros & Cons

| Pros | Cons |

|---|---|

| High growth potential due to small market cap | Extremely volatile, can lead to large losses |

| Opportunity to discover undervalued tokens early | Low liquidity makes buying/selling difficult |

| Can diversify a crypto portfolio | Higher risk of market manipulation (pump-and-dump) |

| Access to emerging and innovative projects | Limited information and transparency on some projects |

| Ability to track trends through daily trading volume | Regulatory and legal uncertainties in certain regions |

Conclusion

For investors engaged with micro-cap tokens, daily trading-volume observation is non-negotiable; such analyses expose liquidity conditions, characterize market engagement, and illuminate possible future pricing trajectories.

Leading data aggregators—CoinMarketCap, CoinGecko, DEXTools, Nomics, and Messari—supply dependable, near real-time statistics, enabling comparative assessments and transaction timing precisions.

When blended with systemic research and disciplined risk frameworks, this quantitative input ameliorates the oppressive volatility typically associated with micro-cap assets, guiding seekers of asymmetric returns toward demonstrably viable entry or exit moments.

FAQ

What is daily trading volume in crypto?

Daily trading volume is the total amount of a cryptocurrency bought and sold within 24 hours. It indicates liquidity and market activity, helping investors gauge interest and price stability.

Which platforms are best for tracking micro-cap token volume?

Top platforms include CoinMarketCap, CoinGecko, DEXTools, Nomics, and Messari, all offering real-time volume data and historical trends.

Why is monitoring volume important for micro-cap tokens?

Micro-cap tokens are highly volatile and low in liquidity. Tracking volume helps detect unusual activity, assess market sentiment, and avoid potential pump-and-dump schemes.