About Voltage Finance Defi

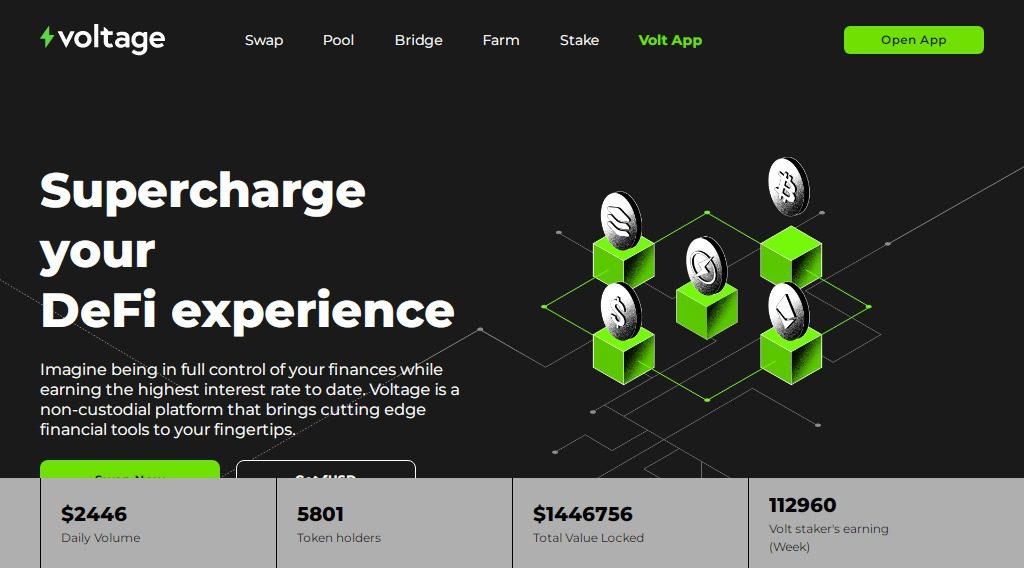

Voltage Finance Defi (FuseFi) is a Defi hub facilitating automated trading of decentralized finance tokens on the Fuse network. Voltage was created to give anyone access to a powerful suite of defi tools from an all-in-one application that is also conveniently accessible on any smart device.

| Compound | Facts |

|---|---|

| Defi Coin Name | Voltage Finance Defi |

| Short Name | VOLT |

| Total Supply | N/A |

| Ethereum Contract | N/A |

| Chat Option | Click Here To Visit Compound Chat |

| Document | Click Here To View Document |

| Official Website | Click Here To Visit |

VOLT Price Live Data

The live Voltage Finance price today is $0.000172 USD with a 24-hour trading volume of not available. WThey e update VOLT to USD price in real-time. Voltage Finance is down 1.58% in the last 24 hours. The current CoinMarketCap ranking is #8429, with a live market cap of not available. The circulating supply is not available and the max. supply is not available.

Take your DeFi everywhere you go!

The Volt AppVoltage Finance Defi is a web 3 non-custodial wallet with everything you need to carry in your pocket. Send, Receive, Swap, Stake & much more with out paying for gas fees and with just one click.

Discover Fuse Dollar

The decentralized stablecoin in Fuse. Multiple stables backing fUSD helps you hedge from the collateral uncertainty.

A fully DAO governed stablecoin where the community decides the collateral, fees and weights.

fUSD mitigates liquidity fragmentation concentrating everything into just one stable.

Make your crypto work for you

Check out how Voltage farms and Volt staking can help you make your crypto work for you. Lock your Volt tokens for stronger voting power and other benefits!

Faucet

Voltage Finance Defi is for all the courageous users looking to explore the Fuse Network but hold 0 Fuse Tokens. If you bridge over to the Fuse Network with an empty wallet, our contract will gift you 0.01 Fuse if you use the bridge on our platform.

Trading

The “Swap” tab is where you can trade one token for another. It is a simple swap interface, just select the two tokens you wish to exchange.

Token Distribution

The token distribution follows a fixed supply, decaying emission model. Use the chart below to further understand how the total supply was allocated.

Several private rounds took place over the first months of the project where 17% of the Tokens were allocated to VC’s and private participants. These private rounds have a 108 week vesting period.

All tokens are distributed according to the emission schedule. That means that the Team and advisors fund, Partnership and LP provision, Foundation fund, Developers fund, and community incentives (LP rewards programs) have a 260 week vesting period.

The Community incentives and Partnerships and LP provision funds were created in order to incentivize and grow the community around Voltage finance. In the near future, the Voltage DAO will be deciding over those funds.

Governance

Voltage Finance Defi core team has an internal roadmap that we feel will benefit Voltage the most as we get to see under the hood daily. The community DAO will have the final say on major decisions that affect how everyone interacts with the protocol. VOLT is a governance token that will allow holders to vote on community proposals.

Proposals

Community proposals can be posted on forum.voltage.finance until we establish our official DAO platform. The forum is where members can discuss and clarify the scope of the proposal with questions. Proposals may be brought up for voting by core team members. If they gain sufficient traction the proposal will be brought to a vote on.

Glossary

Minting – The process of generating new coins using the proof-of-stake mechanism and adding them to the circulation to be traded.

Staking – Participation in a proof-of-stake (PoS) system to put your tokens in to serve as a validator to the blockchain and receive rewards.

Yield Farming – In its simplest form, it involves trying to get the biggest return possible from cryptocurrency.

Slippage – happens when traders have to settle for a different price than what they initially requested due to a movement in price between the time the order (say for Fuse) enters the market and the execution of a trade.