In this article, I will discuss the fundamental and community-driven assets found on the platform, discussing the Top Tokens to Trade on Sushi.

- Key Point & Top Tokens to Trade on Sushiswap List

- 1.Chainlink

- Chainlink (LINK) Features

- 2.OmniCat

- OmniCat (OMNI) Features

- 3.Wrapped Bitcoin

- Wrapped Bitcoin (WBTC) Features

- 4.Illuvium

- Illuvium (ILV) Features

- 5.Synthetix Network

- Synthetix Network (SNX) Features

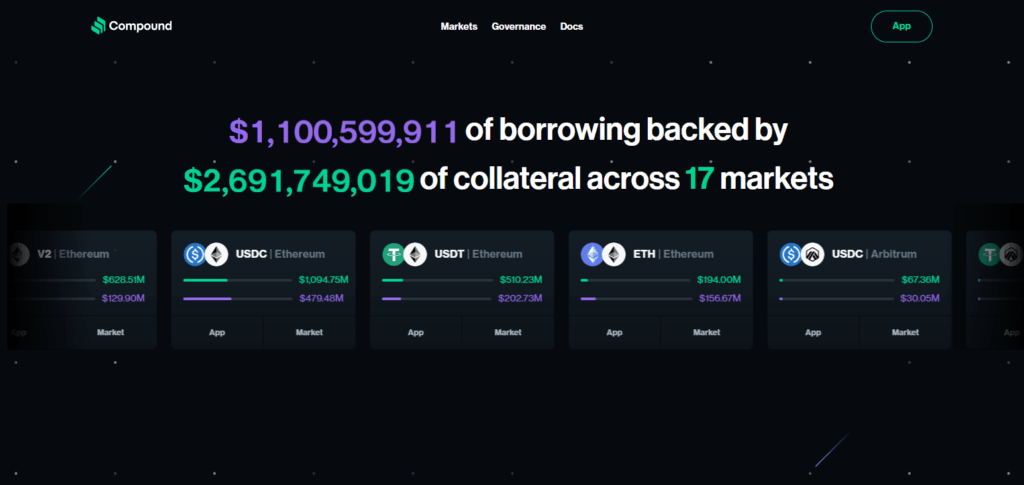

- 6.Compound

- Compound (COMP) Features

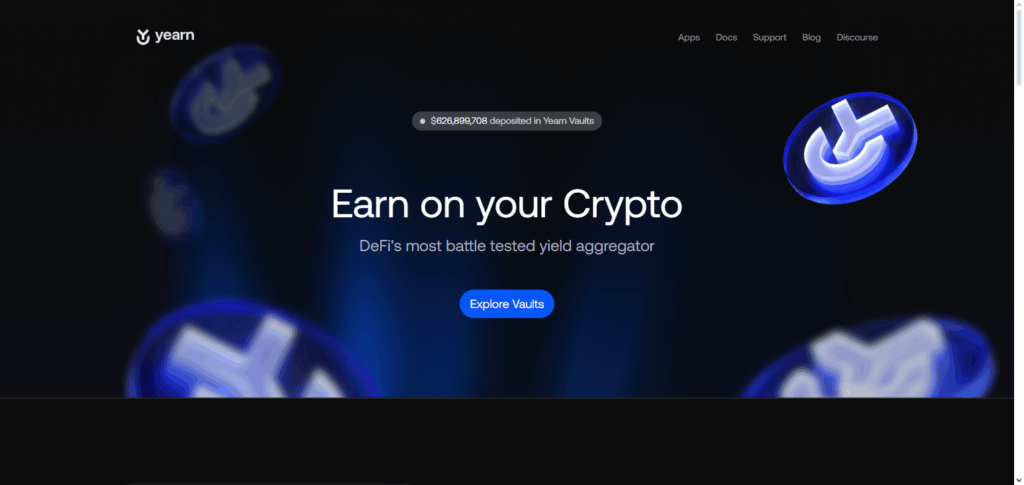

- 7.yearn.finance

- yearn.finance (YFI) Features

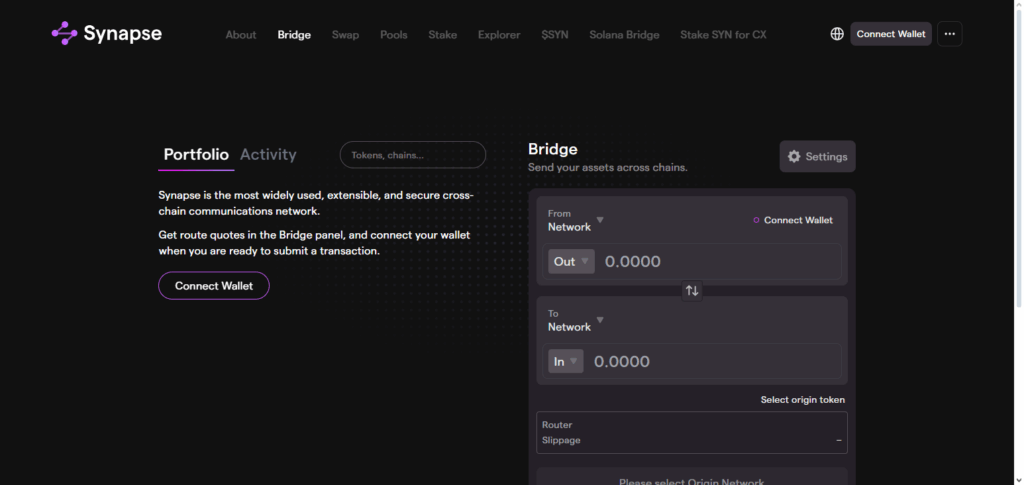

- 8.Synapse Protocol

- Synapse Protocol (SYN) Features

- 9.Aave

- Aave (AAVE) Features

- 10.Own The Doge

- Own The Doge (DOGEOWN) Features

- Conclusion

- FAQ

This list includes both prominent DeFi tokens offered by Aave and Chainlink, as well as emerging tokens OmniCat and Own The Doge. All the listed tokens feature high liquidity, utility, and significant potential within the SushiSwap ecosystem.

Key Point & Top Tokens to Trade on Sushiswap List

| Name | Key Point |

|---|---|

| Chainlink | Decentralized oracle network powering smart contracts. |

| OmniCat | OmniCat offers an intergalactic meme |

| Wrapped Bitcoin | Tokenized version of Bitcoin on the Ethereum blockchain. |

| Illuvium | Blockchain RPG game with NFT-based characters and battles. |

| Synthetix Network | Platform for creating and trading synthetic assets. |

| Compound | Decentralized protocol for crypto lending and borrowing. |

| yearn.finance | Yield aggregator optimizing DeFi yield farming automatically. |

| Synapse Protocol | Cross-chain bridge enabling asset transfers between blockchains. |

| Aave | Decentralized lending protocol with flash loan features. |

| Own The Doge | Meme-based NFT project celebrating Doge culture and community. |

1.Chainlink

Chainlink (LINK) serves as one of the best tokens to trade on SushiSwap because of its importance in the issuance and provision of up to the minute information in the decentralized finance (DeFi) ecosystem.

As a decentralized oracle network, Chainlink helps in the acquisition of the real word information required by smart contracts, an important feature in the context of many DeFi protocols. It is a trader’s delight because of its high trading volume and consistent demand on SushiSwap. Also, Chainlink’s interoperability with several blockchains increases its utility and prominence in the DeFi ecosystem.

Chainlink (LINK) Features

- Decentralized Oracle Network: Serves as a bridge between smart contracts and external systems, granting the ability to automate processes within the DeFi ecosystems and NFTs.

- High Liquidity on SushiSwap: Due to widespread use within the DeFi ecosystem, LINK is frequently traded on SushiSwap and maintains steady volume.

- Cross-Chain Support: Operates on various chains, improving the ecosystem’s interoperability and efficiency in trading.

2.OmniCat

OmniCat (OMNI) serves as an excellent trading token on SushiSwap because of its unique combination of AI-generated memes and cross-community collaboration. OmniCat offers an intergalactic meme commodity by drawing from multiple popular meme coins which serves as a playful yet tactical mascot in the DeFi sector.

Its distinct advantage is providing meme community collaboration on decentralized platforms such as SushiSwap. Meme token traders will find OmniCat appealing with the token’s viral charm and persistent community participation, hence, OmniCat’s active meme community.

OmniCat (OMNI) Features

- AI-integrated Meme Utility: OmniCat is both functional and hype, as OmniCat cleverly blends the appeal of meme coins along with AI-powered utilities.

- Community-Driven Tokenomics: The active community monitors the liquidity and growth of the asset while employing a deflationary system to reduce the circulation supply.

- SushiSwap Popularity Surge: Marked by significant associations, the OMNI asset is trending with mounting traction and surpassing volume spikes on SushiSwap.

3.Wrapped Bitcoin

Wrapped Bitcoin (WBTC) facilitates trades on SushiSwap as it brings Bitcoin’s value and liquidity unto the Ethereum ecosystem. With Bitcoin in ERC-20 form, it is easy for users to trade, lend, or provide liquidity in the Ethereum ecosystem’s DeFi apps such as SushiSwap.

Because of its reputation with liquidity pools and the demand for it, it is easy to access and trade. Essentially, WBTC brings together Bitcoin’s market dominance with Ethereum’s programmability, creating brand new opportunities for Bitcoin users in DeFi.

Wrapped Bitcoin (WBTC) Features

- Bitcoin on Ethereum: WBTC is Bitcoin’s value in Ethereum’s DeFi world. It is an ERC-20 and is thus tradeable on SushiSwap.

- High Market Cap: Due to the asset’s great stability and trust, WBTC dominates in liquidity and trust. It is a locked and trusted asset with great WBTC demand.

- DeFi Collateral Utility: Serves as a loan-borrow asset and in yield farming within the SushiSwap ecosystem.

4.Illuvium

SushiSwap has positioned Illuvium (ILV) as one of their top tokens because of the growing intersection of DeFi and gaming. As the native token for the open-world RPG, Illuvium, players earn ILV through game participation, which they may utilize for in-game activities, staking, or governance.

SushiSwap’s ILV integration benefits from high liquidity which supports underlying game economy transactions through decentralized exchanges. The combination of gaming and DeFi market ILV as an appealing asset for traders and gamers and as an asset with great future value.

Illuvium (ILV) Features

- GameFi Integration: Powers an RPG on blockchain with DeFi and NFT elements within a seamless in-game economy.

- Staking and Governance: In the case of ILV, holders are able to stake and vote on the customizations of the games.

- SushiSwap Adoption: Gathers more attention for its combination of gaming and DeFi which pulls in both traders and gamers.

5.Synthetix Network

Synthetix Network (SNX) is still one of the best crypto assets to trade on SushiSwap as it powers one of DeFi’s leading platforms for synthetic assets. With SNX, it is possible to create on-chain assets that track the price of fiat currencies, stocks, or commodities.

Users who trade SNX on SushiSwap also benefit from a market that is deep and liquid, and at the same time, they are aiding in the collateralization needed for minting the synths. Few tokens are as useful as SNX in the DeFi space, and the unique and multifaceted demand for SNX from traders and liquidity providers stems from its usefulness for collateralizing synthetic assets and for enabling non-custodial derivatives.

Synthetix Network (SNX) Features

- Synthetic Asset Trading: Provides the ability to create and trade synthetic assets that simulate real-world assets.

- Collateral Backbone: The conduct of minting assets known as “synths” requires locking SNX tokens which allows the trading of derivatives.

- Trusted on SushiSwap: In terms of SNX, the tokens have a lot of liquidity and are traded very often which makes SNX an important DeFi asset on SushiSwap.

6.Compound

Compound (COMP) is considered one of the best tokens to transact with on SushiSwap because of its primary function in decentralized lending and governance. Being the governance token of the Compound protocol, COMP grants its holders the ability to participate in governance decisions, including interest rate models and collateral settings.

It is extensively used in DeFi and there is consistent demand for governance participation, which makes it a highly traded asset. On SushiSwap, COMP enjoys substantial liquidity along with seamless integration with other DeFi platforms, which is a plus for both traders and yield farmers.

Compound (COMP) Features

- Decentralized Lending Protocol: The COMP token enables markets based on lending and borrowing and their interest rate algorithms.

- Governance Token: The holders are able to suggest and vote on changes to the protocol which makes the governance distribution remain decentralized.

- Liquidity on SushiSwap: His role in the lending DeFi systems allows COMP to have steady liquidity which results in sufficiency of trade on SushiSwap.

7.yearn.finance

yearn.finance (YFI) is one of the best tokens to trade on SushiSwap as it is one of the innovative yield optimization protocols in DeFi. Users can automate yield farming strategies via yield farming on different platforms which helps in increasing the returns and reduces the effort.

Investors are interested in the token because of the strong governance utility paired with the token’s low supply. YFI is important for users seeking exposure to automated DeFi strategies via a DEX because of the active trading and liquidity farming on YFI on SushiSwap.

yearn.finance (YFI) Features

- Yield Aggregator: Users are able to automate their yield farming strategies using YFI, thus maximizing returned yields.

- Scarcity and Value: As an advanced trader, it is very likely that with a well known low token supply, during DeFi trading, YFI becomes a high value asset.

- High-Volume Sushi Token: Due to the relevance YFI tokens have in DeFi, they are often traded on SushiSwap, making their price very volatile.

8.Synapse Protocol

Synapse Protocol (SYN) has become a leading token to swap on SushiSwap because it fuels one of the most efficient cross-chain bridges in DeFi. SYN permits the transfer and swap of assets between different blockchains and enables extensibility.

Traders prefer SYN on SushiSwap because of the numerous utilitarian bridging and arbitrage opportunities. Its persistent on-chain activity coupled with multichain ecosystem integration make it indispensable for users willing to engage in cross-chain DeFi without relying on centralized services.

Synapse Protocol (SYN) Features

- Cross-Chain Bridge Utility: Allows the instant exchange of assets from different chains in seconds.

- Compatible with Numerous Networks: SYN is compatible with Ethereum, BNB, Polygon and others, perfect for multi-chain traders.

- Preferred by Cross-Chain Traders: Attracts arbitrage and bridge-focused users of SushiSwap.

9.Aave

Aave (AAVE) is one of the leading tokens that can be traded on SushiSwap because of its standing in lending and borrowing on a decentralized level. The benefits of governance and reduced fees in the Aave Protocol provided the users strong engagement.

AAVE is optimally paired with major assets and stablecoins on SushiSwap. Therefore, AAVE has deep liquidity which is favorable for active traders. Its distinctive characteristics are the features of AAVE flash loan and its multi-chain presence which also add strategic value. This establishes AAVE as one of the prominent tokens in DeFi trading.

Aave (AAVE) Features

- Premier Lending Platform in DeFi: Contains services such as flash loans, rate switching, and overcollateralized loans.

- Active and Effective Governance: Voting for AAVE controlled parameters and upgrades is exercised by AAVE token holders.

- Consistent and Innovative SushiSwap Use: AAVE’s constant innovation makes it a SushiSwap staple.

10.Own The Doge

Own The Doge (OTD) is one of the top tokens listed on SushiSwap as it blends meme culture seamlessly with decentralized ownership. OTD encapsulates meme history by allowing the Doge meme to be tokenized via NFTs and DAO. Community members can now participate in an engaging ecosystem that lets them own a portion of digital history.

On SushiSwap, OTD trades actively with users who appreciate cultural touchstones and virality. It stands out as a meme token because of its blend of art, humor, and blockchain functionality, and is especially loved within NFT-focused communities.

Own The Doge (DOGEOWN) Features

- Meme and NFT Combination: Doge’s image can now be owned on the blockchain.

- Token of the Cult: Associated with historical internet culture and supported by a meme-dominated community.

- Increasing Visibility on SushiSwap: Appealing to those looking to trade memes and NFTs.

Conclusion

To sum up, the best tokens to trade on SushiSwap showcase an exemplary blend of utility, innovation, and community involvement throughout DeFi, gaming, stablecoins, and even the meme world.

Foundational assets such as Chainlink, Aave, and Compound are complemented by creative tokens like Illuvium and Own The Doge, each offering distinct value in the decentralized ecosystem. The liquidity and interface of SushiSwap make it easy to trade these tokens, as well as discover and invest in the ever-expanding universe of Web3 finance.

FAQ

What makes a token a good choice to trade on SushiSwap?

Good tokens on SushiSwap typically have strong liquidity, active communities, unique use cases, and integration with DeFi protocols, ensuring smooth trading and utility.

Can I trade both stablecoins and volatile tokens on SushiSwap?

Yes, SushiSwap supports a wide range of tokens including stablecoins like Dai and volatile assets like Illuvium or Chainlink.

Is SushiSwap safe for trading these tokens?

SushiSwap is a reputable decentralized exchange with audited smart contracts, but users should always practice caution and manage risks.