In this article I will discuss the Top Staking Providers for Multiple Tokens focusing on the most robust, flexible, and rewarding staking providers.

- What is Staking Providers?

- How To Choose Top Staking Providers for Multiple Tokens

- Key Point & Top Staking Providers for Multiple Tokens List

- 1. Lido

- 2. Rocket Pool

- 3. Stader Labs

- 4. Ankr

- 5. StakeWise

- 6. Everstake

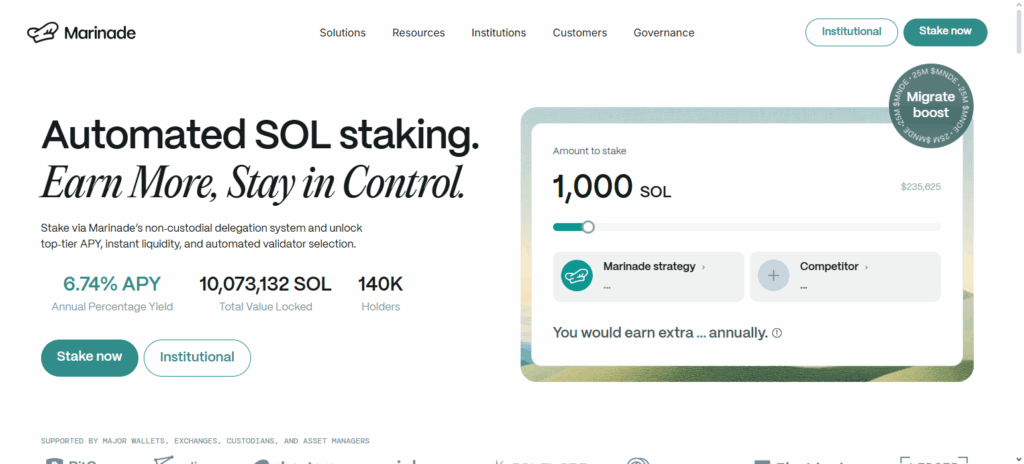

- 7. Marinade Finance

- 8. Bifrost

- 9. pSTAKE Finance

- 10. RockX

- Pros & Cons Top Staking Providers for Multiple Tokens

- Conclusion

- FAQ

The providers streamline staking, support multiple blockchains, and often offer liquid staking, enabling investors to optimize earnings while maintaining liquidity and diversification within a broad range of cryptocurrencies in the growing digital economy of 2025.

What is Staking Providers?

Staking providers are services or platforms which gives users the chance to earn rewards for holding and using the crypto coins to take part in the PoS network. Users validate transactions and secure the network by staking their coins rather than mining.

For validations, tokens are given. The rewards given are staking rewards which are given in tokens.

To earn passive income, staking providers are the best bet. Earning passive income becomes very easy because users do not have to do technical know-how, manage their wallets, or keep track of the network for participation.

How To Choose Top Staking Providers for Multiple Tokens

Supported Tokens: Find the provider with the most cryptocurrencies for staking that you’re interested in.

Staking Rewards: Evaluating the staking APY on different platforms is a great way to maximize potential earnings.

Security: Make sure the coverage is strong and the platforms hold a good reputation in the crypto world.

Fees & Costs: Look for the most transparent platforms, and spending fees that won’t drastically reduce the rewards.

User Experience: Look for an easy-to-use platform that promotes self-service functionality and has good Customer Service.

Lock-Up Periods: Look for a platform that offers more flexibility with withdrawal and staking duration.

Key Point & Top Staking Providers for Multiple Tokens List

| Staking Provider | Key Point |

|---|---|

| Lido | Offers liquid staking for ETH and multiple tokens with high liquidity. |

| Rocket Pool | Decentralized Ethereum staking with low minimum requirements. |

| Stader Labs | Supports multi-chain staking and easy token management. |

| Ankr | Provides node hosting and staking services for various blockchains. |

| StakeWise | Allows efficient ETH 2.0 staking with reward optimization. |

| Everstake | Professional validator services supporting multiple PoS networks. |

| Marinade Finance | Solana-focused staking with liquid staking tokens for flexibility. |

| Bifrost | Offers multi-chain staking and derivative token options. |

| pSTAKE Finance | Enables liquid staking for Cosmos, Ethereum, and other networks. |

| RockX | Provides staking services with secure custody and attractive yields. |

1. Lido

Lido is one of the best staking providers of a number of tokens due to its innovative liquid staking model which enables the staking of Ethereum, Solana, and Polygon, as well as retaining liquidity through derivative tokens.

Unlike its competitors, Lido does not require one to manage validators or technical infrastructure, which makes it highly accessible for both beginner and seasoned investors. Lido provides security through the decentralized selection of validators, regular audits, and competitive rewards.

Lido is one of the most popular providers for multi-token staking. Along with its decentralized finance (DeFi) platform and wallet staking, rewarding users with seamless flexible integration, Lido gives users the ability to optimize staking balance, earning, and flexibility.

| Feature | Details |

|---|---|

| Provider Name | Lido |

| Supported Tokens | Ethereum (ETH), Solana (SOL), Polygon (MATIC), Polkadot (DOT), Kusama (KSM) |

| Staking Type | Liquid Staking (receives stETH, mSOL, etc.) |

| KYC Requirement | Minimal – often not required for basic staking |

| Rewards (APY) | Varies by token, typically 4% – 8% |

| Custody | Non-custodial; users retain control through liquid tokens |

| Unique Feature | Derivative staking tokens usable across DeFi for additional yields |

2. Rocket Pool

Rocket Pool is one of the first providers of staking for multiple tokens. It is famed for its community-centric and decentralized methodology.

Supported by its innovative architecture, Rocket Pool is the only staking platform that requires almost no specialized knowledge and involvement to participate in Ethereum and token staking. It is, therefore, perfectly suited for smaller investors.

Its decentralized network of node operators ensures better security, more transparency, and lowers the risk of centralization. Users stake tokens without losing liquidity by using rETH tokens and can simultaneously participate in other DeFi functions.

Moreover, Rocket Pool is known to offer staking rewards that are above average, in addition to having strong individual governance initiatives, and still innovative with multi-token staking.

| Feature | Details |

|---|---|

| Provider Name | Rocket Pool |

| Supported Tokens | Ethereum (ETH) |

| Staking Type | Decentralized Liquid Staking (rETH tokens) |

| KYC Requirement | Minimal – no KYC for standard staking participation |

| Rewards (APY) | Approx. 3.5% – 7% depending on network conditions |

| Custody | Non-custodial; users hold rETH as proof of stake and rewards |

| Unique Feature | Decentralized network of node operators with low entry requirements |

3. Stader Labs

Stader Labs is a staking provider across multiple tokens and supported networks like Ethereum, Solana, and Terra, providing simple streamlined and automated sophisticated multi-chain staking through smart token distribution using efficient algorithms.

Stader Labs also facilitates liquid staking, allowing users to earn staking rewards and retain the flexibility to access DeFi assets, contributing to the DeFi space.

With a focus on the protection of assets and flexible best-in-class user experiences, both individual and institutional investors can easily onboard and maximize staking across multiple tokens. Stader Labs remains the premier multi-chain staking solution with unmatched innovativeness and ease of use.

| Feature | Details |

|---|---|

| Provider Name | Stader Labs |

| Supported Tokens | Ethereum (ETH), Polygon (MATIC), Hedera (HBAR), Binance Coin (BNB), Terra (LUNA), others |

| Staking Type | Multi-chain Liquid Staking |

| KYC Requirement | Minimal – usually not required for retail staking |

| Rewards (APY) | Typically 5% – 15% depending on token and network |

| Custody | Non-custodial; users receive liquid staking tokens |

| Unique Feature | Smart algorithm optimizes validator selection for better rewards |

4. Ankr

Ankr is a leading provider of staking services for multiple tokens and is noted for its expansive ecosystem that includes node hosting, staking, and DeFi.

Compatible with numerous digital assets, Ankr allows users to stake Ethereum, Polygon, and Avalanche with ease.

Ankr has a competitive advantage thanks to its decentralized architecture, abstracting validator operation complexities while upholding robust security and dependability. Users can enjoy liquid staking to retain investments flexible for other initiatives.

Ankr has intuitive interfaces, competitive yields, and strong cross-chain interactions, making its services appealing to both retail and institutional investors looking to grow their crypto portfolio.

| Feature | Details |

|---|---|

| Provider Name | Ankr |

| Supported Tokens | Ethereum (ETH), Polygon (MATIC), Avalanche (AVAX), Binance Coin (BNB), Polkadot (DOT), more |

| Staking Type | Liquid Staking & Validator Node Hosting |

| KYC Requirement | Minimal – typically not required for staking |

| Rewards (APY) | Around 4% – 12% depending on network and token |

| Custody | Non-custodial; users get liquid staking tokens usable in DeFi |

| Unique Feature | Combines staking with decentralized node hosting and cross-chain support |

5. StakeWise

StakeWise is a leading provider of staking services designed to optimize rewards and maximize efficiency for crypto investors.

It focuses on Ethereum and other PoS networks, offering unique split-reward systems where staking rewards and principal balances are separated and managed flexibly.

It also supports liquid staking, allowing users to remain liquid while actively participating in network validation.

StakeWise is known for transparent and optimized reward distribution, low fees and a user-friendly rewards dashboard which grants users a seamless staking experience. These features position StakeWise as a top provider for multi-token staking offering a competitive and customizable staking experience.

| Feature | Details |

|---|---|

| Provider Name | StakeWise |

| Supported Tokens | Primarily Ethereum (ETH), with plans for multi-chain expansion |

| Staking Type | Liquid Staking with split reward tokens (sETH2 & rETH2) |

| KYC Requirement | Minimal – no KYC for standard staking participation |

| Rewards (APY) | Typically 4% – 6% depending on network conditions |

| Custody | Non-custodial; users retain liquid staking tokens for DeFi use |

| Unique Feature | Reward-splitting system allows flexible reinvestment and reward tracking |

6. Everstake

Everstake stands out as one of the leading staking providers of multi tokens and has more than 30 blockchains under its professional validator services.

Its main edge is the combination of high security, reliability, and performance, which ensure Everstake users earn staking rewards. Everstake staking is flexible which means investors are able to choose either liquid traditional or liquid staking Everstake.

This platform’s transparency is remarkable especially it’s detailed performance reports and analytics which help users track their actions in real time.

Everstake’s competitive yields and reputation in the crypto world, low downtimes, and competitive yields provide a trusty and reliable answer to both individuals and institutions looking to take advantage of multi token staking.

| Feature | Details |

|---|---|

| Provider Name | Everstake |

| Supported Tokens | 30+ tokens including Ethereum (ETH), Solana (SOL), Cosmos (ATOM), Tezos (XTZ), Polkadot (DOT), Cardano (ADA) |

| Staking Type | Traditional & Delegated Staking |

| KYC Requirement | Minimal – no KYC for most staking services |

| Rewards (APY) | Typically 5% – 15% depending on the token and network |

| Custody | Non-custodial; users delegate to professional validators |

| Unique Feature | Wide multi-chain validator network with real-time performance tracking |

7. Marinade Finance

Marinade Finance has established itself as one of the top staking providers over other competitors by introducing users to an innovative liquid staking feature within the Solana ecosystem. Users can stake SOL and receive mSOL tokens which can then be utilized within DeFi protocols to earn additional yields.

This combination of staking rewards and liquidity is unique to Marinade Finance which emphasizes decentralization by evenly distributing the staked assets across multiple validators. This feature of Marinade Finance reduces the risk while maintaining the network’s stability.

Apart from this, the user friendly interface coupled with the transparent reward system helps users maximize their staking abilities. Integrating with other wallets and platforms is a great added feature, which reiterates Marinade Finance as the top competitor for multi token staking.

| Feature | Details |

|---|---|

| Provider Name | Marinade Finance |

| Supported Tokens | Primarily Solana (SOL) |

| Staking Type | Liquid Staking (users receive mSOL) |

| KYC Requirement | Minimal – no KYC needed for standard staking |

| Rewards (APY) | Around 6% – 8% depending on network performance |

| Custody | Non-custodial; assets distributed across decentralized validators |

| Unique Feature | mSOL tokens can be used in DeFi while continuing to earn staking rewards |

8. Bifrost

Bifrost stands out among competitors in that it provides an adaptable platform that enables all users do cross-chain staking as well as work with liquid token derivatives.

Staking of Polkadot, Kusama, and various other networks offers something unique in staking vTokens that are freely transferable in DeFi applications for extra yields. Decentralization, security, and efficient selection of validators in Bifrost’s infrastructure ensures stability in the network and consistently rewarding users.

Bifrost has flexible and low-cost staking plans, as well as real-time performance monitoring, helps investors efficiently manage multi blockchain investments. It’s innovative and highly reliable for those interested in flexible and diverse multi-token staking.

| Feature | Details |

|---|---|

| Provider Name | Bifrost |

| Supported Tokens | Polkadot (DOT), Kusama (KSM), Moonbeam (GLMR), others |

| Staking Type | Liquid Staking with vTokens (voucher tokens) |

| KYC Requirement | Minimal – no KYC required for basic staking |

| Rewards (APY) | Typically 8% – 20% depending on token and network |

| Custody | Non-custodial; users hold vTokens as proof of stake and rewards |

| Unique Feature | Cross-chain liquid staking with vTokens usable across DeFi ecosystems |

9. pSTAKE Finance

pSTAKE Finance is one of the top providers of token staking liquid and staking derivatives. Staking derivatives has kept the liquid and DeFi staking rewards on a single asset flexible and usable.

This trick balances capital efficiency and further yield opening which is available in DeFi. pSTAKE Finance emphasizes security, origin, and pro self-management.

These pro self managing validators can offer solid uptime and always the same rewards with great payer of sETH and sATOM derivatives.

All of the derivatives trained till October 2023 have great interfaces for the users. pSTAKE Finance is simple and effective. It has multichain derivatives to offer and unmatched returns on ETH, ATOM, and sETH and sATOM derivatives.

| Feature | Details |

|---|---|

| Provider Name | pSTAKE Finance |

| Supported Tokens | Cosmos (ATOM), Ethereum (ETH), Persistence (XPRT), Terra Classic (LUNC), and others |

| Staking Type | Liquid Staking (users receive stkTokens) |

| KYC Requirement | Minimal – no KYC required for most staking activities |

| Rewards (APY) | Typically 5% – 12% depending on the network |

| Custody | Non-custodial; users retain stkTokens as proof of stake and rewards |

| Unique Feature | stkTokens can be deployed in DeFi to earn dual rewards |

10. RockX

RockX is one of the leading staking providers for a variety of tokens, offering a professional and secure platform for both retail and institutional investors.

The company’s primary strength is the seamless staking of many available tokens such as Ethereum, Solana, and Polkadot, along with high uptime and reliable validator performance.

RockX’s advanced security features with intuitive design allow investors to stake tokens with no difficulty and monitor the rewards being accrued in real-time with seamless crypto payment processes.

In addition, RockX provides liquid staking for DeFi participation so assets can remain unencumbered. RockX provides competitive yields along with strong transparency and multi-token support, so stands out as a reliable and effective staking platform.

| Feature | Details |

|---|---|

| Provider Name | RockX |

| Supported Tokens | Ethereum (ETH), Solana (SOL), Polkadot (DOT), Cosmos (ATOM), Avalanche (AVAX), more |

| Staking Type | Liquid & Traditional Staking |

| KYC Requirement | Minimal – no KYC for standard staking services |

| Rewards (APY) | Typically 4% – 15% depending on token and network |

| Custody | Non-custodial; users stake directly with secure validators |

| Unique Feature | Institutional-grade staking with strong security and reliable uptime |

Pros & Cons Top Staking Providers for Multiple Tokens

Pros

- Multi-Token Support: Staking on several blockchains enhances diversification as well as rewards.

- Liquid Staking Options: A number of liquid token providers enable staking and DeFi simultaneously.

- Accessibility: Staking has become more staking friendly for novices due to the removal of technical complexities.

- Security Measures: Leading providers employ audited smart contracts to provide asset custody safety.

- Reward Optimization: The more capable platforms offer flexible reward distribution methods and competitive yields.

Cons

- Fees: high commission providers tend to lose more as the charges become more expensive.

- Centralization Risks: A few large providers could control a lot of the network stakes, which carries a risk of decentralization.

- Smart Contract Risks: Liquid staking depends on smart contracts that could be susceptible to exploitation.

- Lock-Up Periods: Some fixed staking periods on certain tokens may diminish liquidity.

- Market Volatility: rewards that are reliant of token prices are greatly discouraged.

Conclusion

To sum up, the leading providers of staking for various tokens assist investors in streamlining their participation in proof of stake networks while helping them maximize their returns.

Lido, Rocket Pool, Ankr, and Stader Labs, among others, excel in offering liquid staking and cross-chain support while providing their clients with easy-to-use interfaces, robust security, and unmatched flexibility.

Each platform has its unique proposition, with decentralized validator networks and novel reward structures being among the most innovative, but they all seek to make staking effortless and profitable. Users can earn reliable yields, gain exposure to the growing multi-token staking ecosystem, and diversify their portfolios.

FAQ

What are staking providers for multiple tokens?

Staking providers are platforms that let users stake different cryptocurrencies across multiple blockchains to earn rewards without running validators themselves.

Which are the top staking providers in 2025?

Some leading providers include Lido, Rocket Pool, Ankr, Stader Labs, StakeWise, Everstake, Marinade Finance, Bifrost, pSTAKE Finance, and RockX.

What is liquid staking, and why is it important?

Liquid staking allows users to earn rewards while receiving derivative tokens they can use in DeFi, ensuring both flexibility and liquidity.

Are staking providers safe to use?

Top providers undergo audits, use decentralized validator setups, and adopt strict security protocols, but risks like smart contract vulnerabilities still exist.

How do I choose the best staking provider?

Look for multi-token support, competitive yields, low fees, strong security, liquidity options, and reliable customer support when selecting a provider.