I will cover the Bridging Aggregators for the Cosmos Ecosystem. These bridging aggregators enable transfers, boost liquidity, and foster the use of dApps within the nascent Cosmos ecosystem.

- What is Bridging Aggregators?

- How To Choose Bridging Aggregators for the Cosmos Ecosystem

- Security and Reliability

- Cross-Chain Compatibility

- Transaction Speed and Cost

- User Experience and Integration

- Liquidity and Support

- Key Point & Top Bridging Aggregators for the Cosmos Ecosystem

- 1. Rango Exchange

- 2. Osmosis Bridge

- 3. LayerZero

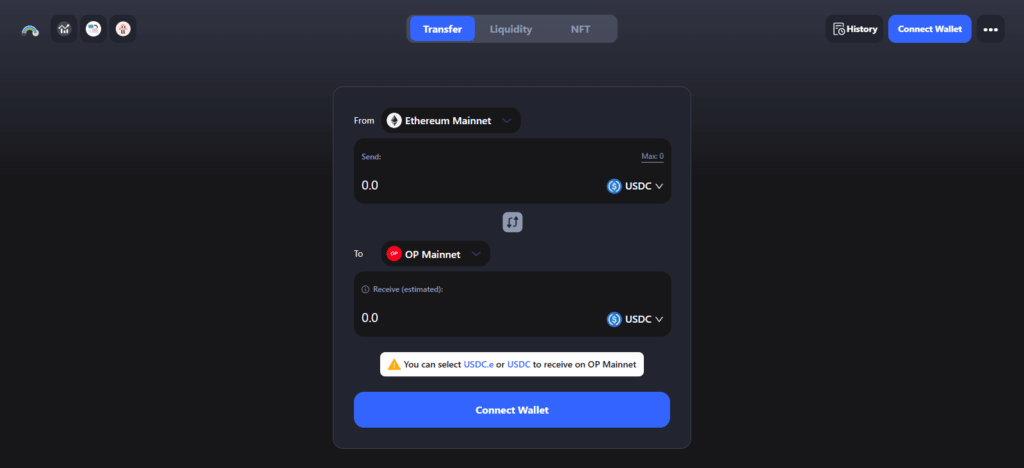

- 4. Celer cBridge

- 5. XY Finance

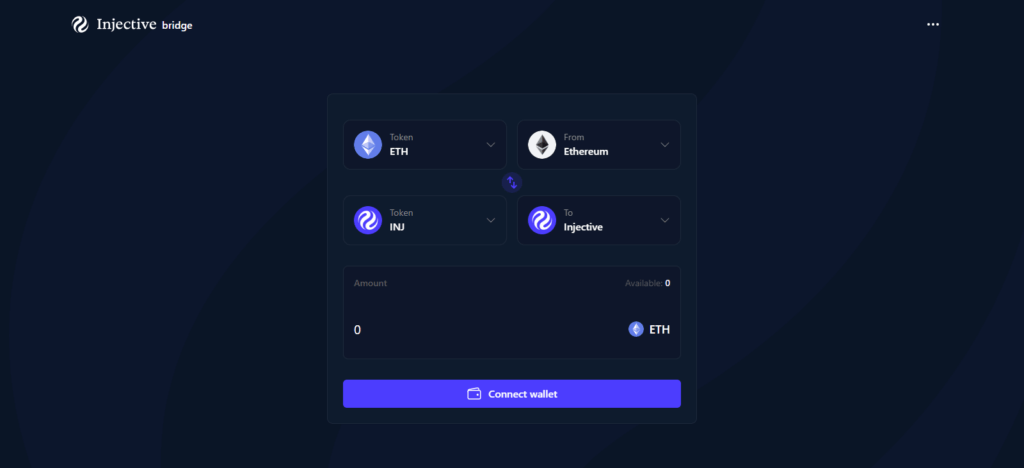

- 6. Injective Bridge

- 7. Axelar Network

- 8. Wormhole

- 9. Connext

- 10. Squid Router

- Pros & Cons Bridging Aggregators for the Cosmos Ecosystem

- Conclusion

- FAQ

Understanding their functionalities, security, and effectiveness provides users and developers with the information needed to make an optimal choice for speedy, low-cost payments and the safe transfer of blockchain assets.

What is Bridging Aggregators?

A bridging aggregator is a platform or intermediary that integrates multiple financial, payment, or data services and provides smooth interconnectivity between them.

It is a ‘bridge’ amidst the systems, allowing businesses or users to manage and process resources from various spheres without having to work with all the providers independently.

In payments, for instance, a bridging aggregator can connect multiple payment gateways and present them as a single interface, so merchants can accept payments using different methods with ease.

In the same way, financial or data aggregators have aggregated information from multiple sources to provide a cohesive, clutter-free user experience while enhancing system speed, accessibility, and overall operational efficiency.

How To Choose Bridging Aggregators for the Cosmos Ecosystem

Security and Reliability

- The use of robust security protocols such as audits and multi-signature wallets should be prioritized.

- Review the history of operational performance and the level of reliability for safe operations; no major hacks or downtimes in operations.

- Transparent reporting and solid governance of the organization should be an aggregator’s focus.

Cross-Chain Compatibility

- Make certain the aggregator connects to other relevant blockchain networks as well as Cosmos.

- Check for robust interoperability for efficient asset transfers across chains.

- Ensure DeFi protocols within the Cosmos benefit from their tokens within the ecosystem.

Transaction Speed and Cost

- Look at the transaction rate across chains.

- Look for high optimizations such as batch processing and routing through low-cost fee paths.

- Network and aggregator service charges should be negligible.

User Experience and Integration

- The aggregator should have a robust user interface.

- Ensure easy access to wallets, various dApps, and other tools in the Cosmos ecosystem.

- Ensure developers have easy access to options for customization.

Liquidity and Support

- There should be sufficient liquid available to bridge the most popular tokens.

- There should be options available for effective, efficient customer service to rapidly resolve problems.* For improved service, Cosmos ecosystem partners are preferable.

Key Point & Top Bridging Aggregators for the Cosmos Ecosystem

| Bridging Aggregator | Key Points |

|---|---|

| Rango Exchange | Multi-chain swap aggregator; focuses on low fees and fast transactions; supports Cosmos ecosystem tokens. |

| Osmosis Bridge | Native Cosmos bridge; seamless cross-chain transfers; high liquidity within Cosmos DeFi. |

| LayerZero | Omnichain interoperability protocol; secure messaging between chains; supports a wide range of networks including Cosmos. |

| Celer cBridge | Fast and low-cost cross-chain transactions; high throughput; easy wallet integration. |

| XY Finance | Aggregates liquidity across chains; supports Cosmos token swaps; focus on optimized routing for low slippage. |

| Injective Bridge | Cosmos-native cross-chain bridge; supports DeFi derivatives and synthetic assets; secure cross-chain swaps. |

| Axelar Network | Decentralized cross-chain communication; scalable and secure; wide support for Cosmos assets and other chains. |

| Wormhole | Cross-chain bridge for multiple ecosystems; secure token and NFT transfers; integrates Cosmos with Ethereum, Solana, etc. |

| Connext | Fast, non-custodial bridging; optimized for Ethereum and Cosmos; supports token transfers with minimal fees. |

| Squid Router | Cross-chain routing protocol; aggregates multiple bridges for optimal swap paths; supports Cosmos ecosystem tokens. |

1. Rango Exchange

Rango Exchange is notable as a bridging aggregator for the Cosmos ecosystem for its speed, low fees, and multi-chain support. Unlike many other bridges, it focuses on seamless interoperability, enabling users to swap tokens across multiple blockchains with minimal friction.

Its smart routing mechanism minimizes slippage and selects the best route for the most efficient, least expensive transaction.

Rango Exchange also provides users with complete control over their assets through audited smart contracts and a non-custodial architecture, which Rango Exchange gives particular attention to.

Rango Exchange focuses on the Cosmos ecosystem, and its extensive cross-chain bridging capabilities make it a reliable solution for traders and developers.

| Feature | Details |

|---|---|

| Platform Name | Rango Exchange |

| Type | Multi-chain bridging aggregator |

| Cosmos Compatibility | Fully supports Cosmos-native tokens and cross-chain transfers |

| KYC Requirement | Minimal KYC; mostly non-custodial access |

| Transaction Speed | Fast cross-chain swaps with optimized routing |

| Fees | Low and transparent fees with minimal slippage |

| Security | Audited smart contracts; non-custodial wallet control |

| User Integration | Easy integration with wallets and dApps |

| Unique Point | Intelligent routing system for cost-effective and seamless transfers |

| Target Users | Traders, developers, and DeFi participants within Cosmos |

2. Osmosis Bridge

Osmosis Bridge is among the best bridging aggregators in the Cosmos ecosystem for its focus on high liquidity and smooth token transfers, as well as its deep integration with Cosmos-native protocols.

Users on the platform can transfer assets across Cosmos chains at very low fees with minimal slippage. What makes Osmosis Bridge unique is its SDK integration, which grants direct access to dapps and liquidity pools.

It low-fee interface and strong security features, in which validation is decentralized, have made cross-chain swaps easier and more dependable.

Osmosis Bridge’s primary focus on assets and interoperability that are native to Cosmos has made it a reputable asset to traders and developers in the space.

| Feature | Details |

|---|---|

| Platform Name | Osmosis Bridge |

| Type | Native Cosmos bridging aggregator |

| Cosmos Compatibility | Deep integration with Cosmos SDK and native tokens |

| KYC Requirement | Minimal KYC; non-custodial access for most transactions |

| Transaction Speed | Fast transfers within Cosmos chains |

| Fees | Low fees with optimized liquidity pools and minimal slippage |

| Security | Decentralized validation; secure smart contract framework |

| User Integration | Easy connection with Cosmos wallets and dApps |

| Unique Point | High liquidity within Cosmos ecosystem for seamless swaps |

| Target Users | Traders, developers, and DeFi users within Cosmos |

3. LayerZero

LayerZero stands at the forefront of bridging aggregators for the Cosmos ecosystem, owing to its ground-breaking omnichain interoperability protocol that ensures secure and instantaneous communication across disparate blockchains.

Unlike traditional bridges, LayerZero’s focus is to interconnect smart contracts across different chains and reduce reliance on centralized intermediaries and the associated risks.

LayerZero’s lightweight, decentralized verification and cost-efficient cross-chain transfers are sent through its secure and fast decentralized verification.

Cosmos-based tokens and applications are built on LayerZero’s support, enabling developers to generate real cross-chain DeFi applications. Its distinctive interoperability with cross-chain systems and seamless security make it a preferred option in the Cosmos ecosystem.

| Feature | Details |

|---|---|

| Platform Name | LayerZero |

| Type | Omnichain interoperability protocol |

| Cosmos Compatibility | Supports Cosmos-based tokens and dApps |

| KYC Requirement | Minimal KYC; non-custodial transactions |

| Transaction Speed | Fast cross-chain transfers with low latency |

| Fees | Low transaction fees via efficient messaging system |

| Security | Decentralized verification and secure smart contract communication |

| User Integration | Easy integration with wallets and Cosmos dApps |

| Unique Point | Direct smart contract-to-smart contract communication across chains |

| Target Users | Developers and traders requiring seamless cross-chain interoperability |

4. Celer cBridge

Celer cBridge is among the leading bridging aggregators in the Cosmos ecosystem due to its swift focus on cross-chain transaction efficiency and costs. It uses Celer Network’s Layer-2 scaling solutions to allow cheap and fast transfers.

This enables smooth and reliable movement of assets across to other chains in Cosmos. Its non-custodial design means users have complete control over their tokens which increases trust and security.

It also supports a broad range of Cosmos-based assets and integrates with wallets and dApps for ease of use. Its combination of performance and cost effectiveness with wide compatibility is the reason why many Cosmos users and developers prefer it.

| Feature | Details |

|---|---|

| Platform Name | Celer cBridge |

| Type | Layer-2 cross-chain bridging solution |

| Cosmos Compatibility | Supports Cosmos-based tokens and cross-chain transfers |

| KYC Requirement | Minimal KYC; non-custodial access |

| Transaction Speed | High-speed transfers leveraging Layer-2 scaling |

| Fees | Low fees due to optimized routing and Layer-2 efficiency |

| Security | Non-custodial design with secure smart contracts |

| User Integration | Easy integration with wallets and dApps |

| Unique Point | Combines Layer-2 scaling for fast and cost-effective cross-chain transfers |

| Target Users | Traders, developers, and DeFi users within Cosmos |

5. XY Finance

XY Finance is a paramount bridging aggregator in the Cosmos ecosystem, thanks to its ability to efficiently aggregate liquidity across numerous chains for cost-effective, seamless token swaps.

Its sophisticated multilayer routing algorithms minimize transaction slippage by optimizing the transaction path. Its algorithms also reduce fees by enabling rapid cross-chain transfers.

XY Finance’s key strength is the seamless, comprehensive integration of other Cosmos-native assets and DeFi protocols, which interconnect numerous decentralized applications.

XY Finance also prides itself on a highly transparent environment for the aggregation of liquidity and sophisticated control over users, which is accompanied by security. This makes it a preferred solution to developers and traders.

| Feature | Details |

|---|---|

| Platform Name | XY Finance |

| Type | Multi-chain liquidity aggregator and bridge |

| Cosmos Compatibility | Supports Cosmos-native tokens and cross-chain transfers |

| KYC Requirement | Minimal KYC; primarily non-custodial access |

| Transaction Speed | Fast transactions with optimized routing |

| Fees | Low fees and minimal slippage through liquidity aggregation |

| Security | Secure smart contracts and decentralized architecture |

| User Integration | Seamless integration with wallets and Cosmos dApps |

| Unique Point | Aggregates liquidity from multiple sources for efficient and cost-effective swaps |

| Target Users | Traders, liquidity providers, and developers in the Cosmos ecosystem |

6. Injective Bridge

Injective Bridge is widely known in the Cosmos ecosystem for its fast, secure, and decentralized cross-chain asset transfers. Bridges do not work the same way.

It focuses on the DeFi apps and protocols in Cosmos, allowing users to move tokens and retain asset ownership. Architecture performs DeFi on layered synthetic and derivative assets without chains, losing security.

Cross-chain transfers are also done within seconds, as they eliminate extra costs and latencies. These features, paired with injective bridges’ integrations into DeFi and the entire Cosmos ecosystem, give it unmatched security that puts it on the same tier as other decentralized bridging apps.

| Feature | Details |

|---|---|

| Platform Name | Injective Bridge |

| Type | Cosmos-native cross-chain bridge |

| Cosmos Compatibility | Supports Cosmos-based tokens and DeFi protocols |

| KYC Requirement | Minimal KYC; non-custodial access |

| Transaction Speed | Fast cross-chain transfers with low latency |

| Fees | Low transaction fees optimized for DeFi assets |

| Security | Decentralized validation and secure smart contracts |

| User Integration | Compatible with wallets and Cosmos dApps |

| Unique Point | Supports advanced DeFi operations like derivatives and synthetic assets across chains |

| Target Users | Traders, developers, and DeFi participants within Cosmos |

7. Axelar Network

The blockchain bridging aggregator for the Cosmos ecosystem is Axelar Network which has advanced innovative cross-chain communication for decentralization and scalability. It bridges the gap between the Cosmos blockchain and multiple other blockchains enabling asset and data transfer decentralization and ease of use.

Axelar’s architecture is designed for resilient message routing and fraud reduction with endpoint verification. These features isolate the margin of errors in cross-chain transactions.

Its ease of access for developers, which Cosmos-native assets are tailored for easy integration with dApps and DeFi products. Its developer-friendly infrastructure, as well as security, Axelar Network has emerged as a leading provider in the Cosmos ecosystem.

| Feature | Details |

|---|---|

| Platform Name | Axelar Network |

| Type | Decentralized cross-chain communication protocol |

| Cosmos Compatibility | Supports Cosmos-native tokens and dApps |

| KYC Requirement | Minimal KYC; primarily non-custodial access |

| Transaction Speed | Fast and scalable cross-chain transfers |

| Fees | Low fees with efficient message routing |

| Security | End-to-end verification and decentralized architecture |

| User Integration | Developer-friendly APIs and wallet integration |

| Unique Point | Provides secure, scalable, and seamless interoperability across Cosmos and multiple other blockchains |

| Target Users | Developers, traders, and DeFi users within Cosmos and multi-chain ecosystems |

8. Wormhole

Wormhole ranks among the top bridging aggregators for the Cosmos ecosystem due to its sophisticated cross-chain infrastructure that links Cosmos to multiple major blockchains, including Ethereum and Solana. Its design enables rapid, secure transfers of tokens and NFTs while preserving decentralization and ease of risk management.

Wormhole’s high liquidity across chains enables seamless, efficient swaps, differentiating it from other providers.

Its multi-chain liquidity on Cosmos-native apps and ease of compilation of myriad blockchain digital assets makes it convenient for developers and traders. Combining swift and secure transfers with multiple chains allows Wormhole to retain its reputation as a preferred bridge across the Cosmos ecosystem.

| Feature | Details |

|---|---|

| Platform Name | Wormhole |

| Type | Multi-chain bridge and token/NFT transfer protocol |

| Cosmos Compatibility | Supports Cosmos-native tokens and cross-chain interactions |

| KYC Requirement | Minimal KYC; non-custodial access |

| Transaction Speed | Fast cross-chain transfers with optimized routing |

| Fees | Low fees and minimal slippage across chains |

| Security | Decentralized and secure cross-chain messaging |

| User Integration | Integrates with wallets, dApps, and Cosmos ecosystem tools |

| Unique Point | Enables secure token and NFT transfers between Cosmos and multiple major blockchains like Ethereum and Solana |

| Target Users | Traders, NFT users, and developers seeking multi-chain interoperability |

9. Connext

Connext is regarded as a leading bridging aggregator in the Cosmos ecosystem for its fast, non-custodial, and reliable cross-chain transfer solutions.

Its design focuses on security and user control, ensuring that users’ funds never leave their wallets throughout the bridging process. Because it optimized transaction pathing, cross-chain token transfers on Cosmos are low-cost and low-latency.

In addition, its friendly wallet and decentralized application designs enable developers to implement cross-chain solutions without the need for intricate infrastructure.

Connext’s speed, security, and ease of integration make its bridging solutions versatile and reliable, reinforcing its position as a top aggregator in the Cosmos ecosystem.

| Feature | Details |

|---|---|

| Platform Name | Connext |

| Type | Non-custodial cross-chain bridging protocol |

| Cosmos Compatibility | Supports Cosmos-native tokens and cross-chain transfers |

| KYC Requirement | Minimal KYC; non-custodial access |

| Transaction Speed | Fast transfers with low latency and optimized routing |

| Fees | Low fees due to efficient routing and minimal overhead |

| Security | Non-custodial architecture with secure smart contracts |

| User Integration | Easy integration with wallets and Cosmos dApps |

| Unique Point | Focuses on fast, reliable, and non-custodial cross-chain transfers |

| Target Users | Traders, developers, and DeFi users within the Cosmos ecosystem |

10. Squid Router

The Squid Router is regarded as the best bridging aggregator in the Cosmos ecosystem due to its unique ability to route across multiple bridges for optimum cross-chain token transfers.

It also lowers transaction fees, slippage, and the time needed to complete cross-chain swaps. Squid Router was built especially for Cosmos-native assets, allowing direct access to dApps and liquidity pools.

Users have complete control over their funds thanks to the secure, non-custodial framework, while cross-chain communication is made easier by the dynamic routing layer.

These reasons illustrate the advanced, dependable nature of Squid Router, particularly in the Cosmos ecosystem.

| Feature | Details |

|---|---|

| Platform Name | Squid Router |

| Type | Cross-chain routing and bridging aggregator |

| Cosmos Compatibility | Supports Cosmos-native tokens and cross-chain transfers |

| KYC Requirement | Minimal KYC; primarily non-custodial access |

| Transaction Speed | Fast transfers with optimized routing across multiple bridges |

| Fees | Low fees with reduced slippage through route aggregation |

| Security | Secure smart contracts and decentralized routing protocol |

| User Integration | Compatible with wallets, dApps, and Cosmos ecosystem tools |

| Unique Point | Aggregates multiple bridges to find the most efficient paths for transfers |

| Target Users | Traders, developers, and DeFi users seeking efficient cross-chain swaps |

Pros & Cons Bridging Aggregators for the Cosmos Ecosystem

Pros

- Seamless cross-chain Transfers: Transfers assets and tokens across the Cosmos network and other blockchains with ease.

- Time and Cost Efficiency: Transfers quicker while spending less due to optimized routing.

- Enhanced Liquidity Access: Improves trading and swaps by aggregating liquidity from different sources.

- Security and Control: Most aggregators are non-custodian allowing for users to have full control over their assets.

- Developer Friendly: Multiple APIs and integration support to develop their own dApps and DeFi Solutions are available from many providers.

- Interoperability: Multiple assets from within the cosmos network and outside blockchains can be utilized for ecosystem participation.

Cons

- Smart Contract Risks: There is a risk of contracts being bridged or aggregated being exploited or bugged.

- Network Congestion: At times of high traffic, transactions can become delayed.

- Limited Asset Support: Some bridges do not support all tokens or assets within the cosmos ecosystem.

- Complexity for New Users: New users have a difficult time understanding the processes of routing and cross-chain swaps.

- Fee Variability: Transaction dependant bridge paths, and network conditions can vary between bridges.

- Dependency on External Chains: Problems with the blockchains linked to the bridge can affect the aggregator’s performance.

Conclusion

Bridging aggregators are integral to the interoperability and performance improvement of the Cosmos systems. Rango Exchange, Osmosis Bridge, LayerZero, Celer cBridge, XY Finance, Injective Bridge, Axelar Network, Wormhole, Connext, and Squid Router offer reliable, fast, and low-cost solutions for cross-chain asset movement.

Each one has a different primary focus—optimized routing, extensive Cosmos integration, minimal charge, and strong security—serving both traders and developers.

Users gain improved liquidity, cross-chain access, and deeper integration to the Cosmos ecosystem due to the use of these premier bridging aggregators, which in turn promotes the growth and adoption of the ecosystem.

FAQ

Are there fees associated with using bridging aggregators?

Yes, fees vary depending on the aggregator, network congestion, and the cross-chain route selected. Optimized routing often minimizes costs.

How do these aggregators ensure security?

Most use non-custodial designs, audited smart contracts, decentralized validation, and robust encryption to protect user assets during cross-chain transfers.

Which are the top bridging aggregators for Cosmos?

Some leading aggregators include Rango Exchange, Osmosis Bridge, LayerZero, Celer cBridge, XY Finance, Injective Bridge, Axelar Network, Wormhole, Connext, and Squid Router.

What are bridging aggregators in the Cosmos ecosystem?

Bridging aggregators are platforms that connect multiple blockchains, enabling seamless transfer of tokens and assets between Cosmos and other networks while optimizing speed, fees, and liquidity.

Why are bridging aggregators important for Cosmos users?

They enhance interoperability, reduce transaction costs, provide access to more liquidity, and allow users to interact with multiple DeFi protocols without switching platforms.