What Is TokenTax?

TokenTax is a cryptocurrency tax software designed to help individuals and businesses calculate their taxes on cryptocurrency transactions. It is a user-friendly platform that simplifies the process of preparing cryptocurrency taxes by automatically importing transaction data from exchanges, wallets, and other sources.

- What Is TokenTax?

- Some Important Points Of TokenTax

- TokenTax Tool Price

- How To Use TokenTax?

- How Does TokenTax Work?

- Is TokenTax Safe?

- TokenTax Features

- Automatic data import

- Accurate tax calculations

- Customizable tax reports

- Tax-loss harvesting

- Audit defense

- Integration with accounting software

- Multi-currency support

- TokenTax Pros & Cons

- TokenTax Conclusion

- TokenTax Tool FAQ

TokenTax calculates your tax liabilities using tax regulations and guidelines from the IRS, and provides you with detailed reports that you can use to file your taxes. Additionally, TokenTax offers a variety of features such as tax-loss harvesting, audit defense, and integration with popular accounting software. Overall, TokenTax helps crypto traders and investors stay compliant with tax regulations and avoid penalties and legal issues.

Some Important Points Of TokenTax

| Important | Points |

|---|---|

| Tools Name | TokenTax |

| Price | $65 |

| Free Version | Available |

| Device Supported | Android , Web , IOS |

| Notifications and Alerts | Yes |

| Customer Support | Live Chat: 24/7 , Email Support , Ticket System |

| Official Website | Click Here To Visit |

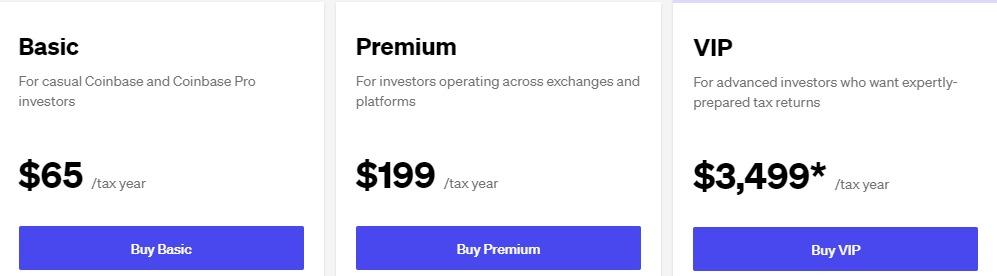

TokenTax Tool Price

For some, crypto trading is casual. For others, it can be a career. Whatever your level of trading, TokenTax has a plan that will fit your needs and your desired level of service.

TokenTax has four unique account tiers:

● Basic

● Premium

● VIP

How To Use TokenTax?

To use TokenTax, you can follow these general steps:

- Create an account: First, go to the TokenTax website and create an account by providing your personal and tax information. You can choose from different pricing plans, depending on your needs.

- Import your transaction data: Connect your cryptocurrency wallets and exchanges to TokenTax, and import your transaction data. TokenTax supports many popular exchanges, including Binance, Coinbase, and Kraken.

- Review and categorize transactions: Once you have imported your data, TokenTax will automatically categorize your transactions and calculate your tax liabilities. You can review your transactions and make any necessary adjustments.

- Generate tax reports: After reviewing your transactions, TokenTax generates tax reports that you can use to file your taxes. The reports include information on capital gains, losses, and income, as well as a summary of your tax liabilities.

- File your taxes: Finally, you can use the tax reports generated by TokenTax to file your taxes. You can either use the reports to prepare your tax returns manually or export them to popular tax software such as TurboTax or TaxAct.

Note that the specific steps you need to take may vary depending on your situation and the type of cryptocurrency transactions you have made. Therefore, it’s always a good idea to consult with a tax professional or accountant to ensure you’re following the proper procedures and meeting all necessary requirements.

How Does TokenTax Work?

TokenTax is a platform designed to simplify the process of cryptocurrency tax reporting. Here’s how it works:

- Connect your exchanges and wallets: TokenTax supports over 40 cryptocurrency exchanges and wallets. To start, you’ll need to connect your accounts to TokenTax using your API keys.

- Import your transaction history: Once you’ve connected your accounts, TokenTax will automatically import your transaction history. This includes all buys, sells, trades, and transfers between wallets and exchanges.

- Calculate your tax liability: TokenTax uses its proprietary tax engine to calculate your tax liability based on the tax laws of your country. This includes calculating capital gains, losses, and income from mining, staking, or airdrops.

- Generate tax reports: After calculating your tax liability, TokenTax generates tax reports in various formats, including IRS Form 8949, Schedule D, and TurboTax. The reports provide a summary of your cryptocurrency transactions and tax liability, making it easy for you to file your taxes.

- File your taxes: TokenTax does not file taxes for you. However, you can use the generated tax reports to file your taxes on your own or with the help of a tax professional.

Overall, TokenTax automates the process of cryptocurrency tax reporting, saving you time and effort in tracking and calculating your tax liability.

Is TokenTax Safe?

Yes, TokenTax is generally considered safe to use. It employs advanced security measures such as two-factor authentication, encryption, and SSL certification to protect user data and ensure the platform’s security. Additionally, TokenTax is compliant with industry standards and regulations, such as GDPR and FinCEN, and follows IRS guidelines to calculate tax liabilities accurately.

However, as with any online platform that deals with sensitive financial information, there is always some level of risk involved. Therefore, it’s important to use strong passwords, enable two-factor authentication, and take other basic security measures to protect your TokenTax account and cryptocurrency assets.

TokenTax Features

Automatic data import

TokenTax automatically imports your cryptocurrency transaction data from exchanges, wallets, and other sources, saving you time and effort.

Accurate tax calculations

TokenTax uses the latest IRS guidelines to calculate your tax liabilities accurately and provide you with detailed tax reports.

Customizable tax reports

TokenTax generates customizable tax reports that you can use to file your taxes, including Form 8949 and Schedule D.

Tax-loss harvesting

TokenTax helps you identify tax-loss harvesting opportunities to minimize your tax liabilities and maximize your returns.

Audit defense

TokenTax offers audit defense services, helping you respond to IRS audit requests and resolve any tax-related issues.

Integration with accounting software

TokenTax integrates with popular accounting software such as QuickBooks, Xero, and Wave, making it easy to track your cryptocurrency income and expenses.

Multi-currency support

TokenTax supports over 4,000 cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, allowing you to track and report on a wide range of crypto assets.

TokenTax Pros & Cons

| PRO | CONS |

|---|---|

| Easy-to-use platform with automatic data import and accurate tax calculations | Pricing can be relatively high compared to other tax software |

| Tax-loss harvesting and audit defense services | Limited customer support options for the lower-priced plans |

| Integration with popular accounting software | May not be necessary for individuals with minimal cryptocurrency transactions or holdings. |

| Range of Tools and Features |

TokenTax Conclusion

Overall, TokenTax is a great platform for traders of all levels to gain access to the markets and to research and analyze market data.

TokenTax Tool FAQ

What types of cryptocurrency transactions can TokenTax handle?

TokenTax can handle a wide range of cryptocurrency transactions, including trading, buying, selling, receiving, and sending crypto assets.

Does TokenTax support all cryptocurrencies?

TokenTax supports over 4,000 cryptocurrencies, including popular coins like Bitcoin, Ethereum, and Litecoin, as well as many smaller and less well-known coins.

How much does TokenTax cost?

TokenTax offers several pricing plans, ranging from $49 to $799 per year, depending on the number of transactions and the level of support you need.

Is TokenTax secure?

Yes, TokenTax uses advanced security measures, such as two-factor authentication and encryption, to protect user data and ensure the platform’s security.

Is customer support available?

Yes, TokenTax offers customer support via email and live chat, although the level of support may depend on the pricing plan you choose.