About Thorchain

Thorchain.org is a liquidity protocol designed to connect all blockchain assets in a marketplace of liquidity through cross-chain bridges and continuous liquidity pools secured by economically incentivised validators.

By leveraging Tendermint, Cosmos-SDK and Threshold Signature Schemes, THORChain is able to remain chain-agnostic, favoring no specific asset or blockchain and able to scale massively without sacrificing security.

THORChain enables users to swap between digital assets on almost any blockchain in a trustless & permissionless setting, with low fees and at market prices. Liquidity is provided by stakers who earn fees on swaps, turning their unproductive assets into productive assets in a non-custodial manner. Market prices are maintained through the ratio of assets in pools which can be arbitraged by traders to restore correct market prices.

Thorchain.org project was conceptualised in 2018 where the majority of R&D was undertaken. Development commenced in June 2019 with THORCHain’s first go-to-market product BEPSwap set for release in August 2019 and mainnet slated for 2020.

| ICO | DETAILS |

|---|---|

| Company Name | Thorchain.org |

| Platform | Ethereum |

| Accepting | BTC, ETH |

| Token Type | RUNE token |

| Bonus | Available |

| Bounty | Available |

| Token Symbol | DGN |

| Price | 1 RUNE token = 0.00008 ETH |

| Token For Sale | 500,000,000 |

| Softcap | N/A |

| Hard cap | 176,800 ETH |

| Country | Switzerland |

| Website | Homepage |

Technology

Decentralised exchanges are notorious for having low or zero liquidity to the point where they can be unusable for low liquid pairs. This can also be the case for low-tier centralised exchanges. Solving liquidity has been a large focus for Bancor Network and arguably a successful endeavour.

Bancor introduced the concept of continuous liquidity by using smart tokens and connectors built on smart contracts deployed on Ethereum. Tokens and Ether are held in smart contracts in such a way that they become bonded and are priced according to the ratio at which they are held. Users can send either tokens or ether to these smart contracts and the other asset is emitted according to a slip-factored price, which takes into account the liquidity depth of the pool. As a result, liquidity is “always available” for these tokens.

THORChain integrates two on-chain liquidity strategies; an adaption of Bancor’s continuous liquidity strategy, the CLP, and on-chain order-book liquidity multiplication adapted from the Komodo blockchain.

Solving Cross Chain

- THORChain observes transactions on external networks

- State is highly-validated; incorrect transactions are ignored or refunded

- Logic is applied to state changes; generating outgoing transactions

- Transactions are signed via a chain-agnostic TSS protocol

- Outgoing transactions broadcast back to the external network

Network Fee

$RUNE is the native currency of THORChain and is consumed as transaction fees on the network. Transactions include both user initiated transactions, pool settlements (double swaps), governance proposals etc. All transaction fees on THORChain will be burned to ensure the total supply of $RUNE never reaches the theoretical 1 billion.

SOLVING SCALABILITY

- Liquidity is sharded into realms to reduce signing committee sizes

- Liquidity is delegated into smaller vaults for faster signing

- Base-infrastructure is Tendermint (100+ Nodes possible)

- Chains and Assets added via economic weight

- High-performance CosmosSDK replicated state machine

Settlement Currency

$RUNE is the base currency and is required to be staked along side every asset in pools. This avoids value being diluted across many pools which has been observed in other implementations. THORChain Without a native settlement currency, each asset would need to be pooled with every other asset, which would eventually result in hundreds of new pools to be created for just one new asset, diluting liquidity. Using the formula below we can calculate the network requirements for various scenarios.

ON-CHAIN LIQUIDITY

- All pools contain RUNE at a 1:1 ratio to asset value

- A single settlement asset means any two pools can be linked

- Only staked capital is secured, simplifying the economic security model

- Pools earn continuous liquidity incentives, 1/3rd of the System Income

Security

- All nodes bond RUNE at a 2:1 ratio to staked RUNE

- Highest bonded nodes are churned in to drive bonding rates

- Nodes are slashed if malicious behaviour is detected

- Nodes earn 2/3rds of the System Income (fees and emission)

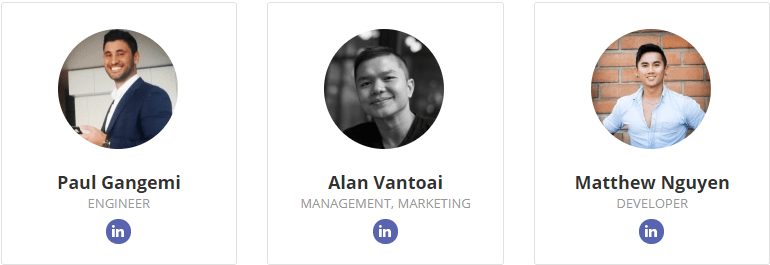

Team

- The team is mostly pseudo-anonymous to protect the project

- Figure-heads, personalities and founders undermine a project’s ability to decentralise

- Transparency is demonstrated in other facets (treasury, code, research)

- In time, Node Operators will fund satellite development teams

- Reach out on Telegram, Twitter or Discord to discuss further