What Is The Fire Token (XFR)?

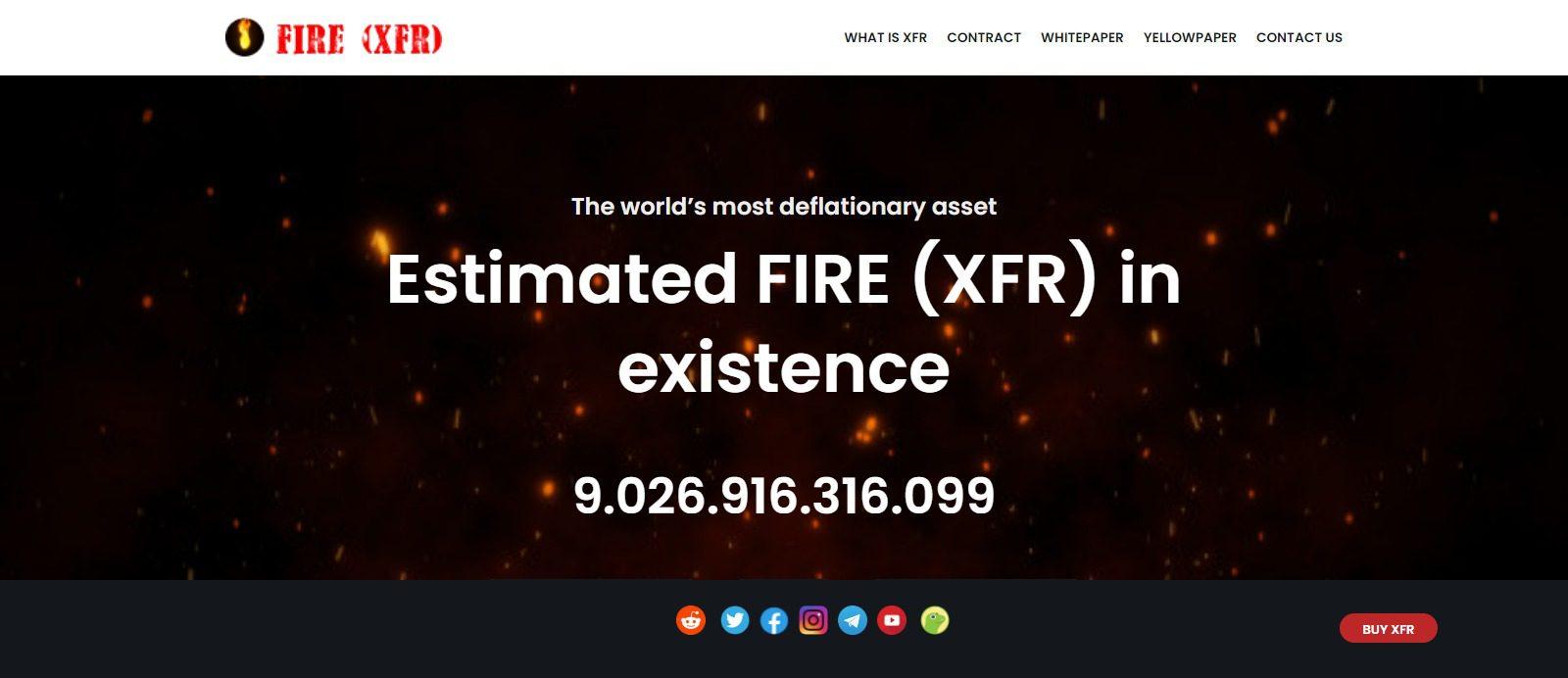

The Fire Token is the world’s most deflationary asset (90% anual), so every day 0.6% of supply disappears. This token is built on the Binance Smart Chain (BSC). The live The Fire Token price today is $4.10e-8 USD with a 24-hour trading volume of $318.22 USD.

- What Is The Fire Token (XFR)?

They update XFR to USD price in real-time. The Fire Token is down 0.01% in the last 24 hours. The current CoinMarketCap ranking is #7271, with a live market cap of not available. The circulating supply is not available and a max. supply of 100,000,000,000,000 XFR coins.

If you would like to know where to buy The Fire Token Coin at the current rate, the top cryptocurrency exchange for trading in The Fire Token stock is currently XT.COM. You can find others listed on crypto exchanges page.

Important Points Table Of The Fire Token Coin

| Basic | Points |

|---|---|

| Coin Name | The Fire Token Coin |

| Short Name | XFR |

| Circulating Supply | 9,185.28B XFR |

| Explorer | Click Here To View |

| Documentation | View Document |

| Website | Click Here To Visit |