About Swop

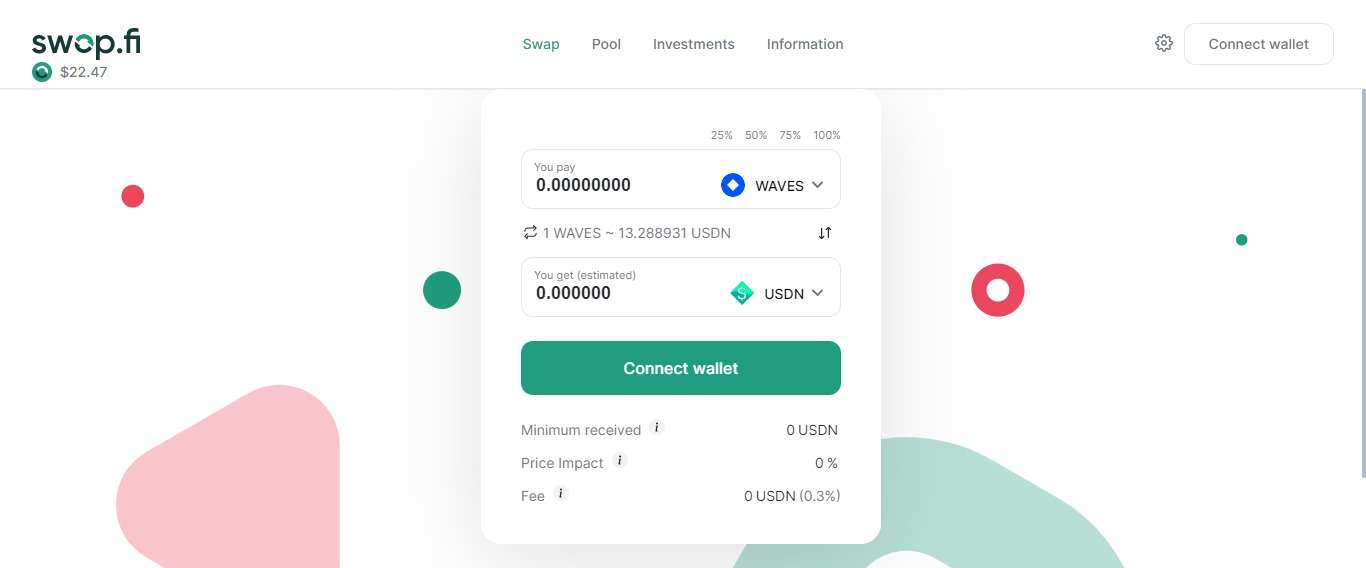

Swop is a service featuring functionality for instant exchange of cryptocurrencies and investing assets in order to receive passive income. The service is based on the Waves blockchain which provides high transaction speed and low network fees. Swap is a safe and legal cryptocurrency exchange platform. The anonymity of your coin or token exchange is ensured to the maximum extent possible.

| Exchange | Details |

|---|---|

| Exchange Name | Swop |

| Exchange Type | Cryptocurrency |

| Langugae | English |

| Exchange Fee | 60% |

| Maker Fee | N/A |

| Withdraw Fee | No Minimum Withdraw |

| Support | 24/7 |

| Top Country | India |

| Website | Homepage |

How To Sign Up & Start Trading

Cryptocurrency Exchange

On Swop.fi, users can exchange assets at a price determined by the pool’s smart contract. The price depends only on the amount of both tokens in the pool and the exchange volume The larger the exchange volume, the more the price changes. The more liquidity in the pool, the less the exchange volume affects the price.

Passive Income

You can get passive income in two ways:

- Invest in the pool of your choice and become a liquidity provider. Liquidity is used to exchange cryptocurrency with other users.

- Stake the SWOP governance token.

A liquidity provider’s income consists of several parts:

- Trading fees. A fee is charged for each exchange. 60% of the fees remain in the pool and, thus, are distributed among the pool’s liquidity providers.

- Neutrino staking rewards. Each pool containing USDN, NSBT, or EURN automatically stakes up to 99% of these assets to the Neutrino smart contract. Daily payouts are added to the pool liquidity and, thus, are also distributed among the pool’s liquidity providers.

- Farming reward in SWOP. It is intended for liquidity providers who staked their share tokens. 1 mln SWOP will be distributed among liquidity providers over the first year after the SWOP token launch, another 1 mln in the second year, and then each year 25% less. The new portion of the farming reward is credited with every new block that appears on the blockchain.

Swop Cryptocurrency staking income consists of 40% of exchange fees in all pools. This part of the fees is converted into USDN and then used to buy SWOP in the SWOP-USDN pool. Purchased SWOP tokens become the staking reward that is credited approximately once an hour.

Features

- The entire logic of the service is programmed in smart contracts. You can view the smart contract code on the blockchain or GitHub. The web application only makes it easier for users to interact with smart contracts and also represents statistics.

- The service does not receive any remuneration. Part of the income goes to liquidity providers; the other part goes to SWOP stakers.

SWOP Governance Token

SWOP holders can stake their tokens to earn the governance reward in SWOP. The stakers can vote for distributing the The -farming reward between liquidity pools and therefore establish which pools will bring greater revenue over the next week. Subsequently, the voting scope will expand, The stakers will be able to govern significant parameters of the system. The price is supported by governance fees that are currently 40% from swap fees in all liquidity pools. Governance fees are converted to USDN and used to buy SWOP in the new SWOP-USDN pool. The daily buyout volume cannot exceed 1% of the amount in the pool.

How to earn SWOP?

1. Add liquidity to the pool of your choice. In return, you receive share tokens.

2. Stake your share tokens to get the farming reward in Swop Cryptocurrency.

You can also regularly stake your available SWOP tokens to earn more from both the farming reward and early-bird reward (if you are entitled to it). If you do so, you will get the governance reward in that you can stake too.

Governance Reward?

The governance reward is intended for SWOP token holders who staked their tokens. Governance fees (currently 40% from swap fees in all liquidity pools) are converted to USDN and used to buy in the new -USDN pool. The daily buyout volume cannot exceed 1% of the SWOP amount in the pool. The tokens purchased with governance fees are distributed among the stakers as a governance reward.