What Is SushiSwap (SUSHI)?

SushiSwap (SUSHI) is an example of an automated market maker (AMM). An increasingly popular tool among cryptocurrency users, AMMs are decentralized exchanges which use smart contracts to create markets for any given pair of tokens.

SushiSwap launched in September 2020 as a fork of Uniswap, the AMM which has become synonymous with the decentralized finance (DeFi) movement and associated trading boom in DeFi tokens.

SushiSwap Defi Coin aims to diversify the AMM market and also add additional features not previously present on Uniswap, such as increased rewards for network participants via its in-house token, SUSHI.

SushiSwap Finance Facts

| Compound | Facts |

|---|---|

| Defi Coin Name | SushiSwap |

| Short Name | SUSHI |

| Platform | Decentralized Finance |

| Ethereum Contract | 0x6b3595068778dd592e39a122f4f5a5cf09c90fe2 |

| Chat Option | Click Here To Visit Compound Chat |

| CEO | Sam Bankman-Fried |

| Official Website | Click Here To Visit |

How does SushiSwap work?

Like many other DEXs, fundamentally consists of several asset pools. Each pool contains 2 assets, such as ETH and LINK (Chainlink). This is because it uses an automated market maker – a smart contract that uses the ratio between two assets in each pool to determine their price.

They covered automated market makers in detail in our recent article about Curve Finance and recommend you head over to read that section first if you are not familiar with AMMs or how they work.

When SushiSwap Defi Coin was initially released, it focused on Uniswap LP (liquidity provider) tokens. LP tokens on Uniswap are ERC-20 tokens issued to liquidity providers when they deposit assets into pools on Uniswap. These tokens can be exchanged for the underlying deposited funds, used in other DeFi protocols, and even exchanged for other LP tokens. Liquidity providers also receive a share of the trading fees of the assets in the pools they provide liquidity to via the LP tokens.

SushiSwap Markets

SushiSwap Exchange

The SushiSwap Exchange helps you to without difficulty switch among 100+ ERC-20 tokens. As with Uniswap, no KYC is needed to apply the SushiSwap change. All you want is Web 3.zero pockets which include Metamask and a few Ethereum to pay fueloline expenses to execute swaps.

Trading expenses at the change are zero.3%, similar to Uniswap. zero.25% of those expenses visit people who are imparting liquidity in SushiSwap’s Liquidity Pools and the final zero.05% is going to the Sushi Bar pool (greater on that during a second).

SushiSwap Liquidity Pools

After The Liquidity Migration ™, SushiSwap introduced “formal” liquidity mining pools. Liquidity vendors may want to earn the 0.25% reduction of buying and selling charges at the platform with the aid of using depositing identical quantities of cryptocurrencies into a current pool on with the aid of using growing their personal pool.

Liquidity vendors are given Liquidity Pool tokens (SLP tokens) that have the identical capabilities as Uniswap’s LP tokens. As you can have guessed, those are the tokens that might be now utilized in lieu of Uniswap’s LP tokens to yield farm

How Is SushiSwap Network Secured?

SushiSwap Defi Coin attempts to mitigate the traditional risks of depositing funds in smart contracts by upping the governance powers of its users. The anonymity of its developers poses questions beyond a technical standpoint. In September 2020, for example, Chef Nomi was involved in a spat with users after withdrawing 38,000 in Ethereum (ETH) from SushiSwap. The funds were subsequently returned, with Chef Nomi publicly apologizing for doing so and calling the move a mistake.

Where Can You Buy SushiSwap (SUSHI)?

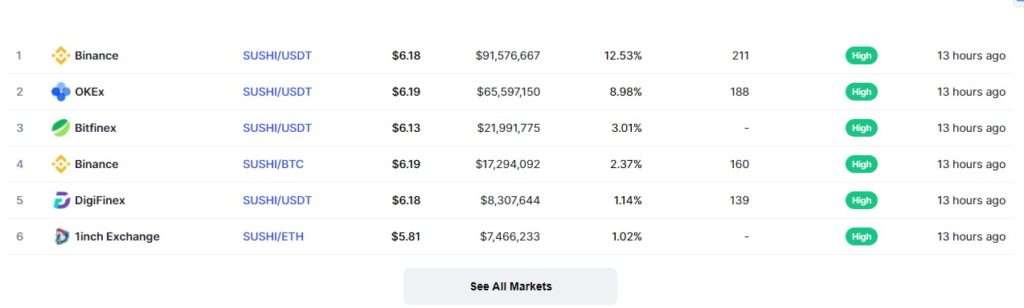

SushiSwap Defi Coin (SUSHI) is a freely-tradable token, with the majority of volume on major exchanges occurring on Binance, Huobi Global, and OKEx. Pairs against other cryptocurrencies and stable coins are active, as well as with fiat, including on Bankman-Fried’s FTX exchange.

What Makes SushiSwap Unique?

SushiSwap primarily exists as an AMM, through which automated trading liquidity is set up between any two cryptocurrency assets.

Its main audience is DeFi traders and associated entities looking to capitalize on the boom in project tokens and create liquidity. AMMs do away with order books entirely while avoiding problems such as liquidity issues, which hamper traditional decentralized exchanges.

The aims to improve on the offerings of its parent, Uniswap, by increasing the impact users can have on its operations and future. The platform takes a 0.3% cut from transactions occurring in its liquidity pools, while its They token is used to reward users portions of those fees. They also entitles users to governance rights.