STON.fi: In this article, we cover a detailed review of STON.fi. How does STON.fi Crypto work & Are important features?

- About STON.fi

- STON.fi Coin Price

- STON.fi Price Live Data

- STON.fi is an AMM DEX for the TON blockchain

- How it works

- Wallets connection

- Select trading pair

- Enter the desired amount

- Review and confirm transaction

- Transaction prcessing

- Roadmap

- Decentralized and Automated

- Why STON.fi

- STON.fi Protocol

- Swap fees

- Mission

- Roadmap

- Conclusion

- FAQ

About STON.fi

STON.fi is a Request For Quote (RFQ)-based cross-chain exchange that relies on Hashed Timelock Contracts (HTLC) to atomically execute cross-chain swaps. This approach eliminates the need for additional trusted entities and offers a combination of deep liquidity and price stability usually associated with RFQ-based exchanges, alongside uncompromising security typically found in intrachain DEXs. Since the protocol doesn’t make any trust assumptions for the participants, we define it as a Zero-Trust Cross-Chain DEX.

STON.fi Coin Price

| Coin Basic | Information |

|---|---|

| Coin Name | STON.fi |

| Short Name | GEMSTON |

| Max Supply | N/A |

| Total Supply | 20,847,141 GEMSTON |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

STON.fi Price Live Data

STON.fi is an AMM DEX for the TON blockchain

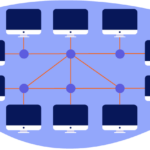

STON.fi is a decentralized automated market maker (AMM) built on the TON blockchain providing virtually zero fees, low slippage, an extremely easy interface, and direct integration with TON wallets

How it works

A typical user flow for using STON.fi can be described in the following steps, which are similar to

those found on any DEX:

Wallets connection

The user connects two wallets to access their token balances and authorize transactions. Unlike

a typical DEX, which requires connecting only one wallet, STON.fi calls for connecting two

wallets to enable cross-chain swaps.

Select trading pair

The user chooses the trading pair they want to exchange, such as swapping Token A for Token

B. These tokens may be on different blockchains.

Enter the desired amount

The user enters the amount of Token A they want to exchange for Token B, or vice versa.

STON.fi’s protocol calculates the exchange rate and displays the estimated amount of Token B

the user will receive.

Review and confirm transaction

The user reviews the transaction details, including the exchange rate, any associated fees, and

the estimated amount of Token B to be received. If satisfied, the user confirms the transaction

using their wallet. Unlike a typical DEX that requires fees to be paid in native tokens (e.g., ETH

for swaps on the Ethereum blockchain), STON.fi intends to offer gasless transactions when the

fee is deducted from the Token A amount. This eliminates the need to hold a native token in the

wallet solely for paying gas. However, this feature will be possible only when the necessary

infrastructure, such as wallets, supports it.

Transaction prcessing

STON.fi processes the transaction through the routing mechanism.

Roadmap

Once the transaction is complete, the user receives a confirmation and can view their updated

token balances in their connected wallet.

Decentralized and Automated

Fully decentralized

STON.fi doesn’t have access to your coins/tokens and never asks for your personal information.

Virtually zero trading fees

TON blockchain has much lower fees and provides higher transaction speed compared to Bitcoin or Ethereum.

Low to zero slippage

As an AMM, STON.fi relies on liquidity pools and simple, yet sophisticated algorithms to determine token prices.

Why STON.fi

STON.fi was founded in 2022. It aims at building a user-friendly crypto exchange for mass-adoption through access to Telegram audience. Putting a high premium on the Community, STON.fi represents a DEX with a human face, providing users with fast support and taking into account their opinions.

An architecture of TON blockchain with sharding allows STON.fi DEX users conduct millions of transactions per second.

STON.fi Protocol

STON.fi is a decentralized exchange (DEX) on TON blockchain. More specifically it is an Automated Market Maker (AMM) exchange employing the Constant Product Market Maker algorithm. The web based app (app.ston.fi) is a visual interface for interacting with a set of smart contracts deployed to the TON blockchain.

The exchange is fully decentralized and non-custodian. Funds are held in permissionless smart contract accounts. This means the only methods to withdraw funds from the pool accounts are those encoded in the smart contract. At a high level this code only allows withdrawals in exchange for an appropriate amount of another asset or by liquidity owners in exchange for their Pool Tokens.

Furthermore, the contracts are fully permissionless. This means that any account can create a pool by issuing the correct set of transactions and that no account has authority over the pool’s assets or functionality.

There is no mechanism to revert or adjust transactions even if they are made in error. Contracts, except the router, are immutable. This means no account has the authority to update or delete pool contracts and funds cannot be stolen. For transparency, all router contract upgrades are time-locked for seven days and a user may withdraw their provided liquidity during this period if they find the changes disagreeable.

Swap fees

While doing a swap, thus a trade of your tokens, on STON.fi, you will interact with liquidity pools. This will lead to Price Impact and Slippage and trading fees being charged on your swap. The trading fee for basic Constant Product Pools is 0.3%:

- 0.2% fee goes to the liquidity providers as a payment by increasing the size of the pools.

- 0.1% fee goes to the STON.fi protocol.

Mission

The mission at STON.fi is to make it easy and fair for everyone to access financial services, no

matter where they live. We’re building a cross-blockchain decentralized platform that provides a

reliable and secure way to trade cryptocurrencies without the restrictions of banks or centralized

services. By offering a simple, user-friendly solution, they aim to help people around the world,

including those living in unbanked and underbanked regions, take control of their financial

future.

The first step towards achieving our mission is enabling people to seamlessly swap any crypto

asset for any other. We aim to provide a secure, reliable, swift, and cost-effective means of

conducting these cross-chain swaps. This capability forms the bedrock of the platform,

facilitating the fluid exchange of value across multiple blockchain ecosystems and laying the

foundation for a more inclusive financial landscape.

Roadmap

Conclusion

In conclusion, STON.fi represents an innovative and groundbreaking approach to decentralized exchange. It operates as a Request For Quote (RFQ)-based cross-chain exchange, leveraging Hashed Timelock Contracts (HTLC) to seamlessly execute cross-chain swaps. This distinctive method eliminates the requirement for additional trusted intermediaries, ensuring a high level of security while simultaneously providing deep liquidity and price stability characteristic of RFQ-based exchanges.

What sets STON.fi apart is its commitment to a trustless environment, as it doesn’t make any assumptions about the trustworthiness of participants. This unique combination of features places it in the category of a “Zero-Trust Cross-Chain DEX,” where security and user autonomy are paramount, revolutionizing the way assets are exchanged across different blockchains.

FAQ

What is STON.fi?

STON.fi is a decentralized exchange that employs a Request For Quote (RFQ) system to facilitate cross-chain swaps. It relies on Hashed Timelock Contracts (HTLC) for secure and trustless execution.

What is an RFQ-based exchange?

An RFQ-based exchange is a system where users request quotes from liquidity providers before executing trades. This approach aims to provide deeper liquidity and price stability, making it advantageous for larger trades.

How does STON.fi ensure security without trusted entities?

STON.fi relies on Hashed Timelock Contracts (HTLC) to ensure secure and trustless swaps. HTLCs use cryptographic mechanisms to guarantee that the swap will occur as intended, eliminating the need for intermediaries.

What is the advantage of cross-chain swaps?

Cross-chain swaps allow users to exchange assets between different blockchains. This is essential for accessing a wider range of tokens and assets without relying on centralized exchanges.

How does STON.fi ensure price stability?

The RFQ-based approach in STON.fi, which involves obtaining quotes before executing trades, contributes to price stability by reducing the impact of market fluctuations during the trade execution process.

Is STON.fi a decentralized exchange (DEX)?

Yes, STON.fi is a decentralized exchange. It allows users to trade directly from their wallets without the need to deposit funds on the platform, ensuring a high level of user control and security.