About Pulseohm

PulseOHM is a DeFi protocol focused on venture capital investments, yield maximizing market strategies, and expanding the utility of the Web3 and DeFi ecosystem by building custom investment products and partnering with growing projects that lay foundations for the future.

They works to grow the intrinsic value of each token through market participation to provide long term value accrual, but also provides a continuous stream of tokens to members who stake their token into The Farm.

As strategies generate new assets, a portion of these new tokens are distributed to members through the farm so members can utilize these assets themselves – providing a unique opportunity for new investors to gain experience interacting with the market alongside.

Pulseohm Coin Price

| Coin Basic | Information |

|---|---|

| Coin Name | Pulseohm |

| Short Name | pOHM |

| Supply (Staked/Total) | 34,051 / 52,135 |

| POHM Price | $4.53 |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

How can I participate in PulseOHM ?

There are two main strategies for market participants: staking and bonding. Stakers stake their tokens in return for more tokens, while bonders provide LP or ETH tokens in exchange for discounted tokens after a fixed vesting period.

What are the benefits from PulseOHM?

The main benefit for stakers comes from dividends paid out in interest-bearing coin, though price exposure remains an important consideration. The main benefit for bonders comes from price consistency.

Bonders commit a capital upfront and are promised a fixed return at a set point in time; that return is in tokens and thus the bonder’s profit would depend on $pOHM price when the bond (minted Token) matures. Bonders benefit from a rising or static price for the $pOHM token!

Staking

Staking is the primary value accrual strategy of pulseOHM. Stakers stake their tokens on the Dapp to earn revenue share rewards, via the farm.

Stake your Tokens in the revenue share staking contract (farm) & those staked holders will periodically receive token streams.

Staked $pOHM recevies staking rewards as $spOHM. APY and rebase time remaining can be seen on the Dapp.

Staking Warm-Up Period

To protect against flash loan attacks a warm up period will be put in place for staked $pOHM.

When you stake $pOHM to receive $spOHM, you:

- 1.Will earn rebases as normal for each epoch that occurs every ~8 hours.

- 2.Will be able to claim $spOHM ($spOHM → $pOHM) after 2 rebases.

- 3.If you claim your original $pOHM amount before 2 epochs is up, your rewards will be waved.

Bonding

You will be able to bond tokens initially. The bond price will be setup to provide ~10-30%+ positive ROI for all bonders.

Bonding is the process of the accruing liquidity and the reserve assets, and providing the value backing for the token.

They gradually owns the liquidity through the bonding process. With bonding, Token intrinsic value is established.

Treasury

One of the key components to this is its Treasury. The Treasury is made up of all assets owned and controlled by the protocol.

The primary responsibility of the Treasury is to ensure pOHM liquidity on open markets and stabilize pOHM with direct market operations in certain situations. Our treasury manages a set of strategic assets for the long term benefit of the protocol. Sustainability and longevity are the key focus of the Protocol at large.

These assets – also known as Protocol controlled assets – are managed via secondary contracts (called allocators) and assets that cannot be managed via contracts are managed by the PulseOHM team via multisigs.

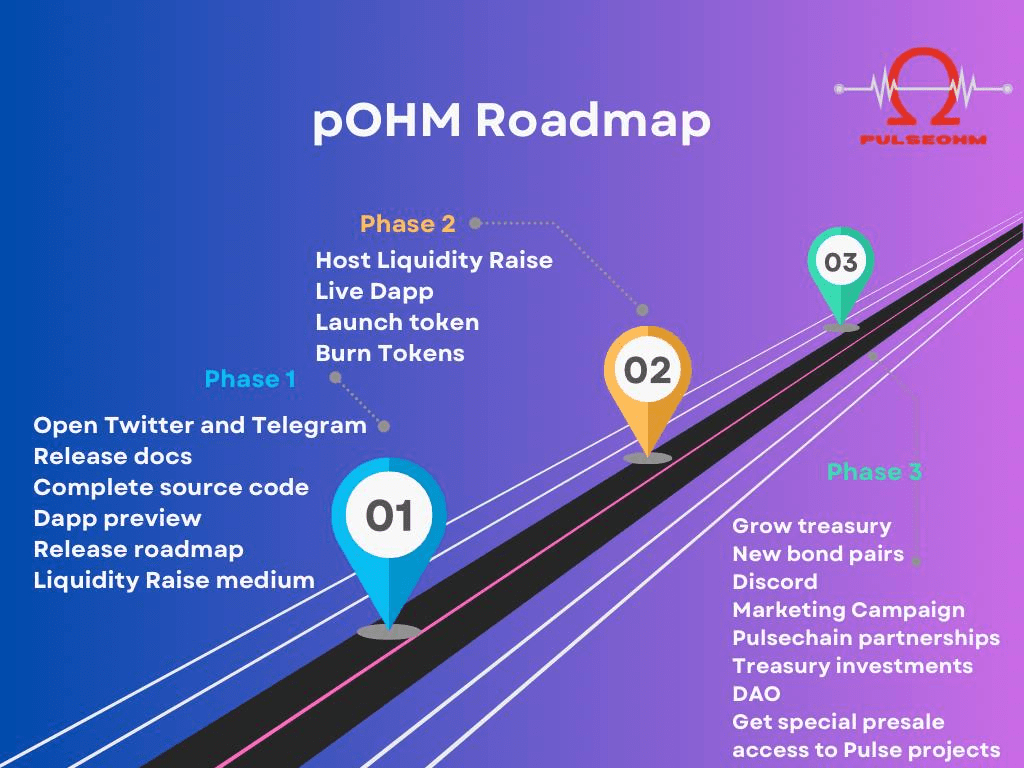

Roadmap

Conclusion

The expansion of the Web3 and DeFi ecosystem, yield-maximizing market tactics, and venture capital investments are all given priority in the DeFi protocol PulseOHM. PulseOHM seeks to pave the road for future developments by creating unique investment products and partnering with innovative projects.

The protocol gives investors the chance to take part in the development of cutting-edge initiatives because of its emphasis on venture financing. Additionally, given the dynamic DeFi sector, its commitment to yield optimisation provides attractive returns. The is positioned to have a substantial impact on the decentralized financial industry by actively participating in the ecosystem’s growth and establishing partnerships.

FAQ

What is PulseOHM?

This is a decentralized finance (DeFi) protocol that specializes in venture capital investments, yield maximizing market strategies, and enhancing the utility of the Web3 and DeFi ecosystem. It achieves this by creating tailored investment products and forming partnerships with promising projects that contribute to the future of decentralized finance.

How does PulseOHM differ from traditional venture capital?

They operates on the principles of decentralization and transparency, distinguishing it from traditional venture capital models. By utilizing blockchain technology and smart contracts, They allows for trustless and permissionless investments. Additionally, This investment strategies are designed to maximize yield and align with the goals of the Web3 and DeFi community.

What investment products does PulseOHM offer?

They develops custom investment products that cater to the needs of the DeFi ecosystem. These products may include tokenized funds, liquidity pools, or yield farming strategies, among others. By leveraging its expertise and partnerships, They aims to provide investors with unique opportunities to participate in the growth of the decentralized finance space.

How does PulseOHM select projects to partner with?

They employs a rigorous selection process to identify projects that have the potential to make a significant impact in the Web3 and DeFi ecosystem. The team evaluates factors such as the project’s technological innovation, team expertise, market potential, and alignment with PulseOHM’s mission. Collaboration with these projects allows PulseOHM to contribute to their growth and expand the overall utility of the decentralized finance landscape.

What are the benefits of participating in PulseOHM?

Participating in They offers several benefits. Investors gain exposure to carefully selected venture capital investments and yield maximizing market strategies, potentially generating attractive returns. Users can benefit from the platform’s innovative DeFi products and services, which aim to enhance the utility of the Web3 ecosystem. Additionally, PulseOHM’s transparent and decentralized nature promotes trust and fosters a collaborative community around decentralized finance.