About Neutrino

The Neutrino protocol is an algorithmic price-stable assetization protocol that enables the creation of stable coins tied to real-world assets or cryptocurrency. The Neutrino protocol is represented by a set of interacting smart contracts written in the programming language Ride and deployed to the Waves blockchain. Most of the operations with the Neutrino protocol are currently available through the Waves. Exchange interface. Navigation through the Waves blockchain is possible with Waves Explorer and the community-driven services like Pywaves or w8io.

The Neutrino system basically consists of 3 core core tokens: WAVES, USDN and NSBT. WAVES is a core token of the Waves blockchain that is used for paying transaction fees. It serves as a collateral for USDN, the main Neutrino stablecoin. USDN is an algorithmic stablecoin pegged to the US dollar. It serves as a collateral for other Neutrino stable assets. NSBT is a recapitalization and governance token of the Neutrino protocol that ensures the USDN collateral reserves’ stability.

Project Neutrino Facts

| Frontier | Facts |

|---|---|

| Defi Coin Name | Neutrino |

| Short Name | USDN |

| Circulating Supply | 354,513,047.47 USDN |

| Explore | Click Here To Visit Explore |

| Chat Option | Click Here To Visit Chat |

| Total Supply | 354,513,602 |

| Official Website | Click Here To Visit |

Algorithmic stablecoin enabling sustainable DeFi

Neutrino USD (USDN) is an algorithmic stablecoin pegged to the US dollar and backed by WAVES. Leveraging the staking model of the Waves protocol’s underlying consensus algorithm, USDN staking yields a sustainable reward of up to ~ 15% APY.

Trade national currencies on a decentralized exchange

Decentralized Forex (DeFo) is an extension on top of the Neutrino protocol that facilitates instant swaps of stable-price assets tied to popular national currencies, indices or commodities.

Neutrino Stable Assets

Neutrino stable assets are digital assets that serve as an equivalent of their underlying real-world analogs. For example, EURN is pegged to the Euro in a 1-to-1 ratio. All Neutrino assets leverage the underlying Waves blockchain’s consensus algorithm to enable staking, which stimulates users to own assets.

Influence the Neutrino protocol’s development with NSBT token

The Token (NSBT) enables its holders to influence decisions concerning the Neutrino protocol, product and feature roadmap, as well as changes to governance parameters.

Decentralized Forex

Decentralized Forex or DeFo is an extension built on top of the Neutrino protocol that enables instant swaps between stable-price assets tied to popular national currencies, indices or commodities. The first DeFo interface is implemented by Waves.

Entities

Overall, five types of on-chain and off-chain entities exist and interact with each other within the Neutrino system, linked together by smart contracts:

Users: anyone who has a Waves account (usually managed through the Waves Keeper and Waves Signer extensions).

Price oracles: A set of predetermined accounts providing a market price feed from different sources to the blockchain.

Pacemaker oracles: any Waves account (usually a bot) that triggers transactions and processes complex computations. It is necessary to have pacemaker oracles for the system to run because of the non-Turing nature of the Ride language and calculation complexity limits.

Waves full node: a Waves node within a peer-to-peer blockchain network that operates based on the Leased Proof of Stake algorithm. It accumulates and distributes block rewards for the Neutrino dApp. Note: You can find a list of full nodes at dev.pywaves.org.

NSBT

Neutrino Token or NSBT (stands for System Base Token) is a recapitalization and governance token for the system. As a recapitalization token, NSBT ensures the stability of collateral reserves in the main Neutrino’s smart contract. New NSBTs are issued for locking WAVES in a contract, serving as additional backing and insuring the system against deficit. When the value of WAVES tokens in USDN backing goes down, it allows users to speculate on the Backing Ratio (BR) parameter.

Staking NSBT

NSBT is a stakable asset enabling holders to earn on WAVES <>USDN swap fees. Fees for swap transactions are accumulated in a pool and subsequently distributed among NSBT stakers on a daily basis. Fees are collected in USDN for WAVES to USDN swaps and in WAVES for USDN to WAVES swaps. Rewards are paid out daily to NSBT stakers’ Waves wallets.

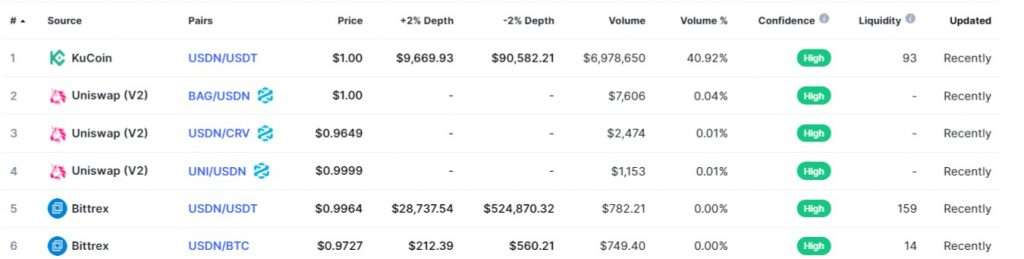

Neutrino USD Markets

Reward

Neutrino reward size for NSBT staking depends on the volume of WAVES <> USDN swaps and a user’s staking balance’s share in the total amount of staked NSBTs. The calculating period is 1,440 blocks, which corresponds to approximately 24 hours. Upon the expiration of 1,440 blocks, swap fees begin to be distributed among NSBT stakers. The distribution system uses the IPB (income per block) parameter. To calculate it, the total period income (a total income for the calculating period) is divided by 1,440 blocks.