About Mento-fi

The stability of Celo’s stable tokens has been preserved via the Mento-fi market maker mechanism. Although it has been effective, the constant-product market maker’s purposefully constrained liquidity causes noticeable slippage when exchanging big quantities of tokens.

The discrepancy between the anticipated price of a trade and the actual price at which the trade is performed is referred to as slippage.

Larger volume deals typically have higher slippage, which results in a worse price for the trader. Mento has proven helpful in keeping stable tokens stable, but traders still need to be aware of the possibility of slippage and modify their trading tactics accordingly.

| Compound | Facts |

|---|---|

| Defi Coin Name | Mento-fi |

| Short Name | MTO |

| Circulating Supply | N/A |

| Token | Celo |

| Chat Option | Click Here To Visit Compound Chat |

| Document | Click Here To View Document |

| Official Website | Click Here To Visit |

How it works

The stable tokens issued by Celo are kept stable by Mento, a market maker system. It employs a constant-product market maker approach, in which traders can use a pool of liquidity to buy or sell tokens. To keep the tokens stable and anchored to the underlying asset—in the case of Celo’s stable tokens, the US dollar—the market maker regularly modifies their price.

However, the market maker’s liquidity is purposefully constrained, thus large volume trades may cause appreciable slippage. Slippage happens when a trade’s estimated price and actual execution price diverge. Trades with higher volumes frequently experience more slippage and sometimes execute at less advantageous prices.

Trading tactics include spreading transactions across numerous orders, employing limit orders rather than market orders, and monitoring the market depth and liquidity of the market maker in order to lessen the impact of slippage. Traders can efficiently use the Mento market maker to trade Celo’s stable tokens while minimising the effects of slippage on their trades by being aware of the potential for slippage and employing proper techniques.

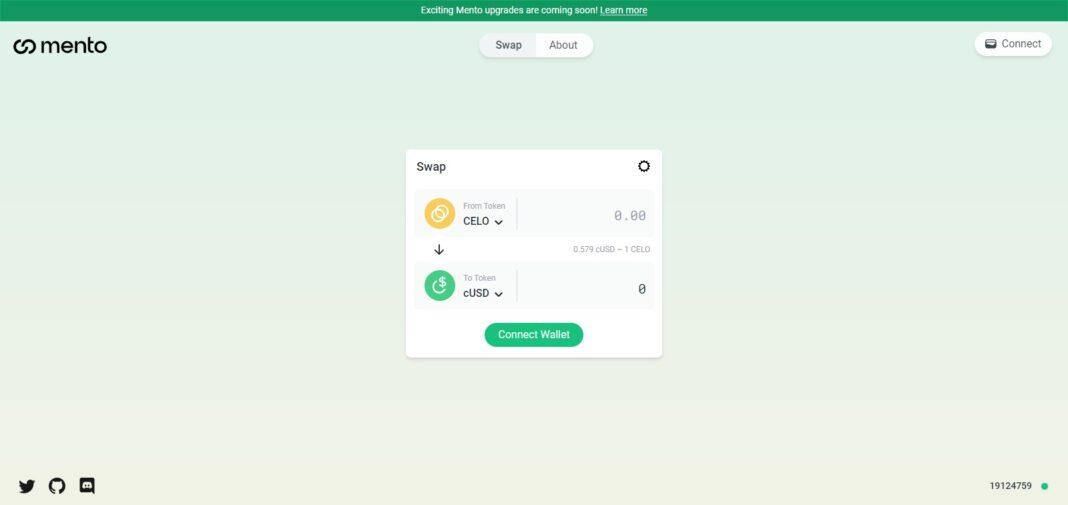

How to start swapping Celo native assets:

- Tap

Connect

in the top-right and select your wallet - Go to the Swap tab (or Granda for large exchanges)

- Input the asset and amount. Tap

Continue

and confirm details

Features

Maintenance of Stable Tokens

Mento-fi was created exclusively to preserve the stability of Celo’s stable tokens. The tokens’ stability and linkage to the US dollar are ensured via a constant-product market maker model.

Constant Market Maker Adjustments

Mento’s market maker regularly modifies the price of the tokens in order to keep them stable even as market circumstances change. As a result, traders may depend on the consistent and predictable value of the tokens.

Limited Liquidity

Mento-fi liquidity is purposefully restricted to avoid the unfavourable effects of high-volume trades on the stability of the tokens. However, when exchanging tens of thousands of tokens at once, this can cause noticeable slippage.

Slippage Management

Traders can employ a number of tactics to lessen the effects of slippage, including spreading out their transactions across numerous orders, utilising limit orders rather than market orders, and monitoring the market maker’s liquidity and market depth.

Effective Trading

Mento-fi is a useful trading tool for Celo’s stable tokens, notwithstanding the possibility of slippage. By employing the right trading techniques, traders can use the market maker to buy and sell tokens while maintaining their stability and reducing slippage.

Mento-fi Conclusion

Mento is a crucial instrument for preserving the stability of Celo’s stable tokens, to sum up. The tokens are successfully kept indexed to the US dollar thanks to its constant-product market maker approach, and its market maker regularly modifies the token price to ensure stability.

However, when trading a lot of tokens, the market maker’s limited liquidity can cause noticeable slippage. Trading tactics include employing limit orders and dividing trades among numerous orders might help traders mitigate this. Mento is still a useful trading tool for individuals wishing to buy and sell Celo’s stable tokens while retaining their stability in spite of this restriction.

Mento-fi FAQ

What is Mento?

Mento is a tool designed to maintain the stability of Celo’s stable tokens by using a constant-product market maker model. It ensures that the tokens remain stable and maintain their peg to the US dollar.

How does Mento work?

Mento’s market maker continuously adjusts the price of the tokens to maintain their stability, even as market conditions change. However, the liquidity of the market maker is intentionally limited to prevent large-volume trades from negatively impacting the stability of the tokens.

What is slippage?

Slippage is the price movement experienced by a trade. Generally speaking, larger volume trades will incur more slippage and execute at a less favorable price for the trader.

Is Mento effective at maintaining the stability of Celo’s stable tokens?

Yes, Mento has proven effective at maintaining the stability of Celo’s stable tokens. However, traders should be aware of the potential for slippage when trading large volumes of tokens.