About LI.FI Airdrop

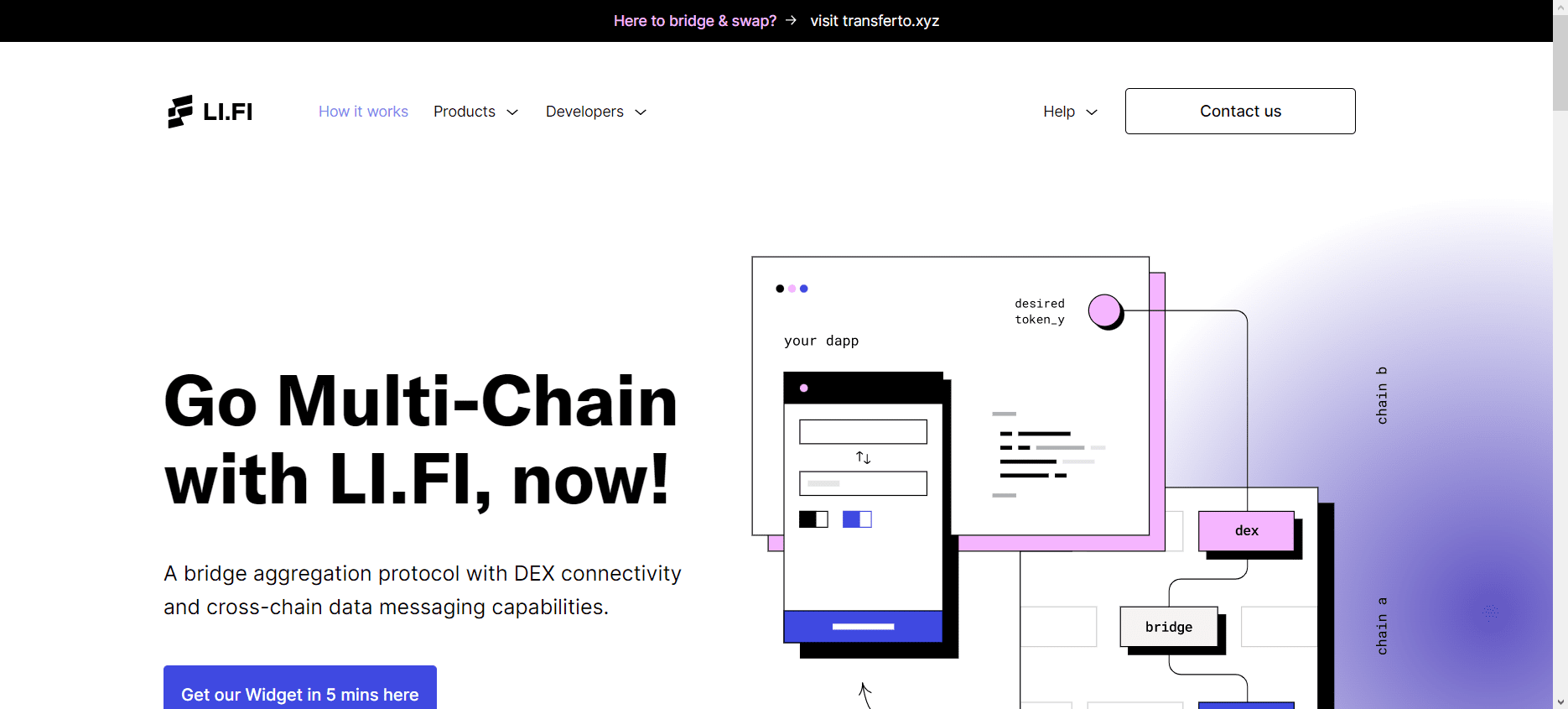

LI.FI Airdrop is a cross-chain bridge aggregation protocol that supports any-2-any swaps by aggregating bridges and connecting them to DEXes and DEX aggregators. They’re like 1inch & Paraswap for bridges, they choose the best bridge to move funds from one chain to another, but since bridges only support stable-coins and a few other coins,

Contents

LI.FI have DEXes on both sides of the bridges to swap before and after the bridge, thus facilitating any-2-any swaps across chains. LI.FI doesn’t have an own token yet but could launch one in the future. Early users who’ve used the bridge may get an airdrop if they launch an own token in the future.

| Platform | Total Value | Max. Participants | Website |

|---|---|---|---|

| ETH | N/A | Unlimited | Click Here To Visit |