What Is Leonidas?(LEO)

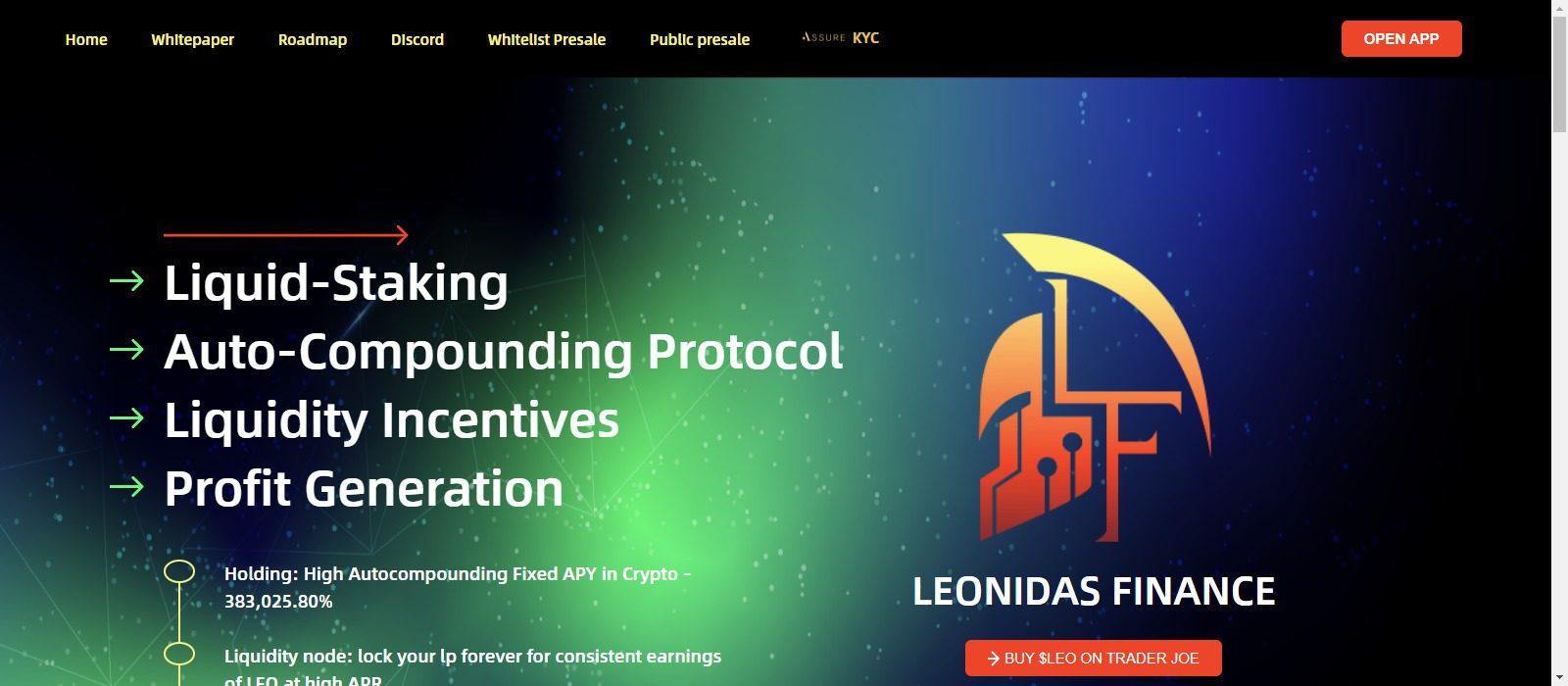

Leonidas Finance provides a Rebase 2.0 decentralized financial asset which rewards users with a sustainable fixed compound interest model. On top of that, users can also earn double-yield by providing and locking liquidity. There is also a profit generation system to bring income to the system.

- What Is Leonidas?(LEO)

- Important Points Table Of Leonidas

- How to Buy the Continental & Trade On Exchange?

- Main Features Include:

- $LEO Token: 383,025.80% APY Auto Compounding in Wallet: APR

- Liquidity Node

- Income Generation Pool (IGP)

- $LEO Treasury

- The Fire Pit

- What is Auto-Staking?

- How It Work

- Tokenomics and Token Distribution

- Token distribution:

Leonidas Coin want to bring a brand-new offering to users that combines the features of many projects they already like, and are forking off $TITANO to do so. The main features include a modified rebase auto-staking model, liquidity nodes, an income generation pool, and of course the versatility offered by a treasury pool.

Leonidas rebase model offers 383,025.80% APY and pays every 15 minutes, making it one of the fastest auto-staking protocols in crypto. Because they use a rebase model, we’ve incorporated a burning feature that burns 2.5% of all LEO traded in order to keep the token stable.

There are also are transaction fees (14% buy and 16% sell) that go to the treasury which can be used for further buybacks if necessary. If not used for buybacks these fees will be used for investments and marketing as the community sees fit. Some of the $AVAX transaction fees are also automatically returned to $LEO holders to reward them for their loyalty.

Important Points Table Of Leonidas

| Basic | Points |

|---|---|

| Coin Name | Leonidas |

| Short Name | LEO |

| Total Supply | 1,000,000,000 |

| Explorer | Click Here To View |

| Documentation | View Document |

| Website | Click Here To Visit |

How to Buy the Continental & Trade On Exchange?

Main Features Include:

$LEO Token: 383,025.80% APY Auto Compounding in Wallet: APR

$Leonidas Coin is the native token which interest rebase rewards are paid. Every token holder automatically receives 0.02355% interest every 15 minutes just for holding $LEO tokens in their own wallet!

Liquidity Node

On top of 383,025.80% APR rewards compounded every 15 minutes, Users can earn more $LEO token on top of their Rebase APY by providing liquidity and stake or lock in our pool, thus bootstrapping more liquidity for the protocol. Lockers may enjoy up to 2x the APRs of the pool.

Income Generation Pool (IGP)

The IGP pool accumulates the trading fees in Avax to distribute back to loyal holders of $LEO

$LEO Treasury

Income generation also comes from Treasury Investment, which will be also redistributed on top of IGP generation.

The Fire Pit

2.5% of all $Leonidas Coin traded are burnt in the Fire Pit. The more that is traded, the more get put into the fire causing the fire pit to grow in size reducing the circulating supply and keeping the LEO protocol stable.

What is Auto-Staking?

With Leonidas Finance, Auto-Staking is exactly what it sounds like. Simply holding the $LEO token in your wallet, regardless of where you got it from, generates more $LEO tokens for you. So where does our 383,025.80% FIX APY come from? Every 15 minutes, the token would rebase and give you 0.0228% of your total $LEO FOR FREE.

Assuming you do not add or remove any tokens from your wallet, with auto compounding being the 8th wonder of the world, after one year you will have approximately 383,025.80% of the token amount you started with.How does this work? It’s coded into the smart contract! To simplify the process, the token essentially airdrops you more tokens into your wallet every 15 minutes depending on how many $ tokens you currently have.

How It Work

$LEO Token

$Leonidas Coin is the native token which interest rebase rewards are paid. Every token holder automatically receives 0.02355% interest every 15 minutes just for holding $LEO tokens in their own wallet!

Liquid-Staking

On top of 383,025.8% APR rewards compounded every 15 minutes for every AVAX wallet holding any $LEO tokens, users can earn more $LEO token on top of their Rebase Apr by providing liquidity and stake or lock, thus bootstrapping more liquidity for the protocol.

Income Generation Pool(IGP))

The IGP pool accumulates the trading fees in Avax to distribute back to loyal holders of $LEO

$LEO Treasury

Income generation also comes from Treasury Investment, which will be also redistributed on top of IGP generation.

The Fire

Pit 2.5% of all $LEO traded are burnt in the Fire Pit. The more that is traded, the more get put into the fire causing the fire pit to grow in size reducing the circulating supply and keeping the LEO protocol stable.

Tokenomics and Token Distribution

Tokenomics:

- Buy: 14% Slippage

$LEO Income Generation Pool (IGP): 5% of order fees are stored in IGP

Fire Pit (Automatic Burn): 2.5% of order fees will be sent to a void address

Treasury: 6.5% of order fees go to the treasury=

- Sell: 16% Slippage

$LEO Income Generation Pool (IGP): 5% of order fees are stored in IGPFire Pit (Automatic Burn): 2.5% of order fees will be sent to a void addressTreasury: 8.5% of order fees go to the treasury

Token distribution:

- 30,000 tokens for Whitelist presale at 0.1 AVAX per token (Unsold tokens will be burned)

- 27,000 tokens for public presale at 0.111 AVAX per token (Unsold tokens will be burned)

- 30,000 tokens for liquidity addition.

- 220,000 tokens for liquidity incentives.

- 0 tokens for team. (Leonidas Finance’s staff will be paid with part of treasury funds)