What Is KLEVA Protocol (KLEVA)?

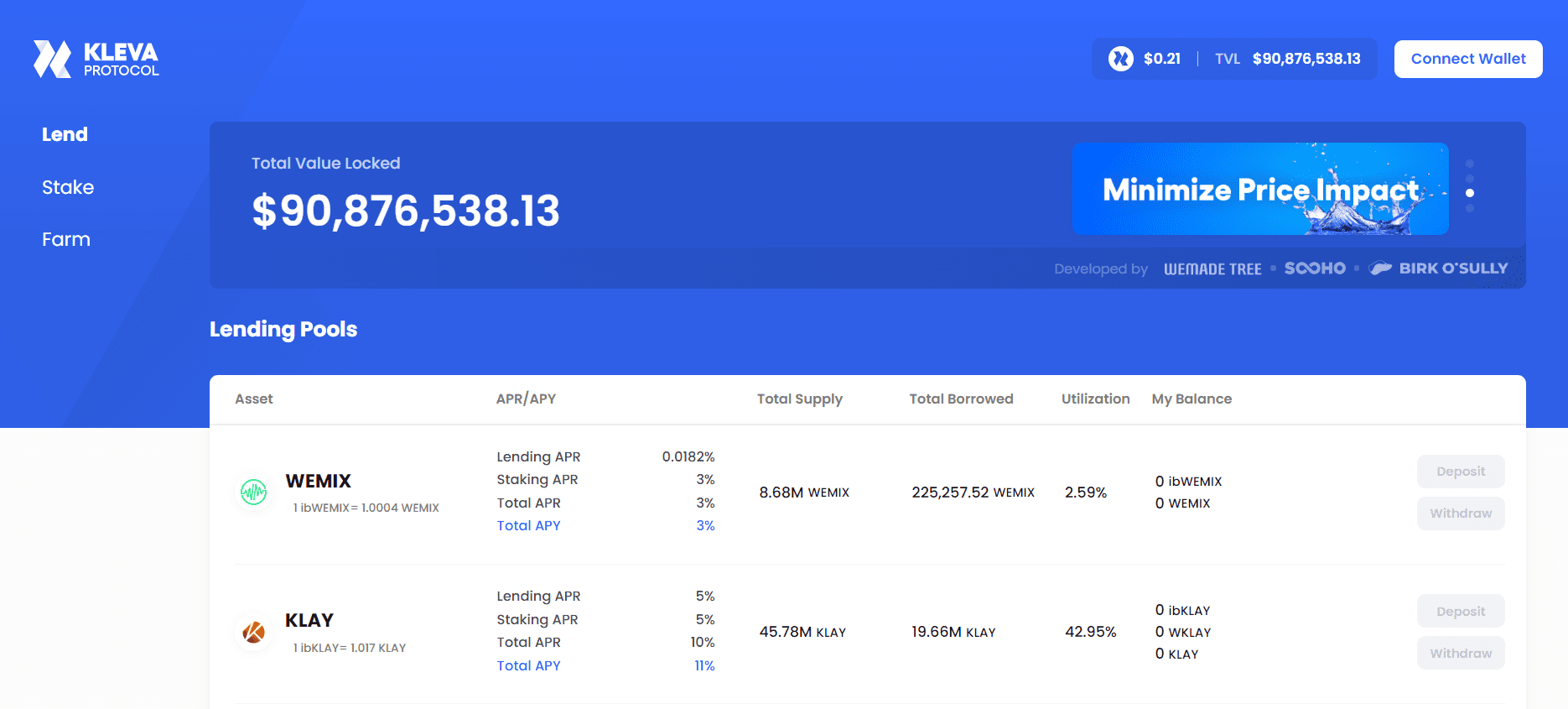

KLEVA Protocol is a DeFi protocol in Klaytn that specializes in Leveraged Yield Farming. We take advantage of the liquidity layers in Decentralized Exchanges and act as the amplifier for these exchanges. By integrating with farms, we trigger an inflow of liquidity to both exchanges and our protocol, leading to a higher TVL for the entire Ecosystem.

Contents

Important Points Table Of KLEVA Protocol

| Basic | Points |

|---|---|

| Coin Name | KLEVA Protocol |

| Short Name |