This article reviews the How to Use the Best Crypto Aggregators for DeFi Yield Farming, which considerably streamline your investment approach and amplify your profits.

- What is DeFi Yield Farming?

- What Are Crypto Aggregators?

- How to Use the Best Crypto Aggregators for DeFi Yield Farming

- Step-by-Step Guide: Using Yearn Finance for DeFi Yield Farming

- Step 1: Go to the Aggregator Platform

- Step 2: Check the Vaults

- Step 3: Deposit Funds

- Step 4: Check Performance

- Step 5: Understand Risks

- Step 6: Optimize with Layer 2

- Step 7: Compare with Other Aggregators

- Top Crypto Aggregators for DeFi Yield Farming

- Key Metrics to Track with Aggregators

- APY (Annual Percentage Yield)

- TVL (Total Value Locked)

- Liquidity Pool Ratio

- Platform Fees

- Gas Fees

- Reward Tokens & Distribution

- Risk Score or Audits

- Yield Source Transparency

- Vault or Pool Age

- Historical Performance

- Tips to Maximize Returns Safely

- Common Mistakes to Avoid

- Ignoring Smart Contract Risks

- Chasing Unrealistic APYs

- Neglecting Gas Fees

- Skipping Research

- Not Diversifying

- Forgetting About Impermanent Loss

- Falling for Fraudulent Sites

- Leaving Rewards Unclaimed

- Pros & Cons

- Conclusion

- FAQ

These platforms simplify the automation of yield-maximizing strategies, provide comparative analyses of leading yield farming pools, and facilitate the handling of several DeFi protocols simultaneously, all while optimizing risk and crypto earning potential.

What is DeFi Yield Farming?

DeFi yield farming allows holders of crypto to earn incentives by lending, staking or providing liquidity to decentralized finance (DeFi) protocols.

Investors no longer have to let their crypto sit stagnant because liquidity pools that fuel decentralized exchanges or lending systems can be used to earn interest, trading fees or governance tokens as rewards.

The objective is to optimize profits by transferring funds between various platforms with the most competitive rates.

Despite the high returns many platforms advertise, performing yield farming will expose users to certain risk elements, particularly impermanent loss, price volatility of the tokens, and weaknesses in the smart contract so users must be diligent and risk aware.

What Are Crypto Aggregators?

Crypto aggregators facilitate the access and utilization of multiple DeFi protocols through a single interface, enabling users to identify the most profitable options for trading, lending, and yield farming.

Instead of manually assessing returns on different platforms, users can access real-time rate, TVL, and yield comparisons. These instruments enhance the optimized allocation of funds by automatically shifting assets to the most lucrative pools.

Yearn.Finance, Zapper.fi, and Beefy Finance are popular examples. They streamline intricate DeFi processes, minimize time and transaction costs, and efficiently enhance crypto returns for all investors.

How to Use the Best Crypto Aggregators for DeFi Yield Farming

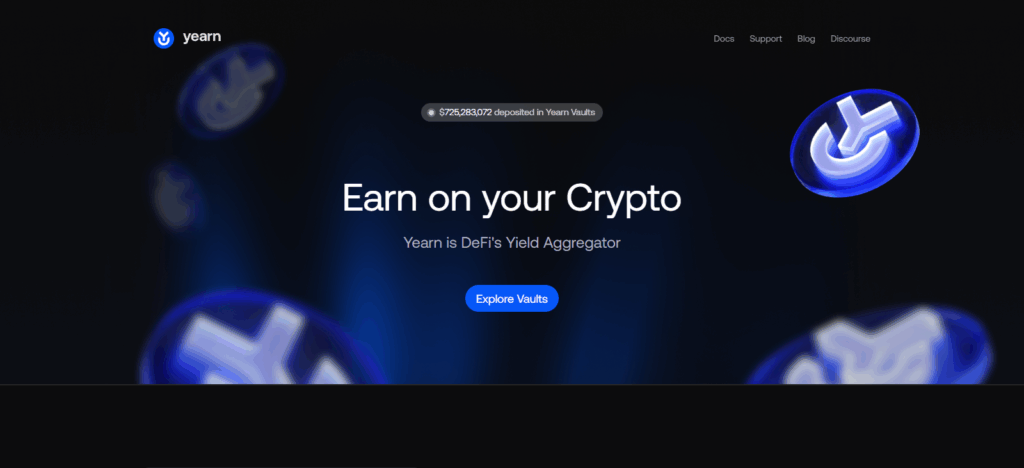

Step-by-Step Guide: Using Yearn Finance for DeFi Yield Farming

Step 1: Go to the Aggregator Platform

- Visit Yearn.finance

- Connect a wallet (MetaMask, WalletConnect, Coinbase Wallet, etc.)

- Make sure the wallet has funds (e.g. USDC, DAI, ETH)

Step 2: Check the Vaults

- Click the “Vaults” tab.

- Check different vaults by asset type and APY.

- For every vault, you can see:

- Estimated APY

- Type of strategy (e.g. Curve, Convex, Aave)

- Risk and fee

Step 3: Deposit Funds

- Choose a vault (e.g. USDC Vault)

- Click “Deposit” and type in an amount

- Confirm in your wallet.

- Your funds will be automatically yield farming.

Step 4: Check Performance

- Your earned yield will be shown in the Dashboard.

- Yearn auto-compounds the earned yield and will move your funds to a higher yield strategy.

- You can withdraw any time and the fee will be minimal.

Step 5: Understand Risks

- Read the vault’s strategy description.

- Know the smart contract risks, impermanent loss (if LP tokens are utilized), and protocol dependencies.

- Yearn employs audits and multisig governance as a risk mitigation strategy.

Step 6: Optimize with Layer 2

- Utilize Yearn on Optimism or Arbitrum for reduced gas fees.

- Bridge assets using Hop or Stargate before deposit.

Step 7: Compare with Other Aggregators

- Use Beefy Finance for its support of multiple chains and automated compounding.

- Compare APYs on various platforms using Zapper or DeFi Llama.

- Certain aggregators provide risk-adjusted yield scores along with TVL metrics.

Top Crypto Aggregators for DeFi Yield Farming

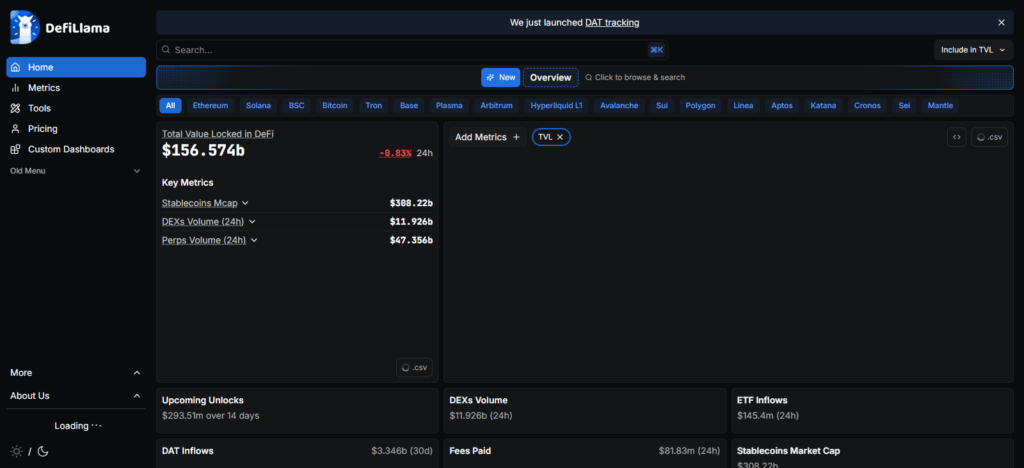

DeFi Llama

DeFi Llama is one of the most prominent DeFi yield farming crypto aggregators. This is because of its transparent, data-centric, and multi-chain approach.

Some of the other aggregators focus on certain protocols, but DeFi Llama aggregates over a hundred projects over many blockchains in DeFi so that users can exactly and reliably assess yield opportunities.

Its intuitive and user-friendly interface shows all the important yield farming analytics such as total value locked, APYs, and other yield farming protocols over a certain period. Their open-source platform and community-driven improvements provide unbiased risk information to users in order to maximize returns in DeFi farming.

Instadapp

Instadapp enjoys a top position as a crypto aggregator primarily because of the automation of smart strategies as well as the sophisticated features in managing a portfolio for DeFi yield farming.

It provides a consolidated interface for automated asset management, enabling users to streamline and optimize asset transfer and yield farming across protocols like Aave, Compound, and Uniswap through a single dashboard.

Instadapp differentiates itself with the “DeFi Smart Layer,” which automates the execution of sophisticated strategies like refinancing, collateral swaps, and yield optimization in a single step.

This minimizes gas expenses and the need for manual execution, which mitigates human error. The simple interface, coupled with sophisticated automation, makes Instadapp valuable to users, regardless of whether they are novice or advanced DeFi yield farmers.

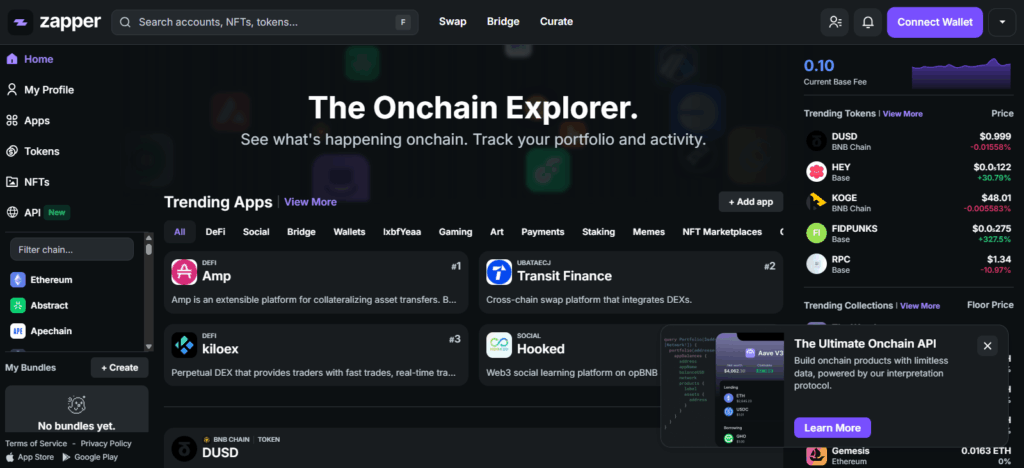

Zapper.fi

Zapper.fi is widely recognized as the easiest DeFi yield farming crypto aggregator because of its automation and all-in-one portfolio management app for DeFi farming. Users can monitor and control their DeFi assets and even investments from one dashboard for all the protocols.

From all the features of the platform, the Zap function is the most notable due to its ability to facilitate entry and exit of liquidity pools in one step. The time, gas, and effort saved is immense.

Not to mention, Zapper.fi has real-time yield and performance monitoring and analytics, and assets and supports multi-chain farming as well.

The Zapper platform is preferred because of its clean visuals, easy-to-use integration farming, and novice DeFi yield farming tools. This is true for all levels of DeFi yield farmers.

Key Metrics to Track with Aggregators

APY (Annual Percentage Yield)

Evaluates the returns you could achieve from a vault or liquidity pool over a year while factoring in the effects of compounding

TVL (Total Value Locked)

The value of all assets locked in a protocol, higher TVL signifies a more trusted and stable protocol.

Liquidity Pool Ratio

The ratio of assets in a pool helps estimate the impermanent loss of a given pool.

Platform Fees

Consider the fees for depositing, withdrawing, and performance to streamline the actual profits you yield.

Gas Fees

Ensure profits are greater than the transaction fees especially on expensive chains like Ethereum.

Reward Tokens & Distribution

Determine the tokens that are rewards and the frequency of distribution or compounding.

Risk Score or Audits

Integrate aggregator tools that provide a risk rating on safety of the protocols or have a linkage to 3rd party audit reports.

Yield Source Transparency

Determine the source of yield, whether it is from trading fees, interest from lending, or token incentives.

Vault or Pool Age

New pools might provide attractive yields but also come with greater risk. Older pools are likely to be more stable.

Historical Performance

Look at historical data to assess consistency to determine and avoid periods of temporary yield spikes.

Tips to Maximize Returns Safely

Open Up to New Opportunities: To ensure minimal risk exposure, allocate your capital to different protocols and networks.

Test the Waters: Make smaller deposits on new platforms and various strategies to ensure the risk is manageable before going bigger.

Pick Audited Entities: Stick to platforms that have had third-party smart contract audits conducted to ensure peace of mind.

Mind the Transaction Fees: Look to avoid paying high network fees on transactions each time, particularly when attempting to close an arbitrage opportunity.

Manage Your Earnings: Gas costs and market conditions should influence how often you should and shouldn’t compound your earnings.

Be In the Know: Stay on top of potential risks or rewards within the ecosystem by following project updates, governance proposals, and the community.

Trustworthy Wallets: Have peace of mind when securing your funds in MetaMask wallets or even a hardware wallet.

Constantly Review Your Yield: Look after your funds and stay engaged by checking APY levels often so you can move your funds into better pools.

Common Mistakes to Avoid

Ignoring Smart Contract Risks

Ignoring audits is risky; ascertain a protocol’s safeness before putting in any money.

Chasing Unrealistic APYs

Unreasonably high APYs come with undue levels of risk. Attempt to focus on stable, lower yields.

Neglecting Gas Fees

Ethereum network congestion makes high transaction costs a profit-erasing risk.

Skipping Research

Investing without prior knowledge of a platform, its assets, and its farming strategy is a risky gamble.

Not Diversifying

Investing in a single pool or chain can lead to total loss.

Forgetting About Impermanent Loss

Liquidity providers need to consider how balance between paired tokens impacts their profit.

Falling for Fraudulent Sites

Always confirm a site’s official URL, social links, and contract addresses before wallet connection.

Leaving Rewards Unclaimed

Unclaimed rewards can expire or lose value, so be efficient in your harvesting.

Pros & Cons

| Pros | Cons |

|---|---|

| 1. Simplifies yield farming – Aggregators combine multiple DeFi protocols into one easy-to-use dashboard. | 1. Smart contract risk – Vulnerabilities in aggregator or connected protocols can lead to losses. |

| 2. Automated yield optimization – They automatically move funds to the highest-yielding pools. | 2. Platform fees – Some aggregators charge performance or withdrawal fees that reduce net returns. |

| 3. Saves time & effort – No need to manually track or switch between DeFi platforms. | 3. Gas costs – Frequent rebalancing or compounding may incur high transaction fees. |

| 4. Multi-chain access – Supports farming across various blockchains from one interface. | 4. Dependence on third-party protocols – If an integrated protocol fails, it can affect your yield. |

| 5. Transparent analytics – Offers real-time data like APY, TVL, and risk metrics. | 5. Learning curve – Beginners may find DeFi terms and strategies complex initially. |

| 6. Better diversification – Enables spreading investments across multiple yield sources easily. | 6. Market volatility – Sudden token price drops can impact farming profits. |

Conclusion

Leveraging high-quality crypto aggregators while engaging in DeFi yield farming changes how people handle their digital assets. These services remove aggravation from complex strategies, automate the yield optimizations, and provide helpful analytics that guide users in making efficient and more informed investments.

Whether it is the analytics DeFi Llama provides, the automation features in Instadapp, or the friendly portfolio management in Zapper.fi, users should remain knowledgeable and posses tools to minimize potential loss.

Risk management, netting profitable key performance indicators, and inter-platform risk diversification are crucial. DeFi yield farming, combined with crypto aggregators, is made lucrative and efficient when people implement risk management strategies.

FAQ

How can I maximize returns safely?

Diversify across multiple protocols, monitor APYs, reinvest earnings strategically, and manage gas fees to ensure consistent and safe yield growth.

Do I have full control over my assets when using aggregators?

Yes, your funds remain in your connected wallet, and aggregators only interact with your assets through approved smart contracts — you retain full ownership.

Can I use multiple aggregators at once?

Yes, using different aggregators helps compare yields, reduce dependency on a single platform, and discover better farming opportunities across networks.