In this article, I will cover the How To Trade Crypto With Bots. You will learn about crypto trading bots, their advantages, and how to put them to use with a detailed walkthrough.

- What is a Crypto Trading Bot?

- How To Trade Crypto With Bots

- Example: Trading Bitcoin with a DCA Bot on Bybit

- Step 1: Create & Fund Your Bybit Account

- Step 2: Access the Trading Bot Dashboard

- Step 3: Configure Your Bot

- Step 4: Launch the Bot

- Step 5: Monitor & Adjust

- Other Place Where To Trade Crypto With Bots

- Why Trade Crypto With Bots?

- Benefits Of Trade Crypto With Bots

- Tips and Best Practices for Beginners

- Common Mistakes to Avoid

- Pros & Cons

- Conclusion

- FAQ

Be it as a novice or as someone who wants to automate your trading, this article will aim to equip you with the necessary knowledge to begin with bot-based trading in a secure and a self-assured manner.

What is a Crypto Trading Bot?

A crypto trading bot is an automated program that fulfills the role of executing trades in crypto currencies for the user. It operates through algorithms that have been established in advance. Such algorithms systemically process data in order to make the execution of trade decisions on the user’s behalf.

With the ability to work non-stop, these bots can automate trading for the entire day and night, swiftly responding to market fluctuations which is crucial for improving a trader’s ability to profit and mitigate losses.

There are different types of crypto trading bots having different strategies including but not limited to arbitrage, trend-following, and market-making. Such diversity makes these bots appropriate for both novice and advanced traders who want to improve their trading.

How To Trade Crypto With Bots

Example: Trading Bitcoin with a DCA Bot on Bybit

Step 1: Create & Fund Your Bybit Account

- Create an account on Bybit

- Fund your account with USDT or BTC and deposit to your spot wallet.

- KYC is optional for basic trading, but verification unlocks trading tier limits.

Step 2: Access the Trading Bot Dashboard

- Navigate to Trade → Trading Bots

- Select DCA Bot for long-term bitcoin accumulation.

Step 3: Configure Your Bot

- Select your pair: BTC/USDT.

- Set the parameters:

- Investment amount: $50 per buy

- Frequency: Every 6 hours

- Strategy: Buy dips or fixed intervals

Step 4: Launch the Bot

- Review the summary and click Start Bot to auto BTC purchase at intervals.

Step 5: Monitor & Adjust

- Monitor the bot performance on the dashboard.

- The bot can be paused, edited or stopped.

- Implement the analytics to improve the bot’s performance with smarter timing. You can later switch to grid or futures trading bots.

Other Place Where To Trade Crypto With Bots

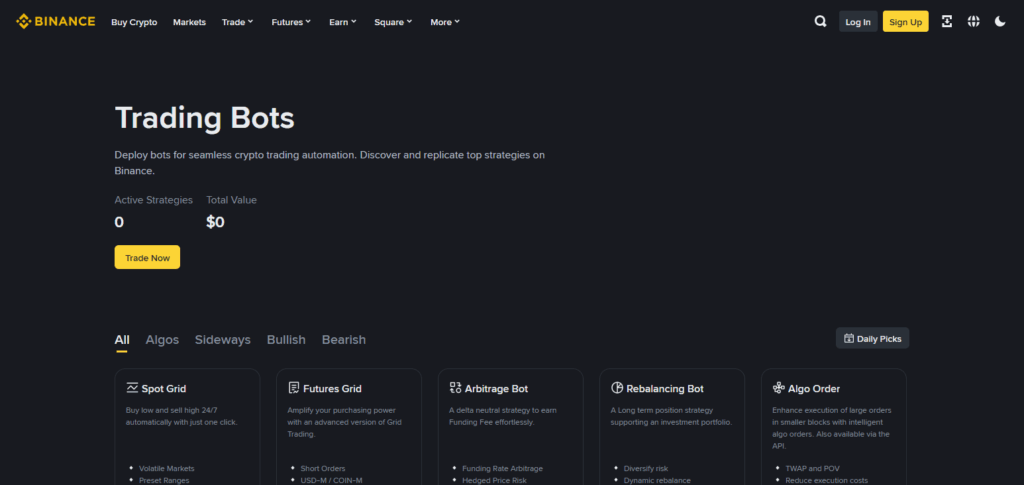

Binance

Binance is one of the best exchanges to trade cryptocurrency with bots because of its deep API integration, liquid markets, and multitude of assets to trade. Its automated systems operate with orders with Binance’s unmatched infrastructure, automated trading relies on consistent speed and uptime.

In addition, Binance’s advanced crypto security and the ability to set trading pairs enhances the advanced bots’ ability to trade strategically. All of these make Binance exceptional for all levels of crypto traders to bot trade.

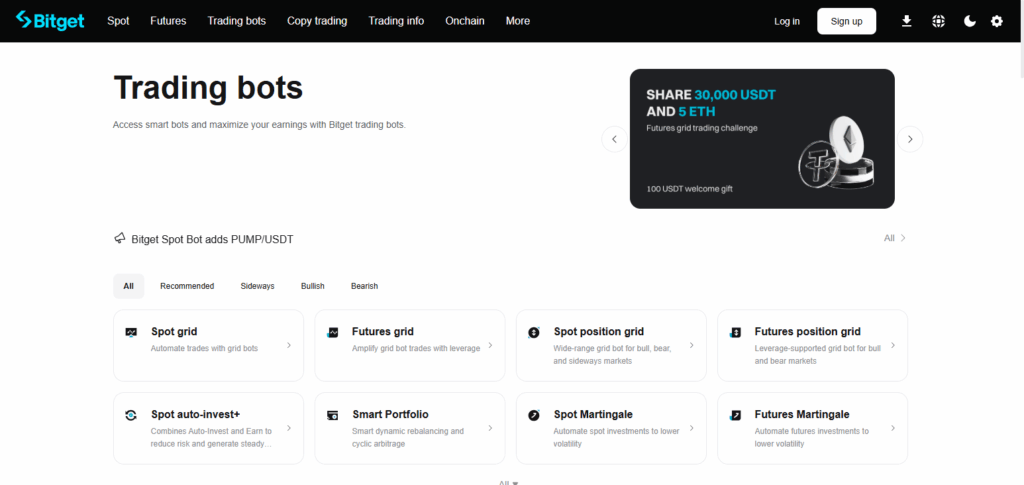

Bitget

Because of its easy to use interface, strong focus on futures trading, and trading crypto with bots, Bitget is an excellent platform. Bitget allows for bots to do HFT through the seamless API integration it provides.

In addition to bots, Bitget’s innovative copy trading feature allows users to automatically follow sophisticated traders, thus diversifying trading strategies. Bitget is an efficient crypto trading platform for bots users due to its low trading fees, sophisticated risk control tools, and the reliable environment it provides for automated trading.

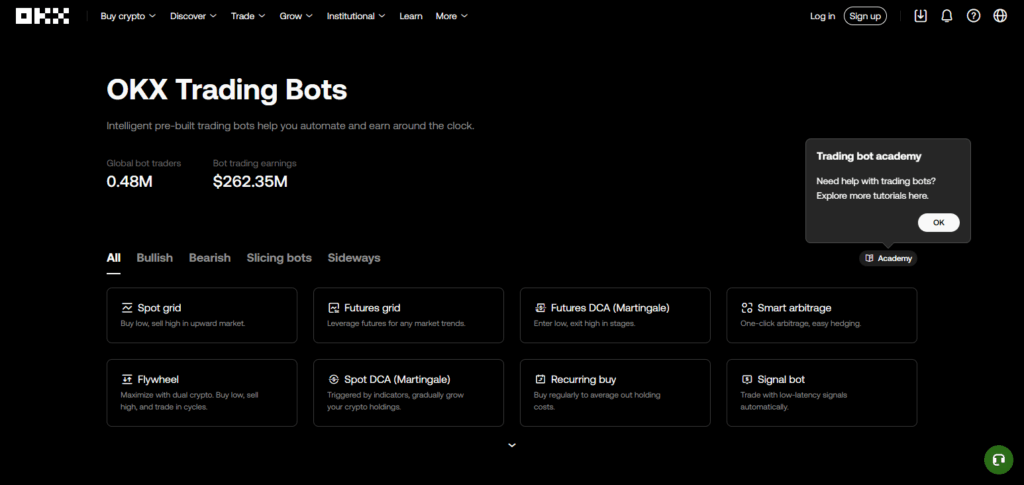

OKX

The OKX trading platform is widely used for automated trading. The reason for its popularity is its many APIs and trading products (spot, futures, and options). OKX executes orders quickly (high-speed and low-latency) which is critical for automated trading success.

The platform provides advanced customization options for bot strategies and offers advanced security, making SSL encryption for data and protection against DDoS attacks. The combination of OKX’s features make it one of the best options in the market for traders needing reliable, flexible and efficient, automated crypto trading.

Why Trade Crypto With Bots?

Always Open: You can trade anywhere and at any time as bots will always be at the ready.

Speed and Efficiency: Bots execute trades instantly, quicker than any human can respond.

Emotion-Free Trading: Bots follow set rules, removing emotional errors.

Backtesting Strategies: Trading strategies can be tried on real past data before going live.

Consistent Execution: Bots follow the plan precisely with no deviation produced by tiredness.

Risk Management: Investments can be secured with features like stop-loss that many bots offer.

Benefits Of Trade Crypto With Bots

Always Available: They trade without breaks, capturing opportunities for profits at all hours.

No Delay in Trading: Time-based profits are guaranteed as bots act immediately, executing every trade without delay.

No Emotion Trading: All the prescribed rules are followed, and thus there can be no emotional errors such as panic selling.

Staying Power: Fatigue is not a factor, and thus he/she will not blunt the strategies.

Backtesting Ability: Any trading strategies can be optimized using backtesting, a method of testing the strategies on past data.

Risk Management: For every critical moment, the bot preset rules for taking profits and stopping losses.

Universal Coin Listing: Diversification can be done across multiple coins and exchanges at the same time.

Tips and Best Practices for Beginners

Start Low: Start with a lower amount to avoid substantial losses as you gain experience.

Select Bots with a Good Reputation: Only select trading bots with a good reputation for crypto trading.

Know Your Strategy: Be familiar with your trading bot’s algorithm and strategy prior to execution.

Consistent Oversight: Periodically assess your bot’s performance as well as the prevailing market conditions.

Manage Risks: Protect your trading capital by setting the appropriate stop-loss limits and not putting all your trades in one basket.

Ensure Using the Latest Version of the Software: Ensure your bots are up to date to take advantage of improvements and security patches.

Test on Demo Account First: Always validate the effectiveness of your strategy on demo accounts before shifting to real accounts.

Common Mistakes to Avoid

Overtrading: Losing a lot of money because of strategically leaving trades open too long or insufficiently guiding trades.

Ignoring Overall Conditions: Forex or stocks trading without having a proper plan which can lead to unwanted results or trades.

Negligence of Risk: Trading without having clean boundaries such a stop loss or without boundaries in a single trade.

Failure to Maintain: API keys which are given too freely or when using automated bots which are not firmed on the internet expose one to hacking.

Unattended Trade Strategies: Not testing the strategy on historical data not uniquely leads to unmanageable automated bots.

Bots Not Supervised: Complete automated process without having a proper check or oversight done.

Pros & Cons

| Pros | Cons |

|---|---|

| Trades 24/7 without breaks | Bots can’t fully adapt to sudden news |

| Fast and precise trade execution | Risk of technical failures or bugs |

| Removes emotional bias from trading | Requires understanding and monitoring |

| Enables backtesting of strategies | Security risks if API keys are not secured |

| Consistent and disciplined trading | Over-optimization can reduce effectiveness |

| Can manage multiple assets/exchanges | Not guaranteed profits due to market volatility |

Conclusion

To summarize, crypto trading bots provide an opportunity to automate trading, seize some market opportunities, and mitigate risks 24/7.

With the right bot selection, clearly defined trading policies, and prudent risk control, novice traders can reduce emotional mistakes and improve their trading experience.

That said, automating trading requires constant market attention, so it is advisable to start with small investments, keep tracking the outcomes, and keep up with the prevailing market scenario. Remember to control the market exposure when embracing automated trading with crypto bots – these tools can perform amazing things, so use them wisely.

FAQ

What is a crypto trading bot?

A crypto trading bot is automated software that buys and sells cryptocurrencies based on preset strategies to help traders execute trades efficiently and without emotion.

Do I need coding skills to use a crypto trading bot?

Not necessarily. Many bots offer user-friendly interfaces and pre-built strategies, so beginners can start without programming knowledge.

Is trading with bots safe?

Trading bots are generally safe if you use reputable software and secure your API keys properly. However, market risks and technical failures still apply.