In this article, I will explain how to safely swap tokens using the best crypto bridges, covering the steps, recommended practices, and the most reliable platforms for safe cross-chain transfers.

- What is Crypto Bridges?

- How to Swap Tokens Safely with the Top Crypto Bridges

- Example: How to Swap Tokens Safely Using Synapse Protocol (Step-by-Step)

- Step 1: Prepare Your Wallet

- Step 2: Visit Synapse Protocol

- Step 3: Configure the Swap

- Step 4: Execute the Swap

- Step 5: Confirm Receipt on Arbitrum

- How Token Swapping Works Across Bridges

- Locking Tokens on the Source Chain

- Verification of the Transaction

- Minting Wrapped Tokens on the Destination Chain

- Cross-Chain Communication Protocols

- Redeeming or Unwrapping Tokens

- Gas Fees and Confirmation Times

- Top Crypto Bridges for Safe Token Swapping

- Key Risks Involved in Token Swapping

- Smart Contract Vulnerabilities

- Bridge Hacks and Exploits

- Phishing and Fake Bridge Websites

- Slippage and Price Volatility

- Network Congestion and Transaction Delays

- Comparison Table of Top Bridges

- Common Mistakes to Avoid When Swapping Tokens

- Using Fake or Unverified Bridge URLs

- Ignoring Smart Contract Audits

- Selecting the Wrong Network

- Skipping Small Test Transactions

- Neglecting Gas Fees and Slippage Settings

- Not Looking Up Token Contract Addresses

- Using Insecure or Public Devices

- Not Monitoring the Transaction Status

- Bridging Unsupported Tokens

- Future of Cross-Chain Token Swapping

- Conclusion

- FAQ

You will gain an understanding of how bridges operate, the potential risks, and strategies for selecting the most secure options for seamless, effective, and safe token exchanges between various blockchains.

What is Crypto Bridges?

A crypto bridge allows users to transfer digital assets or information across multiple blockchains. Since most blockchains work separately and cannot communicate with each other, bridges work as interoperability solutions to transfer tokens like ETH, BNB, or USDT.

They operate by temporarily locking tokens on the source chain and then minting the equivalent wrapped tokens on the other chain. Crypto bridges can also be decentralized, whereby smart contracts operate the bridge.

In the case of control, bridges can be centralized, where one entity manages the entire bridge. Such bridges are of immense value to DeFi applications liquidity transfer and to multi-chain applications.

How to Swap Tokens Safely with the Top Crypto Bridges

Example: How to Swap Tokens Safely Using Synapse Protocol (Step-by-Step)

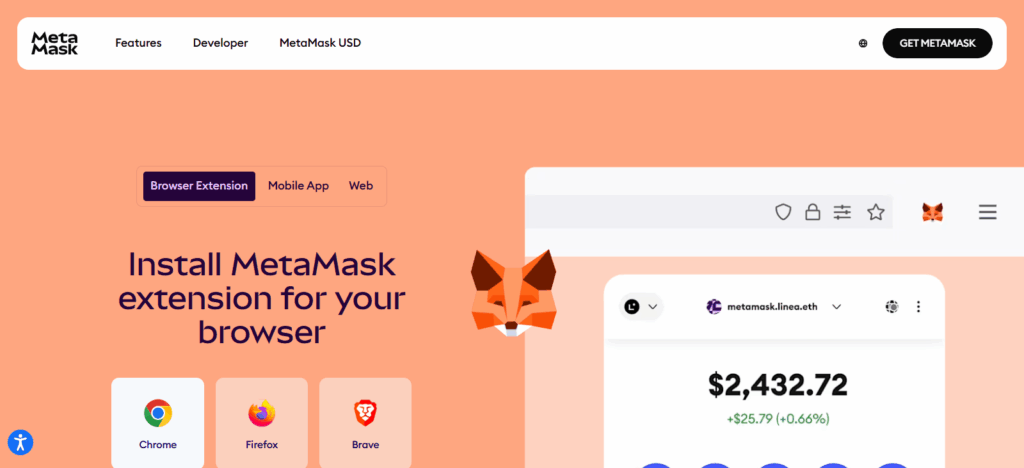

Step 1: Prepare Your Wallet

- Install and set up MetaMask.

- Add both Ethereum and Arbitrum networks to MetaMask.

- Fund your wallet with USDC on Ethereum and some ETH for gas fees.

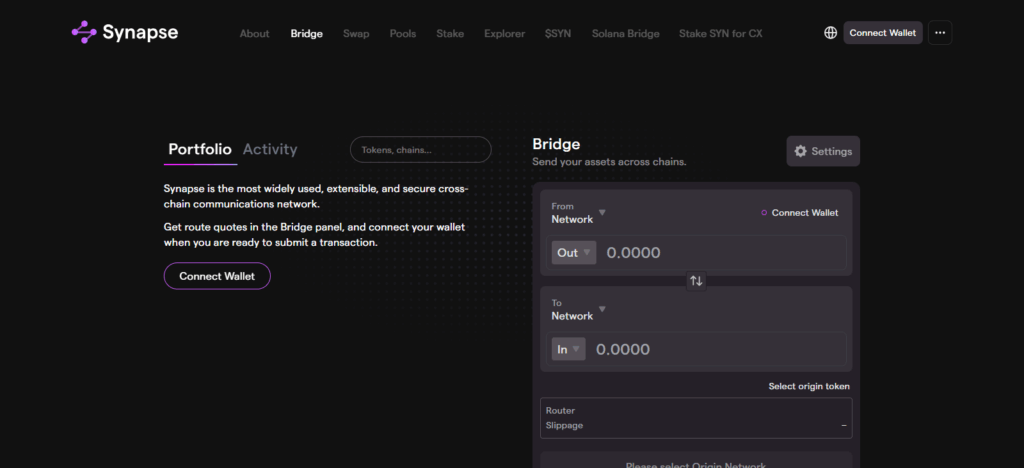

Step 2: Visit Synapse Protocol

- Go to Synapse Protocol.

- Click “Bridge” in the top menu.

- Connect your MetaMask wallet.

Step 3: Configure the Swap

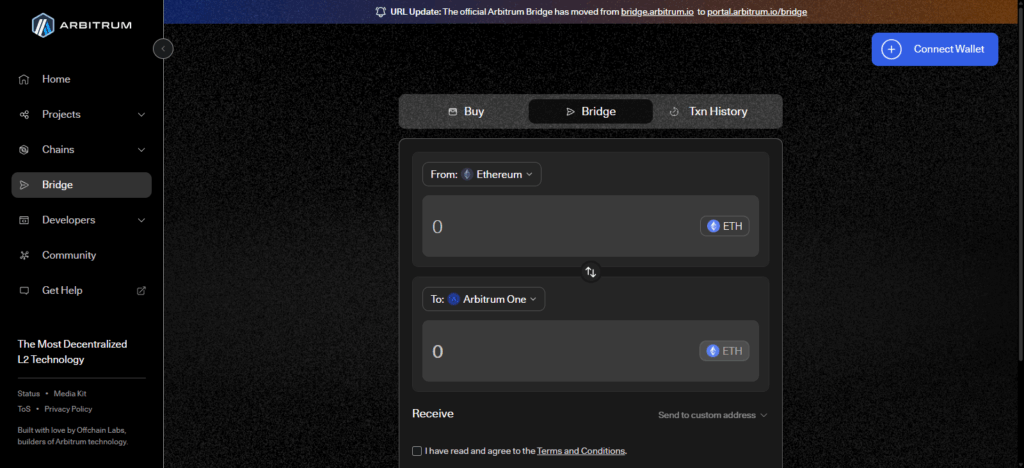

- Choose Ethereum as the source chain and Arbitrum as the destination.

- Select USDC as the token to bridge.

- Enter the amount you want to swap.

- Review the estimated fees and final amount.

Step 4: Execute the Swap

- Click “Bridge Token”.

- Authorize the token transfer in your MetaMask.

- Confirm the transaction and let it process.

Step 5: Confirm Receipt on Arbitrum

- Change your MetaMask to the Arbitrum network.

- Look for USDC in your wallet.

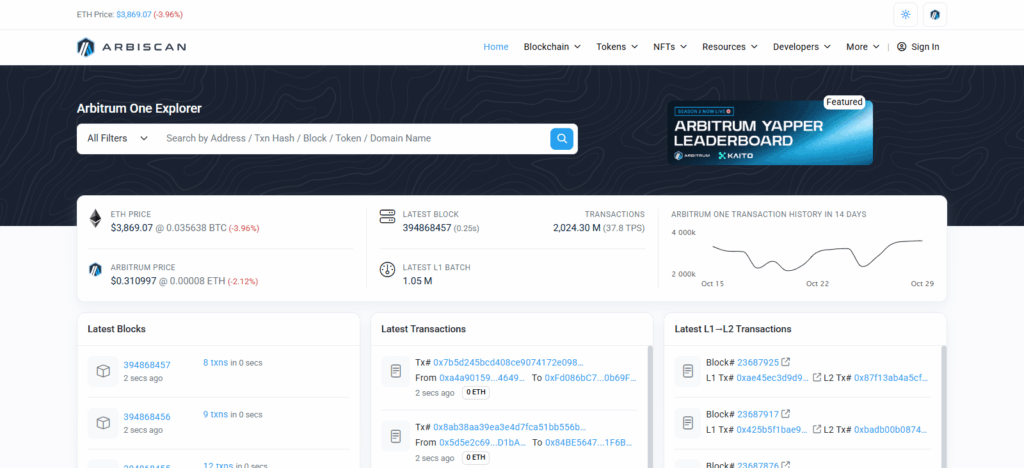

- If necessary, you can check the transaction on Arbiscan.

How Token Swapping Works Across Bridges

Locking Tokens on the Source Chain

When a user asks for a swap to be executed, the bridge locks or holds the tokens on the original blockchain (for example, Ethereum). These tokens will be held in a smart contract or a custodian wallet as a security measure against double spending.

Verification of the Transaction

The bridge network or validator nodes confirm the transaction on the source chain, and upon confirmation, a proof of the locked assets will be sent to the destination blockchain.

Minting Wrapped Tokens on the Destination Chain

After verification of the sent proof, the bridge will mint equivalent wrapped tokens on the target blockchain (for example, minting wETH on Polygon). These wrapped tokens are the assets corresponding to those locked on the source chain.

Cross-Chain Communication Protocols

The bridge applies interoperability protocols and smart contracts to facilitate security, accuracy, and transparency in data transfer during cross-chain transactions.

Redeeming or Unwrapping Tokens

When users wish to withdraw assets, the process is simply the reverse. Wrapped tokens are burned on the destination chain, and the original tokens are unlocked on the source blockchain.

Gas Fees and Confirmation Times

Gas fees are accumulated and priced at every step of the process. Network congestion impacts the expense. Some bridges utilize batching or rollup mechanisms to improve confirmation speeds and reduce costs.

Top Crypto Bridges for Safe Token Swapping

Arbitrum Bridge

The Arbitrum Bridge remains one of the best bridges on the market, one which offers swift, affordable, and safe transfers on the Ethereum mainnet and Arbitrum Layer 2 network.

Every Arbitrum transaction utilizes advanced roll technologies which combines multiple transactions into a single one, which lowers gas costs, and still equipping the transaction with the securability of Ethereum and the latest roll technologies.

The Arbitrum Bridge offers smart contract technologies ensuring the trust of gas payment and operations. This service has been incorporated in the major DeFi systems, which offers a seamless experience in cross-chain transfers.

The Arbitrum Bridge is well known in the community for token swaps, with the most advanced and reliable technologies.

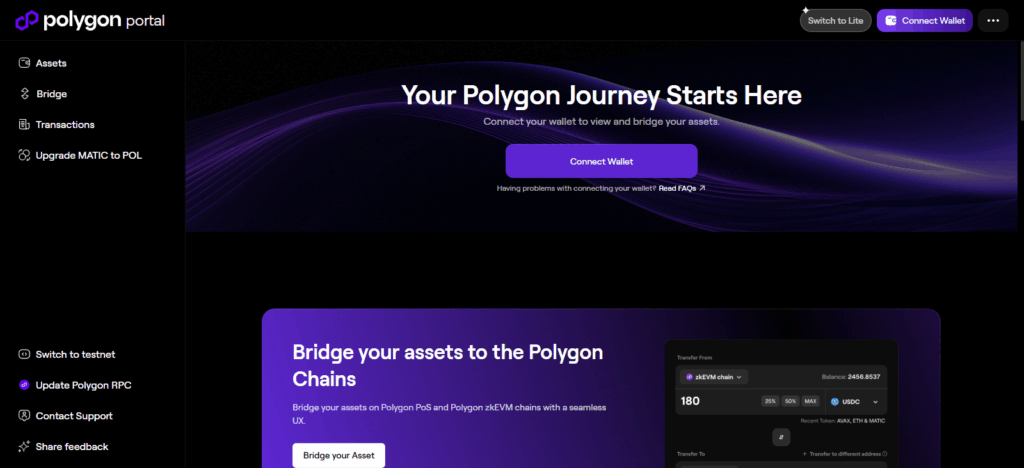

Polygon Bridge

Polygon Bridge stands out among crypto bridges because of its architectural security, speed, and use within the Ethereum ecosystem.

It allows users to swap tokens such as ETH, USDT, and MATIC, in a completely decentralized way, between Ethereum and Polygon. The bridge employs both Proof of Stake (PoS) and Plasma Bridges allowing a seamless and secure transfer to users depending on the transaction’s requirements.

Interoperability between chains should be a priority; Polygon Bridge provides it as a result of reasonable gas fees, high audit confidence in smart contracts, and rapid transaction confirmations.

The bridge makes safe and efficient token swaps due to its user-friendly design coupled with dependable, consistent service.

Avalanche Bridge

Avalanche Bridge is one of the best crypto bridges for secure token swapping due to its innovative security, effectiveness, and customer focus. It allows for near instantaneous transfers of ERC-20 tokens across the Ethereum and Avalanche networks.

Using state-of-the-art Intel SGX hardware to secure enclaves that shields confidential transaction information and private keys, Avalanche provides the utmost security.

It ensures a seamless cross-chain experience with no transfer fees, instant finality, and ease of use. Supporting automated token wrapping offering token swaps without the Avalanche Bridge enhances its transparency and performance reputation.

Key Risks Involved in Token Swapping

Smart Contract Vulnerabilities

Smart contracts operate crypto bridges, and poorly designed contracts and logic errors can lead to vulnerabilities. In previous bridge hacks, hackers exploited these weaknesses to steal assets or mint tokens and evade detection.

Bridge Hacks and Exploits

Cybercriminals target bridges because thousands of assets are floating around. If a bridge’s validation or consensus mechanism is exploited, attackers have instant access to drain the bridge of its assets.

Phishing and Fake Bridge Websites

Scammers often create fake bridge websites that look identical to official ones. Users who connect their wallets or approve transactions on these malicious sites risk losing their funds permanently.

Slippage and Price Volatility

Token prices vary across chains for a variety of reasons. Swaps in poorly liquid markets, and especially in the case of delayed or poorly liquid markets, systems imp to execute slippage in which users are poorly compensated with much less tokens than expected.

Network Congestion and Transaction Delays

When source or destination blockchains are congested, transactions may be stuck or delayed, sometimes for hours. This creates uncertainty and increases exposure to price changes.

Comparison Table of Top Bridges

| Bridge Name | Supported Chains | Security Features | Fees | Speed | Best For |

|---|---|---|---|---|---|

| Arbitrum Bridge | Ethereum ↔ Arbitrum | Ethereum-level security, audited smart contracts, Layer 2 rollup technology | Low | Fast | Low-cost swaps on Ethereum Layer 2 |

| Polygon Bridge | Ethereum ↔ Polygon | Dual security via PoS & Plasma bridges, audited contracts | Low | Fast | Scalable swaps with minimal fees |

| Avalanche Bridge | Ethereum ↔ Avalanche | Intel SGX technology, cryptographic verification, audits | Very Low | Very Fast | Secure high-volume transactions |

| Binance Bridge | BNB Chain ↔ Ethereum | Centralized validation, strong exchange-grade security | Low | Fast | Beginners and exchange users |

| Synapse Protocol | Multi-chain (Ethereum, BNB, Polygon, Avalanche, Arbitrum, etc.) | Decentralized validators, liquidity pool protection | Medium | Moderate | DeFi and liquidity farming users |

| Multichain (AnySwap) | 70+ blockchains | Cross-chain router protocol, smart contract audits | Medium | Fast | Wide multi-chain token support |

| Wormhole Bridge | Solana ↔ Ethereum & others | Guardian network, decentralized verification | Medium | Fast | Solana and cross-ecosystem transfers |

Common Mistakes to Avoid When Swapping Tokens

Using Fake or Unverified Bridge URLs

Using scam URLs and getting caught in phishing scams is a common mistake. Only access bridge sites using official and trusted links, and check the URL a few times before connecting your wallet. Be safe!

Ignoring Smart Contract Audits

Not using security-audited bridges can lead to hacks or losing funds. Confirm if the bridge smart contracts are independently and thoroughly assessed and audited by top firms while checking their bridges.

Selecting the Wrong Network

Sending tokens to the wrong blockchain, for example, using Ethereum instead of BNB Chain can lead to permanently losing your assets. Check source and destination networks to avoid mistakes.

Skipping Small Test Transactions

Avoid swapping large amounts without testing the bridge. Always conduct a tiny test swap first to confirm the bridge and wallet are working properly before transferring any large amounts.

Neglecting Gas Fees and Slippage Settings

Failing to examine the gas fee and slippage tolerance can cause losing a valuable or unworthy swap. Carefully change the slippage to find the best expensive and cheaper swap.

Not Looking Up Token Contract Addresses

Dummy tokens are scams. Before confirming swaps or adding tokens to your wallet, always check token contract addresses from official resources.

Using Insecure or Public Devices

Bridging swaps on shared or malware-infected devices can result in your private keys being exposed. Always use a secured personal device, and you may want to use a hardware wallet for additional protection.

Not Monitoring the Transaction Status

Some users don’t monitor the progress of the swaps, leading to confusion and missed alerts on errors. Always check transaction hashes on blockchain explorers until you receive your tokens.

Bridging Unsupported Tokens

Unsupported tokens on the target network will result in irreversible losses. Always check the bridge’s supported asset list before swaps.

Future of Cross-Chain Token Swapping

Future cross-chain token swaps will become more secure, seamless, and interoperable. The more users work on different networks, the more demand there is for innovative decentralized interoperability protocols.

LayerZero, Chainlink CCIP, and Axelar are places looking to remove trust issues to allow direct and verifiable communication across chains with no middlemen.

Improved smart contract audits along with zero-knowledge proofs and AI-boosted risk detection will improve bridge security and mitigate exploit risk.

Also, more institutional participation on the regulatory side will promote clearer and compliant bridge operations to universal and trustless asset transfers across all blockchain networks.

Conclusion

Ultimately, token swapping on the top crypto bridges necessitates awareness, verification, and safe decision-making.

With the rapid development of blockchain technology, Arbitrum, Polygon, and Avalanche bridges provide fast, inexpensive, and easily accessible cross-chain transfers. More platforms, however, correlate with additional security risks.

To mitigate such risks, users need to check official website URLs, use tested audited bridges, and work with small funds initially and secure their wallets.

Adopting these risk control measures while engaging with trusted and clearly defined bridges allows safe and stress-free cross-chain token swapping.

FAQ

How can I safely swap tokens using a crypto bridge?

To swap safely, always use official and verified bridge URLs, test with a small amount first, check for audits, and verify contract addresses. Use trusted wallets like MetaMask or Ledger, and avoid public Wi-Fi or suspicious links during transactions.

What are the best crypto bridges for safe token swapping?

Some of the most secure and reliable crypto bridges include Arbitrum Bridge, Polygon Bridge, Avalanche Bridge, Binance Bridge, Synapse Protocol, Multichain, and Wormhole Bridge. Each offers strong security, speed, and low fees for cross-chain transfers.

Are crypto bridges safe to use?

Yes, but only when used correctly. Reputable bridges undergo smart contract audits and implement multi-layer security. However, risks like phishing, contract bugs, or hacks still exist—so always double-check the bridge’s legitimacy and avoid new, unaudited platforms.

What fees are involved in token swapping through bridges?

Most bridges charge network gas fees (like Ethereum gas) and a small bridge fee for processing the transfer. Fees vary depending on the blockchain’s congestion and the bridge’s mechanism but are generally lower on Layer 2 solutions like Arbitrum or Polygon.