In this article, I will discuss how to Stake Your Bridged Tokens for Double Rewards, which enables you to earn passive income while utilizing tokens on different blockchains.

- What Are Bridged Tokens?

- How to Stake Your Bridged Tokens for Double Rewards

- Example: Staking of bridged tokens with double rewards

- Step 1: Selecting a Platform

- Step 2: Bridging of Tokens

- Step 3: Wallet Connection

- Step 4: Choosing Token Staking Pools

- Step 5: Depositing Bridged Tokens

- Step 6: Reward Collection

- Step 7: Collect Your Rewards, or Re-stake Them to Maximize Your Yield

- Why Stake Bridged Tokens?

- Benefits Of Stake Bridged Tokens

- Earn Passive Income

- Double Reward Opportunities

- Cross-Chain Flexibility

- Support Network Security

- Compounding Potential

- Portfolio Diversification

- Tips to Maximize Your Earnings

- Risks and Precautions

- Staking relies on smart contracts

- A staking platform that has yet to be audited

- The value of cryptocurrencies

- Delays in bridging tokens

- Staking programs

- Warnings and phishing

- Pros & Cons

- Conclusion

- FAQ

I will break down all necessary procedures and outline suggestions to help maximize earnings and minimize risks, making your staking opportunities as beneficial as possible for your crypto portfolio.

What Are Bridged Tokens?

Bridged tokens are digital currencies that are transferred from one blockchain to another via a bridge protocol, allowing for use across multiple networks. They maintain the original token’s value but are hosted on an alternative blockchain, broadening their accessibility and use case.

For instance, Ethereum tokens can be bridged to Binance Smart Chain or Polygon. Bridged tokens facilitate activities related to decentralized finance (DeFi), staking, and cross-chain trading, thereby providing token holders with numerous ways to generate value while preserving the worth of their tokens.

How to Stake Your Bridged Tokens for Double Rewards

Example: Staking of bridged tokens with double rewards

Step 1: Selecting a Platform

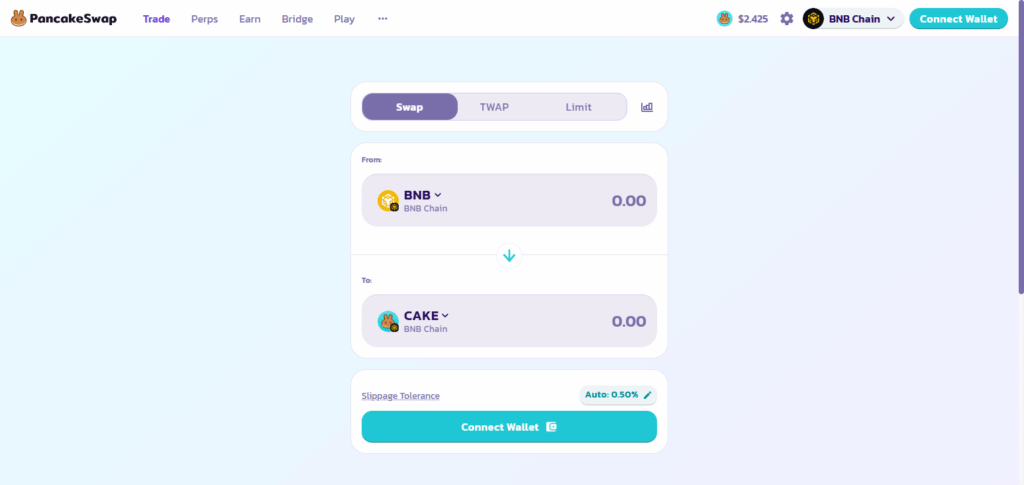

Choose the DeFi or staking platform of your choice that grants access to bridged tokens and offers double rewards. This can be PancakeSwap, Stargate or even Lido.

Step 2: Bridging of Tokens

If your tokens are located on a different blockchain, use a bridge to connect to the network supported by the platform. For instance, bridge Ethereum (ETH) to Polygon as bridged ETH (ETH-P).

Step 3: Wallet Connection

Connect and unlock any supported cryptocurrency wallets, such as MetaMask or Trust Wallet, to the platform. There is a need to make sure that the network aligns with the blockchain of the bridged tokens.

Step 4: Choosing Token Staking Pools

Pick out a staking pool or farm that is compatible with your bridged token and offers double the rewards. This can involve staking a different token on the platform.

Step 5: Depositing Bridged Tokens

Enter the amount of tokens you wish to stake, verify the transaction in your cryptocurrency wallet, and complete the transaction by paying the gas fees.

Step 6: Reward Collection

Collect the rewards periodically. For platforms that provide the option to stake tokens, the chances of earning double rewards can be significantly increased.

Step 7: Collect Your Rewards, or Re-stake Them to Maximize Your Yield

Claim your rewards, or, if you prefer, re-stake your rewards to maximize your overall yield.

Why Stake Bridged Tokens?

Earn Passive Income: Staking bridged tokens enables you to earn reward yields in intervals, hence establishing another passive revenue source.

Double Rewards Opportunities: Some platforms offer additional incentives or “double rewards,” thereby amplifying earnings from staked bridged tokens.

Cross-Chain Utility: Bridged tokens work on different chains which allows access to a broader array of different staking pools and “DeFi” opportunities.

Support Network Security: Staking helps strengthen and secure a blockchain thus contributing to the network’s consensus mechanism.

Compounding Potential: Compounding rewards are achieved by restaking the earned reward tokens which increases overall yield in due time.

Diversification: Staked bridged tokens helps to diversify the crypto portfolio over chains and varied reward systems.

Benefits Of Stake Bridged Tokens

Earn Passive Income

Rewarding tokens will be earned for simply staking.

Double Reward Opportunities

Some platforms offer additional rewards, which can increase profits.

Cross-Chain Flexibility

Tokens can be used on numerous blockchains, providing access to a wide range of DeFi and staking options.

Support Network Security

Staking helps maintain and secure the blockchain network, aiding to decentralization.

Compounding Potential

By re-staking earned rewards, total reward value can be significantly increased.

Portfolio Diversification

Staking bridged tokens reduces risk by spreading investments across chains and reward systems.

Tips to Maximize Your Earnings

Select Pools With the Highest Rewards: Staking pools that offer competitive APYs should also provide double rewards.

Compound Your Rewards: Take your earned rewards and re-stake them to gain from compounding and maximize your returns.

Consider Current Market Conditions: Stake when fees are more economical and rewards are more plentiful to increase your profitability.

Cross-Chain Diversification: Employ bridged tokens on several different blockchains to gain access to unique staking opportunities.

Actively Monitor Major Announcements: Certain platforms may offer bonus rewards or special multipliers that are time-sensitive.

Excessive Lock-Up Avoidance: Only lock tokens when it is strategic to gain more liquidity during the rewards.

Risks and Precautions

Staking relies on smart contracts

All smart contracts have a certain degree of risk. These contracts have possible exploits. Avoid contracts that have not yet been audited.

A staking platform that has yet to be audited

Only use contracts from reputable contracts. Avoid unverified services.

The value of cryptocurrencies

The value of cryptocurrencies and the markets are very volatile. The value of the tokens earned from staking will decrease.

Delays in bridging tokens

Bridging tokens can be a time-consuming process and could have connecting fees. Only use bridging services from reputable websites.

Staking programs

These programs have the potential to hold tokens that are staked for a specified period. Ensure that the tokens can be staked for the specified period.

Warnings and phishing

These internet scams can be extremely malicious. Ensure the webpage to be connected is reputable.

Pros & Cons

| Pros | Cons |

|---|---|

| Earn passive income through staking rewards. | Smart contract vulnerabilities can lead to loss of funds. |

| Opportunity to earn double rewards on some platforms. | Token value may fluctuate due to market volatility. |

| Access to cross-chain DeFi opportunities. | Bridging tokens can involve fees and delays. |

| Supports network security and decentralization. | Some staking programs have lock-up periods, reducing liquidity. |

| Potential for compounding rewards to increase earnings. | Risk of using unverified or unreliable platforms. |

Conclusion

Staking bridged tokens is not only a powerful strategy for generating passive income but also a gateway to appreciating the benefits of cross-chain possibilities. Your crypto profits can appreciate significantly by being selective of reputable platforms, high-reward pools, and double-reward programs.

Staking, however, has its risks, including market volatility, brilliant contract exploits, bridge costs, and token security, which must be mitigated through crypto best practices. Market tokens, through innovative strategic portfolio management and reward staking, can become autonomous income streams, bridged on tokens, with increased value.

FAQ

Can I unstake my bridged tokens at any time?

It depends on the platform. Some staking programs have lock-up periods, while others allow flexible unstaking. Always check terms before staking.

How do double rewards work?

Specific platforms offer additional incentives on top of regular staking rewards, effectively doubling your earnings for participating in particular pools or promotions.

Which wallets support bridged token staking?

Popular wallets, such as MetaMask, Trust Wallet, and Ledger, generally support bridged tokens, but ensure the wallet is compatible with the token’s blockchain network.