I will cover the How to Stake Tokens on Curve, one of the DeFi platforms where users can earn rewards on stablecoins.

- What is Staking Tokens?

- How to Stake Tokens on Curve steps by steps

- Example: Staking USDC on Curve

- Step 1: Connect Your Wallet

- Step 2: Choose a Pool

- Step 3: Deposit Tokens

- Step 4: Receive LP Tokens

- Step 5: Stake LP Tokens

- Step 6: Monitor Rewards

- Step 7: Unstake & Withdraw

- Advantages of Staking in Curve Finance

- Preparation for using Curve Finance

- Download a Web3 Compatible Wallet

- Load Money into Your Wallet

- Study Curve Pools

- Identify the Risks

- Complete Your Protection Measures

- Continue the Learning Process

- Liquidity Staking in Curve Finance

- Maximizing Your Staking Rewards

- Best Place Where Stake Tokens on Curve

- Pros & Cons

- Conclusion

- FAQ

Curve makes it easy for users to earn CRV staking incentives, withdraw governance tokens, and earn passive income, if they deposit their tokens as liquidity. This article will break down the steps of staking on Curve, why it is beneficial, and how to do it safely and effectively to ensure maximum rewards.

What is Staking Tokens?

Staking DeFi tokens involves locking one’s tokens in a blockchain-based network or crypto ecosystem for a variety of functions such as transaction validation, network security, or even liquidity provisioning which is part of the entire blockchain tech process of staking. Users, in turn, gain rewards which could be in the form of new tokens, governance tokens, or a mix of both.

Compared to simple holding, staking is more beneficial as it turns idle assets into cash flow. Depending on the platform, staking encompasses LP tokens, governance tokens, or even the native tokens. It is simple enough for beginners to step into crypto as it rewards them for both network growth and token growth in Decentralized Finance (DeFi).

How to Stake Tokens on Curve steps by steps

Example: Staking USDC on Curve

Step 1: Connect Your Wallet

Go to Curve Finance and link a crypto wallet, like MetaMask, that has USDC and ETH for gas fees.

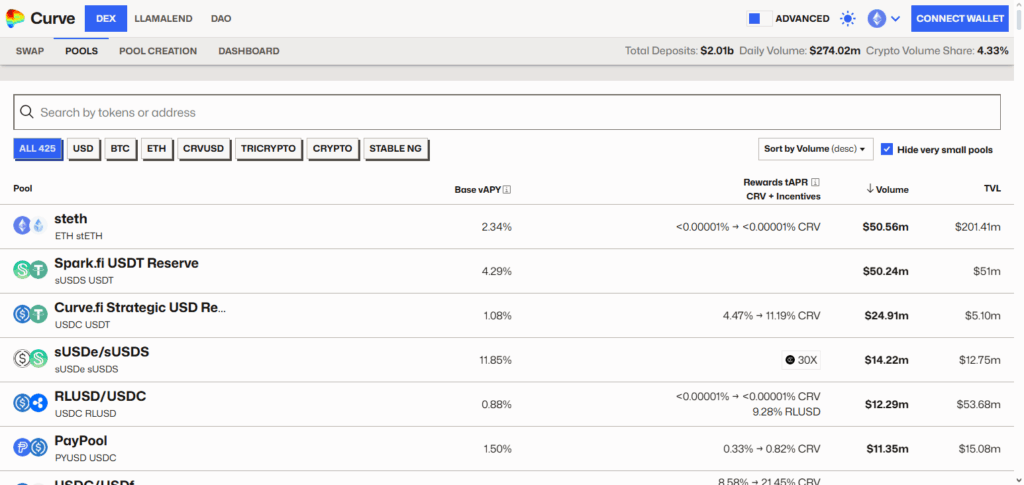

Step 2: Choose a Pool

In “Pools”, select stablecoin pools and tap on “3pool (DAI/USDC/USDT)”.

Step 3: Deposit Tokens

Click on “Deposit” and enter the USDC amount you wish to add. Once you approve the Curve for the tokens to use, you can continue.

Step 4: Receive LP Tokens

Once deposited, Curve will distribute LP (Liquidity Provider) tokens, which signify the portion of the pool you hold.

Step 5: Stake LP Tokens

To stake, click “Stake” and select the LP tokens you wish to stake. Curve will reward you with CRV and sometimes boosted yields for staked tokens.

Step 6: Monitor Rewards

Your dashboard will display the staking rewards, which you can claim instantly or let accumulate.

Step 7: Unstake & Withdraw

Your MetaMask wallet will get the USDC you can withdraw with the LP tokens, and any rewards you earn, which you can staked.

Advantages of Staking in Curve Finance

Earn CRV Rewards ‒ Curve’s native token (CRV) is received as staking incentives.

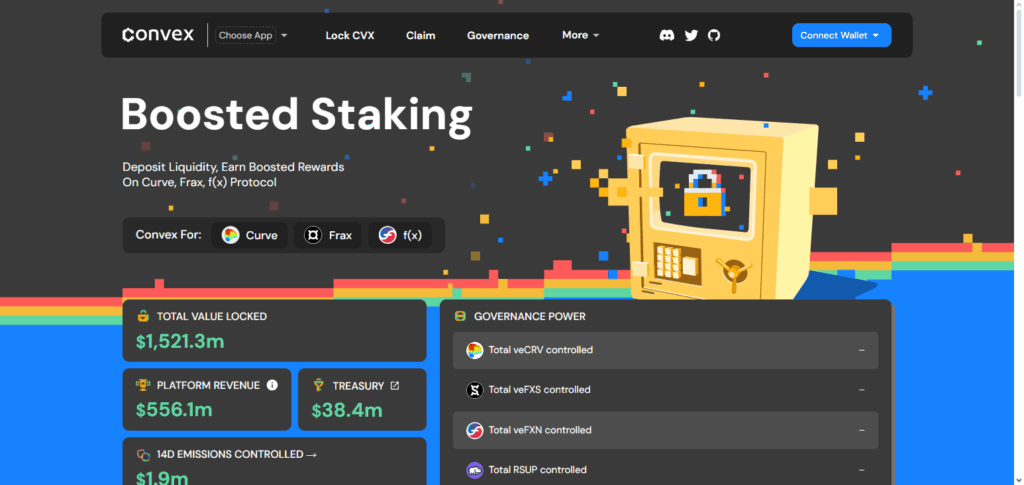

Boosted Yields ‒ By locking CRV or utilizing Convex, users can increase reward multipliers.

Passive Income ‒ Stakers can earn a constant income through the staking of idle tokens.

Governance Rights ‒ Stakers can Vote to Curve’s future decisions which is a right earned from staking CRV.

Stablecoin Focus ‒ Curve’s pools have less volatile risk when compared to other DeFi protocols.

DeFi Integrations ‒ Extra rewards from Convex and Yearn earners.

Flexibility ‒ Stakers can unstake and redistribute funds to other pools.

Preparation for using Curve Finance

A well-defined and organized list of things you need to do before using Curve Finance might look like this:

Download a Web3 Compatible Wallet

- MetaMask, Trust Wallet, and Ledger, among others, are Web3 wallets that you can install.

- Make sure it can work with Ethereum or any other chain that Curve is set up on.

Load Money into Your Wallet

- Fund your Wallet with stablecoins like USDC, USDT, and DAI among other stable tokens worth staking.

- Always keep some Ethereum (or the gas currency of the selected chain) to pay the transactions.

Study Curve Pools

- Along with other decentralized platforms, you can find various pools on the Curve platform.

- Make a decision on the right pool by checking the APYs against the token pairs and reward structures.

Identify the Risks

- Closing Ethereum pools, along with other pools, may be subjected to risks like impermanent loss and other gas fees.

- Only put in money that is not needed, which you are willing to lock up.

Complete Your Protection Measures

- To avoid phishing, check the URL of the official Curve’s website (curve.fi) before any others.

- Keep the 2FA on, or the system can be bypassed completely without 2 factor authentication.

Continue the Learning Process

- Observe the communities’ talks to make sure you don’t miss any from Curve’s “to-do list” updates.

- Look out for any new pools that might be added or any other changes to the rewards system.

Liquidity Staking in Curve Finance

On Curve Finance, users engage in liquidity staking by depositing their tokens, usually stable coins like USDC, DAI, or USDT, in one of Curve’s liquidity pools to earn rewards. When liquidity is added, LP (Liquidity Provider) tokens are given in return which reflect the percentage of the user’s stake in the pool.

These LP tokens can further be staked on Curve or on other platforms like Convex to earn additional CRV tokens, which yield boosted rewards. Plus, the liquidity staking is not the same as just holding tokens.

The former generates income in the form of trading fee income as well as staking rewards. Yet it is also worth emphasizing that there are risks that users need to be aware of, such as permanent loss, vulnerabilities in smart contracts, and gas fees.

Maximizing Your Staking Rewards

Stake LP Tokens via Convex – Stake on Convex Finance for better yields and boosted CRV rewards.

Lock CRV for veCRV – Locking CRV tokens increases staking rewards and CRV governance power.

Select High APY Pools – Allocate funds to better-rewarding Curve pools.

Claim and Reinvest Rewards – Reinvest earned CRV to compound CRV.

Diversify Pools – Invest in several pools to manage risk and increase total yield.

Monitor ETH Gas Fees Over Time – To optimize rewards, carry out your transactions when gas costs are lower.

Stay Updated on Curve Governance – Vote on Curve governance proposals to help control reward and incentive allocation.

Best Place Where Stake Tokens on Curve

Convex Finance

Convex Finance is a defined finance platform that sits on top of Curve Finance and offers additional opportunities for earning rewards by optimizing the staking experience. Convex improves the staking experience by allowing users to CRV token to Curve LP token and then stake it. Users do not have to manually lock the CRV tokens to gain voting power and higher yields.

Even those users who do not want to deal with locking the veCRV would find Convex beneficial as they still get higher returns. Convex has a competitive edge over other platform since it pools the users funds and has most governance power over Curve which helps it to simplify the reward distribution process which makes the platform more attractive to users.

Yearn Finance

Yearn Finance is a yield optimization tool that works with Curve Finance automatially to maximize yield for users that stake tokens. Yearn automates the process of picking pools and strategies by allocating Curve pools and reinvesting the rewards earned to maximize yields.

Yearn stakes tokens on Curve because Curve’s pools concentrated on stablecoins provide stable yield farming returns with a steady supply of liquidity. One unique feature of Yearn is its “vault system”. It not only stakes tokens on Curve but also auto-harvests and compounds rewards, offering users sophisticated strategies without the headache of active management.

Pros & Cons

| Pros | Cons |

|---|---|

| Earn CRV rewards and additional incentives | Gas fees on Ethereum can reduce profits |

| Access to stablecoin-focused pools with lower volatility | Impermanent loss risk in certain pools |

| Ability to boost yields using Convex or Yearn | Smart contract vulnerabilities may exist |

| Passive income from trading fees and staking rewards | Complex for beginners compared to simple staking |

| Governance rights through veCRV locking | Locking tokens reduces liquidity and flexibility |

| Wide DeFi integrations for higher yield strategies | Returns vary depending on pool performance |

Conclusion

To summarize, staking tokens on Curve Finance is a quick way to earn passive income available to even the most beginner DeFi users while contributing to the ecosystem focused on a stablecoin. The users who provide liquidity to the pools and where staking LP tokens get access to governance CRV rewards, boosted yields on Convex and Yearn, and even yield farming.

The opportunities on Curve are unmatched, however, the impermanent loss, smart contract risks, gas fees and stakers loss should not be ignored. Advanced preparation, strategy, and allocation to the right pools can enable you to stake on Curve to earn passive income while keeping your investment security and liquidity.

FAQ

What tokens can I stake on Curve?

You can stake stablecoins like USDC, DAI, and USDT, as well as Curve LP tokens received after providing liquidity.

Do I need CRV tokens to stake?

No, but holding and locking CRV can boost your rewards and give governance rights.

Can I use platforms like Convex or Yearn for staking?

Yes, both Convex and Yearn integrate with Curve to simplify staking and maximize yields.