In this article, I will discuss the How to Stake Tokens on Cross-Chain Pools, which rewards crypto users for supporting several blockchains at a time.

- What Are Cross-Chain Pools?

- Step-by-Step Guide: How to Stake Tokens on Cross-Chain Pools

- Install a Compatible Wallet

- Deposit Tokens

- Connect to PancakeSwap

- Choose a Staking Pool

- Tokens to be Staked

- Check Rewards

- Unstake Your Tokens

- Why Stake Tokens in Cross-Chain Pools?

- Prerequisites for Staking on Cross-Chain Pools

- Supported Wallet

- Supported Tokens

- Minimum Reserve Fund

- Understanding the Set Fees

- Understanding the Pool

- Tips to Maximize Staking Rewards

- Risks and Considerations

- Smart Contract Vulnerabilities

- Network and Bridging Risks

- Market Volatility

- Impermanent Loss

- Liquidity Constraints

- Popular Cross-Chain Staking Platforms and Pools

- Future of Cross-Chain Staking and Pools

- Final Thoughts

- FAQ

Besides increasing liquidity and yield opportunities, cross-chain staking also makes portfolio diversification easier. With the correct instructions and reputable sources, users will be able to participate and earn rewards in these innovative DeFi pools efficiently.

What Are Cross-Chain Pools?

Cross-platform pools are decentralized liquidity pools that allow users to stake or provide tokens on multiple blockchain networks at the same time. While traditional staking or single chain pools provide very little flexibility per blockchain, cross-chain pools enable interaction across multiple blockchains, allowing users to earn substantially more.

Cross-platform liquidity pools utilize custom-built cross-chain protocols and strategic asset cross-chain bridges to move staked tokens across blockchains. These protocols ensure the staked tokens do not lose value while gaining rewards.

Cross-platform pools allow users to hold various tokens in one place while simultaneously providing better yields on staked tokens. This makes cross platform bouls highly attractive for seasoned crypto investors.

Step-by-Step Guide: How to Stake Tokens on Cross-Chain Pools

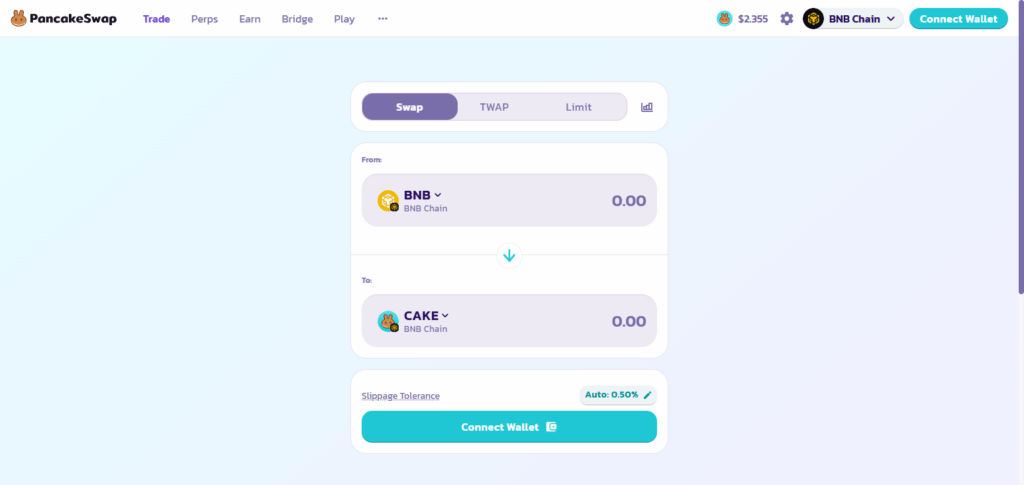

As an example, let us use PancakeSwap:

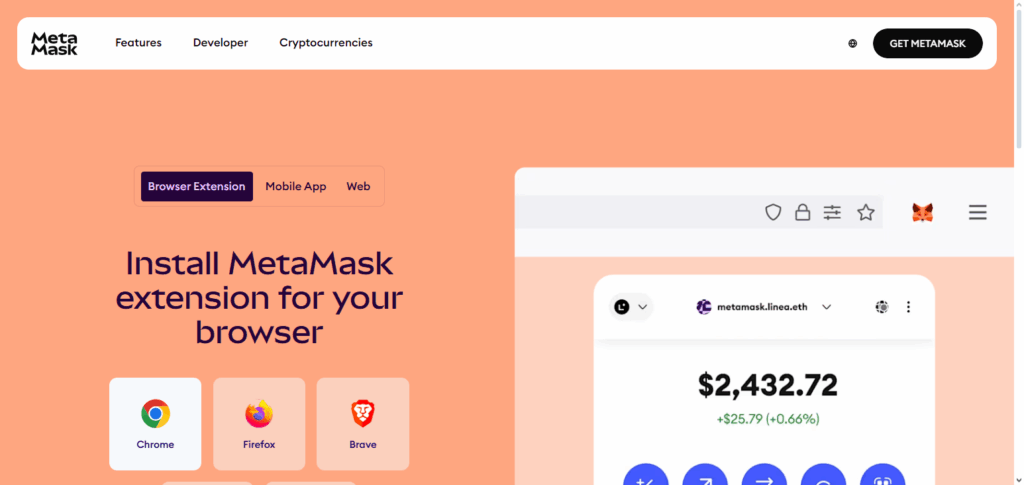

Install a Compatible Wallet

Connect the wallet to the Binance Smart Chain. Install a wallet such as MetaMask.

Deposit Tokens

Ensure to have BNB for transaction fees as well as CAKE or other wallet tokens.

Connect to PancakeSwap

Visit the PancakeSwap official platform and connect your wallet.

Choose a Staking Pool

Pick the desired cross-chain pool or Syrup Pool to stake your CAKE tokens on.

Tokens to be Staked

Confirm the wallet transaction and enter the amount you wish to stake.

Check Rewards

Visit PancakeSwap’s dashboard for the staked tokens and the rewards you’ve accumulated.

Unstake Your Tokens

Blocks and withdrawal limits according to the pool’s contract apply, as well as other fees.

Why Stake Tokens in Cross-Chain Pools?

Cross-chain pools offer several advantages for crypto holders:

Higher Yields: Cross-chain pools tend to offer more lucrative returns as a result of pooled liquidity and different token offerings.

Diversification: Users are able to allocate capital across different blockchains and not rely on a single chain, thus diversifying risk.

Access to Liquidity: Cross-chain pools allow for partial withdrawals or flexible staking, thus more liquidity and freedom on capital.

Support Blockchain Interoperability: Participants help blockchains talk to each other more fluidly.

Compound Rewards: Staked tokens may also earn interest or extra tokens, amplifying returns.

Prerequisites for Staking on Cross-Chain Pools

Supported Wallet

You need a wallet that can hold cryptocurrencies with multiple blockchains and cross-chain protocols, these wallets can include MetaMask, Trust Wallet, and Phantom.

Supported Tokens

Each cross-chain pool only allows certain tokens, always check the cross-chain pools to know which tokens you can stake.

Minimum Reserve Fund

You need to have the minimum tokens staked, and you also need extra tokens reserved to cover the transaction fees.

Understanding the Set Fees

There are certain fees you will need to familiarize yourself with, these include, the network fees, bridging fees, and then the later

Understanding the Pool

You will want to check the pool’s APY, the smart contracts supported, and the general reputation so that you know how to mitigate the risks.

Tips to Maximize Staking Rewards

Picking the Right APY Pool: Analyze all the cross-chain pools to determine the yields they offer—choose the highest yields and determine the risk priority associated with it.

Spread Your Tokens: Cross-chain pools offer unique rewards for staking tokens and those rewards vary between pools. For safety and better earning potential it’s advisable to stake in multiple cross pools.

Consistent Evaluation: Monitor the tokens staked and the rewards accrued and if the APY changes, or the network condition changes, be prepared to shift your strategy.

Restake Your Rewards: A great way to compound interest is to restake your rewards and rapidly increase your tokens accrued.

Avoid Rush Hour: Fewer transactions on the network means fewer fees—this is the ideal time to stake your funds and increase transaction fluidity for the entire network.

Risks and Considerations

Smart Contract Vulnerabilities

Loss of funds can happen through bugs or exploits of the pool’s smart contract. These types of pools have to be used with smart contracts that are well audited and reputable.

Network and Bridging Risks

The movement of tokens between different blockchains requires bridges and these bridges can be hacked or have technological issues.

Market Volatility

The value of staked assets and the value of rewards can decrease in value because of volatile movements in the token’s price.

Impermanent Loss

Providing liquidity in cross-chain pools results in rolling losses which are awful price changes between the paired tokens.

Liquidity Constraints

Some pools may impose lock-up periods or offer penalties to people who withdraw funds before the specified date, making it impossible to access those funds.

Popular Cross-Chain Staking Platforms and Pools

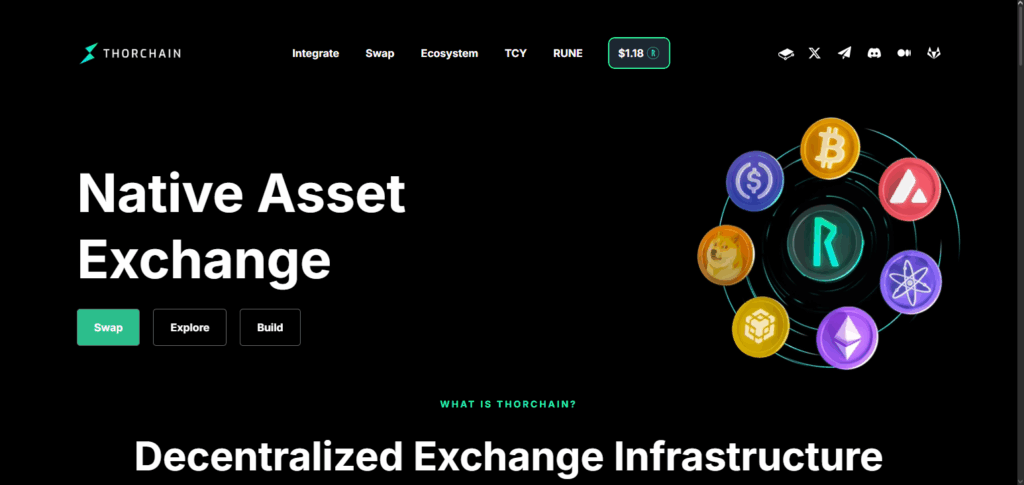

Thorchain (RUNE)

Thorchain (RUNE) is a leading cross-chain staking platform that allows effortless swaps and cross-chain liquidity without a centralized exchange. The platform’s germane decentralized liquidity network is what propels it to the forefront of user’s caché. RUNE token holders supporting cross-chain transactions earn staking rewards by supporting the network.

Unlike traditional pools, Thorchain’s continuous liquidity protocols make it easy to covert liquidity with very little slippage and enhanced security. Investors seeking efficient, interoperable, and high-yield cross-chain staking opportunities consider it to be a one of a kind platform.

THORCHAIN (RUNE) Features

- Decentralized Liquidity Network: Users can perform swaps through several blockchains without a central intermediary.

- Cross-Chain Staking Rewards: Users can stake RUNE tokens and earn staking rewards while maintaining network liquidity.

- Minimal Slippage and Real time Transactions: Assets are securely converted in a speedy manner within the Continuous Liquidity Protocol with little slippage.

Anyswap (Multichain)

Multichain, previously known as Anyswap, is one of the foremost platforms for cross-chain staking, allowing token transfers and liquidity provision across multiple blockchains. Its ease of use is partly a function of the decentralized bridging technology providings users with secure, instant, and trustless cross-chain swaps.

Cross-chain token stakers, in addition to earning rewards on their staked tokens, help enable interoperability between a diverse range of blockchains. Stakers will appreciate Anyswap (Multichain) for its advanced security, competitive fees, and extensive blockchain ecosystem, as well as the straightforward cross-chain staking options.

Anyswap (Multichain) Features

- Decentralized Cross-Chain Bridge: Token transfers across a multitude of blockchains can be done in a secure, trustless, and speedy fashion.

- Staking Rewards: Users can stake their tokens and earn rewards while promoting interoperability.

- Extensive Blockchain Support with Low Fees: Cost-effective and scalable cross-chain solutions are available across a wide number of networks.

Future of Cross-Chain Staking and Pools

The future of cross-chain staking and pools looks highly promising alongside the blockchain interoperability pivoting most attention in the crypto ecosystem. The rise in DeFi and multi-chain network adoption makes staking for liquidity more seamless with better yields and less friction.

Security innovation and automation in contract auditing and yield optimization will certanily boost staking interoperability user confidence. Enhanced project multi-chain integrations will unlock more cross-chain flexible staking options that will certainly amplify crypto portfolio value.

Final Thoughts

Staking tokens on cross-chain pools is a great innovative method to earn rewards, diversify holdings, and promote blockchain interoperability. Understanding the prerequisites, picking reliable platforms such as Thorchain, PancakeSwap and Anyswap (Multichain), as well as methodically following the staking steps, will help users earn the most with the least amount of risk.

Thoughtful monitoring, reinvesting rewards, and staying updated on the network’s progress are essential to long-term success. Cross-chain staking has great profit potential and reflects a smart choice in the growing DeFi world.

FAQ

How do I start staking tokens in a cross-chain pool?

Set up a compatible wallet, ensure you hold eligible tokens, choose a trusted cross-chain pool, deposit your tokens, and confirm the staking transaction.

Can I unstake my tokens anytime?

Unstaking depends on the pool’s rules. Some pools allow flexible withdrawals, while others may have lock-up periods or penalties.

What are the risks of cross-chain staking?

Risks include smart contract vulnerabilities, bridging issues, impermanent loss, market volatility, and network fees.