In this article, I will explore safe staking of crypto on the best DeFi platforms to earn passive income.

- What Is Crypto Staking?

- How to Stake Crypto Safely on the Top DeFi Platforms

- Example: How to Stake ETH Safely on Lido Finance (Step-by-Step)

- Step 1: Research and Choose a Trusted Platform

- Step 2: Set Up a Secure Wallet

- Step 3: Connect Your Wallet to Lido

- Step 4: Choose the Amount to Stake

- Step 5: Confirm the Transaction

- Step 6: Monitor Your Rewards

- Step 7: Stay Secure and Informed

- Top DeFi Platforms for Safe Crypto Staking

- Expert Tips for Safe and Smart Staking

- Staking on Reputable and Audited Platforms

- Full Control of Your Private Keys

- Staking With Small Amounts

- Staking Portfolio Diversification

- Smart Contract Addresses

- Keep Track of Platform Announcements

- Know The Terms of Lock-up and Unstaking

- Maximum Security with a Hardware Wallet

- Common Mistakes to Avoid While Staking

- Not Considering the Security and Audit of a Platform

- Staking on Platform with the Promise of “Guaranteed Profits”

- Not Having a Safe Staking Strategy

- Not Understanding the Unstaking Timelines and Withdrawal Policies

- Using Unsecured or Custodial Wallets

- Not Verifying Smart Contract Addresses

- Future of DeFi Staking

- Conclusion

- FAQ

I will cover reliable staking platforms, essential practices, and strategies to defend your cash from loss. Beginners and seasoned investors alike can use this guide to stake efficiently and safely.

What Is Crypto Staking?

Staking is the practice of locking a specific amount of cryptocurrency in a blockchain network for a period of time in cryptocurrency networks to validate transactions and keep the network secure.

For participating in staking, validators receive rewards in the cryptocurrency equivalent to an interest payment on a traditional savings account.

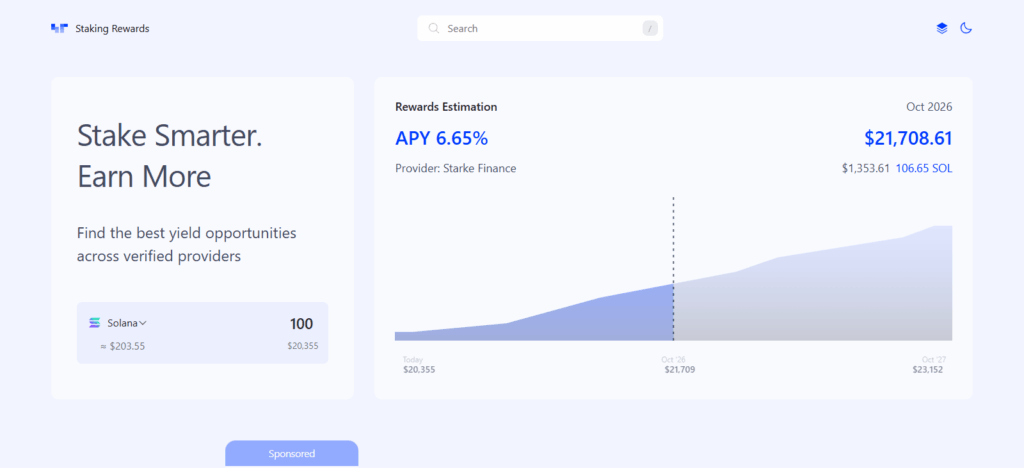

Staking is commonly associated with Proof-of-Stake (PoS) protocols and cryptocurrencies such as Ethereum, Cardano, Solana, and Polkadot. Since PoS systems depend on validators instead of costly energy-draining miners, more cryptocurrency is staked, more validators are chosen and more rewards are distributed.

Unlike mining, staking cryptocurrency consumes no energy, permits individuals to earn with little involvement, and enhances the degree of decentralization of the blockchain network.

There are two basic forms of staking—custodial staking, in which a staking service provides a centralised exchange and handles everything for you, and non-custodial, or DeFi staking, in which you control everything pertaining to your cryptocurrency through staking smart contracts.

Staking cryptocurrency safely and profitably entails choosing credible staking platforms and understanding the staking fundamentals in cross-chain slashing.

How to Stake Crypto Safely on the Top DeFi Platforms

Example: How to Stake ETH Safely on Lido Finance (Step-by-Step)

Step 1: Research and Choose a Trusted Platform

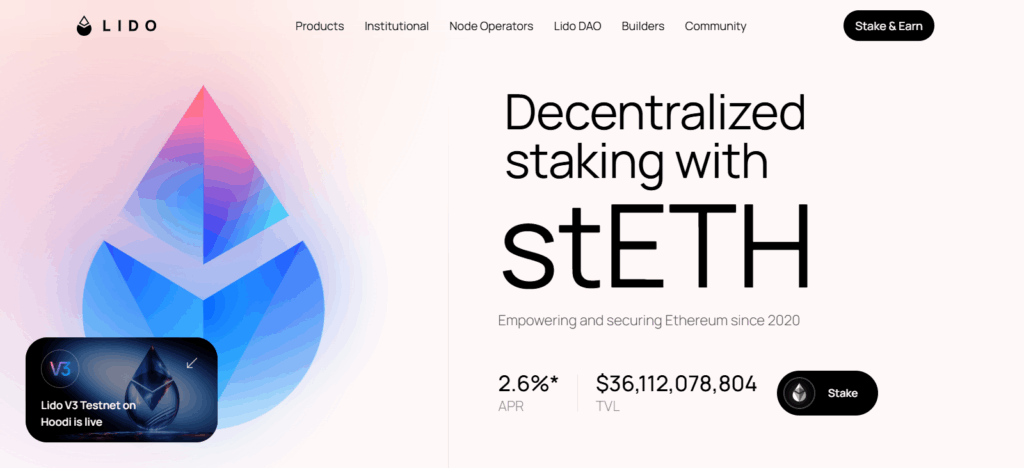

Before staking, research the DeFi platform. Lido Finance is one of the most reputable and audited DeFi staking protocols for Ethereum. It allows users to stake ETH and earn rewards while maintaining liquidity through a token called stETH. Always verify the official website URL (https://lido.fi) to avoid phishing scams.

Step 2: Set Up a Secure Wallet

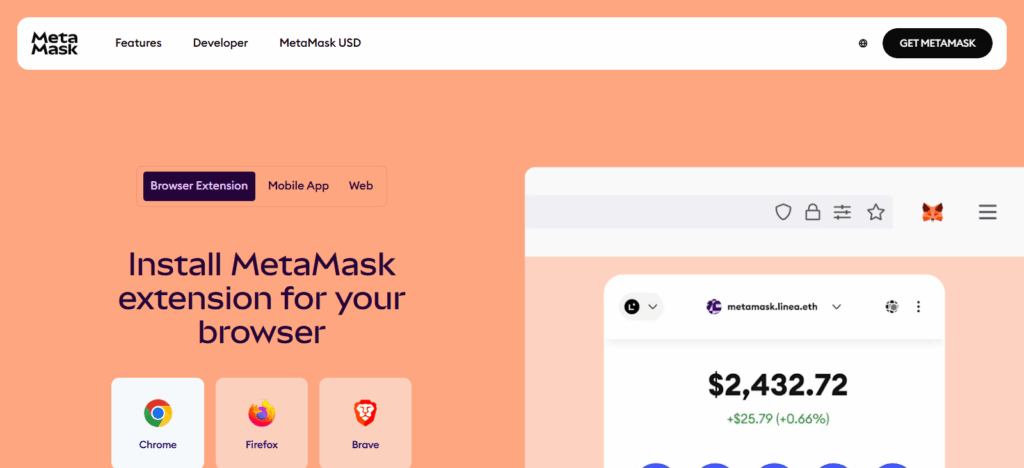

To interact with Lido, you need a non-custodial wallet like MetaMask or Ledger. Install the wallet, create a strong password, and securely store your seed phrase offline. Never share your private keys with anyone or store them on the internet.

Step 3: Connect Your Wallet to Lido

Visit the official Lido Finance website and click on “Stake Now.” Connect your wallet (e.g., MetaMask) by approving the connection request. Ensure the site is legitimate before confirming any connection to avoid connecting to fake sites.

Step 4: Choose the Amount to Stake

Decide how much ETH to stake. If this is your first time, it’s wise to start small. Lido will give you an estimate of your staking rewards and the amount of stETH tokens you will earn.

Step 5: Confirm the Transaction

To submit your transaction, click “Submit” or “Stake,” and confirm the action through your wallet. You will be charged a gas fee to complete this action. After this is done, your ETH will be reserved for staking and you will receive stETH tokens that will be proof of your staked ETH.

Step 6: Monitor Your Rewards

You will receive your staking rewards and earn rewards automatically. This will increase your stETH balance every day. You can monitor your rewards in your wallet or Lido dashboard. The great advance stETH is that it still liquid, allowing you to earn rewards and use in for DeFi lending or trading.

Step 7: Stay Secure and Informed

Glad to see all your staking rewards. Make sure to also monitor your wallet settings. Update your wallet, disconnect and activate your 2FA, and watch for unauthorized links. Check for updates or risks from Lido’s official accounts. Monitor and adjust your staking and DeFi attack vectors.

Top DeFi Platforms for Safe Crypto Staking

Aave

Aave is highly regarded in the DeFi space for safe crypto staking due to its excellent governance framework and security measures. Built on Ethereum, Aave provides users the opportunity to stake AAVE and earn rewards.

AAVE stake holders also support protocol safety by providing liquidity insurance through the Safety Module (an insurance policy against liquidity shortfalls).

What sets Aave apart from the crypto market is its outstanding security features—audited smart contracts, a real-time risk management framework, and governance by the users through a DAO (Decentralized Autonomous Organization).

Aave is backed by its performance and community and is a go-to protocol for safe and reliable crypto staking.

Rocket Pool

Rocket Pool is a first-tier DeFi platform that ensures safe and secure crypto staking while making Ethereum staking more decentralized and accessible.

Users can stake ETH with as little as 0.01 ETH while also having complete control over their assets since they are not custodial contracts. Staking power is also distributed within the community as opposed to just being concentrated with a few entities thanks to the platform’s unique node-operator model.

Audited and open-source smart contracts also provide transparency and security. Lastly, the platform is equipped with the RPL token which is protective and rewarding, making it one of the most secure and trusted DeFi staking platforms.

Yearn Finance

Yearn Finance ranks as one of the safest DeFi platforms for crypto staking, providing automated yield optimization using the smart Vaults system.

It lets users stake ETH, stablecoins, and other tokens and automatically reallocates the staked funds to the most lucrative and safest DeFi protocols. Staking strategy automation and transparency are what sets Yearn Finance apart—staking strategies are designed by veteran members of the community and then passed for decentralized governance approval.

Smart contracts on the platform are routinely audited for security, and funds are always non-custodial, keeping user control intact. Yearn Finance is an excellent option for smart, low-risk staking and is recognized as one of the safest crypto staking platforms available.

Expert Tips for Safe and Smart Staking

Staking on Reputable and Audited Platforms

Stake crypto on only well-known and audited DeFi platforms. Aave, Lido, and Rocket Pool are examples of verified protocols which conduct audits on their systems and are transparent about minimizing hacking risks, and smart contract failures.

Full Control of Your Private Keys

Use non-custodial wallets, like MetaMask and Ledger, to keep your private keys. Control your seed phrase and do not store your seed phrase online to keep your assets safe. A lost seed phrase means lost assets.

Staking With Small Amounts

To begin staking, maintain a small portion of your holdings on staking platforms. This not only helps in gaining operational knowledge of the platform, but also helps in limiting potential exposure. This is particularly useful in more expensive platforms to avoid large user error losses.

Staking Portfolio Diversification

Putting all your funds in a single platform or token increases risk exposure. Smart contract bugs, and token price volatility is mitigated by holding different DeFi projects.

Smart Contract Addresses

Address verification is a must before connecting your wallet, or staking on a platform. DeFi platforms have fake clones designed for scamming purposes. Only verified smart contact addresses on the platform website should be used.

Keep Track of Platform Announcements

Monitor Twitter, Discord, or Telegram for communications on changes to the protocol, software upgrades, and security alerts. Being attentive gives you the ability to respond to threats quickly and efficiently.

Know The Terms of Lock-up and Unstaking

Always read a platform’s staking conditions, paying close attention to any mentions of lock-up periods, withdrawal penalties, or cooldowns. Being informed helps to avoid nasty surprises in terms of liquidity when you need access to your funds.

Maximum Security with a Hardware Wallet

For the longest staking periods, hardware wallets, such as Ledger and Trezor, are the best option as they keep your assets securely offline, safe from any form of online attack.

Common Mistakes to Avoid While Staking

Not Considering the Security and Audit of a Platform

Most newbies stake crypto on high-return platforms without considering the risk involved. If the platform security is weak or the smart contracts are flawed, the funds could be lost forever. Therefore, always ensure to do independent security audits and check for community trust before staking.

Staking on Platform with the Promise of “Guaranteed Profits”

Extremely high APYs may be attractive and is guaranteed to be a scam or an unstable protocol. Staking on platforms promising “guaranteed.” profit is most likely a scam or an unstable protocol.

Not Having a Safe Staking Strategy

Putting all your crypto into one staking platform or token increases risk. If the platform fails or the token price drops, you could lose everything. Diversify across multiple assets and platforms to stay safer.

Not Understanding the Unstaking Timelines and Withdrawal Policies

Some DeFi platforms require you to lock your tokens for a fixed time. If you must access funds, it could create a liquidity issue. Thus, it is always a good idea to checkout the unstaking timelines and withdrawal policies of a staked platform.

Using Unsecured or Custodial Wallets

When you stake using custodial wallets or exchanges, you are relinquishing control over your private keys. If the exchange gets hacked, your assets are compromised. Instead, opt for non-custodial wallets and keep the keys stored offline and in a safe place.

Not Verifying Smart Contract Addresses

Scam websites can closely imitate real DeFi services. Before you approve any wallet transactions, ensure you check official URLs and contract addresses.

Future of DeFi Staking

As the global adoption of blockchain technology develops, the outlook for DeFi staking will only improve. Flexible and accessible innovations like restaking solutions, liquid staking, and cross-chain interoperability will also work to improve staking ease for every user.

More and more users are wanting to use DeFi for peace of mind and passive income as Ethereum 2.0 and other Proof-of-Stake networks are gaining popularity. More clear regulations will increase user confidence.

As DeFi protocols improve and focus on safer audited smart contracts, staking will improve on the aspects of ecosystem efficiency, security, and sustainability.

Conclusion

Staking cryptocurrency on leading DeFi platforms could be a great source of passive income while providing a valuable service on blockchain networks—but prioritizing safety is important.

Reducing smart contract and scam risks is as simple as choosing audited and reputable options like Aave, Lido, Rocket Pool, and Yearn Finance.

Keep private keys safe, avoid concentrating the value of your staked assets on a single platform, and understand the risks of platforms. Knowing how a system operates and keeping your assets secure will yield uninterrupted rewards. Gains in DeFi arise from careful and responsible staking.

FAQ

What is the safest way to stake crypto on DeFi platforms?

The safest way to stake crypto is by using audited, well-established platforms such as Aave, Lido, or Rocket Pool. Always connect through official websites, use non-custodial wallets, and never share your private keys.

Can I lose my crypto while staking on DeFi platforms?

Yes, staking involves some risks such as smart contract vulnerabilities, platform hacks, or token price drops. Choosing verified platforms, diversifying assets, and staying informed significantly reduces these risks.

How do I know if a DeFi staking platform is legitimate?

Check for independent security audits, transparent governance, and an active community presence. Avoid platforms offering unrealistic APYs or lacking verifiable information about their team and contracts.