This article is focused on How to Stake Binance USD for Yield . Staking BUSD provides opportunities for crypto holders to earn passive income by ‘parking’ their stablecoins on reputable investment platforms.

- What is Staking Binance USD?

- How to Stake Binance USD for Yield

- Let’s take a look at staking Binance USD (BUSD) for yield step by step for Binance Earn:

- Create and Verify Your Binance Account

- Deposit BUSD

- Navigate to Binance Earn

- Select Staking Plan

- Enter Amount

- Confirm and Start Staking

- Monitor and Claim Rewards

- How Staking Works for Binance USD

- Tips to Maximize Yield

- Risks and Considerations

- Alternatives to BUSD Staking

- Pros & Cons

- Conclusion

- FAQ

I will focus on the step by step yield processes and strategies, important risks, and other critical factors to keep in mind to help grow your reserve BUSD for the year 2025.

What is Staking Binance USD?

Staking Binance USD involves putting your stablecoin into a protocol or platform to gain passive rewards over time which is earning yield without doing any additional work.

In contrast to other cryptos which are very volatile, BUSD which is the Binance USD is pegged to the US dollars meaning it’s relatively lower risk.

Users, by staking, are providing liquidity to centralized exchanges like Binance or DeFi, which markets then slice to lenders, traders or liquidity pools. Users receive interest or rewards for their liquidity, which, is a low risk method to grow crypto holdings.

How to Stake Binance USD for Yield

Let’s take a look at staking Binance USD (BUSD) for yield step by step for Binance Earn:

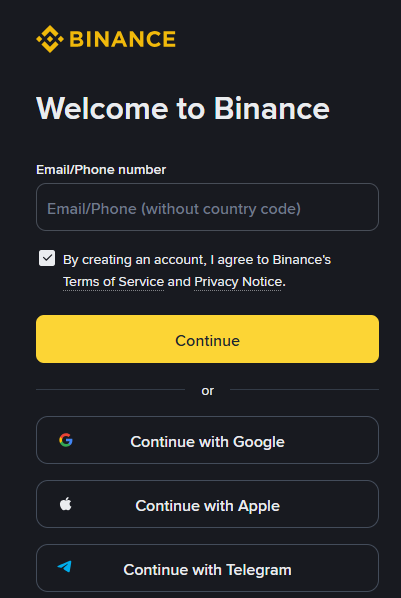

Create and Verify Your Binance Account

During the registration process, complete the specified KYC requirements and ensure the account has 2FA enabled for increased security.

Deposit BUSD

Either transfer BUSD from your external wallet or buy BUSD directly from Binance.

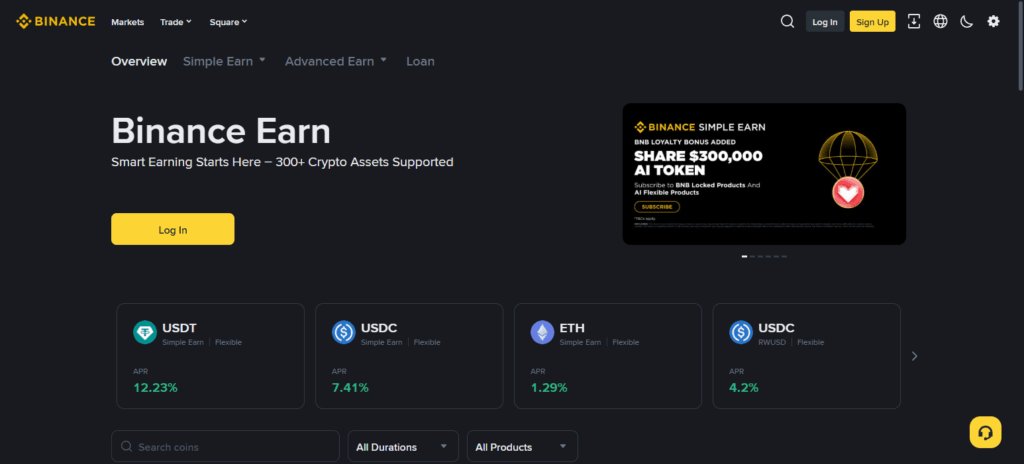

Navigate to Binance Earn

Under “Earn,” look for “Flexible Savings” or “Locked Staking” for BUSD which to select.

Select Staking Plan

Based on your liquidity and yield preference, select a flexible or fixed-term plan.

Enter Amount

Indicate how much BUSD you wish to stake.

Confirm and Start Staking

Your BUSD will start earning interest right away.

Monitor and Claim Rewards

Rewards are conveniently tracked on Binance. They can be taken out or reinvested.

How Staking Works for Binance USD

Choose a Platform: Consider dedicated centralised exchanges like Binance Earn. Alternatively, consider a DeFi platform. In either case, focus on reliability and security.

Deposit BUSD: Send your Binance USD to the designated wallet provided on your staking platform.

Choose a Staking Plan: Flexible staking (easily withdraw your funds at any time) and fixed-term staking (higher yield but your funds are locked for a certain time) are the two options for your staking plan.

Earn Rewards: The platform lend your BUSD for trading and then generates interest or yield.

Claim or Compound: Your rewards are claimable at set intervals which can be put towards reinvesting to increase your overall earnings.

Tips to Maximize Yield

Compare Platforms

Assess interest rates and the reputation of various exchanges and DeFi platforms.

Flexible and Fixed Plans

Utilize flexible staking for liquidity and flexible term staking for maximum gains.

Rewards

Earn rewards and reinvest them for increasing returns.

Multi-Platform Diversification

Allocate your BUSD to several platforms to lower risk and enhance your overall yield.

Housekeeping

Keep track of market conditions, platform changes, and staking promotions that you can use to your advantage.

Risks and Considerations

Platform Risk

Centralized exchanges have the potential to be hacked, encounter technical glitches, and go out of business, and DeFi platforms can have weaknesses in their smart contracts.

Liquidity Risk

As a result of fixed-term staking locking your BUSD, your assets will be inaccessible in the event a crisis arises or in the event of a favorable trading environment.

Regulatory Risk

Stake operations and withdrawal activities may be impacted should there be any changes in crypto regulations.

Yield Changes

Interest fluctuations as a result of increased market demand may undermine the anticipated returns.

Security Gaps

Protecting your assets behind any walls is the first step, and storage wallets along with two-factor authentication safeguards (where applicable) should be additionally deployed.

Alternatives to BUSD Staking

Yield Farming

Contribute Binance USD (BUSD) to liquidity pools on some decentralized finance (DeFi) protocols and receive rewards in different tokens.

Lending Platforms

Centrally and Decentralized lending platforms allow you to lend BUSD and charge a borrower’s interest.

Liquidity Pools

Earn transaction fees by contributing BUSD to certain trading pairs on DeFi platforms in Automated Market Makers (AMMs) like Uniswap or PancakeSwap.

Stablecoin Swaps

Engage in the protocols of stablecoin swap where you supply and get liquidity and the protocol provides chances for earning rewards.

Cross-Platform Strategies

Balance the income from liquidity staking and lending for the income to be broad. This increases income and return.

Pros & Cons

| Pros | Cons |

|---|---|

| Earn passive income with minimal effort | Fixed-term staking can lock funds for a set period |

| Lower volatility since BUSD is a stablecoin | Platform or smart contract risks (hacks, bugs) |

| Flexible staking options allow withdrawals anytime | Yield rates may fluctuate over time |

| Can compound rewards to maximize returns | Regulatory changes may impact staking operations |

| Accessible to beginners with simple setup | Limited growth potential compared to higher-risk crypto assets |

Conclusion

Staking Binance USD (BUSD) is approachable for people looking to earn passive income in cryptocurrency. The income earned from staking can be maximized by picking the covering risks.

Though limited liquidity is frustrating and the instant access to funds is restricted for staked funds, BUSD staking is still the preferred method for creating and growing stablecoin holdings. Fixed staking is easy for both youngsters and advanced investors & in the crypto currency earning funds is simple.

FAQ

How often are staking rewards distributed?

Rewards can be distributed daily, weekly, or at the end of the staking period, depending on the platform.

Is staking BUSD safe?

Staking BUSD is relatively safe due to its stablecoin nature, but platform, smart contract, and regulatory risks still exist.

Can I withdraw my BUSD anytime?

Flexible staking allows withdrawals anytime, but fixed-term staking may lock your funds until the end of the period.

How can I maximize my staking yield?

Compare platforms, diversify staking options, compound rewards, and monitor promotions to increase returns.