This article explains How to Pay Taxes on Crypto Staking Rewards. When you participate in a blockchain network, you earn rewards for ‘staking’, however, these rewards count as taxable income in most jurisdictions.

- Understanding Crypto Staking Rewards and Taxes

- How to Pay Taxes on Crypto Staking Rewards

- Example: Paying Taxes on Staking Rewards from Ethereum 2.0

- Step 1: Identify Staking Rewards

- Step 2: Determine Fair Market Value (FMV)

- Step 3: Calculate Taxable Income

- Step 4: Report on Tax Return

- Step 5: Pay Taxes

- Step 6: Keep Records

- When should I recognize income from my staking rewards?

- Tips for Accurate Tax Filing

- Accounting For Rewards

- Automating Tax Reports

- Accounting For Your Income

- Understanding Applicable Laws

- Using Professional Services

- Periods For Keeping Documents

- Common Mistakes to Avoid

- Failing to Report Small Rewards

- Not Separating Rewards from Other Crypto Income

- Ignoring Fair Market Value

- Not Keeping Tax Dates

- Ignoring Cross-Chain or Multiple Wallets

- Not Keeping Records

- Pros & Cons of Reporting Crypto Staking Rewards

- Conclusion

- FAQ

Knowing when to recognize rewards, their fair market valuation and how to report them remains key to compliance. This guide takes you through a clear, step-by-step process to help you accurately file your taxes.

Understanding Crypto Staking Rewards and Taxes

Crypto staking rewards describe what cryptocurrency holders earn for engaging in the proof-of-stake (PoS) system or other consensus mechanisms on the blockchain networks. When users stake their tokens—locking them in a network wallet for transaction validation and network security—users help in the blockchain and, therefore, earn more tokens as rewards.

Tax-wise, most countries see rewards as income and, therefore, taxable at the moment of receipt, which is the fair market value of the tokens. Rewards also incur taxes when sold, exchanged, or converted to fiat currency as a capital gains tax on the difference between the sale value and the value at receipt.

Penalties and audits may arise from tax authorities for rewards wth poor documentation on amounts, staking dates, and market values. Local laws affect tax treatment, so obtaining specialized crypto tax software or prompts is worth your while. Understanding this will help in tax compliance and correctly analyzing benefits from staking.

How to Pay Taxes on Crypto Staking Rewards

Example: Paying Taxes on Staking Rewards from Ethereum 2.0

Step 1: Identify Staking Rewards

- Assume you staked 10 ETH in Ethereum 2.0 and earned 0.5 ETH as rewards in one year.

- Make a note of each reward in a logbook or spreadsheet.

Step 2: Determine Fair Market Value (FMV)

- Determine the USD value of ETH for each period you received rewards.

- Example: 0.5 ETH × 2,000=2,000=1,000 taxable income.

Step 3: Calculate Taxable Income

- 0.5 ETH = $1,000.

- For tax purposes, you’ll treat this as part of your annual income.

Step 4: Report on Tax Return

- Report it as “Other Income” or “Crypto Income” as applicable according to your tax forms.

Step 5: Pay Taxes

- Tax it according to your income bracket.

- For example, with a 20% tax, you owe $200.

Step 6: Keep Records

- Keep transaction history and FMV calculations.

- These will be useful in audits.

When should I recognize income from my staking rewards?

Rewards received from staking cryptocurrencies are taxable income, received, and accounted for on the date credited to your account, and not when sold, and/or exchanged. Most revenue agencies consider staking income ordinary income.

For example, receiving an ETH during staking earns 1 ETH at $2,500, $2,500 is taxable income at the receipt. If you go on to sell or exchange the ETH, the IRS expects payment for the value it received during the staking period and the value at sale determined at $2,500.

Poor record-keeping and taxable income received on the receipt and the sale can incur penalties for failure to report. Each country has its own specific regulations, and, therefore, tax professionals’ advice and/or crypto tax software are justified as means to ensure exemption.

Tips for Accurate Tax Filing

Accounting For Rewards

Note when and how staking rewards are received and document their fair market value to keep an accurate record.

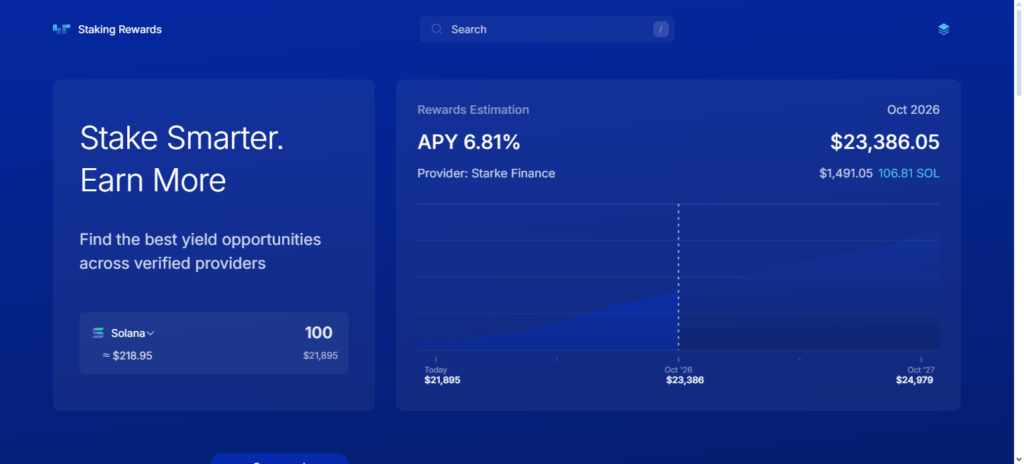

Automating Tax Reports

Tax software provided by CoinTracker and Koinly can help automate calculations and create reports.

Accounting For Your Income

Clearly show staking rewards which are considered income and then later selling or trading as capital gains.

Understanding Applicable Laws

Stay compliant and informed about the applicable crypto tax laws in your jurisdiction.

Using Professional Services

For complex staking or cross-chain rewards, professional guidance ensures accuracy.

Periods For Keeping Documents

For audit reasons, keep records in the form of screenshots, exchange statements, and wallets.

Common Mistakes to Avoid

Failing to Report Small Rewards

No matter the size, all staking rewards are taxable and need to be reported.

Not Separating Rewards from Other Crypto Income

Staking rewards should be kept separate from profits made from trading to prevent miscalculations.

Ignoring Fair Market Value

Using wrong values of the tokens when assessing receipt time will cause faulty reporting.

Not Keeping Tax Dates

Tax reporting hinges on when rewards are received. Not keeping these dates will cause mistakes.

Ignoring Cross-Chain or Multiple Wallets

Rewards from different networks or wallets must all be included.

Not Keeping Records

Not having transaction history will give complications in audits and compliance.

Pros & Cons of Reporting Crypto Staking Rewards

| Pros | Cons |

|---|---|

| Ensures compliance with tax laws and avoids penalties or audits | Reporting can be complex and time-consuming |

| Builds accurate financial records for personal and business use | May increase taxable income, leading to higher taxes |

| Helps maintain transparency with authorities and financial institutions | Tracking rewards across multiple wallets or chains can be challenging |

| Facilitates easier reporting of future capital gains when rewards are sold | Requires careful record-keeping of dates, amounts, and fair market value |

| Provides peace of mind knowing you are legally compliant | May require investment in crypto tax software or professional assistance |

Conclusion

Taxes must be paid on crypto staking rewards to avoid penalties. Compliance, record keeping, determining fair market value at the time rewards are received, and correct reporting on the return are the keys to well-placed and verified taxation.

Documenting the fair value rewards and using crypto tax software minimizes the complexity. For complex situations, record keeping and tax specialists streamline the process. Although it may seem complicated at first, there are multiple simple steps to follow tax obligations while gaining responsibly and legally from staking.

FAQ

Are crypto staking rewards taxable?

Yes, in most countries, staking rewards are considered taxable income at the fair market value when received.

When should I recognize staking rewards as income?

Income should be recognized at the time the rewards are credited to your wallet, not when you sell or exchange them.

How do I calculate taxes on staking rewards?

Multiply the amount of rewards by their fair market value in fiat currency at the time of receipt, then apply your applicable income tax rate.

Do I owe capital gains tax on staking rewards?

Yes, if you sell or exchange the rewards later, any increase in value from the time received may be subject to capital gains tax.