In this article I will cover How To Keep Track of Bridged Tokens in a safe and efficient manner. Bridged tokens are cross chain tokens and their monitoring can be difficult.

- What Are Bridged Tokens?

- How To Keep Track of Bridged Tokens

- Example: Monitoring USDC Bridges from Ethereum to Arbitrum

- Use A Multi Chain Wallet

- Track the Bridge Transaction

- Label & Bookmark Your Assets

- Use Portfolio Trackers

- Create Alerts (If Needed)

- Prevent Confusion with Token Wrappers

- Benefits of Bridged Tokens

- Best Practices for Secure Tracking

- Challenges in Tracking Bridged Tokens

- Common Mistakes to Avoid

- Pros & Cons

- Conclusion

- FAQ

In this article, you will learn dependable methods and useful tools for maintaining your bridged assets and avoiding recurring mistakes in cross-chain token monitoring.

What Are Bridged Tokens?

Bridged tokens refer to digital currencies moved from one blockchain to another through a bridging protocol. The process of bridging tokens locks the original tokens on the source chain while spawning a corresponding value on the destination chain, allowing for cross-chain interoperability.

Through bridged tokens, users can utilize decentralized applications and services across multiple blockchains without diminishing not realizing the value of the token. As with most things, however, there are security issues with bridged tokens. They are managed with decentralized contracts which makes tracking and managing the tokens secure, which introduces problems of loss or fraudulent activity.

How To Keep Track of Bridged Tokens

Example: Monitoring USDC Bridges from Ethereum to Arbitrum

Use A Multi Chain Wallet

- You were using Defendant’s wallet and were connected to Rabby or Zerion that auto-detects assets across chains and display balances without switching.

- These wallets display balance on Arbitrum with no manual switching needed.

Track the Bridge Transaction

- Upon bridging, you paste the transaction hash on Hop Protocol.

- You check status on:

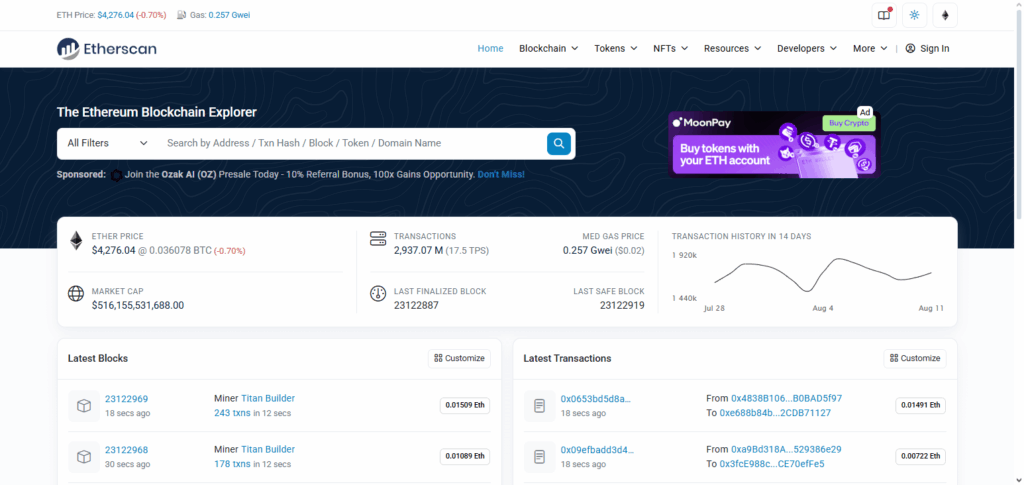

- Outgoing Ethereum transaction on Ether’s scan link: Etherscan

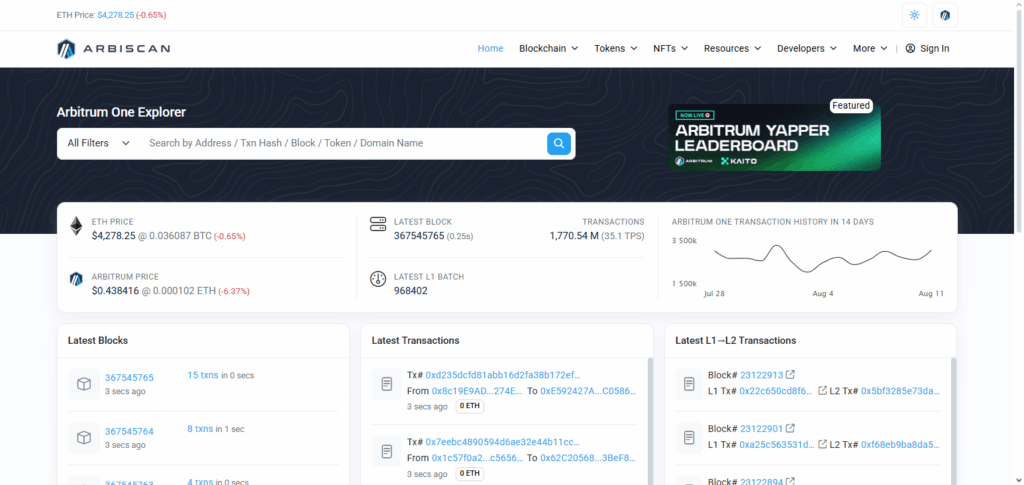

- Incoming Arbitrum transaction on Arbiscan link: Arbiscan

- You verify the USDC is on Arbitrum in around 5 minutes.

Label & Bookmark Your Assets

- In Rabby, the tagged bridged USDC is marked “Arbitrum USDC (Hop)” for easy identification.

- Also, bookmarks the bridge dashboard for easy access later.

Use Portfolio Trackers

- Adds wallet on DeBank or Zapper

- These showcase bridged assets across chains providing information on the value, protocol, and network.

Create Alerts (If Needed)

- For received and sent bridging activities, you can set alerts on Telegram or email through DefiLlama and BridgeWatcher.

Prevent Confusion with Token Wrappers

- You confirm USDC on Arbitrum is not a wrapped or synthetic version, but the canonical one.

- To guard against fake or duplicated assets, you ensure to verify the token contract addresses.

Benefits of Bridged Tokens

Cross-Chain Interoperability: Facilitates the fluid movement of assets across different blockchains.

Increased Liquidity: Provides access to liquidity pools on different networks.

Access to Diverse dApps: Usage of tokens across multiple chains is supported.

Portfolio Diversification: Investors can diversify their portfolios across different ecosystems without liquidating assets.

Enhanced Trading Opportunities: Enables trading and arbitrage across various registries.

Supports Blockchain Innovation: Integrates separate blockchains which stimulate the development and collaboration of the ecosystem.

Best Practices for Secure Tracking

Verify the Token Contracts and Bridges: Always check that you are interacting with the right token contract addresses and well-known bridges.

Use Protected Wallets: Prefer hardware wallets or vetted multi-chain wallets with solid security.

Track Transactions Constantly: Consistently monitor token balances and check the transaction history across all connected chains.

Monitor Notifications: Configure notifications for abnormal activities, such as suspiciously large transfers.

Perform Regular Maintenance: Update wallets and tracking tools to the newest versions for patching vulnerabilities.

Avoid Losing the Private Keys: Never give out the private keys or seed phrases to anyone.

Challenges in Tracking Bridged Tokens

Numerous Blockchains: Each distinct network has its own explorers and standards which makes tracking through various tokens difficult.

Token Obfuscation: Extensive Procedures may make it difficult to determine the status of the original token.

Token Bridge Trust Issues: Possible mistakes may exist due to reliance on outside bridges, introducing the possibility of errors and fraud.

Log Inequality: For some monitoring tools, balances and transactions may be updated in a non-uniform manner, resulting in tracking blocks.

Semi Automated Addition: A number of bridged tokens may be manually added, wallets, and monitoring tools.

Withdrawal Lag: Temporarily enduring confusion may happen due to increase in time it takes to do cross-chain transfers.

Non-uniform Delay: There may be distinct time standards across different blocks which would result in errors and latency.

Common Mistakes to Avoid

Skipping Token Contract Validation: Neglecting verification of the correct token contract might result in monitoring spoofed tokens.

Using Only One Tracking Service: Also known as “one tool syndrome,” this could lead to your requirements being mismatched with the tool, resulting in your tokens being classified as obsolete.

Disregarding Security of the Bridge: Assuming the presence of a secure or anonymous bridge without verification heightens the chances of asset theft.

Failing to Monitor Constantly: If transactions and balances are not checked routinely, problems may go unnoticed.

Disclosing Private Keys or Seed Phrases: A very serious security problem by giving away tokens control.

Failing to Perform Updates: Older versions may lack essential security improvements.

Pros & Cons

| Pros | Cons |

|---|---|

| Enables cross-chain interoperability | Complex to track across multiple blockchains |

| Increases liquidity and trading options | Reliance on third-party bridges introduces risks |

| Access to diverse decentralized applications | Possible delays in cross-chain transactions |

| Facilitates portfolio diversification | Wrapping/unwrapping processes add complexity |

| Supports blockchain ecosystem growth | Risk of losing tokens due to bridge vulnerabilities |

Conclusion

In conclusion, monitoring your crypto bridged tokens is critical to ensuring your crypto assets are managed securely across multiple blockchains.

Practicing secure habits, understanding the bridging complexities, using reliable portfolio trackers, and verifying token contracts all contribute to confident monitoring. Being proactive with the right resources and maintaining vigilance prevents loss while optimizing cross-chain potential in the current blockchain landscape.

FAQ

What are bridged tokens?

Bridged tokens are assets transferred from one blockchain to another via a bridge, allowing cross-chain use without losing value.

Why is it important to track bridged tokens?

Tracking helps ensure your tokens are safe, avoid loss, and keep an accurate portfolio overview across multiple blockchains.

What tools can I use to track bridged tokens?

Popular tools include multi-chain portfolio trackers like Zapper, Zerion, and Debank, as well as blockchain explorers for individual networks.