I will Cover the How to Invest with a Bank Brokerage Account, from opening an account to funding it to making selections of investments, managing risks, and monitoring a portfolio.

- Understanding Bank Brokerage Accounts

- How to Invest with a Bank Brokerage Account

- Example: Investing Through a Bank Brokerage Account

- Step 1: Opening a Bank Brokerage Account

- Step 2: Adding Funds to Your Account

- Step 3: Explore Investment Opportunities

- Step 4: Making and Executing the Order

- Step 5: Investment Monitoring

- Step 6: Adjustments and Rebalancing (If Needed)

- How to Choose the Right Bank for Your Brokerage Account

- Benefits of Invest with a Bank Brokerage Account

- Placing Your First Investment

- Managing Risks and Fees

- Understand Fees and Commissions

- Diversify Your Portfolio

- Set Investment Limits

- Use Stop-Loss Orders

- Monitor Market Trends

- Regular Portfolio Review

- Leverage Bank Tools

- Monitoring and Adjusting Your Investments

- Tips for Successful Investing Through a Bank Brokerage

- Pros & Cons

- Conclusion

- FAQ

Whether a beginner or an experienced investor, one will be able to make smart financial decisions and increase their wealth effortlessly through the safety and ease of a banking tailored investment platform.

Understanding Bank Brokerage Accounts

A bank brokerage account is an account offered by banks to their customers permitting to purchase, sale and hold an array of investments like stocks, bonds, mutual funds and ETFs.

Unlike a traditional saving or checking account, a bank brokerage account is not designed to simply store money, rather focuses investment growth.

Most of bank brokerage accounts have a frictionless bank account integration, adding ease to money transfers and fund management.

Additional services provided include investment research, personalized guidance, and sometimes even access to advisors. Ideal for long term wealth accumulation, bank brokerage accounts cater to investors of any skill level given their controlled, safe environment.

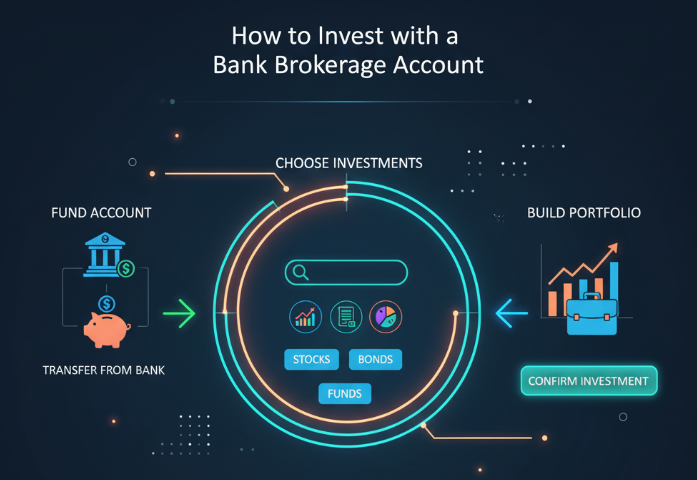

How to Invest with a Bank Brokerage Account

Example: Investing Through a Bank Brokerage Account

Step 1: Opening a Bank Brokerage Account

- Find a bank with a brokerage service.

- Fill out a form and provide documents like identity cards, proof of address, and tax details, which can be submitted online or in a branch.

Step 2: Adding Funds to Your Account

- Move funds from your savings or checking account to your brokerage account.

- Make sure you don’t fall below any account minimum balance.

Step 3: Explore Investment Opportunities

- Utilize bank resources to find a suitable stock that meets your criteria.

- Evaluate performance history and trends and analyst ratings.

Step 4: Making and Executing the Order

- Select a stock, specify the shares or money to be invested, and select from market or limit order.

- Click the trade and check the review fees and confirmation.

Step 5: Investment Monitoring

- Use bank resources to regularly monitor the stocks.

- Use alerts to notify you whenever the price or dividends changes.

Step 6: Adjustments and Rebalancing (If Needed)

- Every so often, check your portfolio.

- Maintain the desired risk or reward ratio by buying, selling, or diversifying.—

How to Choose the Right Bank for Your Brokerage Account

Reputation and Reliability: Choose a bank with good financial health and positive reviews from its users.

Fees and Commissions: Analyze the different account management fees, trading rates, and other hidden fees.

Investment Options: Check if the bank offers necessary investments such as stocks, bonds, ETFs, or mutual funds.

Account Features and Tools: Seek for automated investments, portfolio tracking, and research tools.

Customer Support: Verify availability of assistance via telephone, online chat, or in-person.

Integration with Existing Accounts: Seamless transfers between checking, savings, and brokerage accounts.

Minimum Balance Requirements: Check the required initial deposit and minimum balance to avoid unnecessary fees.

Benefits of Invest with a Bank Brokerage Account

Here are the Advantages of Working with Bank Brokerage Accounts:

Regulation and Security: Investment with bank brokerage accounts are well protected and are highly regulated.

Convenient Fund Management: Bank brokerage accounts are able to integrate to checking and savings accounts for smooth bank transfers.

Research and Tools Access: Most banks with brokerage accounts allow investment tracking, and many other analytics and investment research.

Increased Investment Options: Including bank stocks, other bonds, and other different investments like stocks, ETFs, and mutual funds are bank investments.

Professional Guidance: Bank and other certified advisors provide bank-level automated investment support.

Record Keeping and Reporting: All the bank reports and tax statements are easily organized and can easily be retrieved.

Building Wealth: Allows investment and long term portfolio growth which helps strengthen economic power with time.

Placing Your First Investment

Investing is easy as long as your bank brokerage account is funded and ready. Define your investment objectives and tolerance to risk and examine investment alternatives like stocks, ETFs, and mutual funds on your bank’s trading engine.

Then, choose the investment you want and fill in the trade specifics, like how much you want to buy and how many shares, before confirming the transaction. Ensure that there is no charge on any additional payment and review the fees before confirming the order.

Many banks now offer features like automated contributions and recurring investments that make the task of building a portfolio very easy. Your portfolio needs to be aligned with your financial objectives and thus, needs to be monitored periodically.

Managing Risks and Fees

Understand Fees and Commissions

Know the trading fees, account servicing charges, and even ‘invisible costs’ so that there are no nasty shocks.

Diversify Your Portfolio

Allocate funds in different asset classes so that the risk is minimized.

Set Investment Limits

Don’t have too much exposure on a single stock or single sector.

Use Stop-Loss Orders

Automatically sell an investment once it hits a set price. This limits the loss incurred.

Monitor Market Trends

Know the changes in the market that could potentially impact your investment.

Regular Portfolio Review

Rebalance once in a while so that the level of risk is within your desired range.

Leverage Bank Tools

Analyze, set alerts and manage the risk the bank provided.

Monitoring and Adjusting Your Investments

Regular Portfolio Review: Schedule periodic checks on your investments and their performance.

Track Investment Returns and Dividends: They may also include all return analysis aswell as the income earned and the overall appraisal of the portfolio.

Review Investment Plans: Study and analyze all the necessary plans on finances tha t people advertise.

Rebalance Your Portfolio: Portfolio should be reallocated and adjusted to the appropriate risk.

Reminders: utilize all your bank notifications of relevant and timely price moves as well as alerts on necessary timelines.

Analytical Research: Use the performance metrics and relevant research bank.

Adjustment of Investment Mandate: Investment decisions should be inline and on point with market decisions aswell as the set objectives and acceptance levels.

Tips for Successful Investing Through a Bank Brokerage

Define Your Financial Goals: Determine how and by when you want to get to your objective.

Determine Your Risk Tolerance: Invest in options you are most comfortable with.

Ensure Portfolio and Investment Visibility: Make sure you have investments in different assets in your portfolio to minimize risk.

Implement Investment Policy Guidelines: Use the investments policy portfolio weighed on risk and the analyses of your bank.

Rebalance Your Whole Portfolio Frequency: Monitor the bank and the investments over time.

Manage the Risk: Stay on the path of the recommended risk policy and avoid emotions.

Take the Easy Risk: Accept and invest, plus add plans with a bank relation to minimize risk on the money.

Pros & Cons

| Pros | Cons |

|---|---|

| Secure and Regulated: Investments are protected and regulated by authorities. | Fees and Commissions: Some accounts charge trading or maintenance fees. |

| Convenient Fund Management: Easy transfers between bank and brokerage accounts. | Limited Investment Options: May have fewer alternatives compared to standalone brokerages. |

| Access to Research Tools: Banks provide analytics, reports, and expert guidance. | Potential for Lower Returns: Conservative bank investment options may yield slower growth. |

| Professional Support: Advisors or automated guidance available for investors. | Minimum Balance Requirements: Some accounts require initial deposits or ongoing minimums. |

| Streamlined Record-Keeping: Simplifies tracking, statements, and tax reporting. | Slower Trade Execution: Some banks may have slower platforms compared to specialized brokerages. |

Conclusion

Having a bank brokerage account is safe, easy to use, and all the necessary support is provided. With the use of a bank, understanding the fees and investment options, a client can create a goals-aligned, diverse portfolio.

Consistent evaluation and recuperation, along with the bank’s research tools, assist in managing risks. Investments can be, through scheduled banks, use of market savvy principles with discipline and wise choice, bring about the maximization of value for future use.

Excellent investment goals can be reached easily with the help of a bank brokerage account. With consistency and non impatiently, financial goals can also be achieved.

FAQ

What types of investments can I make?

You can invest in stocks, bonds, ETFs, mutual funds, and sometimes other assets, depending on your bank’s offerings.

Are my investments insured?

Investments are not insured like bank deposits, but most bank brokerages are regulated, and cash holdings may be protected up to certain limits.

How do I manage fees and risks?

Monitor trading fees, account charges, and diversify your portfolio. Use stop-loss orders and bank-provided tools to manage risk.

Can I invest online through my bank?

Yes, most banks provide online trading platforms, mobile apps, and research tools to manage and monitor your investments.

How often should I review my investments?

Regularly review your portfolio—at least quarterly—to ensure it aligns with your financial goals and rebalance when necessary.