In this article, I will talk about How to Invest in Crude Oil. By the end of the blog, you’d be able to know oil stocks, oil ETFs, and oil futures, along with some important elements to check before investing.

- What is Crude Oil?

- How to Invest in Crude Oil

- Step 1: Choose Your Investment Type

- Step 2: Open a Brokerage Account

- Step 3: Fund Your Account

- Step 4: Research the ETF

- Step 5: Place Your Order

- Step 6: Monitor Your Investment

- Step 7: Set Exit and Risk Management Strategies

- Why Invest in Crude Oil

- How much money do you need to invest in oil?

- Factors to Consider Before Investing

- Is investing in oil safe?

- Tips for Beginner Investors

- Start Small

- Diversify Your Portfolio

- Stay Abreast

- Risk Management

- Avoid rash decisions

- Set definite goals

- Common Mistakes to Avoid

- Conclusion

- FAQ

If all steps are followed properly, the new investors would be able to get started with great confidence in the international crude oil market.

What is Crude Oil?

Crude oil starts as petroleum oil that contains heavy complex of hydrocarbon. Oil is in a liquid state that occurs naturally in the earth. Oil is a base material used to make products such as gas, diesel, jet fuels and used as a base to make other products such as plastics, chemicals and lubricants.

Oil comes in different varieties as qualitof Ore oil depends on where it is extracted from. Oil is divided in two categories based on the sulfur present and the density of oil which is considered light and heavy.

Oil is considered a world trade and impacts the economy if the world. It is because of oil that the prices of energy and productions of industries are determined in addition to oil, it affects the geopolitical of the world.

Oil prices are determined and highly susceptible to changes in quos supply and demand. Also, they are affected by geopolitical situations, and the wild expectations from the market.

How to Invest in Crude Oil

To help beginners new to investing, this is a clear, step-by-step example of how to invest in crude oil using oil ETFs.

Step 1: Choose Your Investment Type

Pick an oil ETF (for example, the United States Oil Fund – USO) to invest in for a low-risk, beginner level strategy.

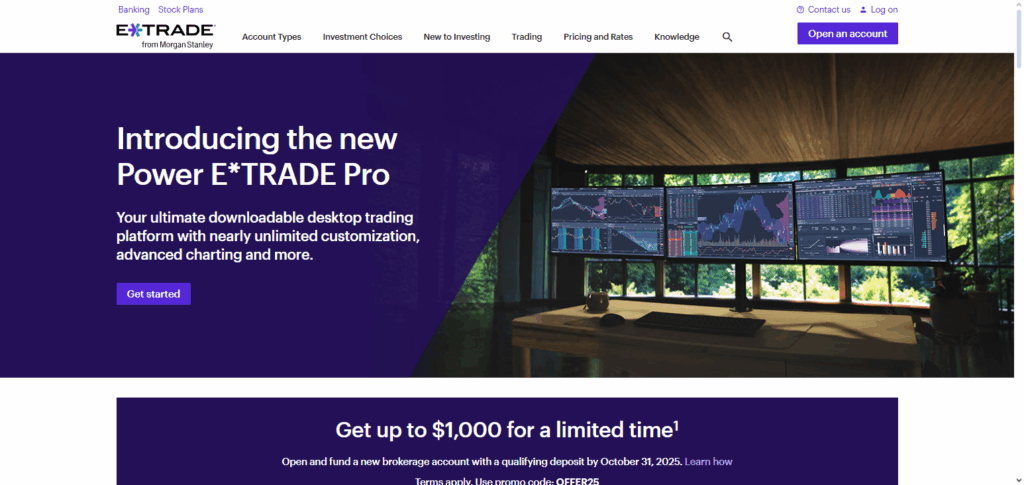

Step 2: Open a Brokerage Account

Sign up with a well-established online brokerage that offers ETF trading, like Robinhood, E*TRADE, or Fidelity.

Step 3: Fund Your Account

Invest the amount you are prepared to spend, with beginner-friendly amounts being \$500–\$1,000.

Step 4: Research the ETF

Examine the ETF’s holdings, past performance, expense ratio and other trends surrounding crude oil.

Step 5: Place Your Order

Use your brokerage account to purchase shares of the ETF for the market price or with a limit order.

Step 6: Monitor Your Investment

Keep an eye on world oil prices, market news, and the performance of the ETF. Shift your strategy if the situation calls for it.

Step 7: Set Exit and Risk Management Strategies

Put a plan in place with profit or stop-loss levels to minimize your downside, and protect your capitol.

Why Invest in Crude Oil

Here are the reasons why invest in crude oil for a beginner’s understanding:

High Return Potential – Like any other commodity oil is traded and the price fluctuates. Investors who know the ups and downs are the ones who collect the most profit.

Portfolio Diversification – If you currently only deal in bonds and stocks, adding oil will give you a different asset class.

Hedge Against Inflation – If the value of the asset is affected, nine times out of ten oil is most likely to be the asset that protects the value.

Global Demand Growth – Trends in renewable energy are positive, and oil is a dominant source of energy, hence it will always be in demand.

Opportunities Across Investment Types – Depending on the risk you are willing to take, you can buy stocks, ETFs, bonds, or mutual funds.

How much money do you need to invest in oil?

The option you select will determine the amount of money you will have to invest in oil:

Oil Stocks – Shares from major companies like ExxonMobil and Chevron range from $50 to $150, therefore you can invest in oil stocks with as little as the price of a single share.

Crude Oil ETFs – ETFs such as USO and BNO can be traded for $20-50, meaning you would only need a couple of hundred dollars to invest.

Oil Mutual Funds – Mutual Oil Funds require a minimum investment in the range of $500-1,000 to be made, dependant on the specific fund.

Futures Contracts – Highly speculative Futures Contracts can be traded for a margin of $5-10,000, meaning thousands of dollars are needed as a minimum to trade one single contract.

Commodity Trading Platforms – These platforms with fractions of trades are available for $100-500, but are much more risky due to the leverage.

Factors to Consider Before Investing

Market trends and price volatility – Due to global shifts in supply and demand and other important conditions in the oil market, the price of oil changes frequently. It is important to study the price change movement of oil.

Geopolitical risks – Wars , political changes, sanctions and instabilities in the area where oil is produced greatly affect the price of oil.

Economic indicators – The demand and the price of oil is influenced by the growth of the global economy, industrial production, and the consumption of oil.

Investment horizon and risk tolerance – Decide if you are investing for short term profit, or for the long-term growth. Remember, the volatility of crude oil is high.

Investment method – Each of the investment types, be it stocks, mutual funds, ETFs, or futures have different levels, costs, and liquidity of risk.

Regulatory and tax implications – Compliance with local laws for some investments may come with tax consequences.

Is investing in oil safe?

Every penny invested in oil can have benefits but can also lead to losses, therefore investment in oil as an asset class cannot be termed as “safe” in any metric. The potential for profit quickly vanishes with regard to investing in oil bonds, stocks, or ETF’s as futures can have high levels of volatility.

Just as with any investment, oil investments also necessitate caution and proper diversification. Capital which cannot be lost and money which cannot be tolerated in case of losses should be steered clear. In oil investment, risk management, stop losses, tapering protocols and other softer risk management then investment size should be used. If done correctly, profit can be realized.

Tips for Beginner Investors

Start Small

It would be wise to make an initial investment as oil stocks or ETFs to understand how the market works.

Diversify Your Portfolio

You should not only focus on oil; rather, it would be best to invest in many other areas to minimize your overall risk.

Stay Abreast

It is important to always monitor the world’s oil prices, geopolitical happenings, and economic data that change or affect the supply and demand.

Risk Management

It is advisable to implement some stop-loss limits, and avoid high-risk investments, such as futures.

Avoid rash decisions

Instances of price hikes and drops should not make you change your investment plan.

Set definite goals

Spelling out particular goals – i.e. whether it is short-term trading or long-term growth – will greatly help your strategy.

Common Mistakes to Avoid

Over-Leveraging in Futures – Too much of borrowed capital in oil futures can result in immense losses when prices turn unfavorable.

Ignoring Market Research – Investing without understanding global oil trends, understanding of oil supply and demand, and geopolitical risks can make for poor choices.

Chasing Short-Term Gains – Listening to noise in the market and attempting to buy and sell oil on every price increase almost always results in losses.

Lack of Diversification – Should you invest in oil exclusively, you increase your overall risk for an investment.

Emotional Trading – Fear and greed can make the execution of a sound strategy very difficult more so than the actual strategy’s execution.

Ignoring the Impact of Fees and Costs – A profits gradual diminish due to excessive trading fees, management fees, and rollover fees in oil futures.

Conclusion

Buying crude oil can bring in new growth potential along with deeper diversification opportunities in a portfolio. But along with new opportunities it also possesses a fair share of risks stemming from changing market conditions along with political and economic changes.

New investors should look at smoother alternatives like oil stocks and ETFs, study instantly shaped patterns, and manage risks.

Proper risk diversification, monitoring world affairs, and avoiding emotional investment can help reduce losses. With ample time and a more thorough analyses and planning an investment in crude oil can be a good portfolio addition and an entry point into the global energy market.

FAQ

Can I invest in oil long-term?

Yes, long-term investments in oil ETFs or stocks can provide growth and dividends while hedging against inflation.

What factors should I consider before investing in oil?

Consider market trends, geopolitical events, economic indicators, risk tolerance, and investment method before committing your funds.

What are common mistakes beginners make?

Avoid over-leveraging, ignoring research, chasing short-term gains, emotional trading, and neglecting fees.

Can I diversify while investing in crude oil?

Absolutely. Combining oil investments with stocks, bonds, or other commodities reduces risk and stabilizes returns.