In this article, i will discuss the How to Integrate Crypto Holdings with Your Bank Account. Having a bank account linked to one’s cryptocurrency facilitates direct transfers, improves access to funds, and augments financial control.

- About Bank Account

- How to Integrate Crypto Holdings with Your Bank Account

- Example: Cashing Crypto to Bank Account from Coinbase

- Step 1: Create and verify each account.

- Step 2: Link your Bank Account.

- Step 3: Change Crypto into Cash.

- Step 4: Withdraw Cash to your Bank Account.

- Step 5: Tracking and Securing Transactions:

- Benefits Of Integrate Crypto Holdings with Your Bank Account

- Tools and Services to Simplify Integration

- Security Tips and Best Practices

- Activate Two-Step Verification (2FA)

- Use Reputable Services and Platforms

- Use Private Keys with Caution

- Regularly Monitor Transactions

- Use Unique, Complex Passwords

- Check Email and Website Phishing Links

- Be Aware of Changes to Best Practices and Security Regulations

- Pros & Cons

- Conclusion

- FAQ

As you continue to read, you will learn how to convert crypto to fiat, utilize a crypto debit card, and manage your portfolio with almost zero risk.

About Bank Account

A bank account refers to an account which the bank manages with the primary purpose of accepting deposits and allowing withdrawals and transactions of money for individuals and businesses.

It serves as a secure storage for money and provides the customer with mid-cap liquidity enabling them to make payments, make payments to, and settle bills, transfers, and withdrawals in a single day.

Types of bank accounts are savings accounts, current accounts, and fixed deposits which cater to specific financial applications. Furthermore, bank accounts are accompanied with a suite of a debit/credit card, online, and mobile banking facilities.

These facilities make it easier for the customer to manage their money which other wise would be on bank’s books.

How to Integrate Crypto Holdings with Your Bank Account

Example: Cashing Crypto to Bank Account from Coinbase

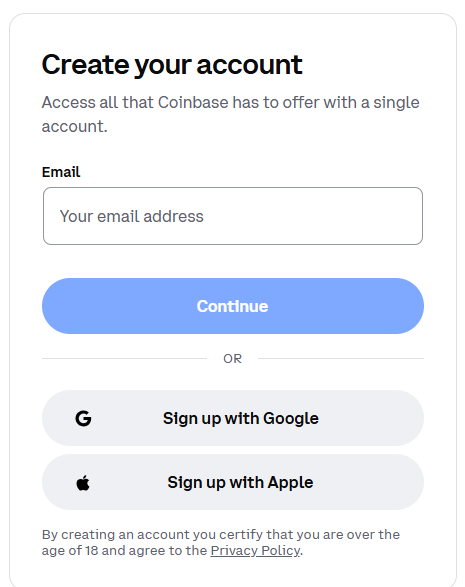

Step 1: Create and verify each account.

- Sign up for Coinbase if you don’t already have an account

- Finish the KYC process by providing your ID and providing some personal information for regulatory purposes.

- Make sure you have your bank account setup so that you can link it.

Step 2: Link your Bank Account.

- Go to the “Payment Methods” section of your Coinbase Account.

- Click “Add a Bank Account” and choose from the country-specific options for ACH, SEPA, and wire transfers.

- Fill out your bank account information and follow the verification process which involves small test deposits.

Step 3: Change Crypto into Cash.

- Go to your wallet on Coinbase and click on the crypto you want to transfer.

- Click “Sell” to change crypto into any fiat currency of your choice. or click “Convert” if you want to instantly switch to your preferred fiat currency (for example USD or EUR etc).

Step 4: Withdraw Cash to your Bank Account.

- Click “Withdraw” and select the Bank Account that you have already linked.

- Input the amount that you want to send, confirm and click send. Generally, the limit that you can send depends on the currency you have if you want the to appear in your Bank Account within 1 to 5 days.

Step 5: Tracking and Securing Transactions:

- Confirm payment has reached your bank account.

- Set up notifications and two-factor authentication for account security.

Benefits Of Integrate Crypto Holdings with Your Bank Account

Easy access to any funds – Hands-on access to your funds by converting crypto to fiat in a matter of minutes.

Smoother transactions – Any form of crypto can be sent or received by a bank account.

More effective financial control – Control and supervise crypto and fiats from a single location.

More ease – Automated crypto transfers, crypto debit cards, and online payments are seamless.

More available liquidity – Convert crypto to cash digitally as and when needed without relying on third parties.

Secure transfers -Use of trusted platforms with protective measures like 2FA ensures security of funds.

More integration of crypto and traditional currency – Simplifies the use of crypto in the day to day financial transactions.

Tools and Services to Simplify Integration

Swapin – Quick conversion of cryptocurrency to fiat currency for organizations and individuals.

BitPay – Selling crypto and withdrawing to bank accounts, debit, and PayPal

Paybis – Withdraw Bitcoin to bank accounts in multiple foreign currencies.

MoonPay – Cryptocurrency trading with bank transfers, credit cards, and PayPal.

Anchorage Digital – Provides comprehensive crypto banking including integrated custodial services.

Sygnum Bank – Provides integrated services for digital assets such as trading, custody, and fiat currency.

Volt – Cross-border instantaneous crypto bank transfers.

Transak – Simplified APIs and SDKs for crypto currency purchase and sale.

Strike – Provides easy bank transfers with minimal charges.

Security Tips and Best Practices

Activate Two-Step Verification (2FA)

It is advisable to turn on 2FA on your crypto exchange and bank accounts to protect yourself from unauthorized access.

Use Reputable Services and Platforms

To avoid online scheme traps and phishing scams, access trustworthy exchange sites, wallets, and bank integration services.

Use Private Keys with Caution

Private keys should be kept within offline hardware wallets and not disclosed to anyone.

Regularly Monitor Transactions

Your crypto and bank accounts should be accessed often to keep track of suspicious and unauthorized activities.

Use Unique, Complex Passwords

To avoid exposure, do not use the same passwords on different accounts.

Check Email and Website Phishing Links

Phishing can be done through email and by typing in fraudulent web pages. It is better to be cautious.

Be Aware of Changes to Best Practices and Security Regulations

Monitor the local laws which are pertinent to crypto and the rules for best practices to ensure safe transactions.

Pros & Cons

| Pros | Cons |

|---|---|

| Easy Access to Funds – Quickly convert crypto to fiat and use it for everyday expenses. | Transaction Fees – Converting crypto to fiat and withdrawing to a bank may incur fees. |

| Portfolio Management – Helps track overall financial holdings in one place. | Processing Delays – Bank transfers can take 1–5 business days depending on the method. |

| Enhanced Financial Flexibility – Seamlessly move funds between crypto and bank accounts. | Regulatory Restrictions – Some countries limit crypto-to-bank transactions. |

| Secure Transactions – Using trusted platforms with 2FA enhances security. | Security Risks – Vulnerable to phishing, hacks, or incorrect account entries if not careful. |

| Convenience – Supports automated transfers, crypto debit cards, and integration with payment apps. | Network Congestion – High blockchain traffic may delay crypto transfers. |

Conclusion

Connecting crypto to a bank account ensures easier access to money, improved control of digital assets, and ease of use in day-to-day activities.

Easy and secure conversion of crypto to cash followed by a bank transfer to a bank account using reputable services and completing KYC requirements along with best practices like two-step verification and anti-money laundering measures.

Some of the issues like restrictions, fees, and delays along with other hurdles in avoiding services of scams, untrustworthy apps and incorrect services may be overwhelming, but with thoughtful strategy, they can be minimized.

Therefore, the use of crypto assets becomes more functional and actionable in real life, which stands to an ease of access to money by bridging the digital and the physical world of finance.

FAQ

Can I link multiple bank accounts to my crypto wallet?

Yes, most crypto exchanges allow you to link multiple bank accounts. You can choose which account to use for deposits or withdrawals, depending on your needs.

How long does it take to transfer crypto to a bank account?

Transfer times vary depending on the platform and method. ACH and SEPA transfers usually take 1–3 business days, while wire transfers can be faster but may incur higher fees.

Are there fees for integrating crypto with a bank account?

Yes, fees may apply for converting crypto to fiat and for bank withdrawals. Fees vary by exchange, withdrawal method, and currency.

Is it safe to link my bank account with crypto exchanges?

Yes, if you use trusted exchanges and follow security best practices like two-factor authentication, strong passwords, and monitoring your accounts regularly.

What should I do if a crypto-to-bank transfer fails?

Check account details carefully, confirm that your bank supports the transfer method, and contact the exchange’s customer support for assistance.