This article will cover how to locate the most affordable fee crypto trading apps that assist you in cost reduction and profit maximization.

- What is Crypto Trading Apps?

- How to Find the Best Low-Fee Crypto Trading Apps

- Example: How to Find the Most Suitable Low-Fee Crypto Trading App (Step-by-Step)

- Step 1: Determine Your Trading Style

- Step 2: Investigate Well-Known Crypto Trading Platforms

- Step 3: Analyze Fee Structures

- Step 4: Analyze Potential ‘Hidden’ Fees

- Step 5: Analyze the Security of the Platform and the Licensing of the App

- Step 6: Test the User Experience

- Step 7: Review Community Feedback

- Step 8: Start Small and Monitor Fees

- Step 9: Use Fee Discounts or Loyalty Programs

- Step 10: Finalize Your Choice

- Why Low Fees Matter in Crypto Trading

- Profit Margins Increase

- Low Fees are Good for Frequent Trading

- More Trading to Diversify a Portfolio

- More Profit for Small Investors

- More Trading Flexibility

- Profit More in the Long Run

- Enhances Trust and Transparency

- Top Low-Fee Crypto Trading Apps in 2025

- Common Mistakes to Avoid When Choosing Low-Fee Apps

- Lowering Security to Lower Fees

- Hidden Fees

- Not Using Apps With Proper Licensing

- User Neglect

- Not Considering Liquidity and Trading Volume

- Future Trends

- Pros & Cons

- Conclusion

- FAQ

Every trader, be it a novice or a seasoned professional, needs to understand the importance of selecting the most appropriate platform.

You will all the fundamental aspects, how to make comparisons, and recommended apps that provide safe and cheap crypto trading in 2025.

What is Crypto Trading Apps?

Crypto trading apps are programs that let clients buy, sell, and manage cryptocurrency on mobile phones and computers. Crypto trading apps link users with crypto exchanges around the world and allow users to trade Bitcoin, Ethereum, and Solana, among other cryptocurrencies.

Such apps offer users trading tools, price charts, and real-time market information and analytics necessary for trading effectively. Crypto trading apps provide automated trading features, staking and crypto-coin apps, and crypto-coin apps provide automated trading features, staking, and crypto-coin portfolio management.

Clients’ assets are protected with safety features like cold storage, encryption, and two-factor authentication. Crypto trading apps are convenient, quick and efficient for trading digital currency.

How to Find the Best Low-Fee Crypto Trading Apps

Example: How to Find the Most Suitable Low-Fee Crypto Trading App (Step-by-Step)

Step 1: Determine Your Trading Style

Establish the range of trading you will engage in (beginner, investor, or active day trader). In the case of a daily trader, ensure the platform has low taker and maker fees and offers rapid order execution.

Step 2: Investigate Well-Known Crypto Trading Platforms

Begin with established trading platforms such as Binance, Kraken, OKX, and Bybit. Then, access their websites to confirm their trading fees are the most current.

Step 3: Analyze Fee Structures

Develop a simple comparison table that includes the trading fee, withdrawal fee, and deposit method costs for each platform. For example, Binance’s fee can range to 0.1%, whereas Coinbase Advanced’s fee can be as high as 0.25%.

Step 4: Analyze Potential ‘Hidden’ Fees

Determine whether there are inactivity fees, spreads or conversion costs that can raise your relevant costs.

Step 5: Analyze the Security of the Platform and the Licensing of the App

Select apps that are reputable and compliant, as well as having two-factor authentication (2FA), encryption, and cold storage.

Step 6: Test the User Experience

Pick 1-2 apps you shortlisted and test the user interface. Make sure the app runs fast, is user-friendly for first-time users, and the customer service is accessible and dependable.

Step 7: Review Community Feedback

Reviews on Google Play, the Apple Store, and crypto forums such as Reddit are valuable for learning about users’ experiences on fee structures and service quality.

Step 8: Start Small and Monitor Fees

To understand fee application on real-time transactions, start trading with a small amount. Log your expenses for deposits, trades, and withdrawals.

Step 9: Use Fee Discounts or Loyalty Programs

You can see how much you can save on trading fees by paying with the exchange’s native token, or taking advantage of other discounts.

Step 10: Finalize Your Choice

Based on your testing and comparison, select the app with the most suitable combination of low fees, security, and simplicity to meet your trading objectives.

Why Low Fees Matter in Crypto Trading

Profit Margins Increase

More of your money gets saved when fees are low as less of your profit gets lost due to transaction costs. It is the small differences that are lost to fees that compound over time and become a loss of profit that can be significant.

Low Fees are Good for Frequent Trading

Those who trade everyday or every week can quickly lose profit due to high fees. Low fee platforms allow high frequency trading to be financially worth it.

More Trading to Diversify a Portfolio

When selling and buying crypto there are low fees less profit will be lost to the fees and allow for more redundancies in a crypto portfolio.

More Profit for Small Investors

Traders with small capital are the ones really benefitting from low-fee trading platforms as a larger amount of their money is going to crypto instead of the fee.

More Trading Flexibility

More relaxed entry and exit comfort allows for more profit to be made.

Profit More in the Long Run

Long-term trading will profit the most with low fees due to the improved return rate generated from the low fees and low trading costs.

Enhances Trust and Transparency

When platforms provide low fee transparency, users tend to trust the platform more. Such platforms show reliability and fairness in their pricing models.

Top Low-Fee Crypto Trading Apps in 2025

Kraken

In 2025, Kraken remains one of the best low-fee crypto trading apps, particularly due to its clear pricing, advanced security, and global reach.

Its maker and taker fees are highly competitive and become even more so at higher trading volumes, which guarantees more value to both novice and professional traders.

Kraken Pro allows even greater cost efficiencies, with deep liquidity, low spreads, and precise trade execution Kraken is also low-cost regulatory compliance, advanced charting, and 24/7 support.

The user trust Kraken focuses on, alongside the stability and affordability over time, is what makes Kraken so popular worldwide among traders seeking low fees.

OKX

In 2025, OKX was recognized as one of the best low-fee crypto trading apps thanks to its flexible fee structure and unique trading options.

It has some of the industry’s lowest maker and taker fees which can be further decreased by holding OKB tokens or trading heavily.

The platform offers great trading tools and liquidity, which together, in coordination with the almost effortless execution of orders, limit slippage.

For both casual and professional traders, OKX’s accessibility to a variety of crypto, futures, and DeFi products is a plus. OKX also boasts excellent security and integrity with its pricing, which makes their service a well-balanced and low-cost trading solution for users from different parts of the world.

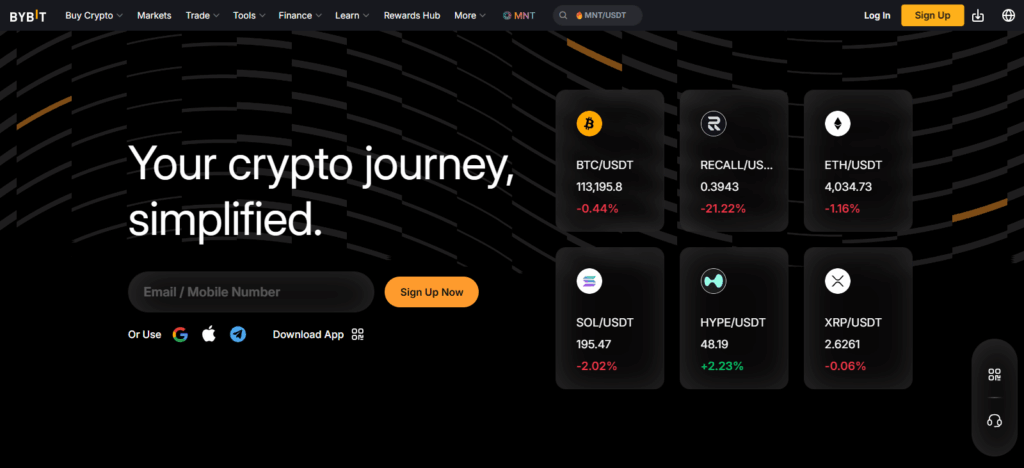

Bybit

Low-fee crypto trading apps recognize Bybit for its competitive pricing, trading at lightning speed, and advanced trading environment.

Bybit provides one of the lowest maker and taker fees in the derivatives and spot markets; consequently, the platform draws the attention of professional and high-volume traders. Bybit further increases the eco Savings through discounts on fees in the VIP and Loyalty programs.

Bybit possesses strong market liquidity, low slippage, and easy-to-use platform to ensure customers can execute trades even with high volatility.

The trading environment, coupled with strong protection of customer data, transparency, and continuous support in several languages, Bybit has eco Savings.

Common Mistakes to Avoid When Choosing Low-Fee Apps

Lowering Security to Lower Fees

Downplaying security for low fees is a huge oversight. The minimum a trader should expect is encryption, cold wallet security, and two factor authentication.

Hidden Fees

Withdrawal, deposit, and conversion fees disguised as low trading fees are a clear depiction of a bait and switch scheme. Know the entire cost to avoid getting ripped off.

Not Using Apps With Proper Licensing

Risking your funds with unlicensed trading apps is as significant as the trading fees. Unlicensed trading apps don’t follow the global financial oversight and compliance regulations for a reason.

User Neglect

Confusing and laggy interfaces can cause very costly mistakes. Pick an app with a solid reputation for being user friendly. It should also be fast and stable.

Not Considering Liquidity and Trading Volume

Choose exchanges with high trading volumes for low-liquidity apps. Price slippage and expensive trades are apps with low trading volumes and high liquidity.

Future Trends

As competition and tech advancements change low-fee crypto trading, its future also looks promising. More exchanges are expected to adopt zero-fee and flexible fee structures because of user expectations and technological advancements.

For custodial trading, decentralized exchanges (DEXs) have low fees, and non-custodial, transparent trading is driving their popularity even more. The use of AI and machine learning technologies will automate optimizations to trade execution that minimizes user costs.

In addition to efficient and cheaper trading, exchanges increasing efficiencies through cross-chain trading and token-based loyalty programs. In essence, future crypto trading will be optimized to be cost-efficient, fast, and responsive to user needs.

Pros & Cons

| Pros | Cons |

|---|---|

| 1. Lower Trading Costs: Helps maximize profits by reducing transaction expenses. | 1. Possible Hidden Fees: Some apps may include withdrawal or spread fees not shown upfront. |

| 2. Ideal for Frequent Traders: Suitable for those who trade daily or in high volumes. | 2. Limited Features on Budget Platforms: Low-fee apps may offer fewer advanced tools. |

| 3. Encourages Portfolio Diversification: Easier to trade multiple coins without worrying about costs. | 3. Lower Liquidity on Smaller Exchanges: Can cause slippage or slower order execution. |

| 4. Accessible for Small Investors: Allows beginners with limited funds to start trading affordably. | 4. Security Risks in Unregulated Apps: Some low-fee exchanges may compromise on safety. |

| 5. Transparent Pricing: Reputable apps clearly display fee structures for better decision-making. | 5. Inconsistent Customer Support: Some low-cost platforms may lack quick or reliable assistance. |

Conclusion

In 2025, identifying an ideal low-fee crypto trading app requires considering cost, security, and app usability. Although low fees can increase profitability, other aspects like regulation, liquidity, and reliability should not be ignored. Leading applications provide straightforward pricing, easy-to-navigate dashboards, and robust security mechanisms.

It is crucial to evaluate multiple platforms, analyze genuine user reviews, and execute low-risk trades to ascertain reliability. By assessing trading apps based on pricing and determining overall value, users can identify low-fee and reliable crypto trading apps with considerable potential for sustained trading.

FAQ

What is considered a low trading fee for crypto apps?

A low trading fee typically ranges between 0.05% and 0.20% per trade. Some exchanges also offer zero-fee trading or discounts based on trading volume or native token usage.

Are low-fee crypto trading apps safe to use?

Yes, but safety depends on the platform’s security measures, regulation, and reputation. Always choose apps with strong encryption, two-factor authentication, and compliance with financial authorities.

Do low fees affect the quality of trading services?

Not necessarily. Many top exchanges maintain low fees while offering high liquidity, fast execution, and advanced tools. However, be cautious of unregulated platforms offering unrealistically low fees.

How can I compare crypto trading fees effectively?

Check each app’s maker/taker fees, withdrawal costs, and hidden charges. Create a comparison chart or use online fee calculators to identify the most cost-efficient option.

Which crypto trading app offers the lowest fees in 2025?

Apps like Binance, OKX, Kraken, and Bybit are among the top low-fee choices in 2025 due to their transparent pricing, deep liquidity, and fee discounts for active traders.