This article helps you earn passive income while growing your crypto holdings seamlessly using the top staking platforms.

- What is Crypto Staking?

- How to Earn Passive Income with the Top Staking Platforms

- Example: How to Earn Passive Income with Binance Earn (Step-by-Step)

- Step 1: Create a Binance Account

- Step 2: Deposit or Buy Crypto

- Step 3: Go to Binance Earn Section

- Step 4: Select the Coin to Stake

- Step 5: Choose Staking Duration & Confirm

- Step 6: Automatic Rewards Collection

- Step 7: Unstake and Withdraw

- Top Staking Platforms for Passive Income

- Benefits of Staking

- Earn Passive Income

- Aids in Network Security

- Better Returns Than Savings

- Opportunity For Token Appreciation

- Flexible Options Provided

- Environment Friendly

- Compounding Opportunities

- Risks and Considerations

- Market Volatility

- Lock-Up Periods

- Validator or Platform Risk

- Reward Fluctuations

- Technical Risks

- Security Threats

- Inflation and Reward Dilution

- Tips to Maximize Staking Returns

- Pick Trustworthy Platforms

- Spread Your Stakes

- Use Compound Staking

- Watch APY and Market Changes

- Pick Your Staking Length Wisely

- Protect Your Wallets

- Get the Latest Info

- Future of Staking and Passive Crypto Income

- Pros & Cons

- Conclusion

- FAQ

Staking enables investors to earn rewards just by holding their digital assets. You will also discover the benefits, most reliable platforms, and some intelligent ways to maximize your staking returns without overexposing yourself to risks.

What is Crypto Staking?

Crypto staking involves putting your digital assets on hold within the requirements of a blockchain network. It validates transactions and secures the blockchain.

In return for your participation, there are staking rewards: usually additional tokens, which equates to earning interest on your savings. Staking occurs on Proof-of-Stake (PoS) blockchains like Ethereum, Cardano, and Solana.

It enables investors to get passive income without the need of trading their assets actively. Rewards differ based on the platform and cryptocurrency, and some need you to lock your tokens for the predetermined durations, but some staking options are more flexible.

How to Earn Passive Income with the Top Staking Platforms

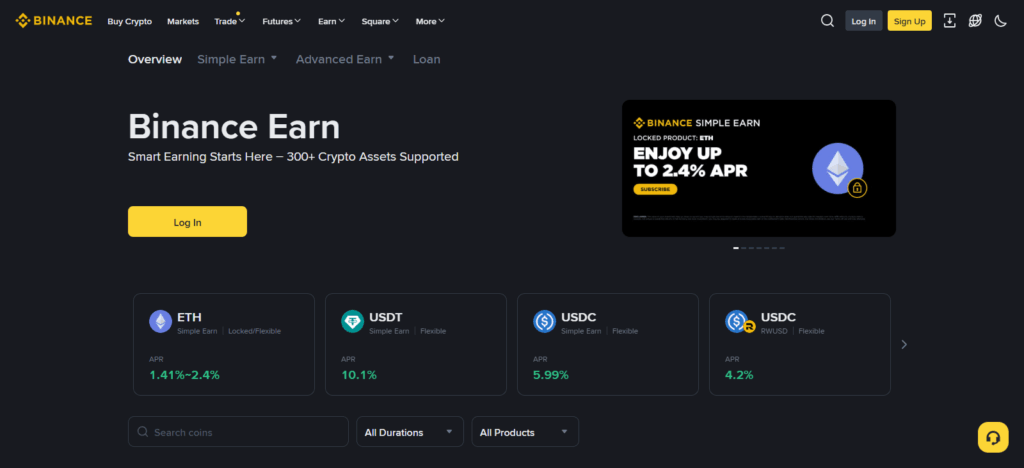

Example: How to Earn Passive Income with Binance Earn (Step-by-Step)

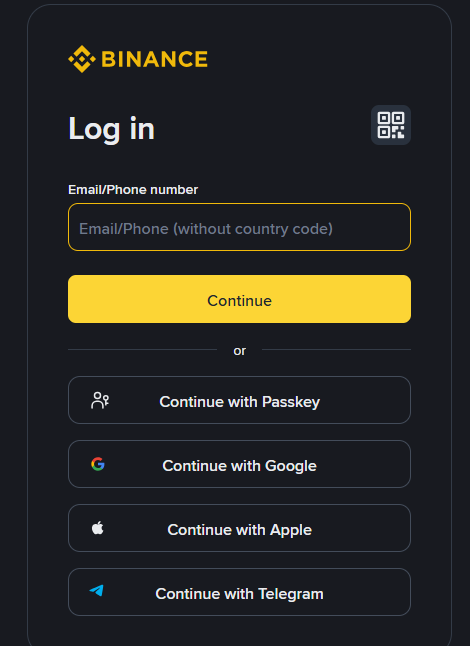

Step 1: Create a Binance Account

Go to the Binance site and sign up with your email address. Go through basic verification (lowest KYC) to unlock some of the staking features.

Step 2: Deposit or Buy Crypto

Buy Ethereum (ETH), Cardano (ADA), or Solana (SOL) directly with fiat or transfer them from another wallet, or just transfer some funds to your Binance wallet.

Step 3: Go to Binance Earn Section

On your Binance dashboard, click the Earn tab. There, you can choose either Staking or Simple Earn.

Step 4: Select the Coin to Stake

Take a look at the crypto assets you can stake. Check the APY you might earn and the lock-up period (e.g., 30, 60, or 90 days).

Step 5: Choose Staking Duration & Confirm

Select either flexible or locked and the amount you want to stake. Hit the confirm button to proceed with the staking process.

Step 6: Automatic Rewards Collection

After you stake, Binance takes care of distributing the earned staking rewards automatically to your wallet. You can check how much you’ve earned in the “Earn Wallet” section.

Step 7: Unstake and Withdraw

You can unstake your crypto and withdraw your tokens and rewards once the staking period is over (or at any time for flexible staking).

Top Staking Platforms for Passive Income

Kraken

Kraken is one of the most reputable platforms for passive income staking for its security, transparency, and adherence to regulations. In addition to offering on-chain and off-chain staking, users can earn rewards on Ethereum, Polkadot, Cardano, and many other cryptocurrencies.

Unlike other platforms, Kraken allows users to unstake at any time without lengthy lock-up periods that can provide better control and liquidity.

Kraken’s user-friendly interface enables users to view earnings and performance in real time, reward tracking is straightforward. Because of its reliable record, Kraken can be trusted for safely earning passive income crypto.

Coinbase Staking

Passive income is easy to earn through Coinbase Staking which is easy to use, dependable, and highly regulated.

Users can stake top crypto assets like Ethereum, Solana, and Cardano right from their wallets without any complicated processes. Coinbase is different because they have a visible reward system and users can track their estimated profits and payment timelines.

Coinbase also takes care of all efficiency and penalty mitigation of validator processes. Coinbase offers a beginner-friendly experience to crypto holders who want to grow their holdings through crypto staking, and Coinbase Staking is also covered with top-tier crypto staking safety.

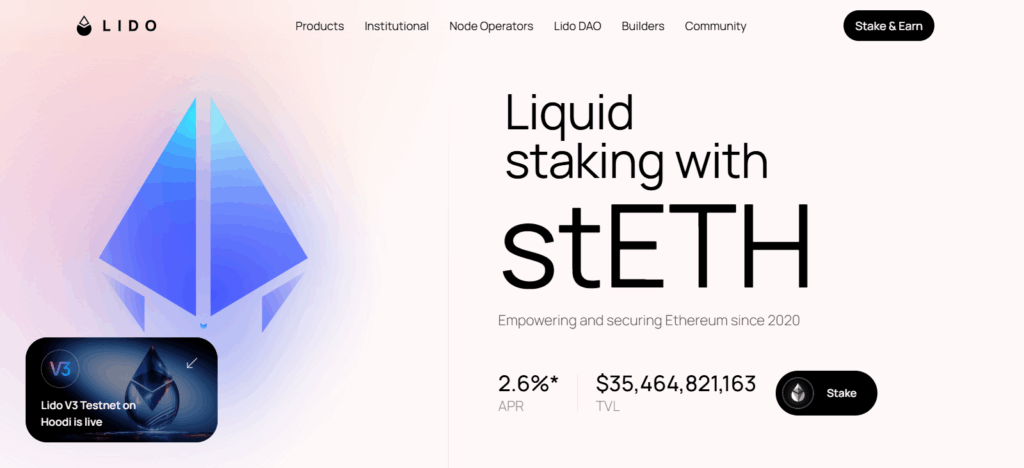

Lido Finance

As one of the first liquid staking paltforms, Lido Finance lets users stake crypto and earn passive income while maintaining access to their assets.

With Lido, stakers get liquid tokens like stETH and stSOL, and these can be traded and used in DeFi protocols to earn extra yield. This means Lido users can freely move and use their funds while liquid staking, avoiding the typical deposit lock staking systems impose.

Lido operates as a DAO and decentralizes their governance, allowing users to propose and vote on key decisions. Lido Finance is compatible with the Ethereum, Solana, and Polygon blockchains, and provides a convenient and efficient staking experience.

Benefits of Staking

Earn Passive Income

Reward earnings come automatically as a result of holding and staking your crypto.

Aids in Network Security

As a result of the decentralization of networks, Staking permits the validation of transactions, thus, securing networks.

Better Returns Than Savings

The annual yields earned from staking are much better than those offered from savings accounts and other bank products.

Opportunity For Token Appreciation

Your tokens that are stake may appreciate in the market while you also earn rewards.

Flexible Options Provided

Almost every network permits a choice between flexible and locked staking.

Environment Friendly

There is a drastic reduction of energy in PoS systems as opposed to PoW systems.

Compounding Opportunities

Your staking rewards can be used to re-stake to earn even more rewards.

Risks and Considerations

Market Volatility

Market fluctuations impact the price of staked tokens and the profits you stand to make.

Lock-Up Periods

Staking platforms may have you lock your assets for a predetermined duration. This may result in a loss of liquidity and access to your funds.

Validator or Platform Risk

Validators and platforms that are of poor quality or unreliable may result in slashing and loss of rewards.

Reward Fluctuations

Staked rewards are highly dynamic and may change depending on the network conditions and the total amount of tokens staked.

Technical Risks

The stake performance and distribution of rewards may be affected by severe bugs and errors.

Security Threats

If there are no proper protection measures, hacked or compromised platforms may result in losing your staked assets.

Inflation and Reward Dilution

The real value of your rewards may decrease over time due to inflation, despite the inflation rate of the tokens diminishing.

Tips to Maximize Staking Returns

Pick Trustworthy Platforms

Make it a point to always stake on regulated exchanges or diffi platforms and to only stake with platforms that have a strong positive reputation and security history.

Spread Your Stakes

Investing within a single cryptocurrency or a single staking platform can be very risky. Try to mitigate risk by evenly spreading your cryptocurrency stakes across various platforms and reward yoursel with more balanced returns.

Use Compound Staking

Boost your yield by staking your earned rewards to restake and applying it to your stakes to earn more interest to increase your yield.

Watch APY and Market Changes

Evaluate your position based on reward with market chances and change your position based on the token price and validator to maximize your return.

Pick Your Staking Length Wisely

Each staking options- flexible and locked has their own advantages. Staking rewards can be more generous on locked stakes but stake with locked stakes if you don’t mind sacrificing liquidity.

Protect Your Wallets

To defend your virtual possessions against hackers and phishing scams, robust, hardware, or reliable wallets should be used.

Get the Latest Info

Changes in rewards, staking opportunities, or system upgrades can be hidden and the only way to discover them is to follow distributions and community changes.

Future of Staking and Passive Crypto Income

Staking and passive income earning in crypto will become popular and profitable due to the shift in crypto networks to Proof-of-Stake (PoS) systems which is more efficient and sustainable.

Investors will have even more opportunities to stake and earn due to innovations like liquid and multi-chain staking and the integration of DeFi. With improved regulatory clarity and more participation from institutions and retail investors, there will be an increase in passive income earning potential and overall crypto adoption.

As new automated staking systems and AI yield optimizers are developed, earning passive income will become risk-free and more convenient. Staking will become more popular and will be the low risk, low effort earning method to crypto investors.

Pros & Cons

| Pros | Cons |

|---|---|

| Earn Passive Income: Generate consistent rewards without active trading. | Market Volatility: Token prices can drop, affecting total earnings. |

| Supports Network Security: Helps maintain blockchain integrity. | Lock-Up Periods: Some platforms restrict access to funds for fixed durations. |

| Potential Token Growth: Staked assets may increase in value over time. | Validator/Platform Risk: Poor validators or insecure exchanges may cause losses. |

| Flexible Options: Choose between flexible or fixed staking plans. | Technical & Security Risks: Bugs, hacks, or downtime can impact rewards. |

| Eco-Friendly: Uses less energy compared to crypto mining. | Reward Fluctuations: APY can change depending on network conditions. |

Conclusion

Generating passive income using leading staking platforms is among the most convenient and safest methods to increase your cryptocurrency holdings. Using staking services on reputable platforms Binance Earn, Kraken, Coinbase, and Lido Finance, users can earn passive income without engaging in any active trading while helping to maintain blockchain networks.

Staking presents a virtually hands-off opportunity to earn crypto, especially alongside active management techniques such as diversification and compounding. One should assess trade-off risks, such as volatility and lock-up withdraw periods. Given the right platform and appropriate crypto staking strategies, it is a potential source of reliable passive income.

FAQ

How can I earn passive income through staking?

You can earn passive income by staking your crypto tokens on trusted platforms like Binance, Kraken, Coinbase, or Lido Finance, which pay you regular rewards in return for securing the network.

Is staking safe?

Yes, staking on reputable and regulated platforms is generally safe, but it still carries risks such as market volatility, lock-up restrictions, and validator errors. Always research before investing.

Can I unstake my tokens anytime?

Some platforms offer flexible staking that allows instant withdrawal, while others have locked staking with fixed periods. Check the platform’s terms before staking.

What are liquid staking platforms?

Liquid staking platforms like Lido Finance let you stake tokens and receive tradable equivalents (like stETH), allowing you to earn rewards while keeping your assets liquid.