I will discuss the How To Convert BTC To USD Safely & Avoid Scams. Amid Bitcoin’s soaring acceptance, understanding reliable channels for liquidating cryptocurrency is paramount.

- What is BTC?

- What is USD?

- How To Convert BTC To USD Safely & Avoid Scams

- Case Study: Converting BTC to USD with Revbit Instant Desk

- Navigate to a Verified Exchange

- Acquire a Quotation with Price Lock

- Transfer the BTC

- Receive US Funds

- Tips to Avoid Scams

- Risk & Considerations

- Common Mistakes to Avoid

- Pros & Cons

- Conclusion

- FAQs

We will evaluate well-established exchanges, explore protective practices to mitigate fraud, identify typical pitfalls to eschew, and outline critical factors that safeguard funds at each stage of the transaction.

What is BTC?

Bitcoin (BTC), the inaugural cryptocurrency, emerged in 2009 through the pseudonymous Satoshi Nakamoto. Functioning on a decentralized, peer-to-peer blockchain, the system enables participants to transfer value directly, circumventing traditional custodians.

The asset’s supply is capped at 21 million units, introducing a documented scarcity in the digital realm. Currently, Bitcoin serves multiple purposes—speculative investment, remittance, and medium of exchange—while commonly being designated as “digital gold” due to its proven capacity to preserve value over time.

What is USD?

The United States Dollar (USD), as the nation’s official monetary unit, occupies a preeminent position among global currencies. Issued and governed by the Federal Reserve System, the USD is celebrated for both intrinsic stability and broad, largely unquestioned, acceptance beyond national borders.

Nations facilitate reserve accumulation in USD; traders express transactions and financiers denominate instruments in USD. Such omnipresence renders the currency a benchmark against which the value of other monetary instruments and heterogeneous assets is regularly judged.

How To Convert BTC To USD Safely & Avoid Scams

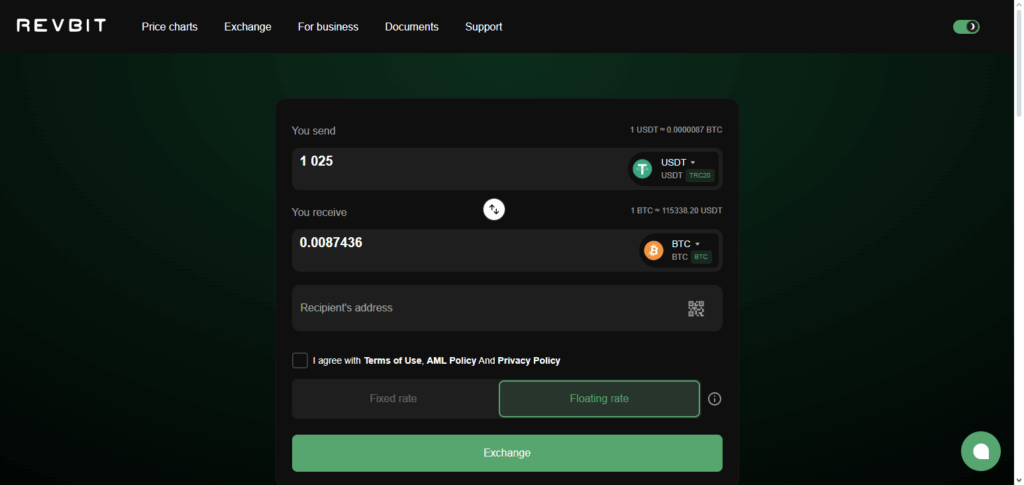

Case Study: Converting BTC to USD with Revbit Instant Desk

Navigate to a Verified Exchange

- Access Revbit.net.

- Verify that the platform is a licensed money-services business (MSB), and request proof of reserves, as well as confirm that client funds are kept in segregated accounts.

Acquire a Quotation with Price Lock

- Input the desired BTC amount for conversion.

- Obtain a price quote valid for 60 seconds: the rate is fixed, and all costs are fully disclosed.

Transfer the BTC

- Record the BTC wallet address supplied.

- Initiate the transfer from a self-custodial wallet (such as Ledger, Trust Wallet, or a custodial exchange wallet like Coinbase).

- Confirm the transfer after one blockchain confirmation.

Receive US Funds

- Upon confirmation, Revbit credits USD to either your on-chain USD stablecoin wallet or the linked bank account on the same business day.

- The platform issues a digital transaction confirmation, evidencing settlement.

Tips to Avoid Scams

Opt for Established Exchanges: Only utilize exchanges or peer-to-peer services with solid reputations and relevant regulatory oversight.

Activate Two-Factor Authentication: Enabling 2FA on trading and wallet accounts significantly strengthens their defenses.

Confirm Authentic URLs: Manually enter or bookmark the official web address to prevent inadvertently visiting a fraudulent site.

Guard Private Keys and Recovery Phrases: Disclosures of these sensitive items will irrevocably compromise any associated wallet.

Evaluate Platform Reviews: Consult independent sources for user testimonials and check for longstanding and verified ratings.

Ignore Unsolicited Offers: Treat overly generous proposals or urgent verification requests as potential phishing attempts, and respond with skepticism.

Risk & Considerations

Risks

Price Volatility: Instantaneous swings in BTC valuation may alter expected USD receipts.

Scams and Fraud: Engagement with unregulated entities—including counterfeit exchanges—may result in irreversible capital loss.

Transaction Delays: Dependencies on blockchain backlogs or exchange processing times risk the strategic timing of the conversion.

High Fees: Disproportionate spread, processing, or withdrawal charges may erode anticipated proceeds.

Considerations

Choose Trusted Platforms: Utilization of licensed, widely validated exchanges is strongly advisable.

Check Fees and Rates: Pre-execution comparison of all applicable charges and the offered exchange rate is essential.

Secure Your Wallet: Deployment of hardware or multsignature wallets, complemented by two-factor authentication, mitigates custodial risk.

Timing the Market: Brief analysis of technical price indicators—and the prevailing sentiment—may prevent decisional loss at execution.

Common Mistakes to Avoid

Trading on Unverified Sites: Conduct transactions only on exchanges with a well-established reputation to minimize fraud exposure.

Disclosing Private Keys: Sharing private keys or recovery sentences invites immediate asset compromise.

Overlooking Costs: Calculate all fees—conversion, withdrawal, on-chain—before initiating a sale to ensure accurate profit assessment.

Speeding through Deals: Verify exchange rates, recipient addresses, and amounts before proceeding to prevent unnecessary losses.

Accepting Unsolicited Offers: Offers substantially better than prevailing market rates usually indicate fraudulent schemes.

Weak Security Practices: Implement strong, unique passwords along with two-factor authentication to create robust account defenses.

Pros & Cons

| Pros | Cons |

|---|---|

| Quick access to cash or fiat currency. | Bitcoin’s value can fluctuate rapidly. |

| Can use regulated exchanges for secure transactions. | Some platforms charge high fees. |

| Global accessibility, no need for banks in some cases. | Risk of scams on unverified platforms. |

| Multiple methods available: exchanges, P2P, ATMs. | Transaction delays may occur on certain platforms. |

| Transparent transaction records on the blockchain. | Incorrect transaction details can cause permanent loss. |

Conclusion

To summarize, the safe and efficient conversion of BTC to USD hinges on recommendation to leverage reputable exchanges, employ sound security protocols, and maintain continuous awareness of potential fraud. Rigorous platform vetting, the activation of two-factor authentication, and meticulous confirmation of all transaction parameters remain essential practices.

An informed assessment of prevailing risks, the evasion of frequently observed errors, and the employment of consistently trustworthy procedures collectively safeguard assets while ensuring that the transfer of Bitcoin into U.S. currency proceeds seamlessly and securely.

FAQs

How long does it take to convert BTC to USD?

Conversion times vary by platform and method. Exchanges may take a few minutes to a few hours, while P2P transactions depend on buyer/seller confirmation.

Are there fees when converting BTC to USD?

Yes, most platforms charge conversion, withdrawal, or network fees. Always check rates before confirming a transaction.

Is it safe to convert BTC via P2P platforms?

P2P can be safe if you use reputable platforms, verify buyers/sellers, and follow security measures like 2FA.