This article explores how to select the most profitable mining pools by analyzing the important aspects that influence mining efficiency, payouts, and profitability over time.

- What is Mining Pools?

- How to Choose the Best Mining Pools for Maximum Profit

- Pool Fees

- Payout Methods

- Pool Size and Hashrate

- Minimum Payout Threshold

- Check the Server’s Location and Latency

- Reputation and Reliability

- Supported Coins and Algorithms

- Pool Performance and Uptime

- Transparency and Security

- Support and Community

- Top Mining Pools in 2025

- Tips to Maximize Mining Profit

- Choose the Right Mining Pool

- Use Energy-Efficient Hardware

- Optimize Power Consumption

- Regularly Monitor Pool Performance

- Stay Updated on Market Conditions

- Explore Different Coins

- Cool Your Mining Equipment

- Protect Your Mined Assets

- Participate in Mining Forums

- Stay Prepared for Hardware Maintenance

- Common Mistakes to Avoid

- Research About New Pool Reputation

- Unstable Pools Lagging Rewards

- Not Learning the Pool Payout Systems

- Not Mine with a Nearby Server

- Poor Choice in Pool Size and Hashrate

- Minimum Payout Not Reviewed

- Neglecting to Track a Pool’s Performance

- Future of Mining Pools

- Pros & Cons

- Conclusion

- FAQ

It will cover how to assess pool size, fees, payout structures, and payouts reliability to guarantee steady income and optimize. This will assist you in cryptocurrency mining more profitably.

What is Mining Pools?

A mining pool refers to a collaborative network of multiple cryptocurrency miners who merge their computing power for better chances of validating transactions and obtaining block rewards.

Participants forgo solo operations and offer their hash power to expedite the resolution of complex cryptographic puzzles.

Once a block is mined, rewards are shared among the computing power stakeholders according to their contributions or shares. In contrast to solo mining, which may be erratic, mining pools enhance and stabilize predictable income.

They alleviate solo competitors and offer sophisticated advanced systems, real-time performance metrics, and streamlined payout systems.

How to Choose the Best Mining Pools for Maximum Profit

Pool Fees

The fees mining pools charge for operation management are usually in the range of 0% – 3%. While lower fees will offer higher returns, ensure the pool offers reliable service. Always strike the best trade- off between cost and service so that you do not select differently only because of low fees.

Payout Methods

Different pools offer payout systems like PPS (Pay Per Share), PPLNS (Pay Per Last N Shares), and FPPS (Full Pay Per Share). Depending on your mining goals, select the method that best suits you: for a regular cash inflow, go for PPS; for higher, less frequent cash inflow, choose PPLNS.

Pool Size and Hashrate

Consistent rewards are received by larger pools that offer regular block-toward filling. less frequent payouts of generous size are more probable with smaller pools. This choice must correspond with your risk and income preferences.

Minimum Payout Threshold

Pools have a minimum threshold qualifying for a payout. This threshold must correspond with your mining power to reduce the time you have to wait to receive your rewards.

Check the Server’s Location and Latency

Your proximity to a pool’s server has a direct impact on your latency and mining efficiency—closer servers mean lower latency. Always pick a pool with servers located within your region or with servers located around the world.

Reputation and Reliability

Join only those in pools which reputation is established and reliable with feedback in the community. Reliable pools mitigate the chances of scams, downtime, or unfair distribution of rewards.

Supported Coins and Algorithms

Select a pool that contains the specific coin you are interested in and the mining algorithm with which you can mine that coin. Pools that support multiple coins allow you to mine different coins to increase profitability.

Pool Performance and Uptime

An uptime of 99.9% or higher guarantees uninterrupted mining. Before you join a pool, ensure you can view the pool performance metrics in real-time.

Transparency and Security

Check for SSL secured connections, 2FA, and transparent reward distribution. Don’t join pools that are unclear about fees or payout histories.

Support and Community

Responsive customer support is important to troubleshooting, so pick pools that have active community support. Choose pools that have clear communication methods such as forums or a Telegram group.

Top Mining Pools in 2025

AntPool

AntPool is regarded as one of the best mining pools globally due to its great infrastructure, efficient reward allocation, transparency, and reliability. AntPool, which is managed by Bitmain, is compatible with several cryptocurrencies, including Bitcoin, Litecoin, and Ethereum.

This versatility appeals to miners. AntPool’s unique advantage is the flexible payout choices they provide; users can receive payments based on their preferred income style whether it is PPS+, PPLNS, or FPPS.

AntPool has real time surveillance of mining activities and robust security which is coupled with an intuitive and easy to navigate control panel.

AntPool’s performance and reliability has earned it the trust of miners worldwide due to its mining and profit consistency. This trust is further emphasized by AntPool’s globally distributed servers which provide low latency connections.

F2Pool

F2Pool is highly regarded globally because of its extensive reliability and community trust. Established in 2013, the pool offers support for over 40 coins, including Bitcoin, Litecoin, and Ethereum.

This enables miners to earn in different coins to increase the value of their portfolios. F2Pool is special because of its easy-to-use interface and the ability to see detailed metrics regarding their performance in real-time. This lets users assess performance and determine profits during chosen time periods.

The system is safe because the non-ambiguous payout system is regular and prompt, which is a core principle of trust.

F2Pool prides itself with servers in different continents which means stable connections. The combination of positive repeations, transparency, and multiple coins is precisely why F2Pool is among the top mining pools in the world.

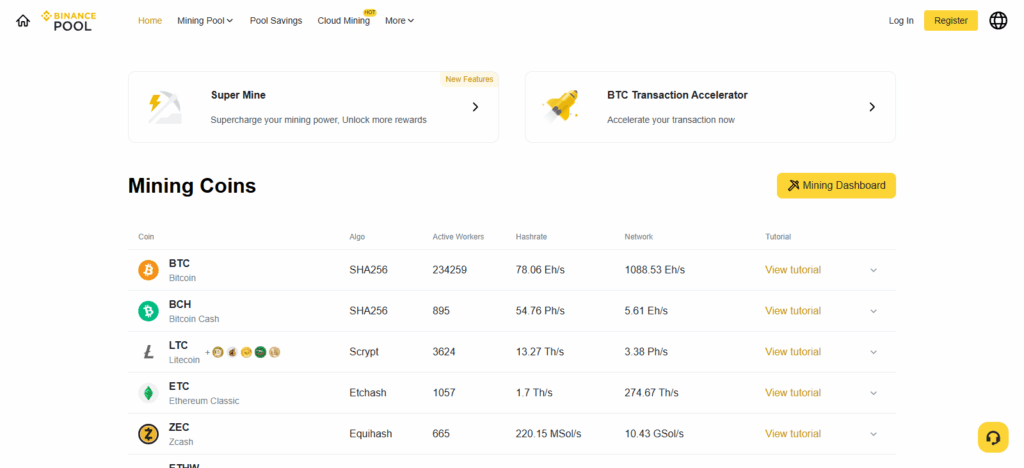

Binance Pool

Binance Pool is an excellent mining platform powered by the global crypto exchange Binance. It allows users to mine and trade crypto seamlessly and simultaneously.

Its distinctive quality is the direct connection to the Binance ecosystem so that miners can convert their coins and access advanced financial services like staking and savings. Binance Pool mines Bitcoin, Ethereum, and Litecoin with great deals and flexible crypto disbursement.

It also has a Smart Pool feature that optimizes mining for the best coin based on current market data. Binance Pool has excellent profitability with outstanding security, transparency, and global server coverage.

ViaBTC

ViaBTC is among the top mining pools worldwide. It is also the most transparent and user-oriented. It allows flexible mining on Bitcoin, Bitcoin Cash, Litecoin and many other cryptocurrencies.

However, the most impressive feature on ViaBTC is the Smart Mining system, which automatically assesses the market and chooses over which coin to mine in order to maximize profit.

This pool also gives the miners autonomy over the earnings through multiple payout methods including PPS+, PPLNS and SOLO.

ViaBTC is also one of the most reliable pools. It has a powerful global server network, high uptime, detailed analytics and analytics. This high level of efficiency and stability is why it has such a high level of popularity among beginners and professionals.

Tips to Maximize Mining Profit

Choose the Right Mining Pool

Pick a trustworthy mining pool that is open and balances its mining fees, has high uptime, and is stable in its payout methods. A mining pool that is trustworthy guarantees consistent earnings and mitigates the threat of downtime or fraud.

Use Energy-Efficient Hardware

Purchase new rigs that have advanced energy saving features. ASIC miners, for instance, have high performance when it comes to mining but have low energy consumption. Buying energized devices helps in the overall reduction of mining electricity expenditure.

Optimize Power Consumption

One of the biggest costs of bitcoin mining is electricity. Power management systems, renewable energy, and off-peak energy plans can help control spending in this area and improve profit.

Regularly Monitor Pool Performance

Over time, pool hash rate, latency and reward variance should be indicators for further action. If you notice decreased performance or irregular rewards, it may be more beneficial to shift to a different pool.

Stay Updated on Market Conditions

Always know current rates for various cryptocurrencies and the ease of mining. When the mining difficulty lowers for the coin, you will likely receive more rewards. Modify your mining methods as necessary.

Explore Different Coins

Try not to stick to a single cryptocurrency. Miners can diversify to different altcoins or engage in multipool services that automatically adjust to mine the most profitable coin in a live sustain cycle.

Cool Your Mining Equipment

Mining hardware that overheats suffers a blow to mining effectiveness, and hardware longevity is minimized. Make use of proper ventilation, dedicated air cooling systems, or climate controlled arrangements to reduce the heat and maintain fine operating conditions.

Protect Your Mined Assets

Mined coins are best kept in wallets to minimize the risk exposure of coins left on mining pool sites. Protection is enhanced with two-factor authentication and the use of cold storage.

Participate in Mining Forums

Participation in the forums of the mining community offers the chance to identify other miners to learn from, discover new tools, monitor trends, and identify profitable coins.

Stay Prepared for Hardware Maintenance

Due to the rapid evolution of mining technology, the maintenance or upgrading of mining rigs on a routine basis is crucial to sustaining a competitive edge and a positive bottom line.

Common Mistakes to Avoid

Research About New Pool Reputation

Valuable guaranteed rewards are probably a scam. Newcomers to mining often fail to checkout user reviews as well as the pools history, which leads to downstream problems from poor admin pools credibility.

Unstable Pools Lagging Rewards

Rewards may happen more frequent as a result of low fees, but there are pools that will harm your rewards due to downtime and their unreliable nature. In the long run, poor performance of a mining pool will limit your rewards.

Not Learning the Pool Payout Systems

Every miner has a different payout allocation and missing out on the type of payout allocation (for example PPS PPLNS or FPPS) a mining pool has will result to losing profits or stale earnings.

Not Mine with a Nearby Server

Poor performance will result from high latency as well as stale mining shares. To avoid these concerns, ensure that your mining pool is within your local area.

Poor Choice in Pool Size and Hashrate

Having frequent rewards and poor pool size consistency leads to the downstream affect of low long term profitability. Consistency will often come from larger pools.

Minimum Payout Not Reviewed

Small miners could be waiting ages to be paid rewards if a particular pool has a high minimum payout. Select pools where the limit is reasonable.

Neglecting to Track a Pool’s Performance

Certain miners will not track the pool’s performance. Tracking performance means being able to identify issues before they affect your earnings, including hash rate, downtime, or delays in payments.

Future of Mining Pools

The industry continues to develop because of changing technology and advancements in market dynamics.

More sophisticated competition and increased network difficulty are pushing mining pools toward the adoption of AI-powered optimization and automated profit switching to more efficiently capture the additional value created by the energy-efficient profit-switching algorithms.

The adoption of more automated profit switching will likely lead to more decentralized mining pools. These pools offer more self-sustainability, control, and automated switching to their users.

As the world reaches for more automated profit switching on pools and self-sustain sustainable mining, improved security and blockchain transparency tools will become the new standard.

Simultaneously, the industry will become more self-sustain sustainable and reach carbon neutral status. The industry will become self-sustain more efficient in the use of energy and offer more decentralized.

Pros & Cons

| Pros | Cons |

|---|---|

| Steady and Consistent Earnings – Rewards are distributed regularly, reducing income fluctuations compared to solo mining. | Pool Fees – Most pools charge fees (usually 1%–3%), which can slightly reduce overall profits. |

| Higher Success Rate – Combined computational power increases the chances of successfully mining blocks. | Centralization Risk – Large pools can dominate hash power, reducing network decentralization. |

| Lower Entry Barrier – Suitable for beginners with limited hardware resources. | Dependence on Pool Operator – Pool mismanagement or server downtime can affect payouts and mining stability. |

| Access to Advanced Tools – Pools offer dashboards, analytics, and monitoring tools for better performance tracking. | Geographic Latency Issues – Distant servers may cause delays and reduce mining efficiency. |

| Multiple Payout Options – Various payment methods (PPS, PPLNS, FPPS) allow flexibility based on miner preference. | Limited Control – Miners have less autonomy over block selection and transaction processing. |

Conclusion

To wrap it up, finding the most profitable mining pool all comes down to balancing fees, method of payout, reliability, and server performance.

A mining pool is not the most profitable just because it has the lowest fees; the most profitable offers consistency, transparency, and reliability through extreme uptime.

By researching their pool reputation, performance, and market shifts, miners are guaranteed to achieve profitability and positive reinvestment for the years to come.

New secure platforms, optimized tools, and advanced mining rigs improve positive results. In the end, carefully choosing a pool and continuously fine-tuning it is the most effective method of profit maximization and sustaining mining profitability in the dynamic cryptocurrency landscape.

FAQ

Do mining pool fees affect earnings?

Yes. Most pools charge fees between 0%–3%, which are deducted from your rewards. While lower fees are preferable, reliability and performance should always take priority over cost alone.

How can I find a trustworthy mining pool?

Research the pool’s reputation, uptime history, and user reviews. Choose pools with transparent statistics, secure systems, and proven payment records.

Is it better to join a large or small mining pool?

Large pools offer more consistent payouts due to frequent block discoveries, while smaller pools may offer higher individual rewards but less consistency. The best choice depends on your mining capacity and risk preference.

Can I switch mining pools anytime?

Yes. You can switch pools at any time if you find better payout terms, lower fees, or improved performance. Always monitor pool profitability and make adjustments when needed.

How do server locations affect mining performance?

Server proximity reduces latency, ensuring faster data transmission and fewer stale shares. Choosing a pool with nearby or global servers helps improve mining efficiency.