In this article, I will discuss how to Calculate Staking Rewards Accurately, their significance in crypto for maximizing your earned returns, and how crypto staking rewards depend on several factors, such as APR.

- What Are Staking Rewards?

- How to Calculate Staking Rewards Accurately

- Other Places to Calculate Staking Rewards Accurately

- Key Factors That Affect Staking Rewards

- Formulas to Calculate Staking Rewards

- Tools and Calculators for Accurate Results

- Online Staking Calculators

- Exchange Provided Calculators

- Wallet Tools

- Custom Spreadsheet Methods

- Blockchain Explorer Calculators

- Tips to Maximize Staking Earnings

- Common Mistakes to Avoid

- Risks and Considerations

- Conclusion

- FAQ

APY, validator’s performance, and strategies of compounding and calculating precision returns, along with the correct formulas and tools to appropriately calculate returns for staking crypto in the year 2025.

What Are Staking Rewards?

Staking rewards are liquidity benefits that investors earn by ‘staking’ and securing their digital assets, essentially acting as a form of collateral for crypto transactions conducted over the blockchain network.

Unlike the interest charged by banks, staking rewards are borne by the network and shared among participators based on their contribution toward ensuring the network is stable and operates efficiently.

How much you earn depends on the total tokens staked, the performance of the validators, network inflation, and the distribution of the rewards.

For many investors, staking offers the opportunity to earn passively while actively supporting the ecosystems of proof-of-stake (PoS) and delegated proof-of-stake (DPoS) blockchains. These rewards are almost always distributed in the form of the cryptocurrency that is being staked.

How to Calculate Staking Rewards Accurately

In Ethereum staking, accurate reward estimation is dependent on the amount staked, duration, network APY, and the validator’s performance. Here’s an example of how to calculate staking rewards for Ethereum (ETH):

Example: ETH Rewards Calculation

Decide the Amount to Stake – Let’s say you stake 10 ETH.

Check Your APY – The staking APY for this example will be 5%.

Calculate Annual Rewards – Calculate annually using the staked amount and APY:

- 10 ETH × 5% = 0.5 ETH (per annum)

Divide Monthly and Daily Reward Data –

- Monthly: 0.5 ETH ÷ 12 = 0.0417 ETH

- Daily: 0.5 ETH ÷ 365 = 0.00137 ETH

Account for Validator Charges – The net rewards, with a 10% fee, would be:

- 0.5 ETH × 90% = 0.45 ETH (after fees).

Other Places to Calculate Staking Rewards Accurately

Figment.io

Figment.io is a reliable blockchain infrastructure provider that assists customers in performing accurate calculations for staking rewards through real-time reward tracking, transparent performance data on validators, and automated reporting systems.

Unlike basic calculators, Figment utilizes real-time network parameters, including inflation, validator commission, and slashing risks, to ensure that users can view realistic earnings rather than estimates. Its most distinctive feature is the combination of institutional-grade staking infrastructure and precise analytics, which provides individuals and enterprises with confidence in their projected and long-term rewards and staking strategies.

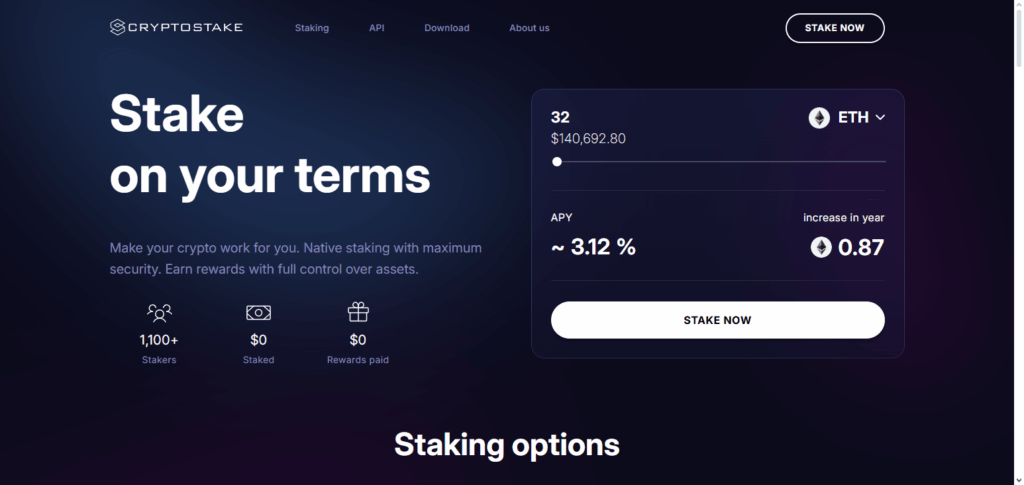

CryptoStake.com

CryptoStake.com employs a robust reward engine assessing price volatility, lock-up periods, validator fees, and network-specific reward files along with other variables to enable users to compute their staking rewards with precision.

Unlike predictions based on most models, static assumptions and their corresponding outcomes do not persist since even real time telemetry computing is done on a blockchain which guarantees persistently accessible data even in turbulent periods. Its primary differentiation is a user friendly simulation tool which unlocks a multitude of staking scenarios, aiding users to configure assets defensively.

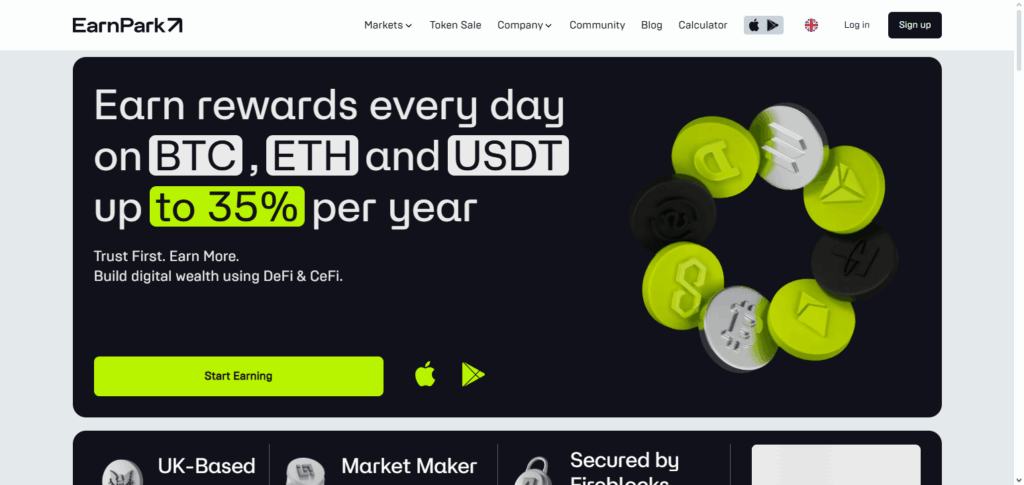

EarnPark.com

EarnPark.com facilitates the precise computation of staking rewards with its ready dashboard that integrates real-time portfolio information with network-specific APRs. Unlike static displays of percentage yields, it elucidates expected earnings with adjustments for compounding intervals, predetermined validator payments, and predetermined token distribution models.

Its primary differentiator is its individualized forecasting engine, which enables accurate reward attribution across diverse portfolios, thereby aiding retail and institutional investors to refine their staking tactics.

Key Factors That Affect Staking Rewards

Amount Staked – It is the proportion of the total tokens that determines the rewards.

Inflation Rate of the Network – The impact of the change in token supply affects earnings.

Performance of Validators & Uptime – Rewards get greater when uptime is maximized and performance is reliable.

Periods of Lock-Up & Penalty – Withdrawal in advance are subject to penalties or forfeited rewards.

Compounding vs Non-Compounding – In stakings that do reinvestment and compounding, the rewards are much greater in the long run.

Formulas to Calculate Staking Rewards

Basic Formula – Staking Rewards = (Staked Amount × Annual Reward Rate) ÷ Total Periods. Staking 1,000 tokens at 10% APR earns 100 tokens yearly – so, a reward of 10% is earned with 100 tokens by a simple stake!

Compounding Formula – Final Value = Principal × (1 + (Rate ÷ Periods))^(Periods × Time), which boosts earnings in the long run due to reinvested rewards.

APR vs APY – Staking is the best example on which to show the difference between the two, whereby APR is simpler and more straightforward in demonstrating the annual return. At the same time, APY is more sophisticated and takes compounding into account.

Tools and Calculators for Accurate Results

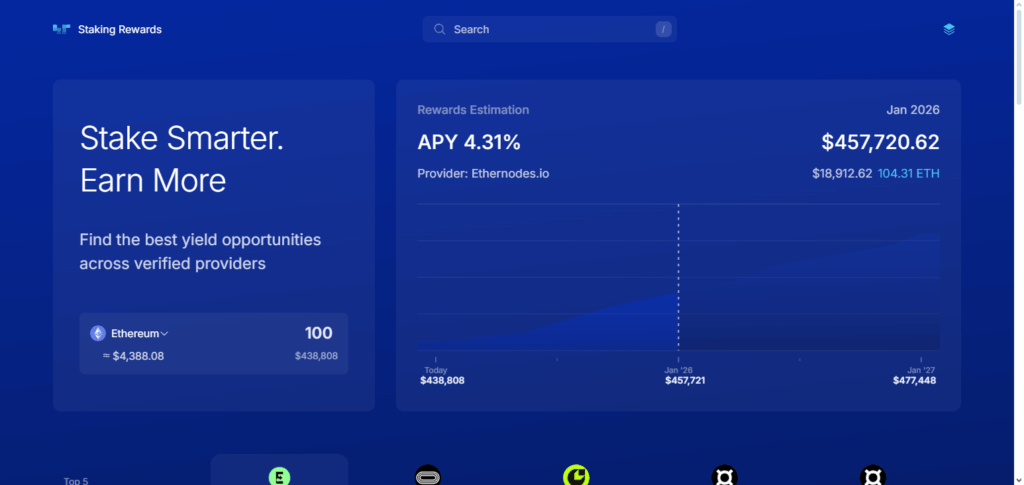

Online Staking Calculators

Sites like StakingRewards.com offer customizable calculators that allow you to enter the token’s duration and amount, estimating your potential earnings.

Exchange Provided Calculators

Many exchanges, such as Binance, Coinbase, or Kraken, have calculators integrated into their platforms that display the approximate APR or APY before staking.

Wallet Tools

Specific cryptocurrency wallets, such as Trust Wallet and Ledger Live, have their own staking calculators, which provide current estimates of accumulated staking rewards.

Custom Spreadsheet Methods

More sophisticated users can create their own models on Excel or Google Sheets which provide estimates of accumulated rewards based on APR and APY, compounding periods, and token price shifts.

Blockchain Explorer Calculators

Some blockchains, such as Cardano and Polkadot, have native explorers that provide estimates of rewards based on real-time blockchain data.

Tips to Maximize Staking Earnings

Choose Reliable Validators – To secure consistent and optimal rewards, prefer validators with high uptime and low commission costs.

Enable Compounding – The benefits of long-term staking rewards derive from reinvesting earned rewards, realizing the power of compound interest.

Diversify Staked Assets – The more staked across various tokens or networks, the more risk and earning potential are reduced.

Minimize Fees – Paying excessive commissions for staking and the associated validators, exchanges or wallets can severely limit profit earned on staking.

Stay Updated on Network Changes – Staking procedures and methods can be adjusted instantly based on blockchain improvements, voting on governance, or rate of rewarding for adapting and potentially increased earnings.

Common Mistakes to Avoid

Overly Optimistic Expectation – A good number of stakeholders only focus on the advertised APY and do not take into account the validator fees and downtimes and alterations in the rewards given by the network.

Ignoring Validator Downtime – Selecting Validators who are not trustworthy may diminish the rewards and even attract penalties such as slash events.

Forgetting About Price Volatility of the Token – An increase in the rewards may not translate to a rise in the total earnings if the token’s value decreases.

Ignoring the Lock-Up Period – Ignoring the withdrawal limitation may cause funds to be invested at the market’s low point, making it impossible to take advantage of the situation.

Neglecting the Power of Compounding – Compound rewards are often left to sit idle, resulting in the loss of potential long-term growth.

Risks and Considerations

Market Risk – Despite the high-stakes rewards offered in a crypto project, there is a risk that the token price may decrease, resulting in lower profits even if a large number of tokens are accumulated.

Slashing Risk – On specific blockchains, penalties are imposed on validators for misconduct or inactivity, resulting in a portion of the staked funds being lost.

Liquidity Constraints – Various crypto staking programs are associated with specific periods of inactivity, which can result in an inability to access, sell, or transfer the tokens, especially during times of market turbulence.

Validator Risk – There is a risk of selecting unreliable validators with high fees or low availability which, in turn, reduces the potential profits gained.

Regulatory Uncertainty – Regulations can impact staking on cryptocurrency, which may impose new tax regulations or, in some instances, may restrict for specific areas.

Conclusion

Accurately calculating staking rewards requires understanding the interrelated networks, reward formulas, and external factors such as validator performance, compounding, and market conditions. Using credible calculators, correct formulas, and understanding the fundamentals of APR vs. APY helps investors estimate their earnings more accurately.

While avoiding common pitfalls, such as overestimating returns or token volatility, helps predict more realistic expectations, investors should still manage these trade-offs. Blending precise calculations with intelligent strategies, such as tiered validator selection, reward reinvestment, and focused network activity adjustments, ensures the most favorable reward-to-risk ratio. This approach makes staking in 2025 a particularly effective means for growing crypto holdings.

FAQ

What’s the difference between APR and APY in staking?

APR shows simple annual returns, while APY accounts for compounding. APY is more accurate if you reinvest your staking rewards.

Do staking rewards change over time?

Yes, rewards can fluctuate depending on network inflation, validator performance, and the total amount staked by participants.

Are online staking calculators reliable?

Yes, but results are estimates. Always cross-check with network data or exchange-provided calculators for higher accuracy.