This article focuses on using top aggregator tools to automate yield farming, allowing you to optimize your passive income from DeFi. Since automated yield farming utilizes smart contracts and other optimization strategies, it removes the need for constant supervision.

- What is Automated Yield Farming?

- How to Automate Yield Farming with the Best Aggregator Tools

- Example: Automating Yield Farming with Gelato Network + Aave

- 1. Choose Your Aggregator Tool

- 2. Connect Your Wallet

- 3. Deposit Assets into a Yield Protocol

- 4. Set Up Gelato Automation

- 5. Set Up Task Parameters

- 6. Pay for the Automation

- 7. Evaluate and Fine Tune

- Why Use Aggregator Tools for Yield Farming?

- Maximized Returns

- Time-Saving & Fully Automated

- Lower Gas & Transaction Costs

- Smart Risk Management

- Beginner-Friendly Access to Advanced DeFi

- Continuous Monitoring & Updates

- Security Enhancements

- Top Yield Farming Aggregator Tools

- Best Practices to Maximize Returns

- Diversify Across Multiple Strategies

- Monitor APY Changes Regularly

- Choose Reputable and Audited Platforms

- Reinvest Profits Periodically

- Watch Gas Fees Before Moving Funds

- Stay Updated on DeFi Market Trends

- Set Clear Risk Tolerance & Portfolio Rules

- Risks & Security Tips for Automated Yield Farming

- Future of Automated Yield Farming

- Conclusion

- FAQ

This guide explains how the best aggregators streamline the earning process and mitigate risks to enhance your profits, even if you’re a novice in DeFi.

What is Automated Yield Farming?

Automated yield farming is a strategy within decentralized finance that uses smart contracts and aggregator tools to shift crypto assets between liquidity pools to maximize returns on investments.

Instead of needing to search for opportunities with elevated annual percentage yields manually, automation focuses on rate monitoring, reward reinvestment, and real-time asset reallocation.

The more sophisticated platforms provide auto-compounding, gas fee savings, and risk-based rebalancing, among other services, to enhance user returns with very little earned effort.

Passive income is easier than ever with decreased user monitoring by automated yield farming— a boon for novice users using streamlined conomics.

How to Automate Yield Farming with the Best Aggregator Tools

Example: Automating Yield Farming with Gelato Network + Aave

1. Choose Your Aggregator Tool

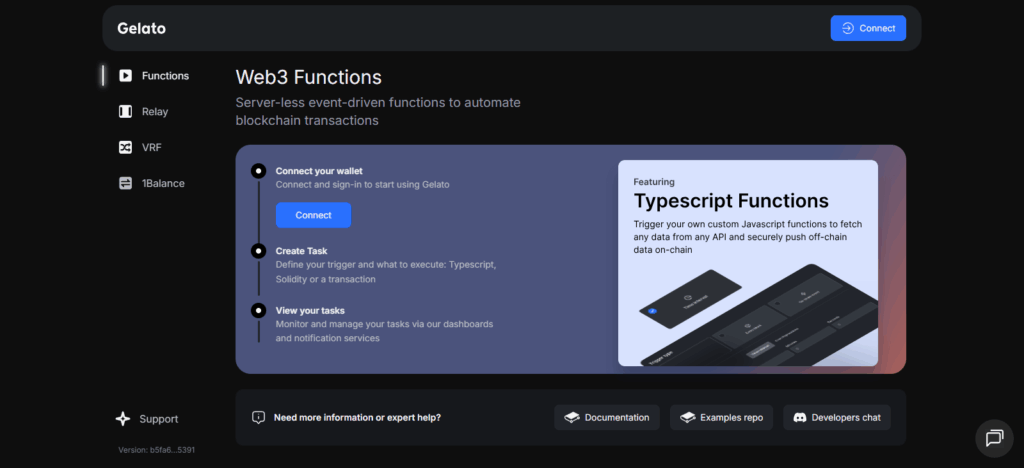

- For automation use Gelato Network.

- For yield farming protocols, combine with Aave or Balancer.

- Optional: use DeFi Llama or Zapper for APY monitoring across protocols.

2. Connect Your Wallet

- MetaMask or WalletConnect can be used.

- Confirm that you are on the right network, either Ethereum or Polygon.

3. Deposit Assets into a Yield Protocol

- For example, to earn interest, deposit USDC into Aave.

- Approve your wallet to spend the tokens.

4. Set Up Gelato Automation

- Visit Gelato Automate.

- You can select a task template such as:

- Compounding rewards automatically

- Rebalancing between pools automatically

- Threshold-triggered automatic withdrawals

5. Set Up Task Parameters

- Specify:

- Trigger conditions such as every 24 hours, a change in APY, or reaching a rewards threshold

- Execution logic such as claim rewards, swap, reinvest, and repeat

- You can use Gelato’s interface or set up the system through smart contracts.

6. Pay for the Automation

- For gas fees, Gelato needs a small amount of ETH or MATIC.

- For tasks to keep running, stake your funds in Gelato’s gas treasury.

7. Evaluate and Fine Tune

- To monitor performance, use a dashboard such as DeBank or Zapper.

- Update your parameters when necessary to improve performance and increase returns.

Why Use Aggregator Tools for Yield Farming?

Maximized Returns

Aggregators ensure maximum profit through automatic strategy shifts and reward auto-compounding with no effort on your part.

Time-Saving & Fully Automated

There’s no need to track APYs on your own and make pool switches manually; the aggregator does this in real-time.

Lower Gas & Transaction Costs

You save on gas fees by optimizing and batching on-chain transactions as opposed to interacting with several protocols yourself.

Smart Risk Management

Strategies reduce risk by reallocating and decreasing exposure to a pool if it becomes too risky or yields fall considerably.

Beginner-Friendly Access to Advanced DeFi

Users can earn passive income without a comprehensive understanding of DeFi mechanics, liquidity pools, or impermanent loss.

Diversified Strategies

Funds can be spread across multiple protocols, which limits the negative effect of a failing or underperforming single pool.

Continuous Monitoring & Updates

Aggregators are able to manually make adjustments based on real-time market trends to expeditiously capture new high-yield opportunities.

Security Enhancements

Risks from unreliable DeFi pools are minimized when audited and fully secured smart-contracts are utilized by reputable platforms.

Top Yield Farming Aggregator Tools

Yearn Finance

Yearn Finance stands among the best yield farming aggregator tools due to unique automation along with the efficiency and smart asset optimization on a singular decentralized layer.

It vaults the community’s built advanced strategies that harvest and reinvest to maximize rewards in a ‘set and forget’ manner. Yearn automates DeFi protocol scanning to cut down manual yield research and fund allocation on the more rewarding protocols. It emphasizes the reduction of the research costs users spend on switching.

The detailed strategy and performance metrics are accessible to the users before the fund deposit, enhancing transparency.

Yearn Finance remains an ingenious and reliable automated yield optimization leader due to advanced ongoing updates, multi-chain expansion and governance optimization.

Beefy Finance

Beefy Finance manages to be top performing yield farming aggregators due to its highly efficient auto-compounding technology and strong multi-chain capabilities.

Unlike other platforms which are limited to a single blockchain, Beefy is able to provide its users with access to yield farming on multiple blockchains, including BNB chain, Polygon, Avalanche, and Arbitrum.

By quickly reinvesting rewards, Beefy’s vaults improve yield performance over longer periods of time. To improve user risk and profit assessment, Beefy provides and maintains transparency to users with detailed strategy descriptions, staking, and profit tracking.

Given the governance by the community, reasonably priced services, valuable strategy relics, and transparency, potentially ranked within the top performing yield farming aggregators.

Best Practices to Maximize Returns

Diversify Across Multiple Strategies

Spread your capital across different chains, assets, and vault types to mitigate and optimize your yield.

Monitor APY Changes Regularly

Rates vary for a number of reasons — either by market or protocol — to make the most of your capital, always be aware of the most profitable pools.

Choose Reputable and Audited Platforms

Use secured and trusted channels to avoid loss or theft of your capital to rug pulls or contract vulnerabilities.

Reinvest Profits Periodically

Profits will inflate the value of your automated systems, but redeploying funds directly will spark the compounding process.

Watch Gas Fees Before Moving Funds

Profit pushing and fee loss can be avoided by waiting for lower network congestion to transact.

Stay Updated on DeFi Market Trends

New systems and incentives are implemented daily, causing quick APY capture to early system deployers.

Set Clear Risk Tolerance & Portfolio Rules

Stabilizing your risk with a combination of volatile assets and stable coins will aid in loss mitigation.

Risks & Security Tips for Automated Yield Farming

Risks in Automated Yield Farming

- Smart Contract VulnerabilitiesBugs or exploits in aggregator or protocol contracts can lead to a loss of funds.

- Impermanent LossProviding liquidity in volatile token pairs can reduce the value of your holdings when prices shift.

- Protocol Failure or Rug PullsUnauthorized withdrawals, malicious teams, or abandoned platforms pose major risks.

- APY FluctuationYield rates constantly change — a once-profitable pool can quickly become inefficient.

- Gas Fee SpikesHigh network costs can eat into profits, especially on chains like Ethereum.

- Liquidity RisksLow TVL pools may experience slippage or delayed withdrawals during market stress.

Security Tips to Stay Protected

- Choose Reputable, Audited PlatformsAlways verify audits and community trust levels before depositing funds.

- Diversify Across Assets and ProtocolsAvoid putting all capital in one vault or pair — reduce exposure to single-point failures.

- Use Hardware Wallets or Trusted Wallet ToolsProtect keys from phishing, malware, and compromised devices.

- Check Strategy Transparency & ActivityEnsure vaults have updated strategies and visible performance tracking.

- Start Small with New Pools

Before expanding your investment, test the strategy for performance. - Monitor Portfolio Regularly

Exiting risky positions early requires regularly reviewing APY, vault health, and market movements. - Maintain a Gas Buffer

Have extra native tokens available so you can withdraw or rebalance quickly if you need to.

Future of Automated Yield Farming

Advancements in automated yield farming will focus on efficiency, security, and universal access in the foreseeable future. Predictive analytics on yield trends, combined with the agility of cross-chain capital mobility, will be achieved with increased artificial intelligence and machine learning capabilities. ‘

Advanced smart contract technology and decentralized insurance will expand risk absorption, promoting automation adoption by novices and institutional players.

Interest in DeFi by traditional finance participants could increase liquidity and foster liquidity earning opportunities. In summary, automated yield farming is moving away from the experimental stage, and it will soon be a widely accepted technology for generating passive income on cryptocurrencies.

Conclusion

Investing in DeFi has become simpler, thanks to automated yield farming which alleviates the burdens of manual pool selection and ongoing portfolio management.

With automated tools such as Yearn Finance, Beefy Finance, and Autofarm Network, users can benefit from optimized returns, gas cost reductions, and automated risk management. Understanding the risks and monitoring performance is essential, but far less effort is required than in fully manual strategies.

There is little doubt that the automation of yield farming brings higher opportunities to most users, regardless of their experience. With the right selection of solid platforms and tactical risk diversification, activities in automated yield farming can significantly simplify the process of earning passive income, particularly in growing the crypto portfolio.

FAQ

What is the minimum investment required?

There is no fixed minimum, but yields should outweigh network fees. On low-fee chains, users can start with smaller amounts.

How do aggregators boost returns?

They auto-compound rewards, monitor APY changes, reduce gas costs, and shift funds to more profitable strategies based on market conditions.

Which network should I choose for automated yield farming?

It depends on your assets and gas preferences. Ethereum has high security but higher fees, while BNB Chain, Polygon, and others offer cheaper transactions.

What risks should I be aware of?

Smart contract vulnerabilities, APY fluctuations, liquidity problems, and impermanent loss can impact returns, so risk management is essential.