In this piece, I’ll go over how AI risk engines are changing prop firm rewards through better risk management, faster payouts, and increased trader fairness.

- What Are AI Risk Engines?

- How AI Risk Engines Are Transforming Prop Firm Payouts

- Step 1: Data Accumulation and Processing

- Step 2: Trader Profiles and Risk Analysis

- Step 3: Instantaneous Risk Score Updating and Monitoring

- Step 4: Adaptive Controls and Capital Protection

- Step 5: Fraud Detection and Rule Enforcement

- Step 6: Performance Validation for Payout Eligibility

- Step 7: Automated Compliance Checks

- Step 8: Payout Calculation and Optimization

- Step 9: Quicker Approval and Processing

- Step 10: Clear Communication and Feedback Loop

- How Prop Firm Payouts Work Today

- Trader Evaluation Stage

- Account Funding and Profit Sharing

- Trading Restrictions and Risk rules

- Minimum Trading Period Requirement

- Payout Request Window

- Manual Review and Compliance Checks

- Payout Methods and Processing Time

- Performance-Based Scaling

- Benefits for Prop Firms and Traders

- Benefits for Prop Firms

- Enhanced Capital Safety

- Decreased Operating Expenses

- Growth Potential

- Improved Fraud Detection

- Quicker Processing of Payouts

- Optimization of Business Strategies

- Benefits for Traders

- More Objective Assessments of Payouts

- Expediency in Accessing Earnings

- Tailored Trading Settings

- Coaching and Performance Analytics

- Greater Transparency and Trust

- Opportunities for Growth in the Future

- Smarter Drawdown & Capital Protection Systems

- Dynamic Drawdown Thresholds

- Predictive Risk Alerts

- Adaptive Position Sizing

- Volatility-Based Risk Controls

- Real-Time Risk Scoring

- Automated Trade Restrictions

- Performance-Based Capital Scaling

- Transparent Risk Dashboards

- Challenges & Limitations of AI Risk Engines

- Data Quality and Reliability

- Algorithmic Bias

- Lack of Explainability

- Over-Reliance on Automation

- High Implementation Costs

- Regulatory and Compliance Risks

- Cybersecurity Threats

- Model Drift Over Time

- Limited Adaptability to Black Swan Events

- Trader Trust and Acceptance

- Faster & Automated Payout Processing

- Future Trends in AI-Driven Prop Trading

- Conclusion

- FAQ

You will discover how proprietary trading organizations are protecting capital, preventing fraud, and developing more transparent, data-driven payment models for long-term trading performance with the use of real-time monitoring, behavioral analysis, and automated compliance tools.

What Are AI Risk Engines?

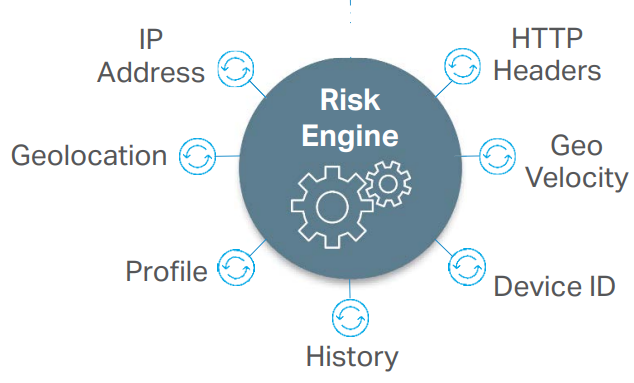

AI risk engines are sophisticated software tools that apply artificial intelligence, machine learning, and real-time data analytics to understand, evaluate, and automate the management of trading risk.

They build risk profiles for individual traders by analyzing and interpreting significant amounts of market data, trader data, account data, and historical performance data.

Unlike traditional systems which set rules, limit manual interference, and are reliant on outdated systems, AI risk engines learn from fresh data and recalibrate risk limits, drawdown limits, and exposure limits as trading conditions change in real time.

They monitor for and identify patterns of trading abuse, over-leveraging, latency arbitrage, and trading violations, sending alerts and implementing trade restrictions or account review.

Fewer predictive modeling systems coupled with behavioral analysis and automated compliance give prop firms more control while protecting their risk capital and assuring the trading conditions remain fair and operationally efficient.

How AI Risk Engines Are Transforming Prop Firm Payouts

Step 1: Data Accumulation and Processing

The AI risk-engine system integrates with various data sources such as trading platforms, financial market feeds, and accounting systems to analyze current and past data streams such as traded instruments, position sizes, leverage, drawdowns, market volatility, trader behavior, etc. It then synthesizes data streams and generates a baseline for risk and payout estimations.

Step 2: Trader Profiles and Risk Analysis

The AI makes a dynamic risk trader profile utilizing machine learning. It assesses various factors such as consistency, winning/losing ratios, risk/reward ratios, emotional trading, trading discipline, and adherence to rules. These profiles get continuously updated with new trades and market changes.

Step 3: Instantaneous Risk Score Updating and Monitoring

The AI assesses every open trade and assigns a risk score based on exposure, volatility, and relevant behavioral factors. If the risk score goes beyond a limit, the system will flag the account for warnings, limit orders, and temporary or additional account restrictions.

Step 4: Adaptive Controls and Capital Protection

The AI modifies drawdown limits, position sizing, and max exposure based on the trader’s risk score. The more relaxed limits a trader gets, the more disciplined and high-performing they are. On the other hand, stricter controls are implemented when a trader demonstrates riskier behavior to protect company capital.

Step 5: Fraud Detection and Rule Enforcement

The engine looks for signs of copy trading, account sharing, latency arbitrage, and the coordination of multiple accounts. With state-of-the-art nuance detection, only genuine acts of trading that comply with the Firm’s policies are eligible for payment consideration.

Step 6: Performance Validation for Payout Eligibility

The AI calculates total trading profits, evaluates trading behavior, and ensures firm policies are followed prior to a payout being disbursed. The AI also reviews performance data and cross-examines risk against compliance performance to avoid discrepancies and ensure accuracy.

Step 7: Automated Compliance Checks

Identity, regulatory, and internal compliance are checked in a single step, which minimizes the need for manual reviews. This step also ensures that the firm’s regional compliance regulations and policies on payouts are adhered to.

Step 8: Payout Calculation and Optimization

Unlike other firms that reward profit-driven trading, the AI assesses profits, performance, risk, discipline, and consistency to counterbalance payout percentages to performance metrics. This means that firms can incentivize traders to engage in positive trading activities by giving them faster or larger payouts.

Step 9: Quicker Approval and Processing

Automated checks mean that approvals for payments can be done in hours rather than days. This boosts trader satisfaction and improves trust in the company’s platform.

Step 10: Clear Communication and Feedback Loop

Traders get dashboards that display their risk score, compliance score, and how close they are to getting a payout. The AI incorporates this feedback to fine-tune its models, making them more accurate and better over time.

How Prop Firm Payouts Work Today

Trader Evaluation Stage

Most prop firms have yet another sacrosanct structure they all share: The Trader Evaluation Stage. Before accessing fire capital, a trader must pass their evaluations, or challenges, as they like to call them. This phase is designed to test their profitability aspect, their risk management skills, as well as their rule enforcement skills, like maximum drawdown and daily loss limits.

Account Funding and Profit Sharing

Profit would then be split with the firm, and the trader would get the rest. The split is usually within the ratios of 70/30 to 90/10 and is subject to the firm’s stipulated policies and performance incentives.

Trading Restrictions and Risk rules

Payouts may be of firms of a max drawdown, daily loss cap, lots sizes, and trading time. Account closure and loss of your payouts is the result of breaking any of these.

Minimum Trading Period Requirement

They have to ensure that the trader stays in the market long enough so as to not create profits through unsustainable, short-term and high stakes.

Payout Request Window

If traders wish to obtain a payout, they may be subject to a request schedule. For example, they may be able to make requests every two weeks or once a month. If they make requests during other periods, the requests will be processed in the next cycle.

Manual Review and Compliance Checks

There is often a manual review and compliance check associated with payout requests. The staff will take a look at the trade history, recalculate the profits, and check if they followed the rules. This causes a slowdown in the time needed for approvals.

Payout Methods and Processing Time

Most approved payments are sent using bank transfers, digital payments, or crypto to PayPal. Depending on the payment method and the company used, processing time takes a few days to a week.

Performance-Based Scaling

A few companies will grant traders account scaling opportunities. This means giving consistent and profitable traders more access to company capital. Over time, the traders will receive better profit split ratios, which will increase their payout amounts.

Benefits for Prop Firms and Traders

Benefits for Prop Firms

Enhanced Capital Safety

With the implementation of AI-based risk monitoring, the potential of losing large and unexpected sums of money is minimized through the application of drawdown restrictions and exposure limits.

Decreased Operating Expenses

Increased levels of automation result in the reduction of large compliance and support teams, decreasing the time allocated to manual reviews, and in turn, decreasing administrative costs.

Growth Potential

Firms are able to onboard and supervise thousands of traders around the world without losing oversight of the risks or the accuracy of payouts.

Improved Fraud Detection

With the use of advanced pattern recognition, the detection of copy trading, multi-accounting, and breach of firm rules improves, maintaining the profitability of the firms and the integrity of the trading platform.

Quicker Processing of Payouts

Automated systems for the verification of payouts, result in faster approvals, thereby enhancing the reputation of the platform and decreasing the volume of support requests.

Optimization of Business Strategies

The results from AI powered analytics provide firms with actionable strategies to optimize their pricing, rules, and payouts and to structure their businesses of better trading in real time.

Benefits for Traders

More Objective Assessments of Payouts

Objective assessments based on data are decreasing bias and the potential for human error in approving or denying payouts.

Expediency in Accessing Earnings

With the introduction of compliance automation, the time it takes to receive payouts has been considerably reduced from a matter of days to only a few hours in some cases.

Tailored Trading Settings

Different risk profiles enable traders to get customized limits, capital scaling, and payout bonuses, which are tied to their behavioral consistency and discipline.

Coaching and Performance Analytics

AI dashboards assess and report various metrics around a trader’s performance, which assists them in fine-tuning their strategies and improving risk management.

Greater Transparency and Trust

Being able to monitor risk scores, rule adherence, and payout prospects fosters trust in the firm’s platform.

Opportunities for Growth in the Future

Over the long run, traders who are consistent are able to receive larger capital injections, enhanced profit sharing, and top priority payouts.

Smarter Drawdown & Capital Protection Systems

Dynamic Drawdown Thresholds

Instead of daily or overall loss limits, the AI system adjusts drawdown limits based on trader activity, volatility, and recent risk management; this provides a more individualized approach.

Predictive Risk Alerts

Machine learning detects potential risk patterns. Alerts are sent before a trader is on the verge of a large loss, and, if necessary, trading is limited automatically.

Adaptive Position Sizing

A trader’s consistency, win rate, and market conditions determine the maximum lot size and overall exposure, thus controlling risk.

Volatility-Based Risk Controls

In times of great market volatility, AI adjusts the leverage and exposure limits to reduce the risk of loss to the firm from rapid market changes.

Real-Time Risk Scoring

Automated decision systems are guided by live trade updates to a trader’s risk score based on exposure, distance to drawdown, and behavioral factors.

Automated Trade Restrictions

If risk management thresholds are violated, the system suspends trading, stops new positions from being opened, or lowers account tiers automatically.

Performance-Based Capital Scaling

Trade consistently and take low risk to gain larger capital allocations and improved trading terms, while high-risk accounts get less.

Transparent Risk Dashboards

Traders understand their drawdown, risk level, and exposure in order to make better decisions, comply with rules and avoid breaching any.

Challenges & Limitations of AI Risk Engines

Data Quality and Reliability

AI engines require reliable and accurate data within the markets and trading. If the data is incomplete, delayed, or corrupted, risk assessments can reflect unfairly and therefore, inaccurate assessments can reflect unfair payouts.

Algorithmic Bias

AI models may unfairly penalize or reward a certain trading style due to the biases present in the market conditions, and a lack of data, thus, decreasing transparency and fairness.

Lack of Explainability

The complexity of machine learning models can make it difficult for the parties involved such as firms and traders to justify a certain risk, or make a decision to award a payout due to the opaque nature of the models.

Over-Reliance on Automation

AI systems can run without human oversight, and therefore an extreme market event can go unnoticed due to the AI systems being overly reliant on automation, thus increasing the chance of a market error.

High Implementation Costs

Highly specialized personnel are needed to maintain, integrate and develop the AI infrastructure and this requires a hefty investment to be made on data engineering and technology.

Regulatory and Compliance Risks

AI systems are developed according to the financial and data protection regulations of that region which can be time-consuming to rectify and integrate as the funds and regulations can vary.

Cybersecurity Threats

Sensitive financial and personal data is handled by risk engines, making them susceptible to data breaches and cyberattacks.

Model Drift Over Time

AI models need regular training to remain accurate, and effective, and to avoid losing relevance, as market conditions and trading behaviors shift.

Limited Adaptability to Black Swan Events

AI models are trained using historical data, and extreme market events are rare and unpredicted. Because of this, their responses are often inaccurate.

Trader Trust and Acceptance

Automated systems may cause distrust among traders, particularly when they are unable to explain or contest how payout decisions are made.

Faster & Automated Payout Processing

Prop firms have greatly benefited from AI risk engines because of the automation and increased speed of processing payouts. Rather than going through tedious manual checks, which can be time-consuming, AI systems check a trader’s profit calculations, compliance with the rules, and examine their trading history in real time.

The AI systems check drawdown limits, risk scores, and behavior patterns to make a decision regarding their eligibility to make a payout before the trader even submits the request. After a payout has been approved, automated compliance checks and identity verification are initiated.

This reduces both the time and effort put in by the employees. Because of this new system, firms can now process payouts in a matter of hours rather than days. This improves the satisfaction of their traders, and firms are able to scale their operations without having to hire more people for support or compliance staff.

Future Trends in AI-Driven Prop Trading

Attention and focus are vital for a trader. The moment you lose focus even for a split second, a bad trade can happen that can wipe out a big portion of your profits. Automatic trading can free you from the need for constant focus. Having a system that can trade for you will allow you to divide your attention.

It can relieve you from the burden of keeping a close watch on the trade. However, this does not mean that you can take you seat and relax. You will still need to adjust and tune your automated trading strategies to the current market situation. Additionally, keeping manual control on your automated system will still require your full attention, keeping you in the same stressful conditions as a manual trading.

Conclusion

The way prop firms assess performance, manage capital, and make payments is being radically transformed by AI risk engines.

These systems replace slow, rule-based processes with dynamic, data-driven decision-making by fusing behavioral intelligence, automatic compliance, and real-time monitoring. Faster approvals, more equitable profit sharing, and improved defense against fraud and excessive risk are the outcomes.

More openness, customized trading terms, and more reliable access to profits are all benefits for traders. Scalable expansion, lower operating expenses, and increased capital efficiency are all made possible for businesses. Prop trading payments will become more automated, reliable, and consistent with long-term, sustainable trading success as AI technology develops.

FAQ

What is an AI risk engine in prop trading?

An AI risk engine is a software system that uses machine learning and real-time data to monitor trader behavior, assess risk levels, detect rule violations, and automate payout eligibility and compliance checks.

How do AI risk engines speed up payouts?

They automate profit verification, rule compliance checks, and identity validation, reducing manual reviews and allowing many payouts to be approved within hours instead of days.

Are AI-driven payout decisions fair for traders?

Yes, AI systems use transparent, data-based criteria such as consistency, drawdown control, and risk behavior, reducing human bias and improving fairness in payout approvals.

Can AI risk engines detect fraud or cheating?

Yes, they use pattern recognition and anomaly detection to identify copy trading, account sharing, latency arbitrage, and coordinated multi-account activity.